Weekly Recap for Week Ended May 23, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended May 23, 2025

Egypt’s Thndr raises $15.7M

On Monday, May 19 Egyptian retail investment platform Thndr announced that it had raised $15.7M. Thndr plans to use the funds to support regional expansion in the UAE and Saudi Arabia with the goal of replicating its success in Egypt. Thndr’s mission is to democratize investing and improve financial literacy across the MENA region. Thndr’s offerings include investment in local and U.S. stocks, gold, mutual funds and savings products. According to a Thndr blog post, the company achieved total value traded on the Egyptian Stock Exchange (EGX) of $3.5B, accounting for 11% of retail value traded, and served as an entry point for 82% of all newly registered investors on EGX, adding 190.1k new investors to the market. According to the company only 2% of individuals in MENA invest, suggesting a long runway for growth for the company.

Given growth prospects in the region, this sounds like an exciting time for Thndr. Further, I find it really interesting that this is the third retail trading platform announcement I’ve heard of in the past couple of months behind Kraken’s acquisition of NinjaTrader (my write-up on the announcement here) and Kraken’s expansion into equities trading (my write-up on the announcement here) – granted the other two have both come from Kraken (and there is another Kraken announcement below LOL). It feels like we are starting to see a proliferation of retail trading platforms similar to what we saw in the earlier days of the U.S. focused eBrokers, however this time around it’s focused on international equities and derivative products (beyond just options). I would not be surprised if we see this trend continue and / or start to see some of the more established players target upstarts, such as Thndr, in new regions to aid with international expansion goals via M&A. The next few years could be a very exciting time for players such as BULL 0.00%↑, ETOR 0.00%↑, HOOD 0.00%↑ and even IBKR 0.00%↑ all of whom have an international presence and are looking to further expand that presence.

Backed Announces xStocks: Coming Soon to Kraken and Solana

On Thursday, May 22, Backed, a company focused on bridging the gap between real world assets and the blockchain, and Kraken announced that the xStocks product was set to launch soon on Kraken and be integrated with Solana’s DeFi apps. xStocks is a new product launch that will bring popular U.S. equities such as Apple, Tesla, Google and Meta, onchain as tokenized assets. Providing onchain exposure will allow clients to bypass traditional brokerage barriers such as geographic barriers and allow clients to use the tokens as collateral in lending protocols. The tokenized assets will initially be offered to non-U.S. customers in Europe, Latin America, Africa and Asia. xStocks tokens will be backed by shares in the underlying security as Backed will acquire shares in the background, which should keep the token’s price inline with the underlying asset, and tokens will be redeemable for cash value of the underlying security. I think this is an exciting product launch as it greatly opens access to U.S. market exposure for international investors. I do think this will come as a bit of a threat to the eBrokers currently focused on addressing U.S. equities exposure for internationally located clients (ex. Thndr above). This will be something I keep my eyes on closely as the product rolls out and begins to ramp up.

CME Interest Rate Roll Update

I mentioned a couple times on X (Twitter) over the past week that CME 0.00%↑’s interest rate roll was set to begin and that interest rate futures volumes should pick up pace during the final few days of the month. I wanted to provide a quick update on the roll progression and expectations for the next couple of days below. But first, what is the “roll”? The roll in interest rate futures occurs every three months during the second month in the quarter (February, May, August, November). During the roll period, which is typically the final ~6 trading days of the month (but really the first 4 days of the final 6), market participants offset expiring front month quarterly futures contracts while re-establishing new positions in the deferred month contract. Essentially, traders are shifting Open Interest (OI) from the expiring contract into next quarter’s contract to maintain their position in the market which creates a big uptick in volumes for a handful of days and can cause monthly ADV during the roll month to go from tracking down Y/Y to up Y/Y very quickly. CME has a pretty cool visual of this OI shift available on its website here.

Based on what I’m seeing through the first two days of the roll and using historical activity as a guide for the final couple of trading days of the month, I think CME’s Interest Rate futures volumes could end May up 13% Y/Y, which is up significantly from the currently tracking +4% Y/Y.

CME Daily Interest Rate Futures Volumes in May + Estimates

Source: company documents and my estimates

CME Historical Roll Volume % Increase / Decrease vs. ADV Prior to Roll

Source: company documents and my estimates

Shameless Plug on eBroker Overview

As a final note before we get into the weekly recap, on Monday, May 19 I published An Overview of the Retail Online Broker (eBroker) Industry. I’m re-linking this here just in case you haven’t had a chance to take a look yet. I’m considering this to be somewhat of a “higher level” overview of the industry and intend to expand up on it in the coming months / years (I do not intend to republish this extremely frequently as I don’t want to bombard your inbox with the same note over and over but maybe annually or semi-annually refresh the data and include new insights). If anyone has feedback on the report I would welcome any criticism / suggestions.

Company Specific Updates for Week Ended May 23, 2025

Exchanges

CME Group Inc. (CME)

FX Spot+ Trades $1.4 Billion in a Single Day With Over 40 Clients Active in First Month

Clients active in first month include 20 banks that had previously not interacted with the FX futures market

Intercontinental Exchange, Inc. (ICE)

Thursday, June 5

10:30am

First Look at Mortgage Performance: Foreclosure Activity Edges Higher Following Recent Record Lows

National delinquency rate ticked up 1 bp to 3.22% in April, up 13 bps from the same time last year

Serious delinquencies improved seasonally but rose 14% from April 2024

Foreclosure starts, sales, and active inventory all rose on an annual basis for the second consecutive month

Prepayment activity jumped to 0.71%, the highest level since October. The rise was driven by stronger home sale and refinance-related prepayments

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Dean Berry to Join MarketAxess as Group COO and CEO of EMEA & APAC

Joins from LSEG where he was head of Workflow business since January 2024 and interim co-Head of LSEG’s Data & Analytics business

Mr. Berry spent the first 16 years of his career as a fixed income trader

Expected to join MKTX in 4Q25

Tradeweb Markets Inc. (TW)

CEO to participate in Piper Sandler Global Exchange & Trading Conference

Thursday, June 5

11:30am ET

Online Brokers

Webull Corporation (BULL)

eToro Group Ltd. (ETOR)

Launches Recurring Investments Feature

Enabled for users in the U.K., Europe and the UAE

Users can now set up automated repeat purchases of an asset at regular time intervals

Feature available for stocks, ETFs and crypto

Initial investment starts at $25 USD with a maximum of $5,000 USD per transaction and a total of $25k USD in transactions per month

The Charles Schwab Corporation (SCHW 0.00%↑)

Announces Advisor ProDirect Membership Program for Advisors Going Independent

Designed to simplify the move to independence

Participating firms will work with dedicated consulting team to guide them step-by-step through principles and best practices

Highly structured program includes four phases: Launch, Learn, Connect and Grow

Designed for advisors in the $50M - $300M client asset range

Fee-based model that is complementary to Schwab Advisor Services

Charles Schwab Recognized as Best Investing Platform Overall by U.S. News

Company Specific Updates Anticipated for the Upcoming Week (Ended May 30, 2025)

Exchanges

Intercontinental Exchange, Inc. (ICE)

CEO Presents at Bernstein Conference

Wednesday, May 28 - 2:30pm ET

Fixed Income Trading Platforms

None to Note

Online Brokers

None to Note

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended May 23, 2025

U.S. Leading Economic Indicators (Apr.) – (1.0%) vs. consensus (0.9%) and prior (0.8%)

Initial jobless claims (week ended May 17) – 227k vs. consensus 230k and prior 229k

S&P Flash U.S. Services PMI (May) – 52.3 vs. consensus 50.6 and prior 50.8

S&P Flash U.S. Manufacturing PMI (May) – 52.3 vs. consensus 49.8 and prior 50.2

Existing Home Sales (Apr.) – 4.0M vs. consensus 4.13M and prior 4.02M

New Home Sales (Apr.) – 743k vs. consensus 695k and prior 670k

Major Macro Updates Scheduled for the Upcoming Week (Ended May 30, 2025)

Monday, May 26

None to Note – Memorial Day Holiday

Tuesday, May 27

Durable Good Orders (Apr.) – consensus (7.8%) and prior 9.2%

Durable Goods Minus Transportation (Apr.) – prior 0.0%

S&P CoreLogic Case Shiller Home Price Index (Mar.) – prior 4.5%

Consumer Confidence (May) – consensus 86.0 and prior 86.0

Wednesday, May 28

May FOMC Meeting Minutes Released

Thursday, May 29

Initial jobless claims (week ended May 24) – consensus 228k and prior 227k

GDP First Revision (Q1) – consensus (0.3%) and prior (0.3%)

Pending Home Sales (Apr.) – consensus (0.4%) and prior 6.1%

Friday, May 30

Personal Income (Apr.) – consensus 0.3% and prior 0.5%

Personal Spending (Apr.) – consensus 0.2% and prior 0.7%

PCE Index (Apr.) – consensus 0.1% and prior 0.0%

PCE Y/Y (Apr.) – consensus 2.2% and prior 2.3%

Core PCE Index (Apr.) – consensus 0.1% and prior 0.0%

Core PCE Y/Y (Apr.) – consensus 2.6% and prior 2.6%

Advanced U.S. Trade Balance in Goods (Apr.) – prior ($163.2B)

Advanced Retail Inventories (Apr.) – prior (0.1%)

Advanced Wholesale Inventories (Apr.) – prior 0.4%

Chicago Business Barometer (May) – consensus 45.5 and prior 44.6

Final Consumer Sentiment (May) – consensus 50.8 and prior 50.8

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

For the week ended May 23, 2025, volumes and volatility were mixed W/W despite some increased concerns about the U.S. fiscal situation and renewed tariff threats entering the mix on Friday. Based on what I have seen, people are beginning to shrug off the tariff threats given how quickly these have been backtracked over the past couple months.

The average VIX for the week was up 10% from the prior week, average realized volatility declined 22% W/W, average volatility of volatility (as measured by the VVIX) was up 10% W/W and the average MOVE index (U.S. Treasuries volatility) was up 2% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were down 3% W/W, CME futures volumes were seasonally up 27% W/W, and ICE futures volumes were up 1% W/W.

Total U.S. Equities ADV was down 6% W/W, as both on-exchange trading and TRF volumes were down about 6% W/W. Industry equity options volumes were down 18% W/W while index options volumes fell 12% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking lower in May-to-date relative to April but are generally higher Y/Y. This comes as volatility is up MTD on a Y/Y basis.

The average VIX in May-to-date is up 59% Y/Y while realized volatility is up 122% Y/Y and volatility of volatility is up 26% Y/Y. Treasuries volatility is higher as well Y/Y as the average MOVE index in May-to-date is up 9% Y/Y.

Futures volumes are mostly higher Y/Y as ICE futures MTD ADV is up 18% vs. May 2024 ADV. Meanwhile, CME ADV is up 5% Y/Y while CBOE futures ADV is down 20% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 40% MTD while option volumes are up 29% for equity options and up 17% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

The market fell on the week (down 260 bps W / W) as treasury yields rose following the house passing Trump’s Big, Beautiful Bill amid growing concerns about the U.S.’s growing debt burden. Markets came under additional pressure on Friday as Trump threatened additional tariffs on the E.U and a took jabs at a number of companies as well.

In terms of the companies I follow, companies levered to trading activity performed the best in the group. Within the exchange space, CBOE was up 5% and CME was up 3% while ICE and NDAQ ended the week flat. In fixed income trading land, MKTX increased 1% while TW was up slightly on the week. Amongst the eBrokers, ETOR and HOOD both increased 2% while IBKR and SCHW were down 1%. BULL declined 1% on the week after falling 9% on Friday following the release of its inaugural earnings on Thursday evening (which I thought was a pretty good report).

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

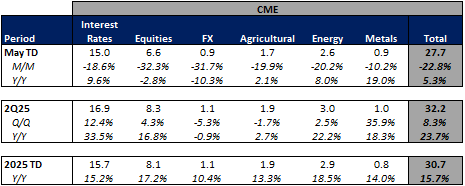

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

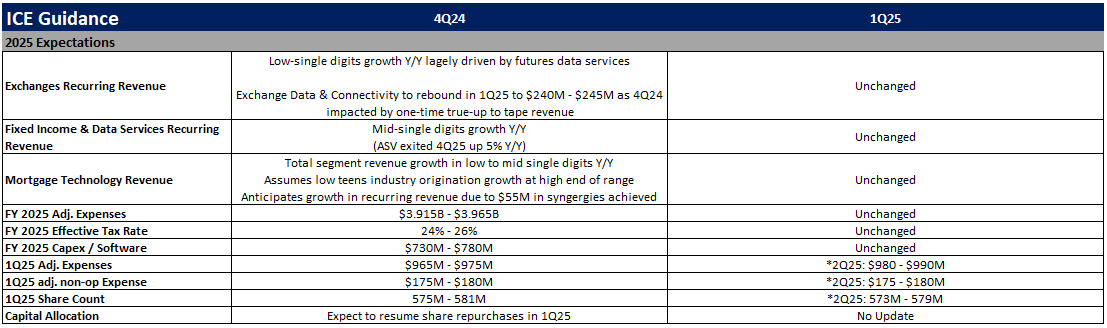

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

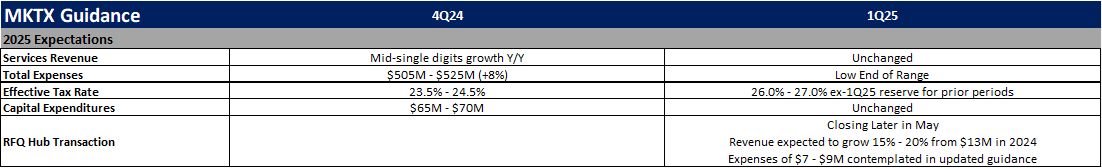

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

The Charles Schwab Corporation (SCHW)