Weekly Recap for Week Ended February 7, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Company Specific Updates for Week Ended Feb. 7, 2025

Exchanges

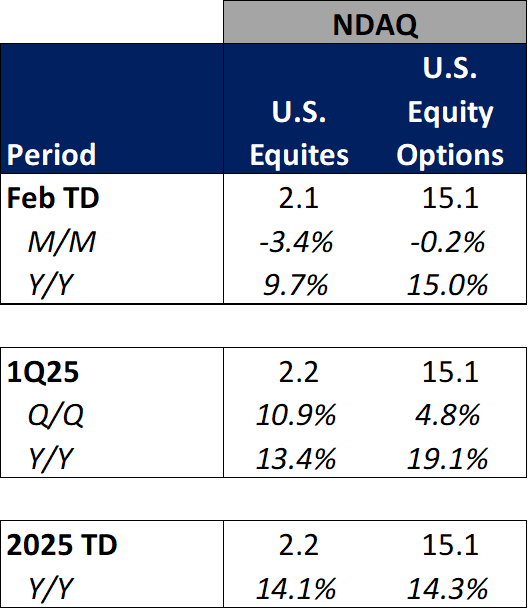

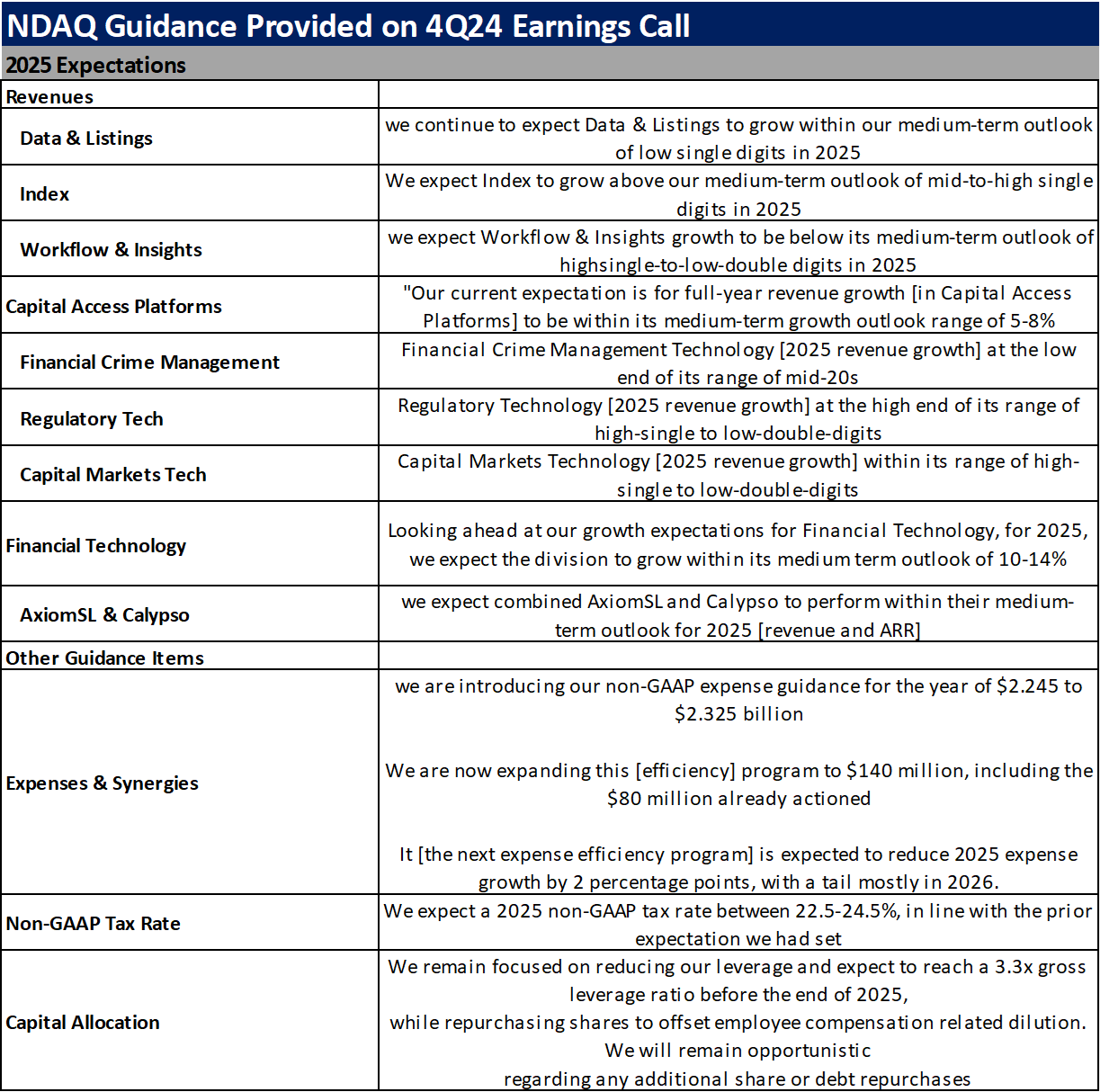

Nasdaq, Inc. (NDAQ)

U.S. volumes up strong Y/Y with equities ADV up 19% and U.S. options ADV up 21%

Ceded market share in both though as U.S. equities market share was down 170bps Y/Y and U.S. options market share was down 110bps Y/YGrowth in FinTech segment was a bit softer than medium term guide

Europe volumes lagged as Options & Futures ADV was down 4% Y/Y and equities ADNV was down 4% Y/Y

Likely no major impact to revenue estimates given revenue mix

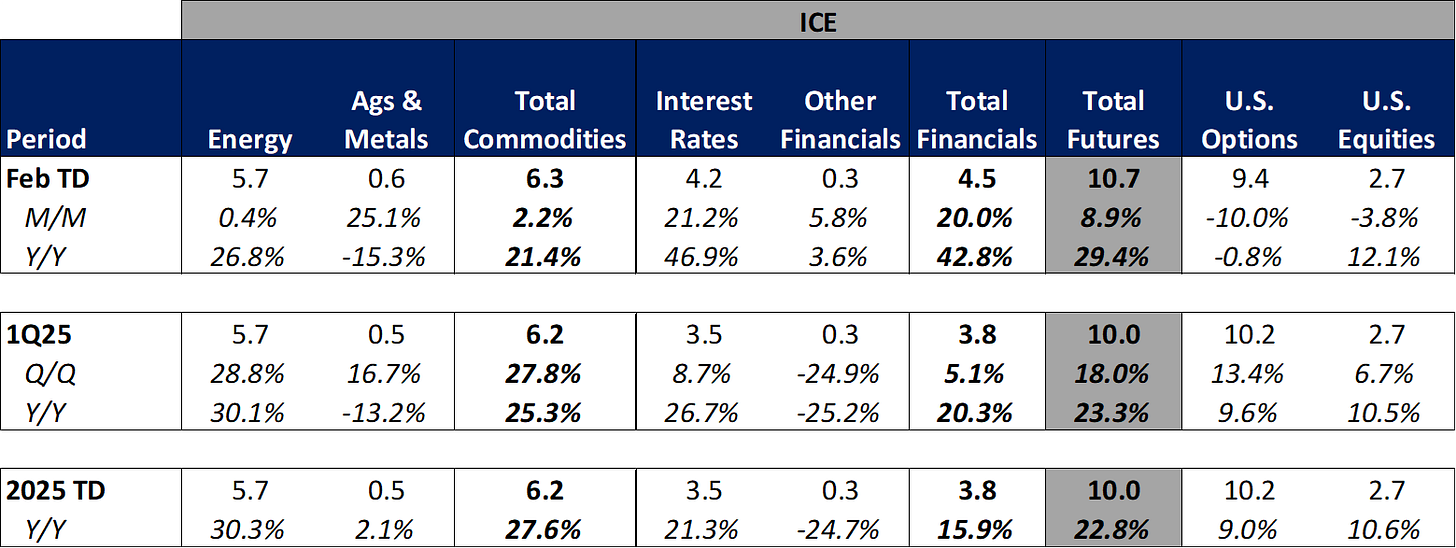

Intercontinental Exchange, Inc. (ICE)

Reported financial results for the fourth quarter and full year of 2024

EPS come in at $1.52 vs. consensus of $1.49.

Overall revenues were inline with the street at $2.3B (+6% Y/Y)

Mortgage Technology revenue was a bright spot in the quarter, increasing 1% Y/Y (first quarterly Y/Y increase for as far back as we have pro forma data for the Black Knight acquisition)

Exchange revenues were up 9% Y/Y, marking another quarter of strong revenue growth in the segment

Fixed Income and Data Services revenues were up 3% Y/Y, driven by 5% growth in recurring revenues while transaction revenues declined 7% Y/Y

ICE maintained solid expense control in 4Q24 and operating margins expanded 140bps Y/Y

Results were received positively as stock was up >4% on the day

See bottom of this post for a full recap of ICE guidance for 2025

Reports January 2025 Statistics

Futures ADV was up 21% Y/Y in January driven by a 26% Y/Y increase in Energy ADV and a 22% Y/Y increase in Interest Rates ADV.

U.S. options ADV was up 17% Y/Y, however, market share fell 137bps Y/Y to 19.6%.

U.S. equities ADV was up 15% Y/Y, however, market share declined 293bps Y/Y to 17.5%.

RPCs were mixed with Energy, Interest Rates and U.S. Equities RPCs declining M/M while U.S. Options RPC was unchanged M/M and Ags & Metals and Other Financials RPCs increased slightly M/M.

Given the trading results for the month, I’d expect modestly positive revisions to consensus revenue forecasts for 1Q25 in the coming days.

Announced board authorization of its first quarter 2025 dividend of $0.48 per share

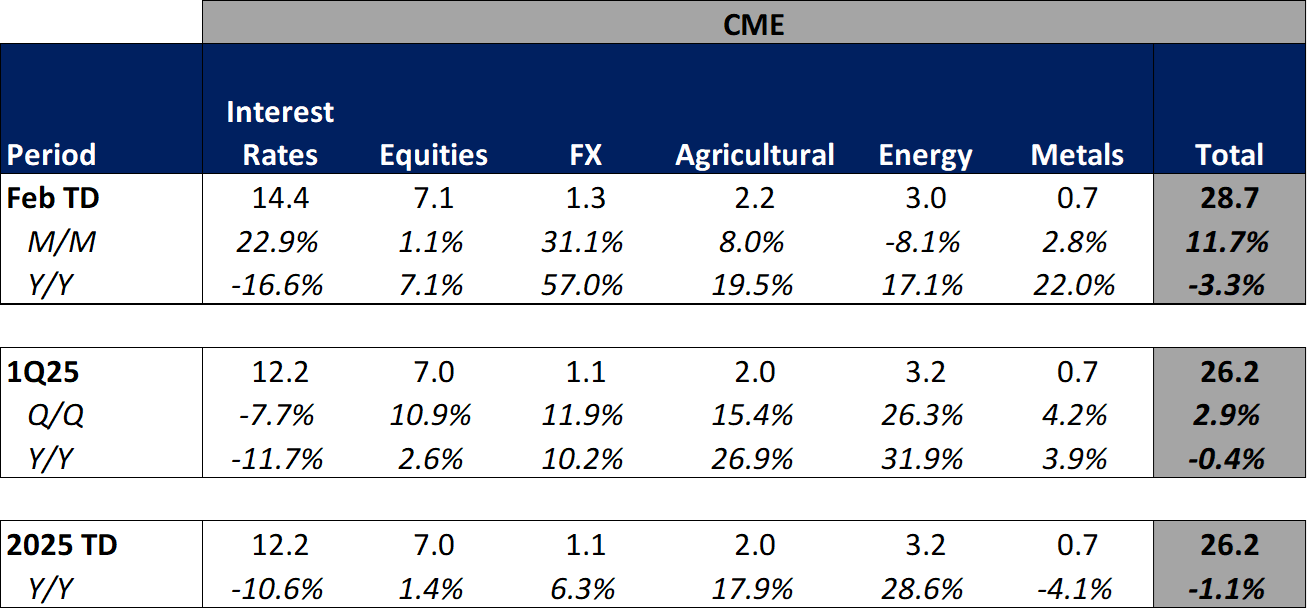

CME Group Inc. (CME)

CME Group Reports Record January ADV of 25.7 Million Contracts

Total CME Futures ADV was up 2% Y/Y in January. Performance was a bit mixed as Interest Rates ADV was down 11% Y/Y while all other products showed solid Y/Y growth, ranging from +7% for Equities to +35% for Ags

Given strong performance for some of CME’s higher priced contracts, could see upward revisions to revenue forecasts for 1Q25

Note, CME has yet to report 4Q24 results (scheduled for 02.12.25, pre-market)

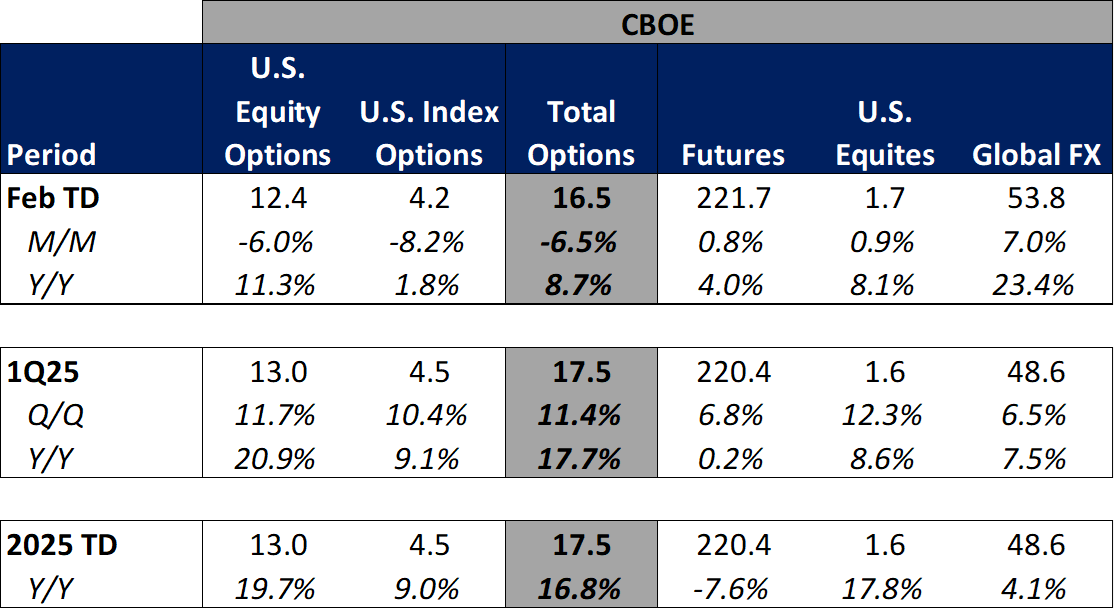

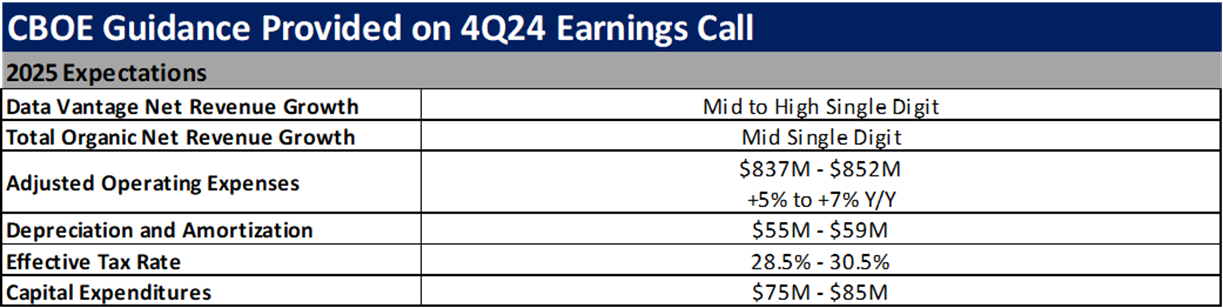

Cboe Global Markets, Inc. (CBOE)

Reports Results for Fourth Quarter 2024 and Full Year

Reported 4Q24 EPS of $2.10 vs. consensus of $2.12

Revenues of $525M (+5% Y/Y) came in a touch light of consensus at $527M

Data revenue growth accelerated in the quarter to 8% Y/Y (up from 5-6% range the last two quarters)

Expenses of $205M were up 7% Y/Y, bringing full year expenses essentially inline with CBOE’s most recent guidance

Operating margins contracted a bit Y/Y from 61.6% in 4Q23 to 6.10% in 4Q24

Expense guidance seems OK to me for FY25 but Data revenue guide seems a bit underwhelming

See bottom of this post for a full recap of CBOE guidance for 2025

Reports Trading Volume for January 2025

Options contracts were up strongly Y/Y (10%+) while futures volumes declined a bit (-4%)

North American Equities volumes were up in the mid-single digit plus range Y/Y while Europe and Japan volumes were up double digits % Y/Y.

Though Australia equities declined slightly Y/Y (-4%)

FX volumes were also up nicely (+12%)

Overall, a strong January for CBOE volumes

Would expect modest upward revisions to revenue forecasts in the coming days

Cboe Announces Plans to Launch 24x5 U.S. Equities Trading

I mentioned in last week’s recap that the market was headed this direction as exchanges need to meet the market where the demand is

I view this as further confirmation of the above

I still think there are a lot of thorny market structure issues that need to be resolved as the market heads towards 24x5 trading

Hires Meaghan Dugan as Head of U.S. Options, Marking Latest Expansion of its Global Derivatives Team

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Announced financial results for the fourth quarter and full year ended December 31, 2024

Posted 4Q24 EPS of $1.73 vs. consensus of $1.69

Revenues were inline with the street at $202M (+3% Y/Y)

Company showed expense control in the quarter with operating expenses up 2% Y/Y

Operating margins increased to 39.5% (+50bps Y/Y - second quarter in a row demonstrating operating leverage)

Stock reacted mildly positively (+1.6%) though it remains well below where it closed Tuesday (2/4/25) after Wednesday’s (2/5/25) month volume release showing continued market share losses in January (more on this below)

See bottom of this post for a full recap of MKTX guidance for 2025

Announces Trading Volume Statistics for January 2025

Total Credit ADV (Average Daily Volume) was down 8% Y/Y to $14.5B while Total Rates ADV was up 45% Y/Y to $24.5B

Market share was once again soft in January. U.S. High Grade (USHG) Credit market share declined 150 bps Y/Y to 17.7% while U.S. High Yield (USHY) Credit market share declined 100 bps Y/Y to 12.0%

This marks the 4th consecutive month of Y/Y market share declines in USHG credit and the 20th consecutive month of Y/Y market share declines in USHY credit

Further, MKTX released preliminary fee per million stats for credit and rates products, both of which were down Y/Y

Given the market share and fee per million trends I would expect 1Q25 revenue estimates to trend downward

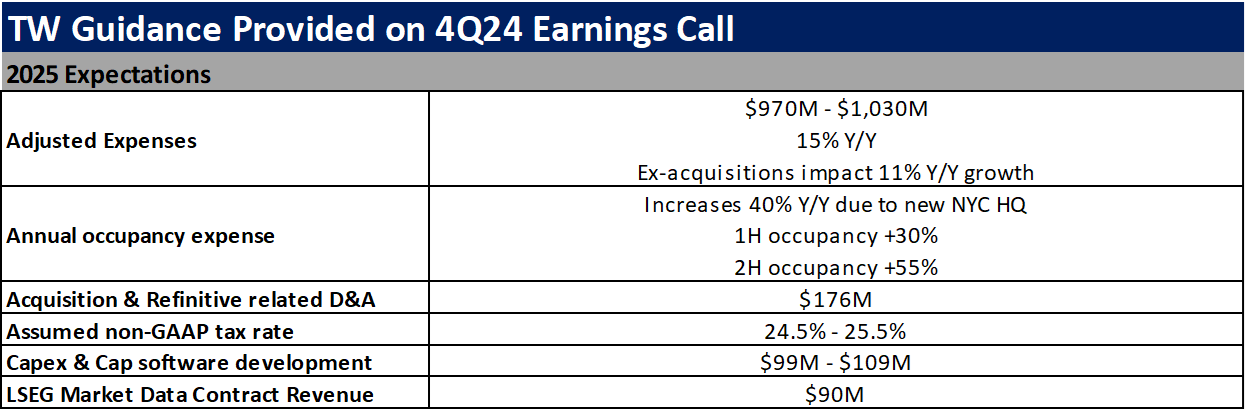

Tradeweb Markets Inc. (TW)

Reported financial results for the fourth quarter and full year ended December 31, 2024

Reported earnings of $0.76 vs. consensus of $0.74

Revenues came in at $463M (+25% Y/Y), 1% above consensus

Expenses were up 25% Y/Y

Overall 4Q results were solid but commentary from the call and a bit softer volume / market share trends in January drove the stock modestly lower (-1.4%)

See bottom of this post for a full recap of TW guidance for 2025

Reported total trading volume for the month of January 2025

ADV came in at $2.4T (+20% Y/Y

Ex-volume from ICD acquisition ADV was up 6% Y/Y

Market share continued to increase in USHG and USHY credit but grew at a slower pace than we’ve seen the last few months

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

Reports Brokerage Metrics and Other Financial Information for January 2025

Client accounts grew 31% Y/Y to 3.45M

Daily Average Revenue Trades (DARTs) grew 58% Y/Y to 3.473M

Client equity grew 39% Y/Y to $591B

Margin loans increased 47% Y/Y to %65B

Client Credit balances increased 17% Y/Y to $120B

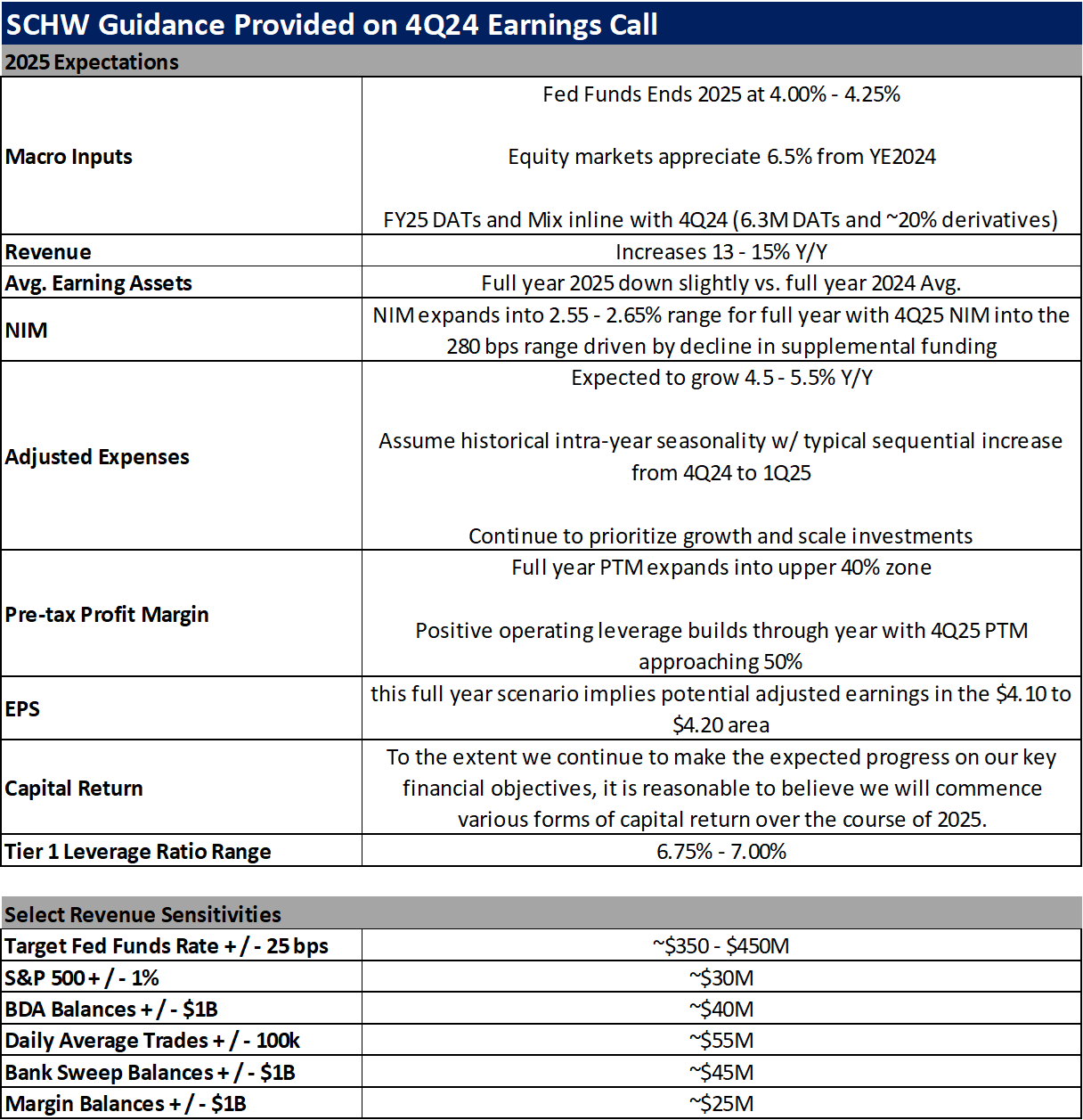

The Charles Schwab Corporation (SCHW)

Robinhood Markets, Inc. (HOOD)

Company Specific Updates Anticipated for the Upcoming Week (Ended Feb. 14, 2025)

Exchanges

CBOE

CME

4Q24 EPS Expected Wednesday, Feb. 12 (pre-market) – Consensus expects EPS $2.45 on Revenue of $1.51B

ICE

NDAQ

Fixed Income Trading Platforms

MKTX

Online Brokers

HOOD

4Q24 EPS Expected Wednesday, Feb. 12 (post-close) – Consensus expects EPS $0.44 on Revenue of $930M

SCHW

IBKR

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Jan. 7, 2025

Final Manufacturing PMI for January – 51.2 vs. prior month 50.1

ISM Manufacturing for January – 50.9% vs. consensus 50.0% and prior 49.3%

Job Openings for December – 7.6M vs. consensus 8.0M and prior 8.2M

ADP Employment for January – 183k vs. consensus 150k and prior 176k

Final Services PMI for January – 52.9 vs. consensus 52.9 and prior 52.8

ISM Services for January – 52.8% vs. consensus 54.0% and prior 54.1%

Initial Jobless Claims for week ended Feb. 1 – 219k vs. consensus 214k and prior 208k

U.S. Employment Report for January – 143k vs. consensus 169k and prior 307k

U.S. Unemployment Rate for January – 4.0% vs. consensus 4.1% and prior 4.1%

U.S. Hourly Wages Y/Y for January – 4.1% vs. consensus 3.7% and prior 3.9%

Major Macro Updates Scheduled for the Upcoming Week (Ended Feb. 14, 2025)

Monday, Feb. 10

None to note

Tuesday, Feb. 11

NFIB optimism Index (Jan.) – prior 105.1

Wednesday, Feb. 12

CPI Y/Y (Jan.) – consensus 2.8%, prior 2.9%

Core CPI Y/Y (Jan.) – consensus 3.1%, prior 3.2%

Thursday, Feb. 13

Initial jobless claims (week ended Feb. 8) – prior 219k

PPI Y/Y (Jan.) – prior 3.3%

Core PPI Y/Y (Jan.) – prior 3.3%

Friday, Feb. 14

Retail Sales (Jan.) – consensus 0.3%, prior 0.4%

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

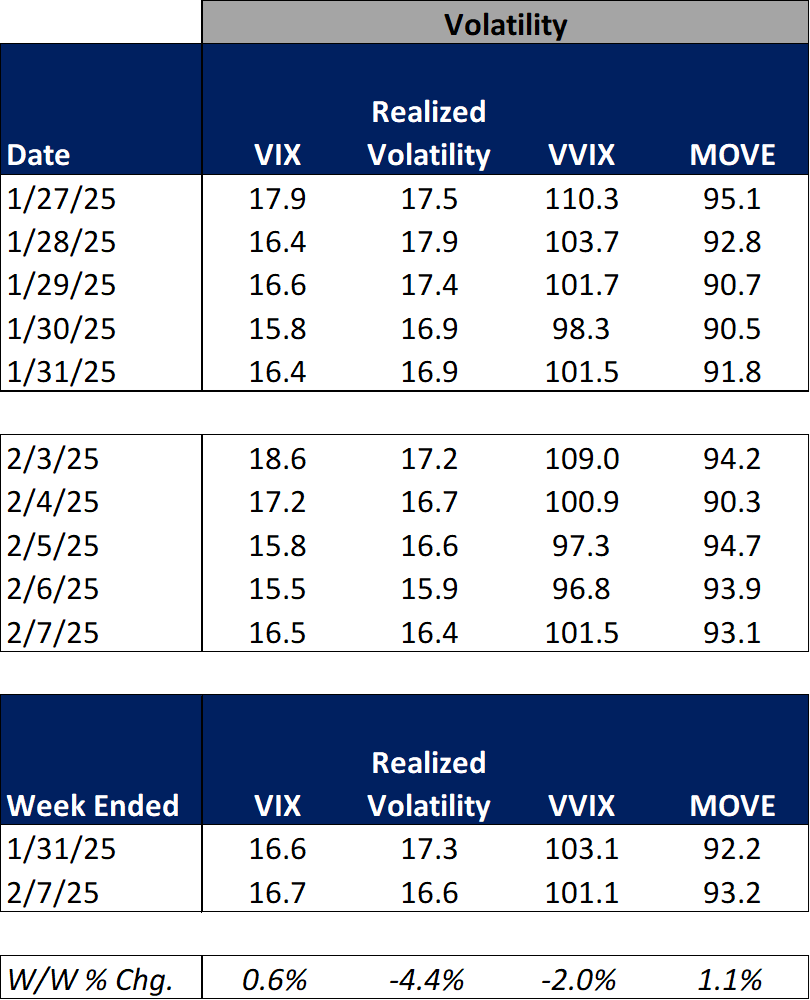

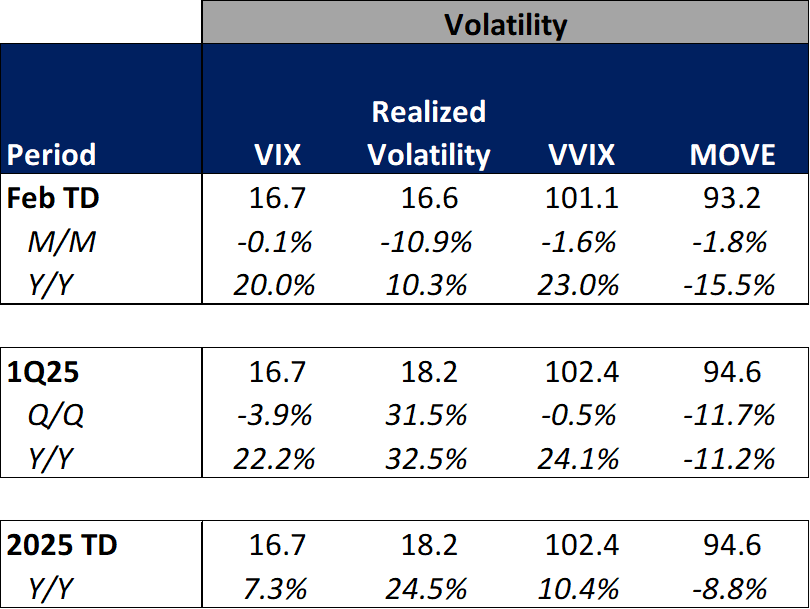

For the week ended February 7, 2025, volumes were mixed week over week, as were volatility metrics, in a week driven by trade war concerns, earnings reports and macro data.

The average VIX for the week was up 1% from the prior week, average realized volatility was down 4% W/W, average volatility of volatility (as measured by the VVIX) was down 2% W/W and the average MOVE index (U.S. Treasuries volatility) was up 1% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were down 5% W/W, CME futures volumes were up 7% W/W (driven by an 18% W/W increase in interest rate futures) while ICE futures volumes were up 10% W/W.

Total U.S. Equities ADV was down 1% W/W, mainly driven by on-exchange trading as TRF volumes were essentially flat W/W. Industry equity options volumes also decreased (-6% W/W) and index options volumes declined (-6% W/W).

For further detail on weekly volume trends by exchange and by product line please see the charts below.

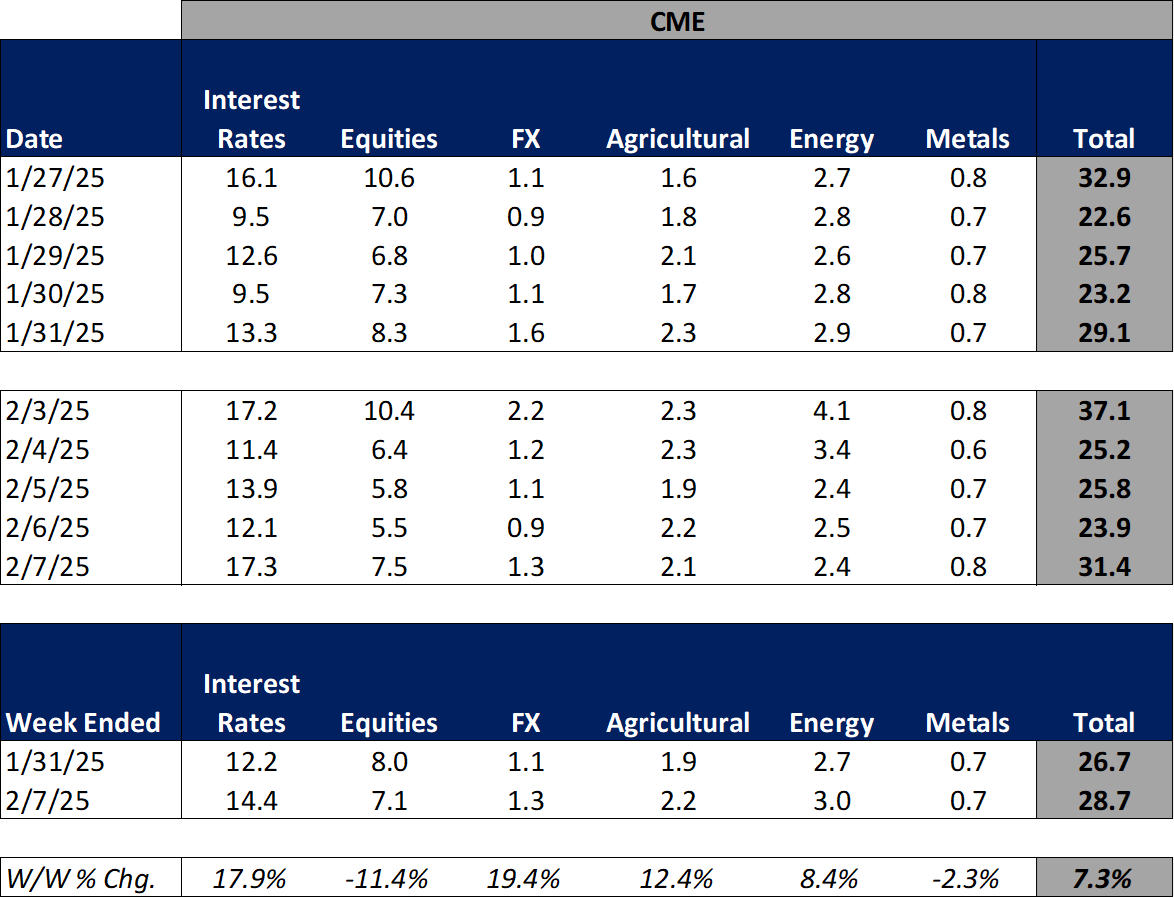

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

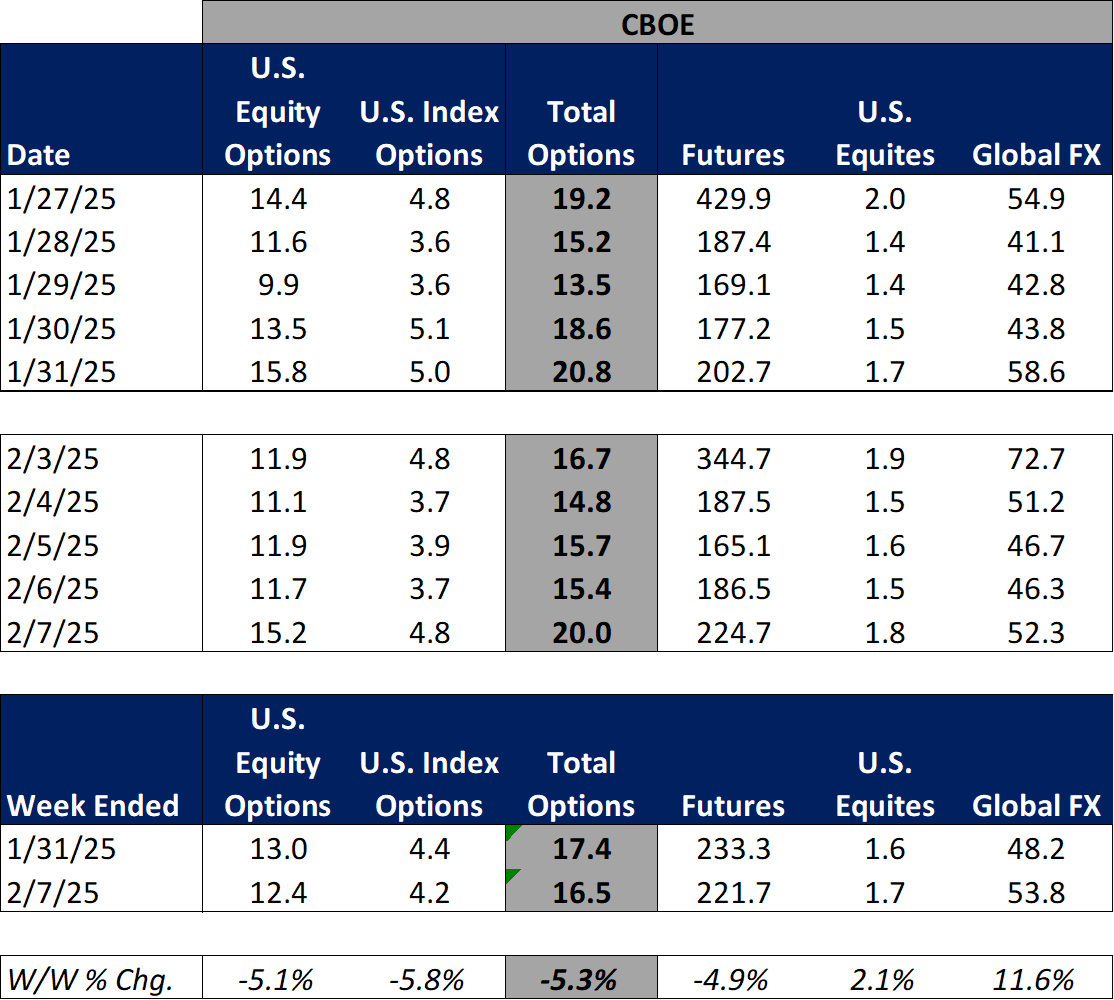

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

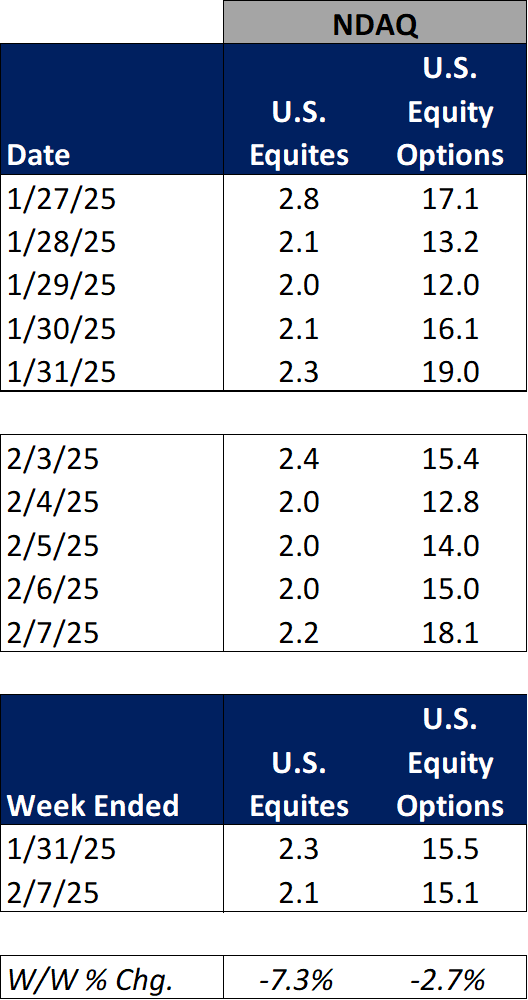

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

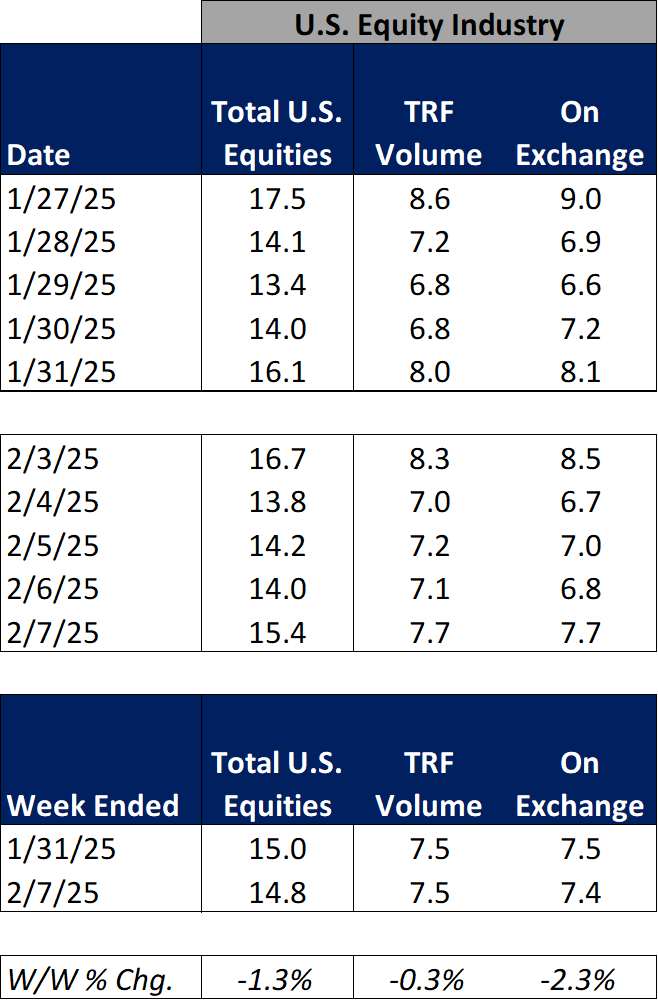

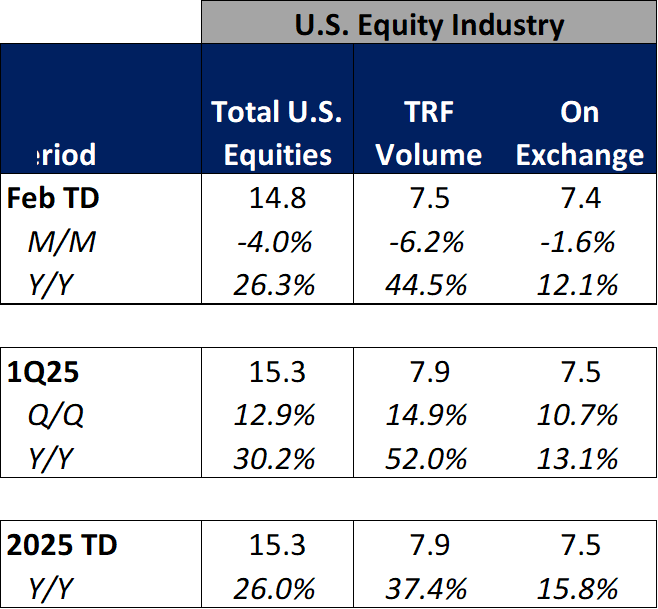

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

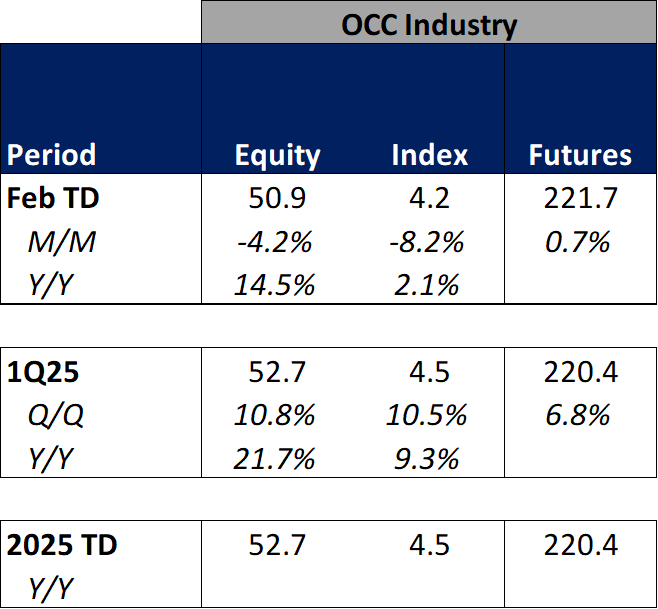

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes have started February on a solid note with most products showing Y/Y monthly ADV growth in February-to-date. This comes as volatility is generally higher MTD on a Y/Y basis.

The average VIX in February-to-date is up 20% Y/Y while realized volatility is up 10% Y/Y and volatility of volatility is up 23% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in February-to-date is down 16% Y/Y.

Futures volumes are somewhat mixed as ICE futures MTD ADV is up 29% vs. February 2024 ADV. Meanwhile, CME ADV is down 3% Y/Y while CBOE futures ADV is up 4% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 26% MTD while option volumes are up 15% for equity options and 2% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

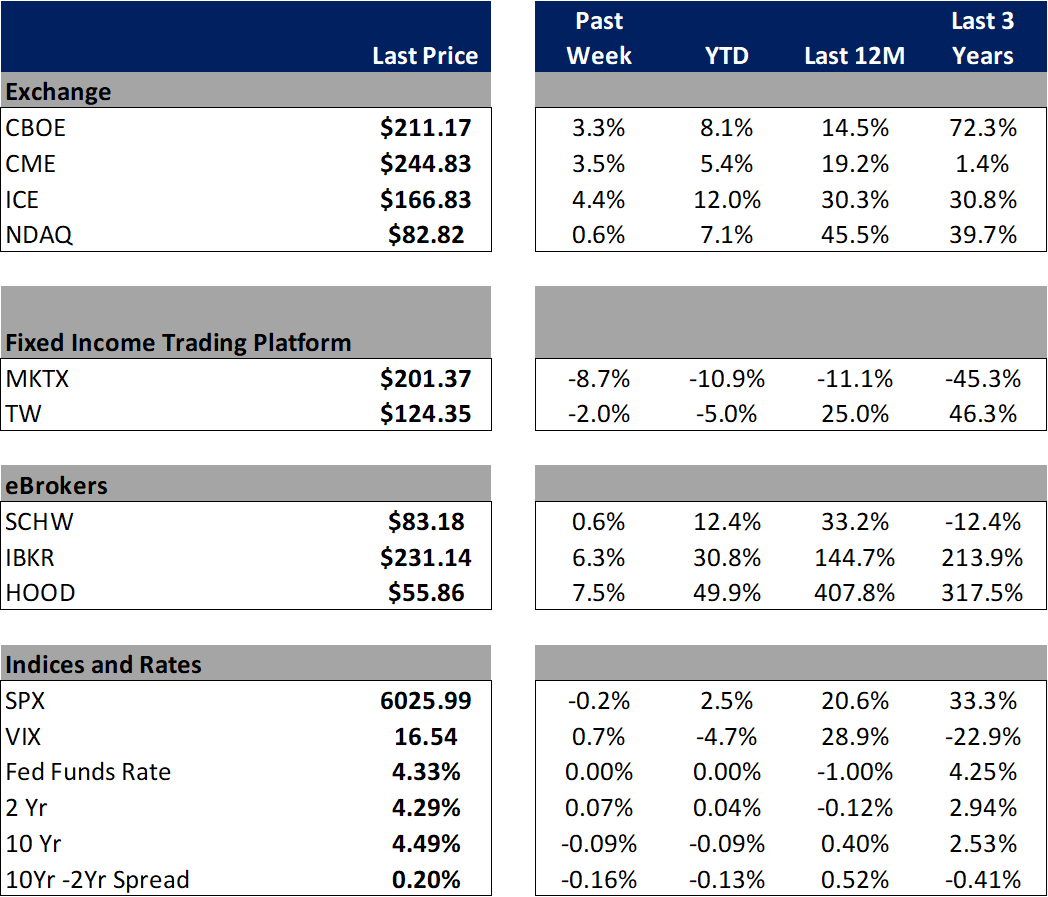

Major Indices, Interest Rates and Company Share Price Trends

Markets both started and ended the week on a tougher note, though the S&P 500 only ended up down 20bps for the week. Monday kicked us with indices falling early in the day due to the tariff announcements on Canada, Mexico and China coming out of last weekend. Markets rebounded a bit Tuesday after it was announced that tariffs on Canada and Mexico would be delayed at least 30 days as both countries agree to help secure the U.S. border. Over the next couple sessions, markets moved slightly higher as 4Q24 earnings season continued. Ultimately, markets closed out the week in the red as Friday brough jobs data for January, which was lower than economists expected (though December’s jobs figure was revised higher).

In terms of the companies I follow, it was a busy week of exchange earnings with ICE, CBOE, TW and MKTX all reporting on Thursday and Friday. ICE performed the best amongst the exchange group (+4% on the week) driven by a solid earnings report, highlighted by signs of growth in the Mortgage Tech business. Within the fixed income platforms space, MKTX declined dramatically (-9%) due to a weak January volume report released Wednesday, showing market share in USHG and USHY continued to come under pressure. Within the online broker space, HOOD performed strongest as retail investors used this weeks volatility to continue to drive into the market, as was highlighted by an FT article on Thursday.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

The Charles Schwab Corporation (SCHW)