Weekly Recap for Week Ended February 14, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Feb. 14, 2025

The past week plus has been characterized by several interesting updates coming out of the diversified financials space.

First, the retail trader seems to be influencing market decisions more and more every day. In the past week Charles Schwab (SCHW 0.00%↑) announced that it was expanding 24 hour trading to all of its clients across the entire list of S&P 500 and Nasdaq 100 stocks. Additionally, Intercontinental Exchange (ICE) announced a partnership with Reddit (RDDT) to develop data products for capital markets based on conversations taking place on Reddit. While these data products will likely not focus solely on retail traders’ sentiment and also include sentiment around products/services that Reddit users are conversing about outside of simply stock picks, in my mind it still brings validity to the staying power/influence of the retail trader. A consistent theme over the past couple of years has been the rise of the retail trader and both announcements further validate that trend.

Second, increasing competition in the diversified financials space. This past week ICE 0.00%↑ announced that it was planning to relocate its Chicago stock exchange to Texas. ICE noted that Texas is the state that represents the largest number of NYSE listings and this announcement is in direct response to the pending launch of the Texas Stock Exchange (TXSE). To me, this announcement validates the TXSE launch. While NYSE moving an exchange to the Texas market may make it more challenging for TXSE to rapidly gain listings and market share I think this announcement shows NYSE was growing concerned about listings migrating to the Texas exchange due to the likely more lax listings and board oversight standards planned for the Texas exchange. I would not be entirely shocked if Nasdaq announced similar plans in the coming months / years in order to defend its listings business.

Finally, given the changing regulatory environment in the U.S. and pro crypto stance of the current administration, we are starting to see more and more companies in the diversified financials space announcing plans to go public. eToro formally announced that it confidentially filed for an IPO with the SEC. Additionally, there have been numerous news articles published within the last couple of weeks suggesting a handful of crypto exchanges and custody companies (Gemini, Bullish Global, Circle, BitGo to name a few) are considering filing in the coming year. Regardless of how this turns out it will be an interesting time in the space and could greatly increase the list of well-established publicly traded exchange and trading companies.

Company Specific Updates for Week Ended Feb. 14, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE)

CME Group Inc. (CME)

Reports 4Q24 and 2024 earnings results

Posted EPS of $2.52 vs. consensus of $2.45

Revenue came in at $1.52B which was about 1% above consensus at $1.51B

RPCs (revenue per contract) were solid for the quarter, increasing 3% Y/Y, though this was largely driven by mix shifts so could revert in coming months

Expense growth for the quarter was a little elevated (+6.6% Y/Y - vs. growth through 3Q of 3.3% Y/Y)

2025 Guidance Highlights

OpEx $1.65B (+3.8% Y/Y)

CapEx $90M

Tax rate 22.5% - 23.5%

Other Notes

RPC fee changes could increase transaction revenue 1.0% - 1.5% Y/Y

Market data fees increased 3.5% at start of year

Increasing surcharge by 10bps on non-cash collateral for participants that don’t post 30%+ of margin requirement in cash

Total impact of fee changes announced could increase pre-tax income 2.0% - 2.5% Y/Y assuming same volume and collateral levels

All in all I thought the quarter was solid and that guidance updates were inline with my expectations

Announced First Trades of Physically-Delivered Ethanol Futures & Options

Nasdaq, Inc. (NDAQ)

Announced Cash Tender for up to $200M in Debt

View as a positive as NDAQ continues to focus on deleveraging

Intercontinental Exchange, Inc. (ICE)

Announced Collaboration with Reddit to Create and Distribute Data Products for Capital Markets

Partnership will apply ICE’s data science and machine learning to the content provided on Reddit

Will offer real-time look at news and trends impacting global markets

I view this as an extremely interesting development

In my mind this proves out the rise of the retail trader (sentiment on stock from retail community will be viewed instantly and in an easily digestible manner)

Beyond what stocks retail is picking general sentiment on products / services will be just as meaningful to market participants

New York Stock Exchange to Launch NYSE Texas

Reincorporating NYSE Chicago in Dallas, Texas

Companies will be able to list on NYSE Texas

Direct response to TXSE

I think NYSE is becoming concerned about more lax regulatory agenda from TXSE and this is an effort to stem potential outflow of listings to TXSE

Fixed Income Trading Platforms

Tradeweb Markets Inc. (TW)

Online Brokers

Robinhood Markets, Inc. (HOOD)

EPS came in at $1.01 vs. consensus of $0.45

EPS included $0.47 of one time items, ex-items EPS of $0.54 still handily beat the street

Revenue of $1.01B beat consensus of $952M

Adj. EBITDA margin expanded from 28% to 60% Y/Y

The Charles Schwab Corporation (SCHW)

Announced TD Bank Secondary and Plans $1.5B Stock Buyback

TD will dispose of remaining stake in SCHW

I view this as a positive for 2 reasons

Removes overhang from potential TD sales in the future

Proves SCHW is serious about returning to its historical capital allocation strategy

Reported January Monthly Metrics

Net New Client Assets were $30.6B (3.6% annualized growth rate)

Down from seasonally elevated 7.1% NNA growth rate in December 2024 but up from 2.4% in January 2024

Total client assets ended January at $10.3T, up 2% M/M, aided by $201M in market gains

Cash as a % of client assets declined to 9.8% from 10.1% at the end of December, which is not entirely surprising given the market gains in the month as well as typical seasonal patterns

Thus, transactional sweep cash seasonally declined to $399.6B (down $19.0B M/M)

Average interest earning assets were essentially unchanged in the month at $431.5B

Also noted that it paid down $3.7B in supplemental funding balances in January, ending the month at $46.2B

I view this monthly update as positive due to 1) continued supplemental funding paydowns and 2) strong core metric trends during a seasonally softer month

Makes Expanded 24-Hour Trading Available to All Clients

After piloting ETH trading for clients from November 2024 through January 2025 with a small group of clients expanding to all clients

Securities available for ETH trading include all S&P 500 stocks, Nasdaq 100 stocks, and hundreds of ETFs

In my view, the market is moving to meet the retail trader where it wants to trade as a number of exchanges have also filed to extend equity trading hours to 24/5 in recent months

eToro Group

Announces confidential draft IPO filing

This has been in the news for a while but officially announced by the company on Feb. 12

eToro attempted to go public in 2022 via SPAC but those plans were delayed

Company Specific Updates Anticipated for the Upcoming Week (Ended Feb. 21, 2025)

Note markets will be closed Monday, February 17 for the Presidents’ Day Holiday

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

None to Note

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Feb. 14, 2025

NFIB Optimism Index for January – 102.8 vs. consensus 104.5 and prior month 105.1

CPI Y/Y for January – 3.0% vs. consensus 2.8% and prior 2.9%

Core CPI Y/Y for January – 3.3% vs. consensus 3.1% and prior 3.2%

Initial Jobless Claims for week ended Feb. 8 – 213k vs. consensus 225k and prior 220k

PPI Y/Y for January – 3.5% vs. prior 3.5%

Core PPI Y/Y for January – 3.4% vs. prior 3.5%

Retail Sales for January – (0.4%) vs. consensus 0.3% and prior 0.3%

Major Macro Updates Scheduled for the Upcoming Week (Ended Feb. 21, 2025)

Monday, Feb. 17

President’s Day Holiday – None to Note

Tuesday, Feb. 18

Homebuilder confidence Index (Feb.) – consensus 46 and prior 47

Wednesday, Feb. 19

Housing Starts (Jan.) – consensus 1.4M and prior 1.5M

Building Permits (Jan.) – consensus 1.46M and prior 1.48M

Thursday, Feb. 20

Initial jobless claims (week ended Feb. 15) – consensus 215k and prior 213k

Philadelphia Fed manufacturing survey (Feb.) – prior 44.3

U.S. leading economic indicators (Jan.) – consensus 0.0% and prior (0.1%)

Friday, Feb. 21

S&P Flash U.S. Services PMI (Feb.) – consensus 52.6 and prior 52.9

S&P Flash U.S. Manufacturing PMI (Feb.) – consensus 50.7 and prior 51.2

Consumer Sentiment (Feb.) – consensus 67.8 and prior 67.8

Existing Home Sales (Jan.) – consensus 4.13M and prior 4.24M

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

For the week ended February 14, 2025, volumes generally declined week over week, as volatility metrics fell across the board, in a week of lighter earnings, macro and geopolitical releases.

The average VIX for the week was down 7% from the prior week, average realized volatility was down 11% W/W, average volatility of volatility (as measured by the VVIX) was down 9% W/W and the average MOVE index (U.S. Treasuries volatility) was down 8% W/W.

Futures average daily volumes (ADV) declined as CBOE futures volumes were down 11% W/W, CME futures volumes were down 10% W/W, and ICE futures volumes were down 9% W/W.

Total U.S. Equities ADV was up 5% W/W, mainly driven by off-exchange trading as TRF volumes were up 8% W/W. Industry equity options volumes were flat W/W while index options volumes declined (-7% W/W).

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

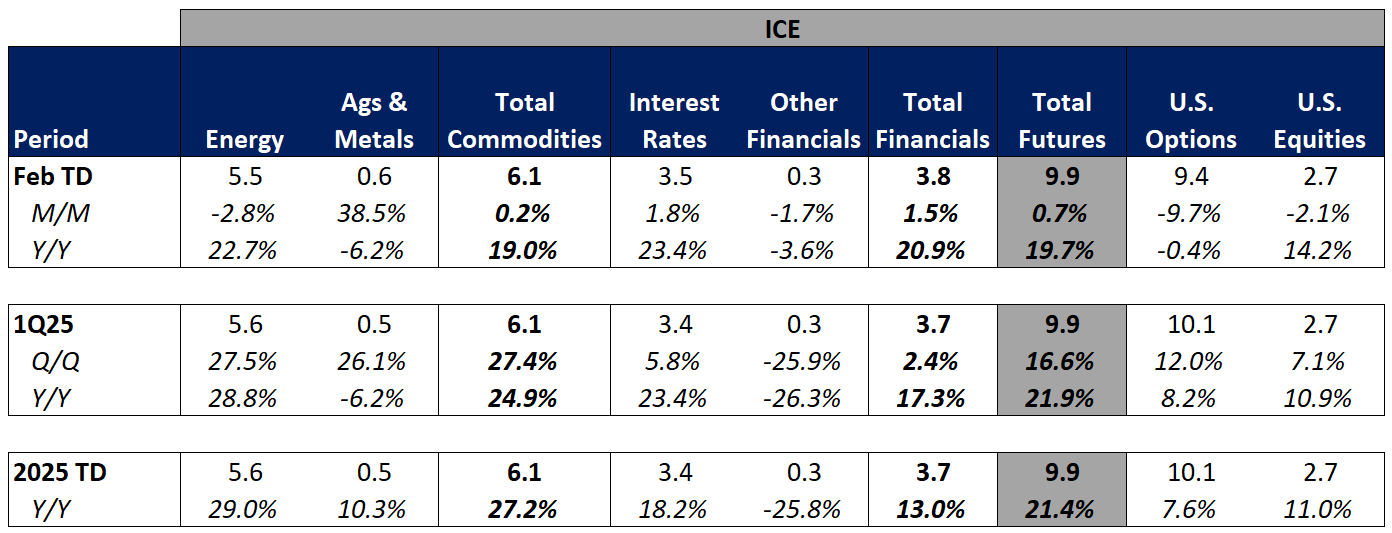

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

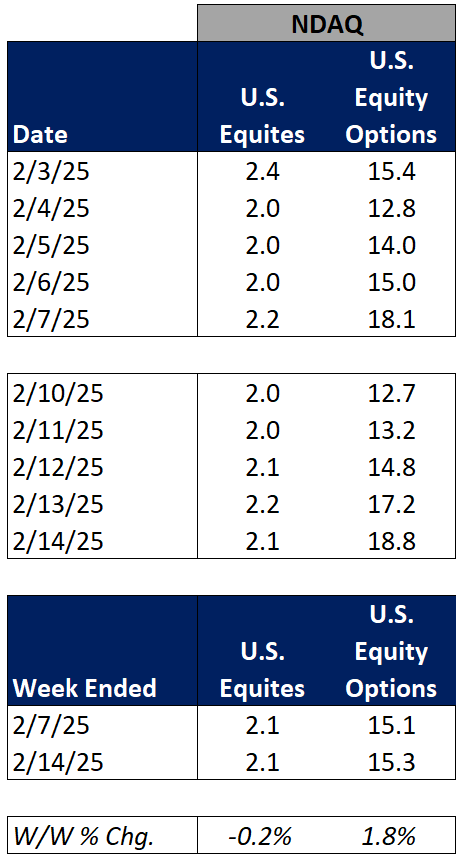

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking mixed in February-to-date. This comes as volatility is generally higher MTD on a Y/Y basis.

The average VIX in February-to-date is up 16% Y/Y while realized volatility is up 4% Y/Y and volatility of volatility is up 18% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in February-to-date is down 19% Y/Y.

Futures volumes are somewhat mixed as ICE futures MTD ADV is up 20% vs. February 2024 ADV. Meanwhile, CME ADV is down 8% Y/Y while CBOE futures ADV is down 2% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 30% MTD while option volumes are up 14% for equity options and down 1% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

Markets ground mostly higher this week with the S&P up 1.5% W/W as the market seems to be shrugging off potential tariff threats. Yields were stable W/W, with the 2-Year falling 3bps and 10-Year falling 2bps, and volatility declined 11% W/W. The market took a brief pause Wednesday following the CPI release, showing January inflation figures accelerated and came in above economists’ forecasts, though the grind higher resumed Thursday.

In terms of the companies I follow, HOOD performed the strongest (+17%), highlighted by incredibly strong earnings on Wednesday after the close. Within the exchanges, CME showed strongest performance, closing out the week roughly flat, following a solid earnings report released Wednesday morning. On the Fixed Income Trading Platform side, MKTX continues to sell off, following its January metrics release showing continued market share losses.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

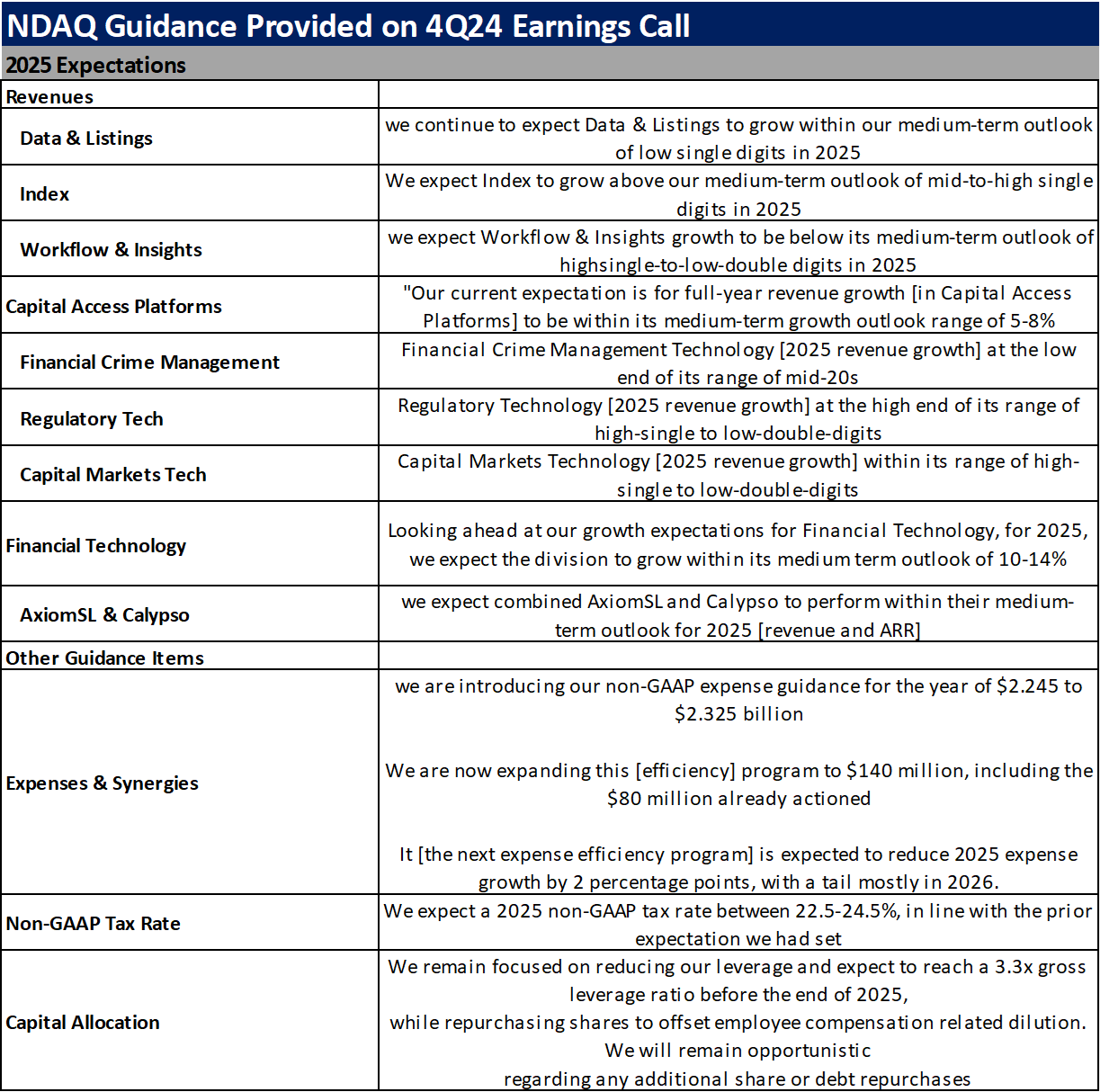

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

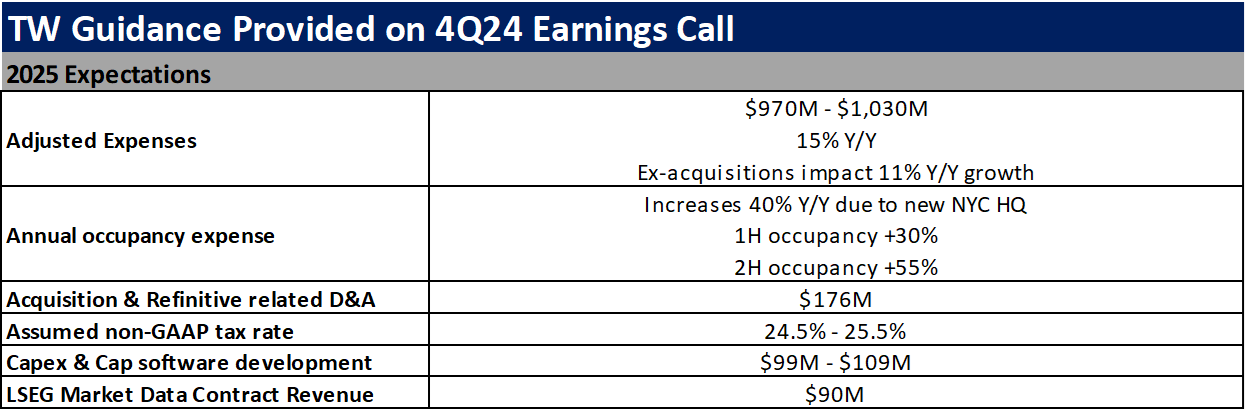

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

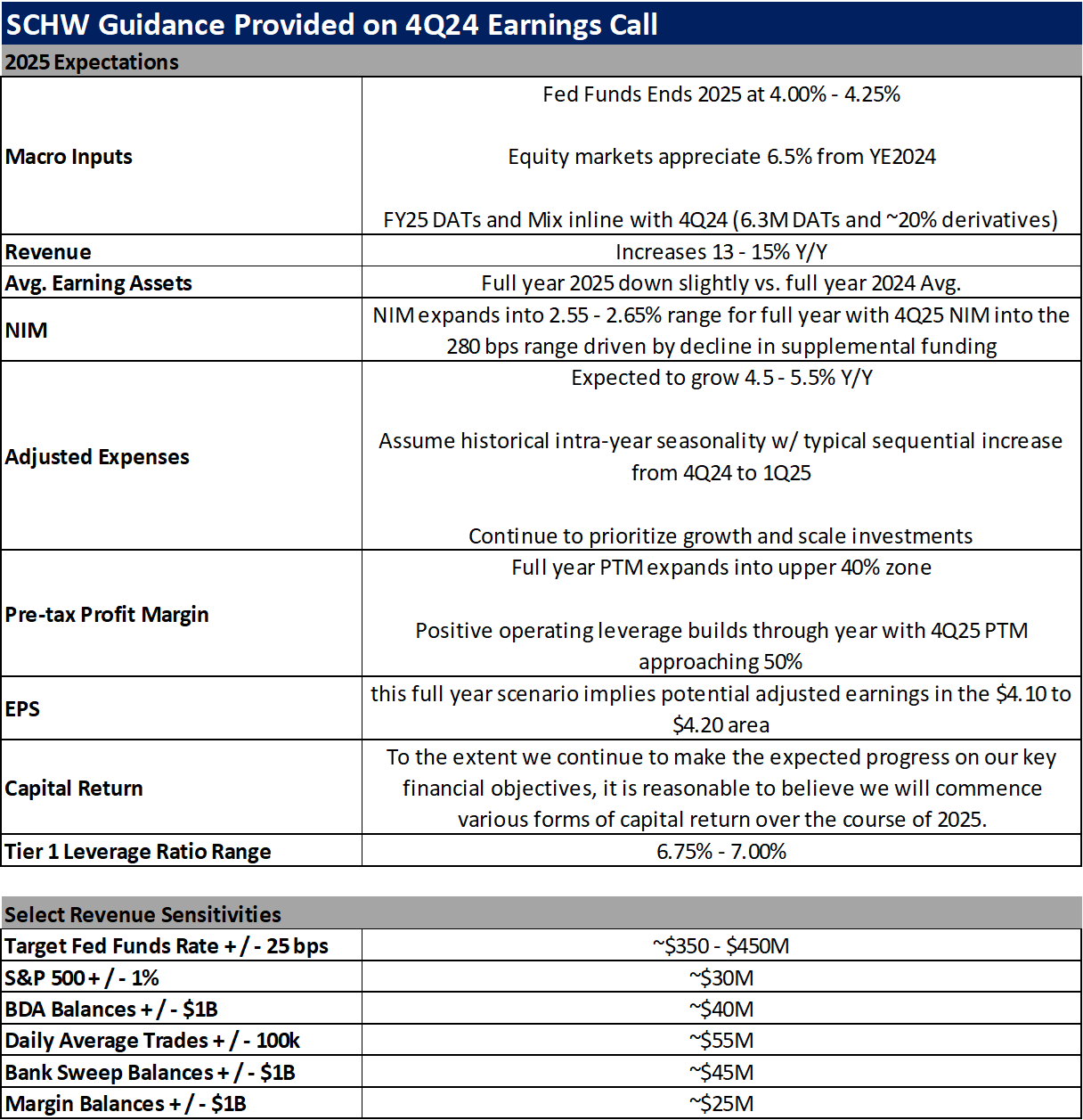

The Charles Schwab Corporation (SCHW)