Webull Corporation (BULL) 1Q25 Earnings Review

Solid First Quarter as a Public Company in My View; Net Asset Gathering Strong; Product Roadmap Shows a Lot to Look Forward to

Operating Margin Expands Nicely as Revenue Grew Double Digits While Expenses Declined

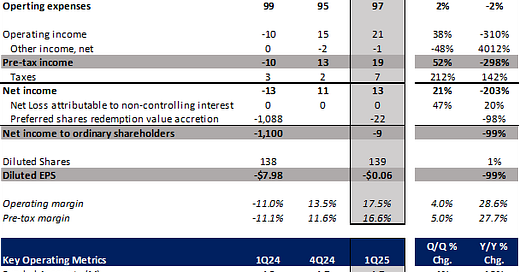

BULL 0.00%↑ reported 1Q25 earnings post-market close this evening. Total revenue came in at $117M, up 7% Q/Q and up 32% Y/Y. The sequential increase in revenue was driven by an increase in trading-related revenues, which rose 13% Q/Q and were up 52% Y/Y to $82M. Meanwhile, net interest revenue declined 6% Q/Q (-4% Y/Y) to $31M and other revenue fell 5% Q/Q (+62% Y/Y) to $5M. On the expense side, operating expenses came in at $97M, up 2% sequentially (-2% Y/Y) and drove operating margins to 17.5% (up 4 percentage points Q/Q and up 28.6 percentage points Y/Y). Non-operating expense came in at $1M (-48% Q/Q) and diluted EPS came in at a per share loss of $0.06, an improvement from a per share loss of $7.98 in the year ago period. Please note, on the expense front I am looking at expenses on a GAAP basis (meaning I am not excluding share-based compensation from the total expense figure).

Given this was BULL’s first earnings report following its SPAC deal in April, there were no consensus estimates established for which to make a comparison this quarter.

In terms of key operating metrics, total funded accounts came in at 4.7M (+1% Q/Q, +10% Y/Y), customer assets ended the quarter at $12.6B (-7% Q/Q, +45% Y/Y), and DARTs for the quarter came in at 924k (+19% Q/Q, +44% Y/Y). Average assets per customer account came in at $2,669 (-9% Q/Q, +32% Y/Y). BULL also began releasing customer net deposits with its 1Q25 earnings release. Net deposits for 1Q amounted to $1.1B which equates to an annualized growth rate of 31% relative to the 4Q24 ending customer assets level.

BULL Earnings Summary and Key Operating Metrics

Source: company data

Highlights from BULL Earnings Call, Presentation and Press Release

In terms of the outlook going forward, BULL management touched on several details during this evening’s earnings call that are worth highlighting:

New Product Offerings – Crypto – Webull plans to launch crypto trading in international markets in 2Q25 and relaunch crypto trading in the U.S. in 3Q25

New Product Offerings – Options – The company is enabling advanced options strategies in international markets in 2Q25 with support for extended trading hours of index options coming in 3Q25

New Product Offerings – Other – Corporate bond trading is expected to launch by the end of 2Q25 and mutual fund trading is anticipated during 4Q25

Webull Premium – This product was launched in March as a subscription-based membership service. As of May 15, the product had 40k users, representing $2B in customer assets (16% of Webull 1Q25 ending customer asset base) and has brought in $260M in net AUM. Webull premium caters to active traders and long-term investors and subscribers have higher account NAVs than Webull’s average

Collaboration with Visa – Announced in May, Webull users can transfer money between Webull brokerage account and external bank account through Visa Direct

Geographic Expansion – The company plans to launch brokerage in the Netherlands during 3Q25

Other notable highlights from the earnings call/press release:

Key Growth Pillars – Management outlined the key growth pillars for the company moving forward which include: 1) broadening the company’s product offerings, 2) entering new asset classes, and 3) expanding access globally

LatAm Product – During 1Q25, Webull launched its LatAm app which has consolidated its Brazil and Mexican platforms. This new app should make it easier for Webull to expand into new geographies within the region

Retirement Accounts – Growth and demand for retirement accounts continues to be strong. Currently have $1B in retirement fund AUM

Options Trading – Seeing increased sophistication with its clients trading options. Anticipate continuing to invest time and resources throughout the year to expand offerings here

Expenses – Adjusted expenses (ex-SBC) increased modestly Y/Y. This was driven by increases in G&A spend and Technology (as well as brokerage, which has grown with trading volumes) however this has been offset by decreases in marketing spend as Webull has looked to optimize marketing spend and has shifted towards more asset match promotion activity vs. free stock giveaways that it had leaned more towards in the past

Trading Revenue Commentary – Trading revenue per trade increased from $1.37 in 1Q24 to $1.47 in 1Q25

Broad Thoughts / Outlook

While there are no real consensus figures to base expectations off, I thought this was a pretty good quarter for BULL. Revenue growth was solid both Y/Y and Q/Q. Obviously the growth in transaction-based revenue could be chalked up to increased volatility, but that strength should be seen continuing into at least 2Q25. Expenses were well maintained in my opinion and margin expansion was impressive as Webull reigned in marketing spend. Additionally, on the metrics front, the NNA annualized growth rate was the best amongst the four eBrokers that report Net Deposit figures (granted off a low base) and has been for the past couple quarters. Client account growth remained solid, average assets per account are growing at an impressive rate Y/Y and DARTs were really strong in the quarter. See chart below for further details on key metrics across the eBrokers.

eBroker Quarterly Key Metrics Comparison