Weekly Recap for Week Ended April 18, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Apr. 18, 2025

Kraken Announces Expansion into Equities Trading

On Monday, April 14, Kraken announced that it would begin to roll out commission-free equity trading to clients in select markets. The initial offering will include >11k U.S. listed stocks and ETFs for clients based in New Jersey, Connecticut, Wyoming, Oklahoma, Idaho, Iowa, Rhode Island, Kentucky, Alabama and the District of Columbia. Kraken plans to expand access to additional U.S. states in the future. The announcement is further proof that Kraken is pushing to become a one-stop cross asset class shop and follows Kraken’s announcement to acquire NinjaTrader on March 20, which gives Kraken an entrance into the U.S. futures market with NinjaTrader’s FCM license.

While the news shouldn’t come as a surprise (Kraken has not been shy about its intent to expand its multi-asset class offering) I do view this as a potential threat to online brokers. Given its client base, of the publicly traded online brokers, HOOD 0.00%↑ is likely most at risk from a new entrant into the equity trading space. I also view this as a threat to eToro, which publicly filed an F-1 with the SEC on March 24. IBKR 0.00%↑ and SCHW 0.00%↑ are likely more insulated from the new entrant given IBKR’s much more global client focus and model that additionally caters to professional traders and introducing brokers and SCHW’s more affluent client base and focus on broader wealth management offerings.

SEC Approves Green Impact Exchange (GIX) Form 1 Application

On Monday, April 14, the Green Impact Exchange (GIX) announced that the SEC has approved its Form 1 application. GIX plans to become a dual-listings and trading venue that is focused on sustainability with intent to begin trading in early 2026. By dual-listing on GIX, companies are showing their commitment to environmental sustainability as GIX’s listings standards will require certain environmental sustainability initiatives. According to GIX, the sustainability economy is currently worth $35T and certain green-focused investors have little valuable insight into a company’s sustainability efforts given current reporting standards, thus the need for an exchange where listing standards require real-time commitments to environmental sustainability. GIX’s team is comprised of a number of former NYSE, asset management and bank execs and the company’s technology is going to be powered by current exchange operator MEMX.

Previously, I have written that I welcome additional competition in the exchange space, which I reiterate here and applaud GIX for its Form 1 approval. That being said, as I’ve previously stated, the road ahead for GIX to gain material market share will be an uphill battle. Of the new entrants into the exchange space over the past ~8 years, the largest, IEX, still only has 3% market share of U.S. equities trading and collectively the 4 new entrants only have 6-7% share today.

Source: Cboe Global Markets

eToro Adds all HKEX-listed Stocks and ETPs to its Platform

On Tuesday, April 15, eToro announced that it was phasing into its platform the ability to trade all HKEX-listed stocks and ETPs. According to an eToro survey of 10k retail investors across 12 countries, 22% believe China will generate the strongest returns over the next 5 years. This announcement drastically increases eToro’s (ETOR 0.00%↑) stock trading offering as HKEX is one of the top ten global stock exchanges by market cap. I view this as a welcome addition to eToro’s offering as the company plans to go public later this year (though plans are currently on hold given current market volatility and impact to peer valuations).

Note: Within the company guidance tracker section of this post, SCHW and IBKR guidance tables have been updated to reflect commentary from this week’s earnings calls.

Company Specific Updates for Week Ended Apr. 18, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE)

CME Group Inc. (CME)

Announced Sale of OSTTRA JV with S&P Global to KKR

Total enterprise value of OSTTRA $3.1B split evenly between CME Group and S&P Global

Further financial terms not disclosed

OSTTRA offers post-trade offerings across interest rates, FX, credit and equity asset classes

Provides connectivity and workflow solutions to banks, broker-dealers, asset managers and other market participants

KKR plans to increase investments in technology and innovation across the platform

Intercontinental Exchange, Inc. (ICE)

Announces New RFQ Protocol on ICE TMC for MBS Trading

Provides wealth management and retail brokerage clients more flexible trading environment

Later this year plans to integrate pricing and analytics from ICE Mortgage Technology into ICE Bonds

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Reports record trading week in U.S. government bonds

Also reported all-time single day record of $102.3B U.S. government bonds traded on April 9

Announces 1Q25 Earnings Release Date

Wednesday, May 7, pre-market

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

Reports 1Q25 EPS of $1.88 vs. consensus of $1.93

Adjusted revenue missed consensus expectations by 1%

Pre-tax income came in 2% below the street

A full recap of IBKR results is available here

The Charles Schwab Corporation (SCHW)

Announces Strategic Investment in Wealth.com

Wealth.com is an estate planning platform in wealth management

SCHW’s investment will help Wealth.com scale capabilities

Two firms are developing opportunities to offer access to Wealth.com’s estate planning tools to SCHW clients

Reports 1Q25 EPS of $1.04 vs. consensus of $1.01

Revenue beat consensus expectations by 1%

Pre-tax income came in 1% above the street

A full recap of SCHW results is available here

Company Specific Updates Anticipated for the Upcoming Week (Ended Apr. 25, 2025)

This week we’ll kick off exchange earnings with CME and NDAQ reporting. Much of the revenue picture is known for CME, given it publishes daily volumes and 80% of revenue is tied to transaction-based fees. That said, there will likely be some interesting commentary on the outlook and how clients have reacted in the current environment. It will also be interesting to hear how retail trading behavior has been given CME’s product push into more retail focused product lines. For NDAQ, I’ll be interested to hear how the non-transaction businesses are faring in the current environment and what the impact has been on sales pipelines.

Exchanges

CME Group Inc. (CME)

1Q25 Earnings Release – pre-market Wednesday, April 23 with call at 9:30am ET

Nasdaq, Inc. (NDAQ)

1Q25 Earnings Release – pre-market Thursday, April 24 with call at 8:00am ET

Fixed Income Trading Platforms

None to Note

Online Brokers

None to Note

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Apr. 18, 2025

Import Price Index (Mar.) – (0.1%) vs. consensus 0.0% and prior 0.2%

Import Price Index Minus Fuel (Mar.) – 0.1% vs. prior 0.1%

Empire State Manufacturing Survey (Apr.) – (8.1) vs. consensus (12.4) and prior (20.0)

U.S. Retail Sales (Mar.) – 1.4% vs. consensus 1.2% and prior 0.2%

Retail Sales Minus Autos (Mar.) – 0.5% vs. consensus 0.3% and prior 0.7%

Industrial Production (Mar.) – (0.3%) vs. consensus (0.1%) and prior 0.8%

Capacity Utilization (Mar.) – 77.8% vs. consensus 77.9% and prior 78.2%

Business Inventories (Feb.) – 0.2% vs. consensus 0.3% and prior 0.3%

Homebuilder Confidence Index (Apr.) – 40 vs. consensus 37 and prior 39

Initial jobless claims (week ended Apr. 12) – 215k vs. consensus 225k and prior 224k

Housing Starts (Mar.) – 1.32M vs. consensus 1.41M and prior 1.49M

Building Permits (Mar.) – 1.48M vs. consensus 1.44M and prior 1.46M

Philadelphia Fed Manufacturing Survey (Apr.) – (26.4) vs. consensus 3.5 and prior 12.5

Major Macro Updates Scheduled for the Upcoming Week (Ended Apr. 25, 2025)

Monday, Apr. 21

U.S. Leading Economic Indicators (Mar.) – consensus (0.5%) and prior (0.3%)

Tuesday, Apr. 22

None to Note

Wednesday, Apr. 23

S&P Flash U.S. Services PMI (Apr.) – consensus 53.0 and prior 54.4

S&P Flash U.S. Manufacturing PMI (Apr.) – consensus 49.3 and prior 50.2

New Home Sales (Mar.) – consensus 680k and prior 676k

Fed Beige Book Published

Thursday, Apr. 24

Initial jobless claims (week ended Apr. 19) – consensus 220k and prior 215k

Durable Goods Orders (Mar.) – consensus 1.4% and prior 0.6%

Core Durable Orders (Mar.) – prior (0.3%)

Existing Home Sales (Mar.) – consensus 4.10M and prior 4.26M

Friday, Apr. 25

Final Consumer Sentiment (Apr.) – consensus 50.8 and prior 50.8

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

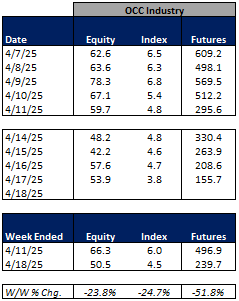

For the week ended April 18, 2025, volumes and most volatility metrics cooled considerably from the volatile prior week, though generally remained elevated relative to historicals. Note that the week ended April, 18 was a holiday shortened week with markets closed on Friday for Good Friday.

The average VIX for the week was down 27% from the prior week, average realized volatility remained heightened and was up 15% W/W, average volatility of volatility (as measured by the VVIX) was down 23% W/W and the average MOVE index (U.S. Treasuries volatility) was down 9% W/W.

Futures average daily volumes (ADV) declined as CBOE futures volumes were down 52% W/W, CME futures volumes were down 52% W/W, and ICE futures volumes were down 42% W/W.

Total U.S. Equities ADV was down 37%W/W, mainly driven by on-exchange trading as TRF volumes were down 29% W/W. Industry equity options volumes were down 24% W/W while index options volumes declined 25% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking higher in April-to-date. This comes as volatility is up significantly MTD on a Y/Y basis.

The average VIX in April-to-date is up 116% Y/Y while realized volatility is up 239% Y/Y and volatility of volatility is up 50% Y/Y. Treasuries volatility is higher as well Y/Y as the average MOVE index in April-to-date is up 17% Y/Y.

Futures volumes are higher Y/Y as ICE futures MTD ADV is up 60% vs. April 2024 ADV. Meanwhile, CME ADV is up 59% Y/Y while CBOE futures ADV is up 28% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 91% MTD while option volumes are up 43% for equity options and up 28% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

This week was a bit calmer than we’ve seen the past couple weeks with all of the trade war headlines hitting the tape from April 2 through April 11. Ultimately, the market closed the week out down 150bps as earnings season really got into full swing and the market took a moment to digest the trade war news and potential implications for the broader economy.

In terms of the companies I follow, the online brokers kicked off earnings season with IBKR and SCHW reporting 1Q results. IBKR fell 7% on the week after missing 1Q revenue and EPS estimates and indicating that client margin balances had contracted ~12% in early April. SCHW fell 1% on the week, generally inline with the broader market, as 1Q earnings results were solid and as the company continued to make progress on reducing supplemental funding at the bank. The exchanges performed fairly well, rising 0.4% - 1.8% for the week as the environment is generally favorable for their transaction-based businesses. Fixed income trading land was positive as well with MKTX rising 1.5% and TW up 4.9%.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

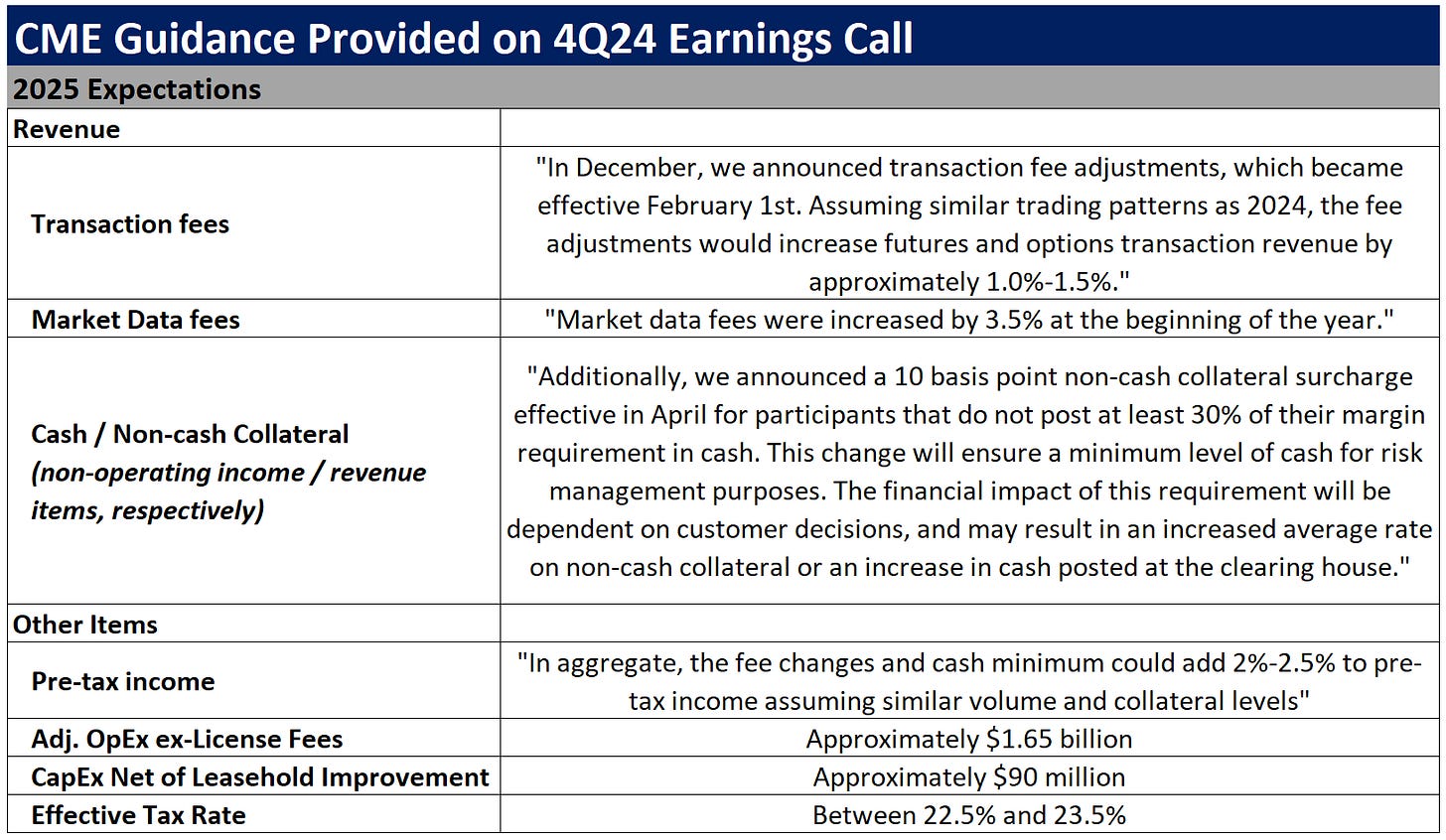

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

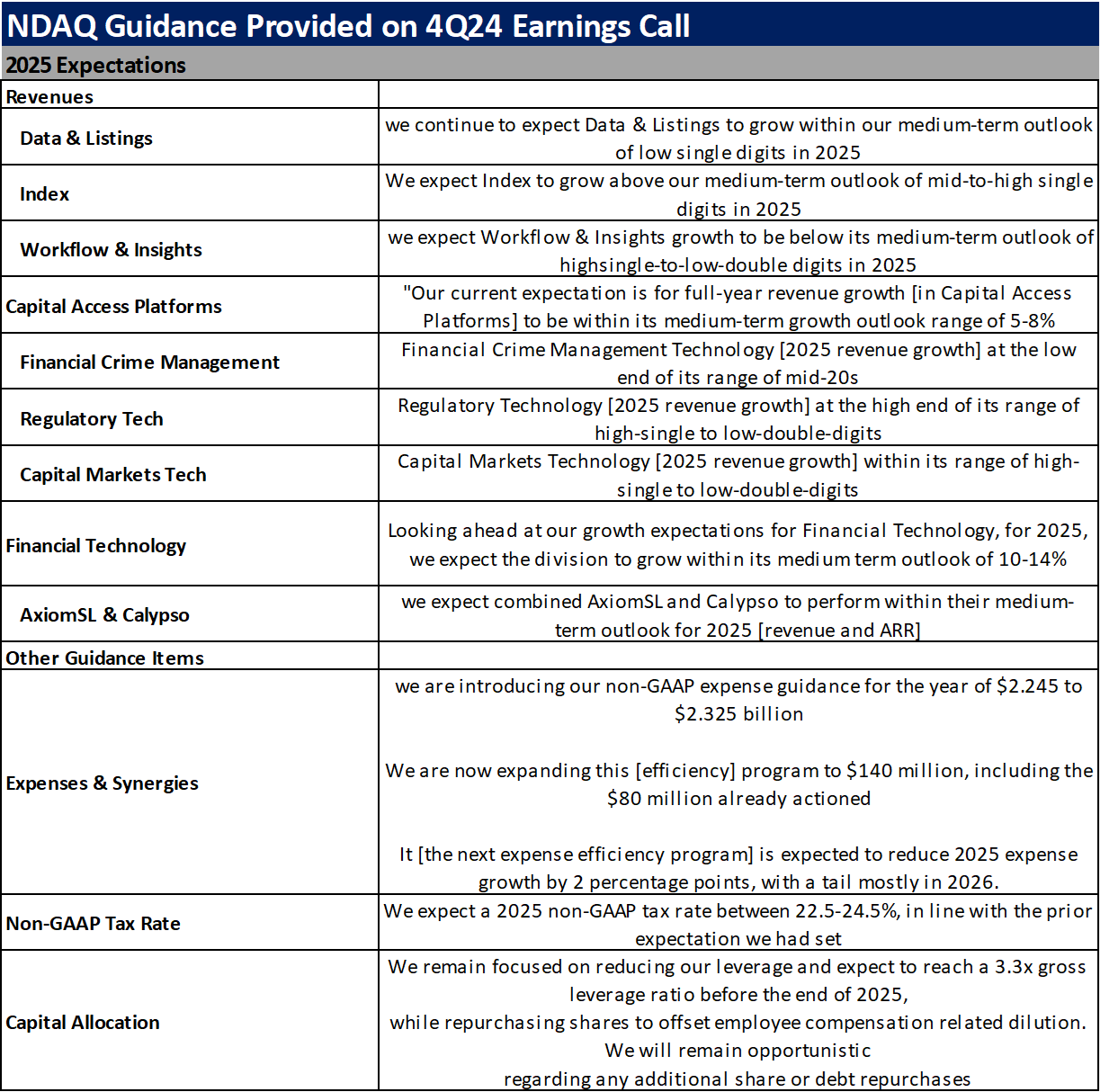

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

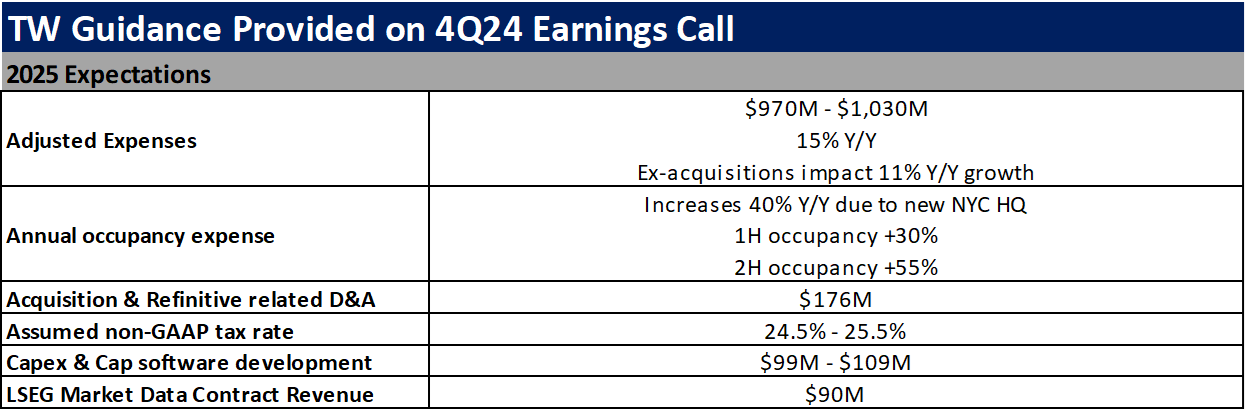

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 1Q25 earnings call, but key annual highlights are included above for the sake of simplicity

The Charles Schwab Corporation (SCHW)