Weekly Recap for Week Ended June 27, 2025 + A Bunch of Markets News This Week

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Jun. 27, 2025

Exchanges Working with SEC to Ease Public Company Disclosure Rules

According to Reuters, Nasdaq (NDAQ 0.00%↑) and NYSE (ICE 0.00%↑) are working with the SEC to ease the regulatory burden on corporates looking to go public. According to the article (via Nasdaq data), the number of public companies in the U.S. has shrunk by 36% since 2000 to about 4,500. This has partly been driven by companies choosing to stay private longer in order to avoid additional regulatory scrutiny that comes with being public as well as the additional costs associated with maintaining a public listing. In terms of the regulatory burden the article points to AAPL’s IPO as an example, in which AAPL’s prospectus was 47 pages long when it went public in the 1980, which compares to the average IPO prospectus today at 250 pages, much of which includes generic risk language and disclosures. Additionally, the exchanges and SEC are looking into adjusting the proxy process, which could make it more difficult for small shareholders to launch proxy contests. Finally, the article also mentions potentially reducing fees associated with maintaining a public listing.

I think this should be a welcome development for markets, the exchanges, and investors. While easing the regulatory burden on corporate issuers could be viewed as “risky” for investors, there is likely way too much that goes into the public filing process. Additionally, adjusting the proxy process likely increases a company’s desire to go public as proxy contests from small activist holders can become a major headache for management and boards versus remaining owned by a single private equity holder. I think this will be great for public investors as they have largely missed out on the growth of some very large privately held assets in recent years / decades.

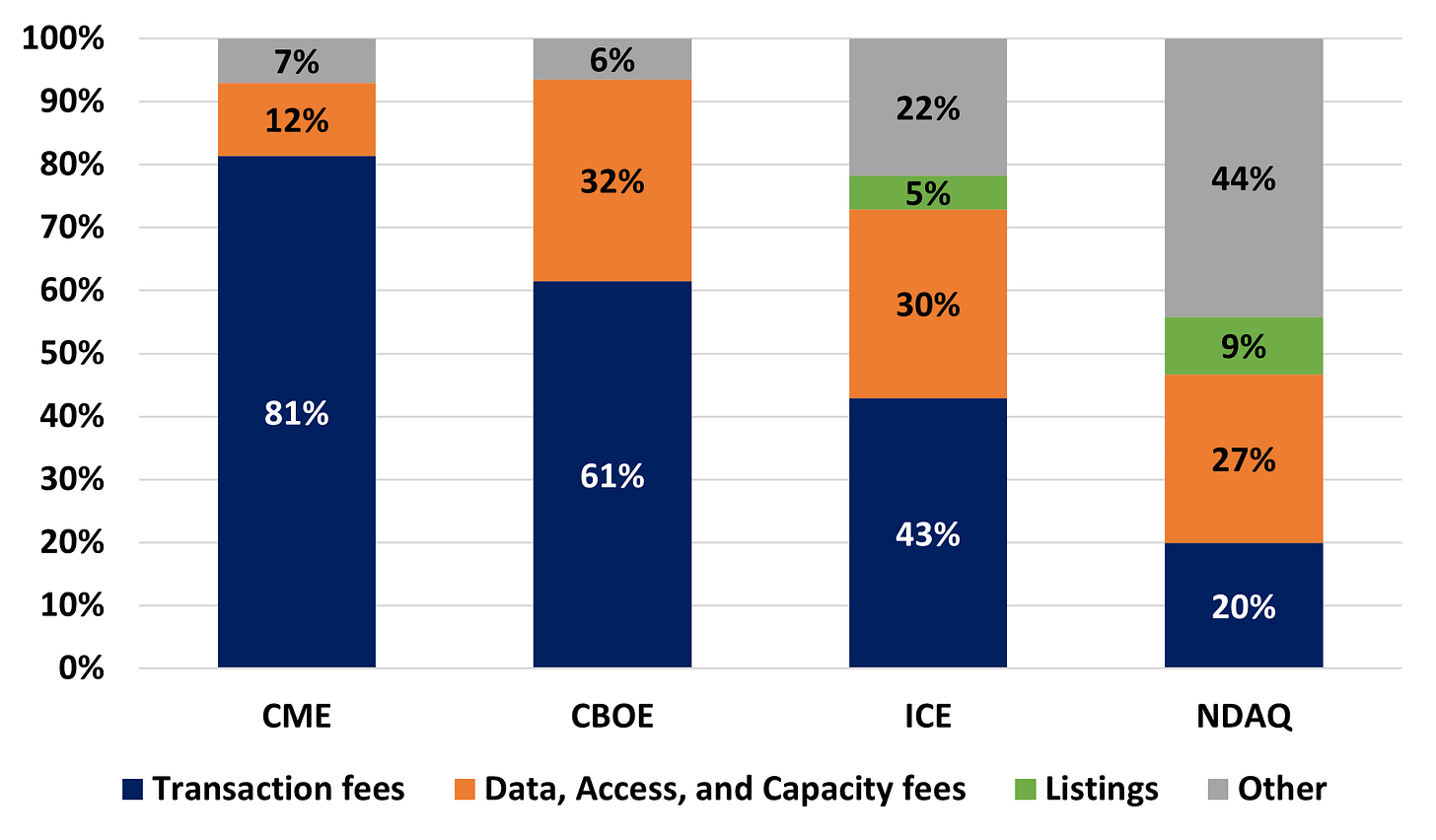

While lowering listings fees for corporates could be a headwind for ICE and NDAQ’s listings revenues, listings only comprise about 5% and 9% of total net revenue for each, respectively (see chart below). Further, this would likely be made up through 1) an increase in the total number of listings overall, 2) increased trading activity with more issuers on the exchange, 3) increased data revenues, 4) increased ancillary revenue (e.g. Nasdaq’s Board and IR insights, index-related revenue, etc.).

Exchange 2024 Net Revenue Composition

Source: company documents

Citadel Attempting to Stop Launch of IEX Options

According to a Bloomberg article, Citadel Securities has asked the SEC to stop the launch of a new options exchange from IEX Group. The new exchange would be able to delay, cancel and reprice options orders on behalf of market makers. According to the article and IEX these features are a way to avoid latency arbitrage, which IEX believes will increase competition and potentially allow for tighter spreads and increased liquidity. Citadel (and others - SCHW 0.00%↑, NYSE, IMC) view this differently, suggesting it could negatively affect pricing across options exchanges. Citadel has been widely critical of IEX’s offerings historically, though the SEC approved IEX’s equities exchange, which IEX launched in 2016, so it remains to be seen how this will unfold over the coming months.

More News on Bridging the Gap Between Decentralized Finance and Traditional Finance

Digital Asset announced a $135M funding round led by DRW Venture Capital and Tradeweb (TW 0.00%↑) with participation from BNP Paribas, Circle Ventures ( CRCL 0.00%↑), Citadel Securities, the DTCC, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu (VIRT 0.00%↑). The funding round is meant to accelerate the adoption of the company’s Canton Network. The Canton Network is a public, permissionless blockchain built for institutional finance that currently supports bonds, money market funds, alternative funds, commodities, repos, mortgages, life insurance and annuities with about 400 participants on the network. Canton provides transparency and financial confidentiality users by allowing institutions to set privacy settings according to their needs. Additionally, Nasdaq and QCP announced that they have connected Canton to Nasdaq Calypso, offering 24/7, automated margin and collateral management – see more in Nasdaq section below.

Bruce Markets Funding Round

Bruce Markets announced a strategic investment round from major financial services players including Apex Fintech Solutions, Fidelity, Nasdaq Ventures, NH Investment Securities, PEAK6 Investments, Robinhood, tastytrade and Webull (BULL 0.00%↑). Bruce Markets operates an alternative trading system (ATS), specifically focused on overnight trading hours from 8pm to 4am ET Sunday through Thursday nights. Bruce’s trading system is powered by Nasdaq technology (thus I am not surprised to see Nasdaq Ventures in the investment round). Previously I’ve written about the increased interest in 24-hour trading (here and here) as all the major online brokers now offering 24-hour trading in some form and all three of the major exchange operators are currently working together with the SEC to offer 24-hour trading and shape NMS rules to fit the extended trading day.

This is yet another example of the increased influence retail traders have had on shaping U.S. market structure in recent years. The increased need for a 24-hour trading session has come from 1) retail traders looking to trade stock outside of their personal workday and 2) international retail investor interest in the U.S. markets looking to place trades during their waking hours. I fully expect the SEC and major exchanges to establish a framework to allow for overnight trading on the SEC registered exchanges, likely within the next year. The one question I have with that, as it relates to Bruce Markets, is why we need a dedicated ATS to the overnight session. But hey, maybe NDAQ buys them outright.

Funding Rounds in Prediction Markets Space

This past week several news outlets reported that both Kalshi and Polymarket were closing in on or completing raising another funding round. According to a blog post from Kalshi it raised $185M in Series C funding at a $2B valuation led by crypto VC Paradigm while Bloomberg reported that Polymarket was close to finalizing a $200M round at a $1B valuation led by Founders Fund. The prediction markets space has exploded in popularity in recent years with IBKR 0.00%↑ and HOOD 0.00%↑ also having launched their own prediction markets / contracts (IBKR here and HOOD here). I will not be surprised to see these marketplaces continue to expand and become even more commonplace and further integrated into traditional finance (exchanges, brokers, etc.) down the road. And eventually I’m anticipating a wave of consolidation amongst the major players, similar to exchange consolidation in the mid-late 2000s and early 2010s, so I look forward to that eventuality.

Gemini Announces Tokenized Equity Trading in E.U.

On Friday June 27, Crypto platform Gemini announced the launch of tokenized U.S. equity trading for clients in the E.U. beginning with tokenized MicroStrategy (MSTR). The company plans to expand into other stocks as well as ETFs in the coming days. This announcement follows several similar announcements from Coinbase (COIN 0.00%↑) and Kraken in recent weeks and adds another potential competitive threat to the eBrokers I discuss here regularly. To see a full recap of my recent thoughts, please see my post from last week here.

Programming Note

As an FYI (not that I have a ton of followers, but still want those of you who do follow to be informed) - I will be OOO from the evening of 7/17 through 7/27. As such, there will likely be no weekly update for the week ended 7/18 and the week ended 7/25. Additionally, this means I will be delayed in getting earnings recaps out for IBKR, SCHW, CME & NDAQ. I fully anticipate having full earnings reviews out for all four during the week ended 8/1.

Company Specific Updates for Week Ended Jun. 27, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE)

Announces date of Second Quarter Earnings Release and Conference Call

Friday, August 1 pre-market

Conference Call at 8:30am ET

CME Group Inc. (CME)

To Launch FTSE CoreCommodity CRB Futures on July 21

CoreCommodity CRB Index tracks a basket of 19 commodities across energy, ags, precious metals and industrial metals

Intercontinental Exchange, Inc. (ICE)

RBC Capital Markets Joins ICE Clear Credit as an FCM

First FCM with a Canadian parent company on ICE Clear Credit

Nasdaq, Inc. (NDAQ)

Announces 2Q25 Earnings Release Date

Thursday, July 24 pre-market

Call at 8:00am ET

Nasdaq and QCP Connect Canton Network to Nasdaq Calypso

Calypso expanding capabilities to support automated 24/7 margin and collateral management across crypto derivatives, fixed income, exchange-traded derivatives and OTC derivatives

Allows for real-time capital efficiencies enabling financial institutions to allocate capital more efficiently while maintaining confidentiality through Canton’s privacy settings

Fixed Income Trading Platforms

Tradeweb Markets Inc. (TW)

Introduces T-bill Trading on ICD Portal

Corporate treasurers can now trade T-Bills via direct connection between ICD and Tradeweb’s institutional trading platform

Marks first step in integrating ICD workflows across a variety of TW products

ICD currently facilitates over $4.5T in annual trading volume and has over 550 corporate treasury organizations as clients

Online Brokers

Webull Corporation (BULL)

Re-Enters Crypto Market with Launch in Brazil

Anticipates relaunching in U.S. and other markets in coming months

eToro Group Ltd. (ETOR)

Partnership with Visa

Offers 4% back in stock on everyday purchases

Zero currency conversion fees as well as a number of other perks

Launches Target Date Portfolios in Partnership with Franklin Templeton

Portfolios target 2028, 2030, 2033 and 2035 and automatically calibrate weight of equity and fixed income allocations based on remaining time period

Robinhood Markets, Inc. (HOOD)

Reports MTD Trading Volume Through June 24

Equity Volume $142B

Options Volume 132M

Crypto Volume $7B

Projecting these volumes through month end gets you to potential transaction revenue for 2Q25 of around $500M (-15% Q/Q, +52% Y/Y)

Interactive Brokers Group, Inc. (IBKR)

Thursday, July 17, 4:30pm ET

The Charles Schwab Corporation (SCHW)

Announces Summer Business Update

Friday, July 18, 8:30am ET

Company Specific Updates Anticipated for the Upcoming Week (Ended Jul. 4, 2025)

Exchanges

Cboe Global Markets, Inc. (CBOE)

June Volume Release and May RPCs

Thursday, July 3 post-close

CME Group Inc. (CME)

June Volume Release and May RPCs

Wednesday, July 2 pre-market

Intercontinental Exchange, Inc. (ICE)

June Volume Release and June RPCs

Thursday, July 3 pre-market

Fixed Income Trading Platforms

None to Note

Online Brokers

Robinhood Markets, Inc. (HOOD)

To Catch a Token Crypto Keynote

Monday, June 30, 11:00am ET

Interactive Brokers Group, Inc. (IBKR)

June Metrics Report

Tuesday, July 1 post-close

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Jun. 27, 2025

S&P Flash U.S. Services PMI (Jun.) – 53.1 vs. consensus 53.0 and prior 53.7

S&P Flash U.S. Manufacturing PMI (Jun.) – 52.0 vs. consensus 51.5 and prior 52.0

Existing Home Sales (May) – 4.03M vs. consensus 3.95M and prior 4.0M

S&P Case-Shiller Home Price Index (Apr.) – 3.4% vs. consensus 4.0% and prior 4.1%

Consumer Confidence (Jun.) –93.0 vs. consensus 98.4 and prior 98.0

New Home Sales (May) – 623k vs. consensus 695k and prior 722k

Initial Jobless Claims (week ended Jun. 21) – 236k vs. consensus 246k and prior 246k

Advanced U.S. Trade Balance in Goods (May) – $96.6B vs. prior ($87.6B)

Advanced Retail Inventories (May) – prior (0.1%)

Advanced Wholesale Inventories (May) – prior 0.0%

Durable Goods Orders (May) – 16.4% vs. consensus 6.5% and prior (6.6%)

Core Durable Goods Orders (May) – 1.7% vs. prior (1.4%)

GDP Second Revision (1Q) – (0.5%) vs. consensus 0.2% and prior (0.2%)

Pending Home Sales (May) – 1.8% vs. consensus (0.5%) and prior (6.3%)

Consumer Sentiment (Jun.) – 60.7 vs. consensus 60.5 and prior 60.5

Personal Income (May) – (0.4%) vs. consensus 0.3% and prior 0.8%

Personal Spending (May) – (0.1%) vs. consensus 0.1% and prior 0.2%

PCE Index (May) – 0.1% vs. consensus 0.1% and prior 0.1%

PCE Y/Y (May) – 2.2% vs. consensus 2.3% and prior 2.2%

Core PCE Index (May) – 0.2% vs. consensus 0.1% and prior 0.1%

Core PCE Y/Y (May) – 2.7% vs. consensus 2.6% and prior 2.6%

Major Macro Updates Scheduled for the Upcoming Week (Ended Jul. 4, 2025)

Monday, Jun. 30

Chicago Business Barometer (Jun.) – consensus 43.0 and prior 40.5

Tuesday, Jul. 1

S&P Final U.S. Manufacturing PMI (Jun.) – prior 52.0

Construction Spending (May) – consensus (0.1%) and prior (0.4%)

Job Openings (May) – consensus 7.3M and prior 7.4M

ISM Manufacturing (Jun.) – consensus 48.6 and prior 48.5

Auto Sales (Jun.) – prior 15.6M

Wednesday, Jul. 2

ADP Employment (Jun.) – consensus 120k and prior 37k

Thursday, Jul. 3

Initial Jobless Claims (week ended Jun. 28) – consensus 240k and prior 236k

U.S. Employment Report (Jun.) – consensus 115k and prior 139k

U.S. Unemployment Rate (Jun.) – consensus 4.3% and prior 4.2%

U.S. Hourly Wages (Jun.) – consensus 0.3% and prior 0.4%

Hourly Wages Y/Y (Jun.) – consensus 3.9% and prior 3.9%

U.S. Trade Deficit (May) – prior ($61.6B)

S&P Final U.S. Services PMI (Jun.) – prior 53.7

Factory Orders (May) – consensus 8.7% and prior (3.7%)

ISM Services (Jun.) – consensus 50.5% and prior 49.9%

Friday, Jul. 4

None to Note, July 4 Holiday

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

For the week ended June 27, 2025, volumes were mixed while volatility metrics were lower W/W.

The average VIX for the week was down 15% from the prior week, average realized volatility fell 12% W/W, average volatility of volatility (as measured by the VVIX) was down 14% W/W and the average MOVE index (U.S. Treasuries volatility) was down 3% W/W.

Futures average daily volumes (ADV) were lower as CBOE futures volumes were down 25% W/W, CME futures volumes were up 13% W/W, and ICE futures volumes were down 22% W/W.

Total U.S. Equities ADV was up 2%W/W, as TRF volumes rose 5% W/W while on-exchange volume were unchanged W/W. Industry equity options volumes were up 2% W/W while index options volumes rose 1% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

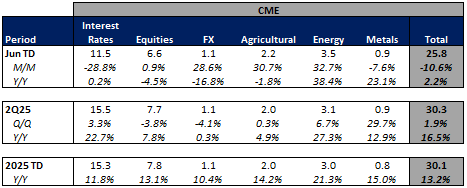

CME Futures Volumes (M)

Source: Company Daily Volume Releases

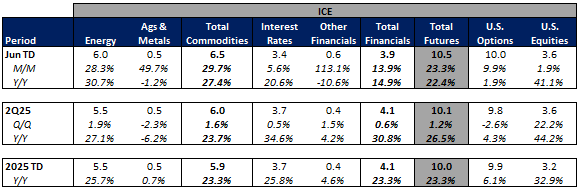

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking mixed in June-to-date relative to May but are mainly higher Y/Y. This comes as volatility is up MTD on a Y/Y basis.

The average VIX in June-to-date is up 44% Y/Y while realized volatility is up 74% Y/Y and volatility of volatility is up 22% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in June-to-date is down 4% Y/Y.

Futures volumes are mixed Y/Y as ICE futures MTD ADV is up 22% vs. May 2024 ADV. Meanwhile, CME ADV is up 2% Y/Y while CBOE futures ADV is down 21% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 54% MTD while option volumes are up 15% for equity options and up 18% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week ending at a record high, rising 340bps W/W. Yields were lower while the curve steepened a bit and the VIX fell 21% on the week.

In terms of the companies I follow, ETOR showed the strongest performance, rising 9% W/W, followed by HOOD up 6% and IBKR up 5%. Rounding out eBroker-land, BULL rose 2.2% and SCHW was up 1%. Fixed income trading land was mixed once again with MKTX flat and TW rising 4%. In exchange land NDAQ showed the strongest performance, rising 4% given the market rally while ICE rose 2%, and CBOE and CME were both up 1%.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: Yahoo Finance

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

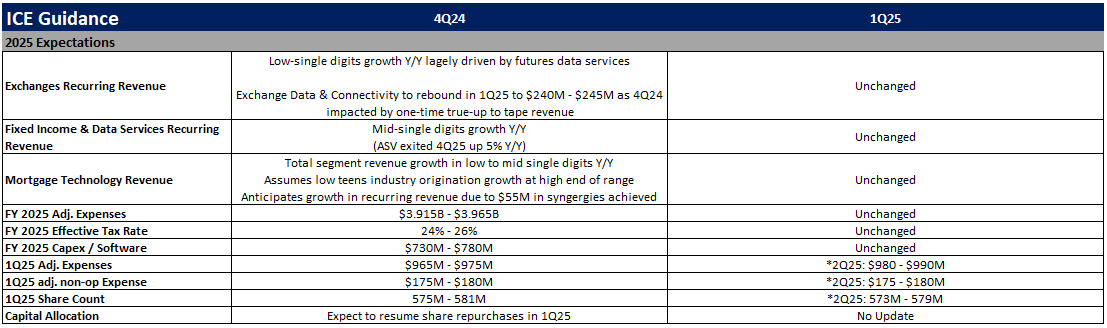

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

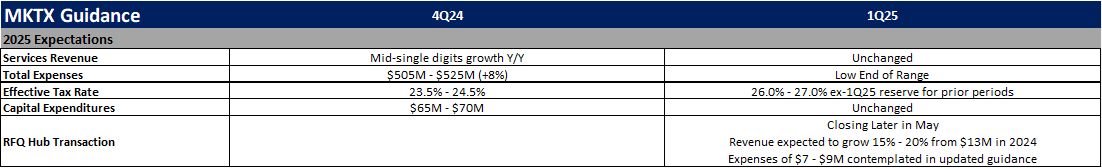

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

The Charles Schwab Corporation (SCHW)

The Canton Network integration with Nasdaq Calypso is a realy big deal that I dont think gets enough atention. Having 24/7 automated margin and collateral management across multiple asset classes could be a game changer for how institutions allocate capital. The fact that NDAQ is positioning itself at the intersection of traditional finance and blockchain shows they understand where the industry is headed. I also find it interesting that Nasdaq Ventures invested in Bruce Markets and their platform is powered by Nasdaq technology. It shows NDAQ is playing both sides smart, investing in extended hours trading venues while also providing the tech infrastructure. Regarding the SEC work on easing listing requirements, this seems like a smart move even if it might slightly reduce listing fees short term. You make a good point that more listings overall plus increased trading and data revenue would more than offset any fee reduction. The stat about IPO prospectuses going from 47 pages for Apple to 250 pages average today is kind of insane when you think about it.