More eBroker News (Yay!) + Weekly Recap for Week Ended June 20, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Jun. 20, 2025

eBroker Competition Continues to Heat Up: X Plans to Enter Investment and Trading; COIN Seeking Approval for Tokenized Equities

This past week, on June 19 (when U.S. markets were closed for the Juneteenth holiday), the FT published an article stating that X (Twitter) plans to enter the world of investing and trading as it pushes to become a “super app”. According to the FT, X CEO, Linda Yaccarino, stated that “you will be able to come to X and transact your whole financial life on the platform”, including offerings such as peer-to-peer payments, investments and trading. Any push into investing and trading would put X in direct competition with the eBrokers (BULL 0.00%↑ , ETOR 0.00%↑ , HOOD 0.00%↑ , IBKR 0.00%↑ , SCHW 0.00%↑ ) as the most likely users of X’s potential investment platform would be retail investors. In my mind the most at risk would be the platforms that cater more specifically to the “active” retail trader (BULL, ETOR, HOOD).

What is interesting to me is that this is the third such announcement over the past 30 days in which another platform has acknowledged plans to enter the retail online broker space. According to Reuters in an article also published this past week (June 17), COIN 0.00%↑ ’s chief legal officer stated that the company is seeking regulatory approval from the SEC to offer “tokenized equities”, whereby COIN would purchase and hold the underlying securities and offer tokens to investors to trade that represent ownership in the underlying security. COIN’s potential offering mimics almost exactly an announcement from Kraken on May 22 that it is planning to offer tokenized equities of certain U.S. stocks and ETFs to its international clients in the coming months.

So, amidst an increasingly competitive retail brokerage environment, we have decided to continue to bid up shares of HOOD to the moon? All three of these announcements directly compete with areas HOOD has had the most success and / or is looking to expand into (crypto traders – Kraken and COIN entering the equity trading space thus impeding the need to switch to HOOD; international expansion – Kraken offering is international focused; the social aspect of retail trading – X entering the space while HOOD has benefited from retail traders discussing trades using X’s Cashtag feature). I simply do not understand the thought process here.

The retail trading environment has always been an extremely competitive space. Recall the price wars of 2017-2019 – granted mostly driven by HOOD becoming a contender 😊 (SCHW cuts to $6.95 Feb 2, 2017, SCHW and Fidelity cut to $4.95 Feb 28, 2017, E*TRADE follows suit Mar 2, 2027, SCHW cuts to $0 Oct 1, 2019). During each of these periods of heightened competition, the stocks got absolutely spanked. I KNOW that what I’ve described and pulled in as evidence is directly hacking away at revenue and earnings vs. just potentially impacting growth through more competitors on the field but COME ON. We’re really going to trade HOOD at 60x earnings with THREE (potential) companies vying for their market share? I’m not buying it. (For full thoughts on this bizarre valuation disconnect please see my earlier thoughts here).

This is how I’ve been feeling for the past few weeks:

Source: Giphy

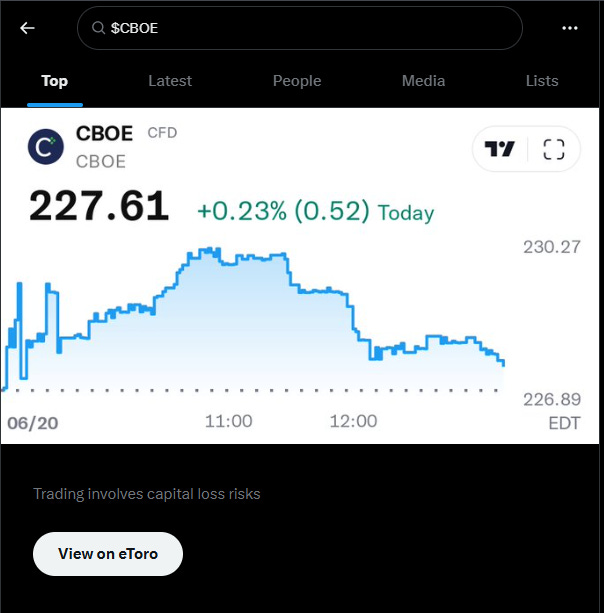

What’s further infuriating to me is on Friday, June 20, ETOR traded down 5%, my guess is on the X news. ETOR has had a partnership with X since mid-2024 whereby ETOR (the social trading platform) publishes financial education content on X and ETOR is featured prominently at the top of the cashtag search literally with a button below suggesting you go trade the specific ticker on ETOR’s platform (see screenshot below). Do we really think ETOR is going to be the loser in the space due to X embedding trading in its platform? Do we really think Elon is going to screw over the platform his company has had a partnership with for the past year? Maybe he is, he’s a bit of a loose cannon. Do we really think X is going to go it alone and build out their own retail brokerage from the ground up AND obtain all the necessary regulatory licenses in which to do so over continuing to partner with someone who has already done the heavy lifting?

Source: X

But seriously. If anything, I view this as an opportunity for ETOR for two reasons. First, in the smaller (near term but maybe bigger long term for shareholders) of the two benefits cases, I could see this further deepening X’s partnership with ETOR and having ETOR’s trading directly embedded within the X app, which could open up ETOR for much more rapid account and asset gathering (for relatively cheap). Second, in an absolute bullish scenario (for current shareholders), why can’t X just buy ETOR and own the whole platform outright? Crazier things have happened. I mean ICE 0.00%↑ was going to buy EBAY at one point for crying out loud (imagine ICE building out indices and then futures products around those indices following the price of beanie babies)!

Regardless of what shakes out between X and ETOR, I see HOOD as a relative loser here. I don’t see how this announcement can be beneficial for HOOD. X is a global platform. ETOR is a global platform. HOOD is expanding internationally, sure, but for now primarily a U.S. based platform. With regards to crypto tilt, ETOR and HOOD are roughly similar, so that doesn’t really weigh into a decision-making process here. I just don’t get what’s happening in the eBroker space right now.

Can someone please tell me where I’m wrong or mis-thinking things? I would love to know.

I promise some day I will stop hammering on the eBrokers (and would honestly like to talk about something else for once), there’s just been a lot of news so here we are…

Company Specific Updates for Week Ended Jun. 20, 2025

Exchanges

CME Group Inc. (CME)

Launches Futures on Mexico’s IPC Index

Provides broad exposure to Mexican equity market and tracks most liquid stocks on Bolsa Mexicana de Valores (BMV)

Contract will be denominated in Mexican pesos

Available for trading on August 18, subject to regulatory approvals

Announces 2Q25 Earnings Release and Conference Call

Wednesday, July 23

Earnings Release Posted 7:00am ET

Conference Call 8:30am ET

Intercontinental Exchange, Inc. (ICE)

ICE to dual-list on NYSE Texas

In its first three months, 10 companies from a range of sectors have chosen to dual-list on NYSE Texas

ICE will maintain its primary listing on the NYSE

Launches Average Prime Offer Rates (APOR) Index

Represents the annual percentage rates derived from average interest rates, points, fees and other terms on mortgages that are offered to consumers

Uses the same data from ICE Mortgage Technology’s loan origination system that the CFPB uses as the foundation of the weekly APOR

APOR is used to determine whether a loan meets certain regulatory requirements

ICE APOR will be updated weekly on the ICE Index Platform and publicly available

Nasdaq, Inc. (NDAQ)

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Further Expands MKTX’s EM offering

IGBs will be able to trade alongside 29 other local currency bond markets on the platform

Provides both Foreign Portfolio Investors (FPIs) and market makers with an enhanced trading experience throughout the entire trade lifecycle

Online Brokers

eToro Group Ltd. (ETOR)

Robinhood Markets, Inc. (HOOD)

Announce Date of June-to-date Trading Color Release

June 26 post-close

Introducing Robinhood Legend Charts on Mobile

Robinhood introduced its more powerful charts from its desktop app Legend now on its mobile app

Robinhood Presents: To Catch a Token

June 30 at 11am ET

Robinhood will be hosting a keynote event to unveil next-generation crypto products

The Charles Schwab Corporation (SCHW)

Company Specific Updates Anticipated for the Upcoming Week (Ended Jun. 27, 2025)

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

Robinhood Markets, Inc. (HOOD)

Expected to release June-to-Date trading color

Thursday, June 26 post-close

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Jun. 20, 2025

Empire State Manufacturing Survey (Apr.) – (16.0) vs. consensus (6.0) and prior (9.2)

U.S. Retail Sales (May) – (0.9%) vs. consensus (0.6%) and prior (0.1%)

Retail Sales Minus Autos (May) – (0.3%) vs. consensus 0.1% and prior 0.0%

Import Price Index (May) – 0.0% vs. consensus (0.1%) and prior 0.1%

Import Price Index Minus Fuel (May) – 0.3% vs. prior 0.4%

Industrial Production (May) – (0.2%) vs. consensus (0.1%) and prior 0.1%

Capacity Utilization (May) – 77.4% vs. consensus 77.7% and prior 77.7%

Business Inventories (Apr.) – 0.0% vs. consensus 0.0% and prior 0.1%

Homebuilder Confidence Index (Jun.) – 32 vs. consensus 35 and prior 34

Housing Starts (May) – 1.26M vs. consensus 1.35M and prior 1.39M

Building Permits (May) – 1.39M vs. consensus 1.42M and prior 1.42M

Initial Jobless Claims (week ended Jun. 14) – 245k vs. consensus 246k and prior 250k

FOMC Interest Rate Decision – Fed held rates steady at 4.25% - 4.50% inline with expectations

Philadelphia Fed Manufacturing Survey (Jun.) – (4.0) vs. consensus (2.0) and prior (4.0)

U.S. Leading Economic Indicators (May) – (0.1%) vs. consensus (0.1%) and prior (1.4%)

Major Macro Updates Scheduled for the Upcoming Week (Ended Jun. 27, 2025)

Monday, Jun. 23

S&P Flash U.S. Services PMI (Jun.) – consensus 53.0 and prior 53.7

S&P Flash U.S. Manufacturing PMI (Jun.) – consensus 51.5 and prior 52.0

Existing Home Sales (May) – consensus 3.95M and prior 4.0M

Tuesday, Jun. 24

S&P Case-Shiller Home Price Index (Apr.) – prior 4.1%

Consumer Confidence (Jun.) – consensus 99.1 and prior 98.0

Wednesday, Jun. 25

New Home Sales (May) – consensus 689k and prior 743k

Thursday, Jun. 26

Initial Jobless Claims (week ended Jun. 21) – consensus 248k and prior 245k

Advanced U.S. Trade Balance in Goods (May) – prior ($87.6B)

Advanced Retail Inventories (May) – prior (0.1%)

Advanced Wholesale Inventories (May) – prior 0.0%

Durable Goods Orders (May) – consensus 6.5% and prior (6.3%)

Core Durable Goods Orders (May) – prior (1.3%)

GDP Second Revision (1Q) – prior (0.2%)

Pending Home Sales (May) – consensus 0.0% and prior (6.3%)

Friday, Jun. 27

Consumer Sentiment (Jun.) – consensus 59.5 and prior 60.5

Personal Income (May) – consensus 0.3% and prior 0.8%

Personal Spending (May) – consensus 0.2% and prior 0.2%

PCE Index (May) – consensus 0.1% and prior 0.1%

PCE Y/Y (May) – consensus 2.3% and prior 2.1%

Core PCE Index (May) – consensus 0.1% and prior 0.1%

Core PCE Y/Y (May) – consensus 2.6% and prior 2.5%

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

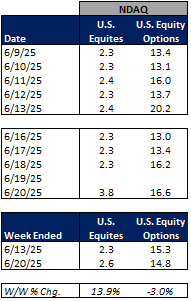

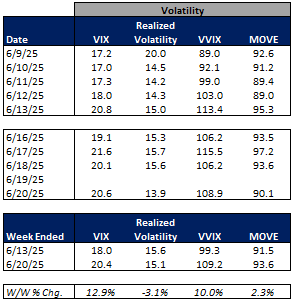

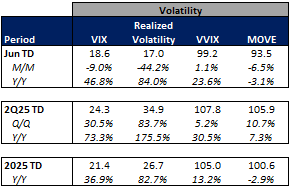

For the week ended June 20, 2025, volumes were mixed while volatility metrics were mainly higher W/W.

The average VIX for the week was up 13% from the prior week, average realized volatility fell 3% W/W, average volatility of volatility (as measured by the VVIX) was up 10% W/W and the average MOVE index (U.S. Treasuries volatility) was up 2% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were down 1% W/W, CME futures volumes were up 5% W/W, and ICE futures volumes were up 18% W/W.

Total U.S. Equities ADV was down 9%W/W, as TRF volumes fell 13% W/W while on-exchange volume declined 5% W/W. Industry equity options volumes were up 3% W/W while index options volumes rose 3% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking mixed in June-to-date relative to May but are mainly higher Y/Y. This comes as volatility is up MTD on a Y/Y basis.

The average VIX in June-to-date is up 47% Y/Y while realized volatility is up 84% Y/Y and volatility of volatility is up 24% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in June-to-date is down 3% Y/Y.

Futures volumes are mixed Y/Y as ICE futures MTD ADV is up 25% vs. May 2024 ADV. Meanwhile, CME ADV is up 4% Y/Y while CBOE futures ADV is down 17% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 53% MTD while option volumes are up 13% for equity options and up 15% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

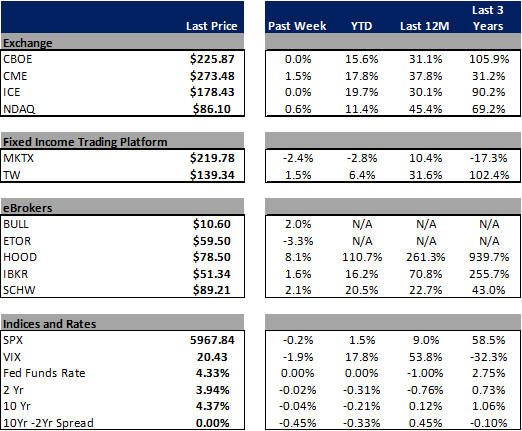

Major Indices, Interest Rates and Company Share Price Trends

The market was essentially unchanged on the week (down 20 bps W/W) despite geopolitical uncertainty increasing dramatically while treasury yields down slightly W/W.

In terms of the companies I follow, HOOD showed the strongest performance, rising 8% W/W while BULL, IBKR and SCHW were all up 2% and ETOR fell 3% on the week. Fixed income trading land was mixed once again with MKTX falling 2% and TW rising 2%. In exchange land little was changed with CBOE and ICE each flat on the week, NDAQ rising less than 1% while CME was up 2% as volatility across certain asset classes picked up amidst geopolitical concerns swirling in the market.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: Yahoo Finance

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

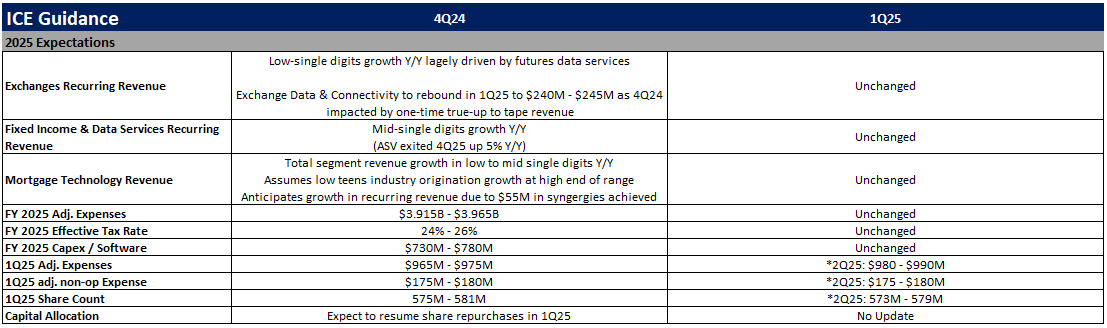

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

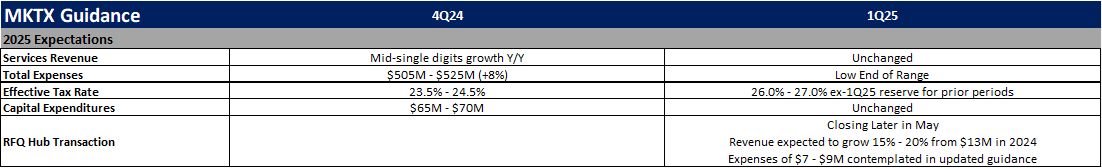

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

The Charles Schwab Corporation (SCHW)