Weekly Recap for Week Ended April 11, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Apr. 11, 2025

Ripple acquires Prime Broker Hidden Road

On Tuesday, April 7, Ripple announced the $1.25B acquisition of Hidden Road. Hidden Road is a Prime Broker that offers institutions clearing, prime brokerage and financing across FX, digital assets, derivatives, swaps and fixed income and Ripple is a provider of digital asset infrastructure for financial institutions. Following the acquisition, Hidden Road plans to use Ripple USD, Ripple’s stable coin, as collateral across its prime brokerage products making Ripple USD the first stablecoin to enable cross-margining between the digital assets and traditional markets. Additionally, Hidden Road will migrate its post-trade activity across XRPL.

Notably, this acquisition is the second >$1B transaction in the past month that combines a player in the traditional financial services space with a player in the digital asset space. Recall that on March 20, Kraken announced the acquisition of NinjaTrader for $1.5B. As mentioned in my recap note from March 24, I am not entirely surprised to see another deal announced blending the traditional and digital asset spaces and view this as an exciting opportunity to bring together the two markets. I reiterate that I believe we will continue to see similar deals in the coming months and years given the more crypto-friendly administration.

Company Specific Updates for Week Ended Apr. 11, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE)

Plans to Launch New Cboe FTSE Bitcoin Index Futures

planned to launch on April 28, 2025

aim to complement Cboe Bitcoin U.S. ETF Index options

expected to offer traders greater choice, versatility and capital efficiency

Expands Derivatives Market Intelligence Franchise into Asia Pacific with Strategic New Hire

Wei Liao to spearhead launch of Cboe's market intelligence and content franchise in APAC

Expansion reflects growing demand for derivatives trading, data, and client education in the region

Initiative furthers Cboe's continued growth of its Global Derivatives business in international markets

CME Group Inc. (CME)

Nasdaq, Inc. (NDAQ)

Reports March Volumes and 1Q25 Statistics

ADV for March was up strongly:

U.S. Equity Options +26% Y/Y

U.S. Equities +23% Y/Y

European Options and Futures +6% Y/Y

European Equities +19% Y/Y

RPCs were mainly lower Q/Q, though held up better than I had anticipated

U.S. Equity Options essentially unchanged

U.S. Equities declined 5% Q/Q

European Options and Futures declined 4% Q/Q

European Equities declined 5% Q/Q

Average AUM tracking NDAQ indices increased 5% Q/Q to $662B – should be a positive for the index business in 1Q

Futures and Options Contracts tracking Nasdaq indices increased 31% Q/Q – should be a positive for the index business in 1Q

Based on these results, I now project EPS for the quarter of $0.79 vs. the consensus estimate of $0.76

Intercontinental Exchange, Inc. (ICE)

ICE Mortgage Monitor: Home Prices Cool Heading Into the Spring Home-Buying Season

According to an early look at March data from the enhanced ICE Home Price Index (HPI), annual home price growth has decelerated to 2.2%

90% percent of U.S. markets experiencing slower home price growth compared to three months ago

Early March data shows condo prices dropping for the first time in more than a decade, with the largest impact in the Sunbelt

Fixed Income Trading Platforms

Tradeweb Markets Inc. (TW)

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

Expands Crypto Trading Again with Additional Tokens

Announced the addition of new cryptocurrency tokens to its trading platform: Chainlink (LINK), Avalanche (AVAX), and Sui (SUI)

The Charles Schwab Corporation (SCHW)

STAX Score Drops Amid March Uncertainty

STAX decreased to 48.36 in March, down from 51.94 in February

clients decreased their market exposure by offloading equities in March, but those outflows were buoyed somewhat by buying in fixed income and ETFs

Introduces Alternative Investments Platform

Platform tailored to SCHW’s high net worth (HNW) and ultra-high net worth (UHNW) clients with more than $5M in household assets at SCHW

Offers investment funds across private equity, hedge funds, private credit and private real estate

According to a SCHW survey, more than half of SCHW’s HNW clients expect to have at least 5% of their portfolio allocated to alternative investments over the next three years

SCHW serves more than a million multimillionaire investors representing over $3T in SCHW client assets

SCHW also provides alternative investment solutions for independent advisor clients with over 37% of advisors who custody at SCHW leveraging one of SCHW’s alternative investment platforms

Company Specific Updates Anticipated for the Upcoming Week (Ended Apr. 18, 2025)

This week we’ll start to get some actual micro updates and hopefully be able to transition away from just thinking about volatile trade policy and the broader macro implications (just kidding, that’s still going to be top of mind 😊). IBKR and SCHW kick off earnings in the space on Tuesday (post-close) and Thursday (pre-market), respectively, so we will get an update on the online brokers and likely updates on the broader macro implications for their client bases and overall businesses. Note that this Friday is the Good Friday holiday so most markets will be closed for the day.

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

1Q25 Earnings Release – 4:00pm ET

The Charles Schwab Corporation (SCHW)

1Q25 Earnings Release – pre-market

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Apr. 11, 2025

Consumer Credit (Feb.) – ($0.81B) vs. consensus $15.5B and prior $8.9B

NFIB Optimism Index (Mar.) – 97.4 vs. consensus 98.7 and prior 100.7

Wholesale Inventories (Feb.) – 0.3% vs. consensus 0.4% and prior 0.8%

Minutes from March FOMC meeting released

Initial jobless claims (week ended Apr. 5) – 223k vs. consensus 223k and prior 219k

CPI (Mar.) – (0.1%) vs. consensus 0.1% and prior 0.2%

CPI Y/Y (Mar.) – 2.4% vs. consensus 2.6% and prior 2.8%

Core CPI (Mar.) – 0.1% vs. consensus 0.2% and prior 0.2%

Core CPI Y/Y (Mar.) – 2.8% vs. consensus 3.0% and prior 3.1%

Monthly U.S. Federal Budget (Mar.) – $161B vs. consensus $115B and prior $237B

PPI (Mar.) – (0.4%) vs. consensus 0.2% and prior 0.1%

Core PPI (Mar.) – 0.1% vs. consensus 0.3% and prior 0.4%

PPI Y/Y (Mar.) – 2.7% vs. prior 3.2%

Core PPI Y/Y (Mar.) – 3.4% vs. prior 3.5%

Prelim. Consumer Sentiment (Apr.) – 50.8 vs. consensus 54.6 and prior 57.0

Major Macro Updates Scheduled for the Upcoming Week (Ended Apr. 18, 2025)

Monday, Apr. 14

None to Note

Tuesday, Apr. 15

Import Price Index (Mar.) – consensus 0.1% and prior 0.4%

Import Price Index Minus Fuel (Mar.) – prior 0.3%

Empire State Manufacturing Survey (Apr.) – consensus (10.0) and prior (20.0)

Wednesday, Apr. 16

U.S. Retail Sales (Mar.) – consensus 1.2% and prior 0.2%

Retail Sales Minus Autos (Mar.) – consensus 0.4% and prior 0.3%

Industrial Production (Mar.) – consensus (0.2%) and prior 0.7%

Capacity Utilization (Mar.) – consensus 77.9% and prior 78.2%

Business Inventories (Feb.) – consensus 0.3% and prior 0.3%

Homebuilder Confidence Index (Apr.) – consensus 38 and prior 39

Thursday, Apr. 17

Initial jobless claims (week ended Apr. 12) – prior 223k

Housing Starts (Mar.) – consensus 1.41M and prior 1.5M

Building Permits (Mar.) – consensus 1.46M and prior 1.46M

Philadelphia Fed Manufacturing Survey (Apr.) – consensus 3.7 and prior 12.5

Friday, Apr. 18

None to Note – Good Friday Holiday

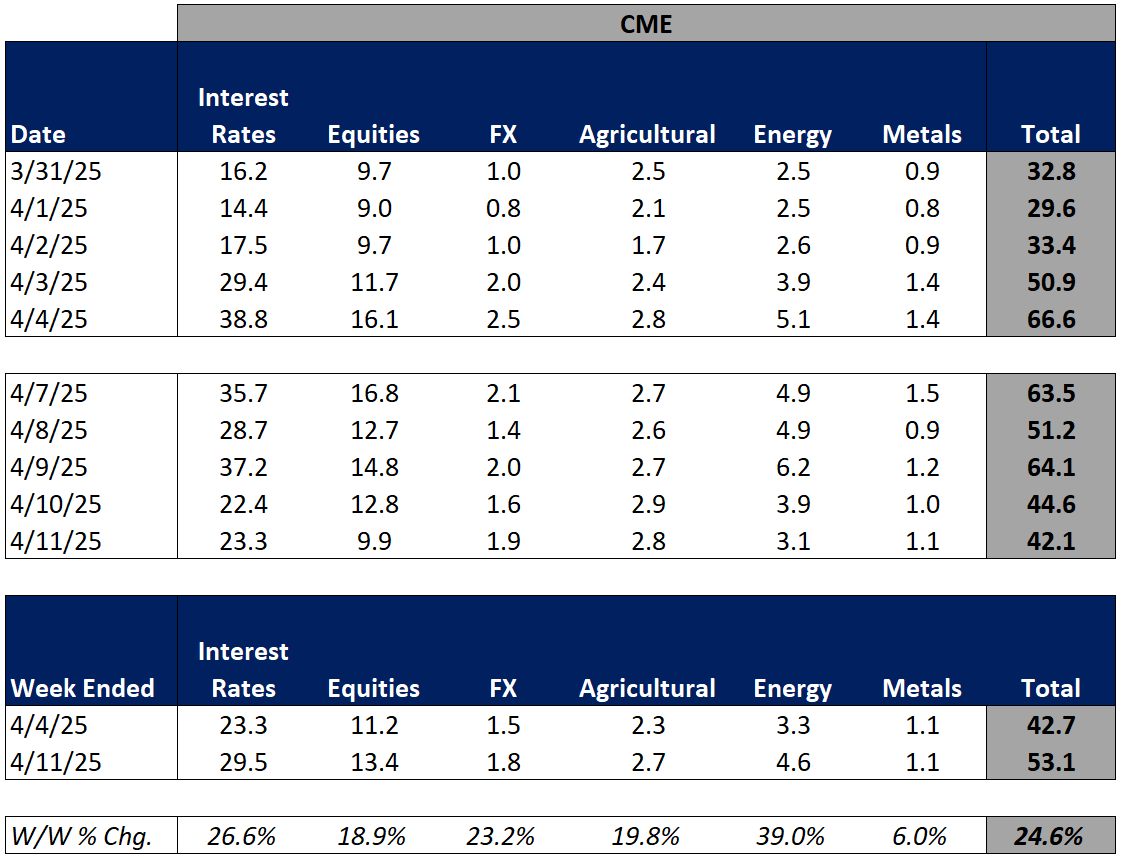

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

For the week ended April 11, 2025, volumes and volatility were both significantly higher week over week.

The average VIX for the week was up 50% from the prior week, average realized volatility was up 73% W/W, average volatility of volatility (as measured by the VVIX) was up 33% W/W and the average MOVE index (U.S. Treasuries volatility) was up 22% W/W.

Futures average daily volumes (ADV) increased substantially as CBOE futures volumes were up 27% W/W, CME futures volumes were up 25% W/W, and ICE futures volumes were up 24% W/W.

Total U.S. Equities ADV was up 32% W/W, mainly driven by on-exchange trading as TRF volumes were up 23% W/W. Industry equity options volumes were up 12% W/W while index options volumes declined 5% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking higher in April-to-date. This comes as volatility is up significantly MTD on a Y/Y basis.

The average VIX in April-to-date is up 127% Y/Y while realized volatility is up 202% Y/Y and volatility of volatility is up 57% Y/Y. Treasuries volatility is higher as well Y/Y as the average MOVE index in April-to-date is up 17% Y/Y.

Futures volumes are higher Y/Y as ICE futures MTD ADV is up 82% vs. April 2024 ADV. Meanwhile, CME ADV is up 87% Y/Y while CBOE futures ADV is up 50% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 111% MTD while option volumes are up 53% for equity options and up 39% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

Well, another wild week passed us by. Ultimately, the market closed the week out up nearly 6% driven by Trump’s sudden pivot to delay the implementation of reciprocal tariffs by 90 days. The market spiked 9.5% on Wednesday on the news and though we gave back some of the gains on Thursday, Friday ultimately closed out positive and capped off a volatile week.

In terms of the companies I follow, the online brokers showed the strongest performance, rising 11% - 27% which was a reversal of the heavy losses experienced in the sector the prior week in the immediate aftermath of the tariff announcements. The exchanges performed fairly well, with NDAQ rising 4.8% trading roughly along with broader markets, while CME was up 2.8%, CBOE was flat and ICE shed 0.5%. Fixed income trading land was mixed with MKTX rising 4.2% and TW falling 1.9%.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

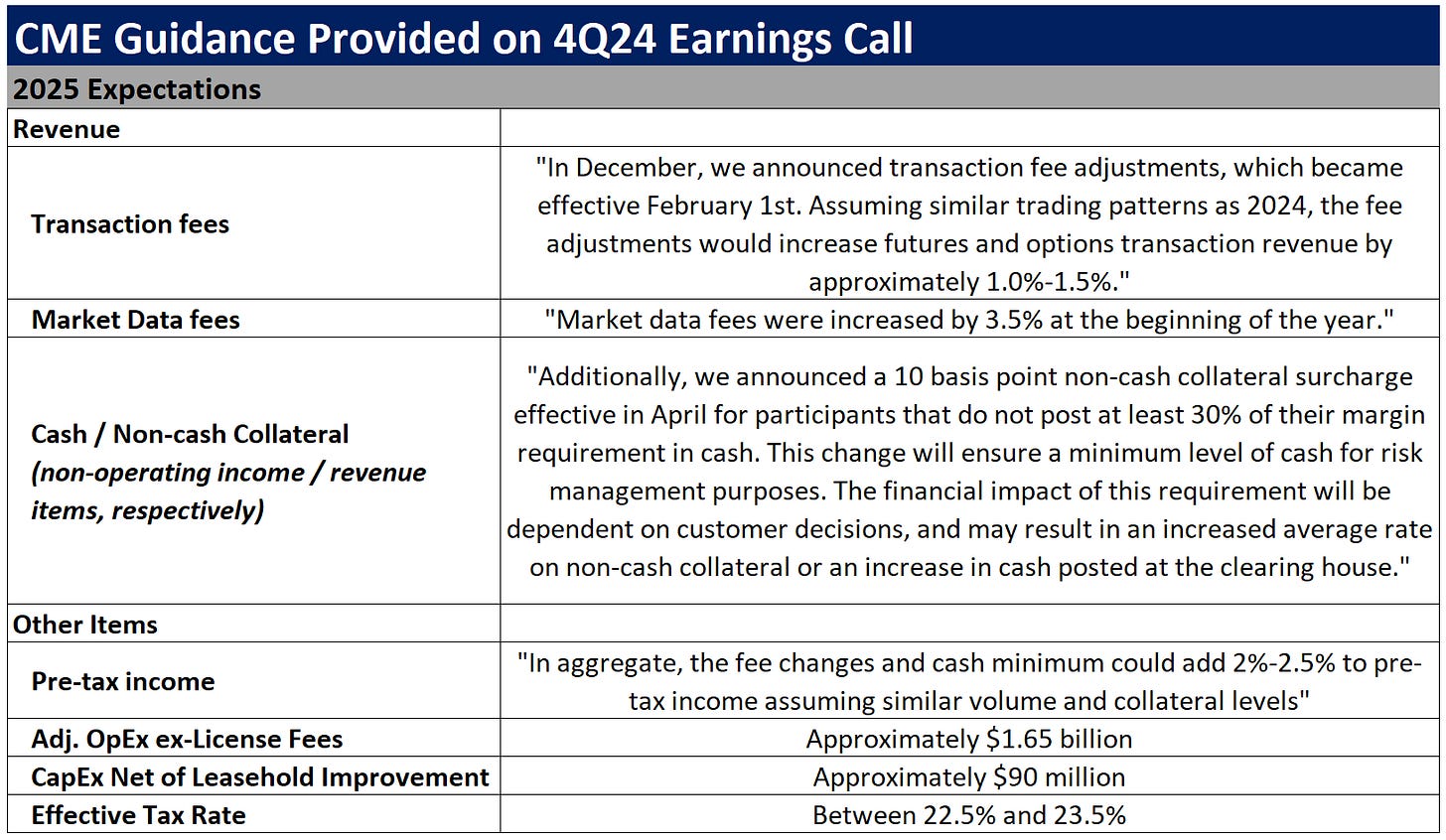

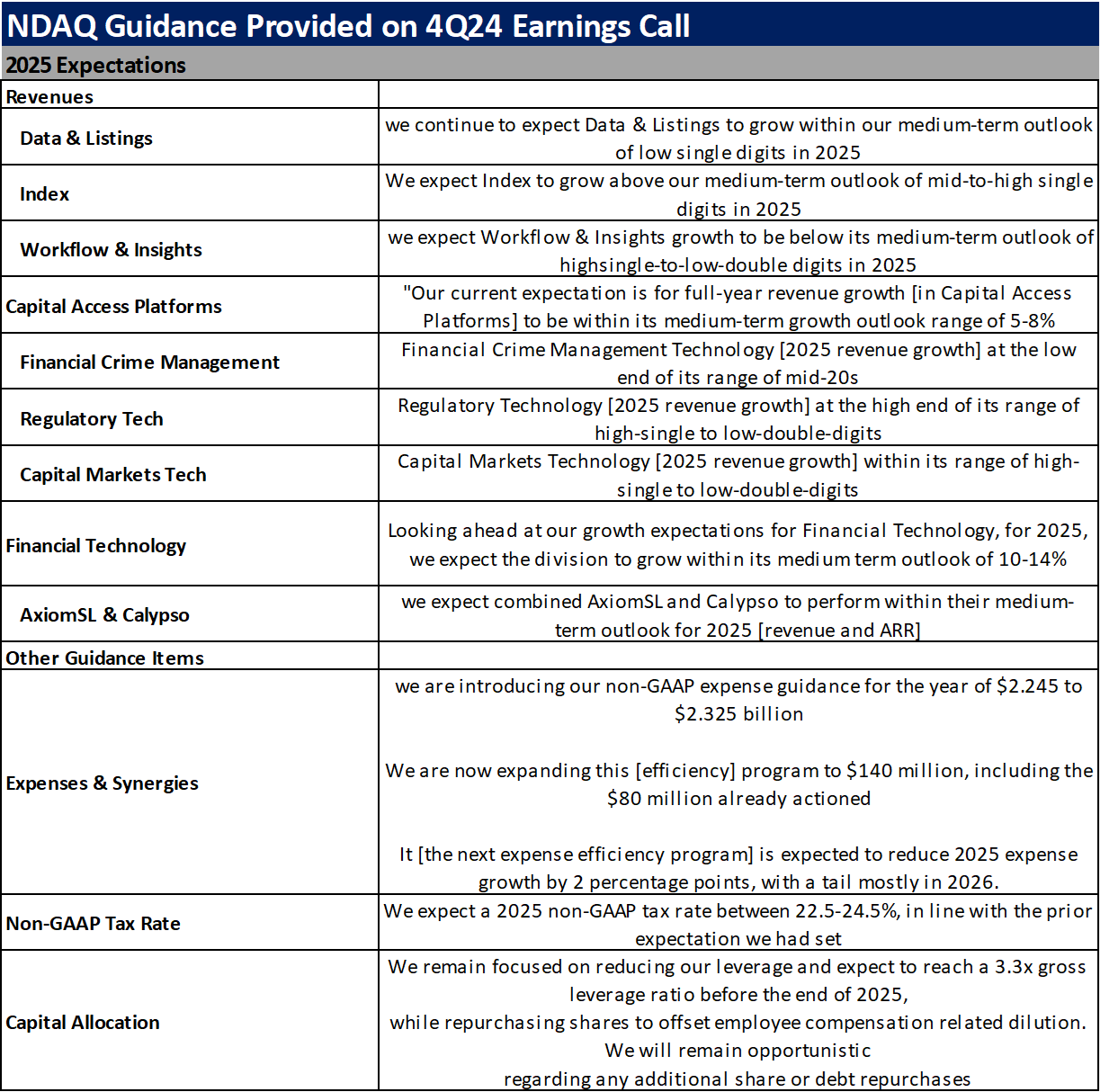

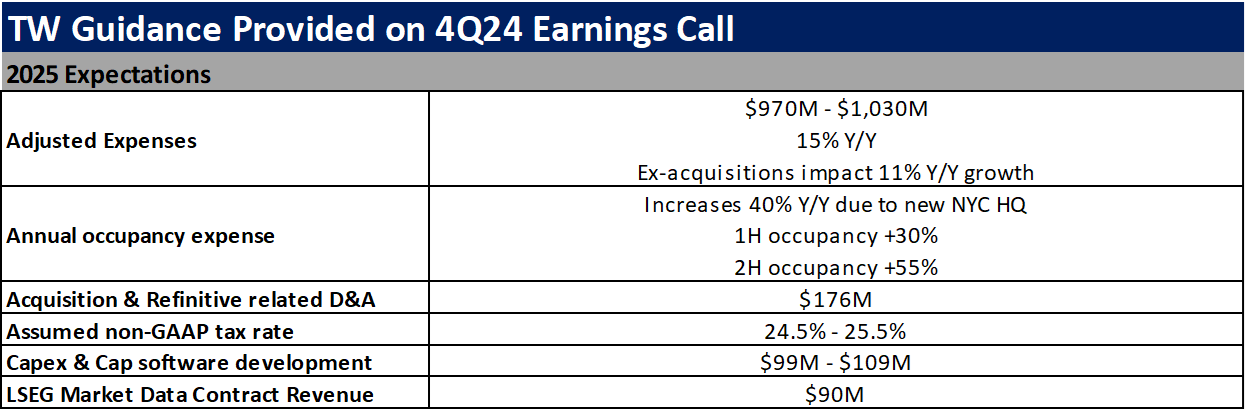

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

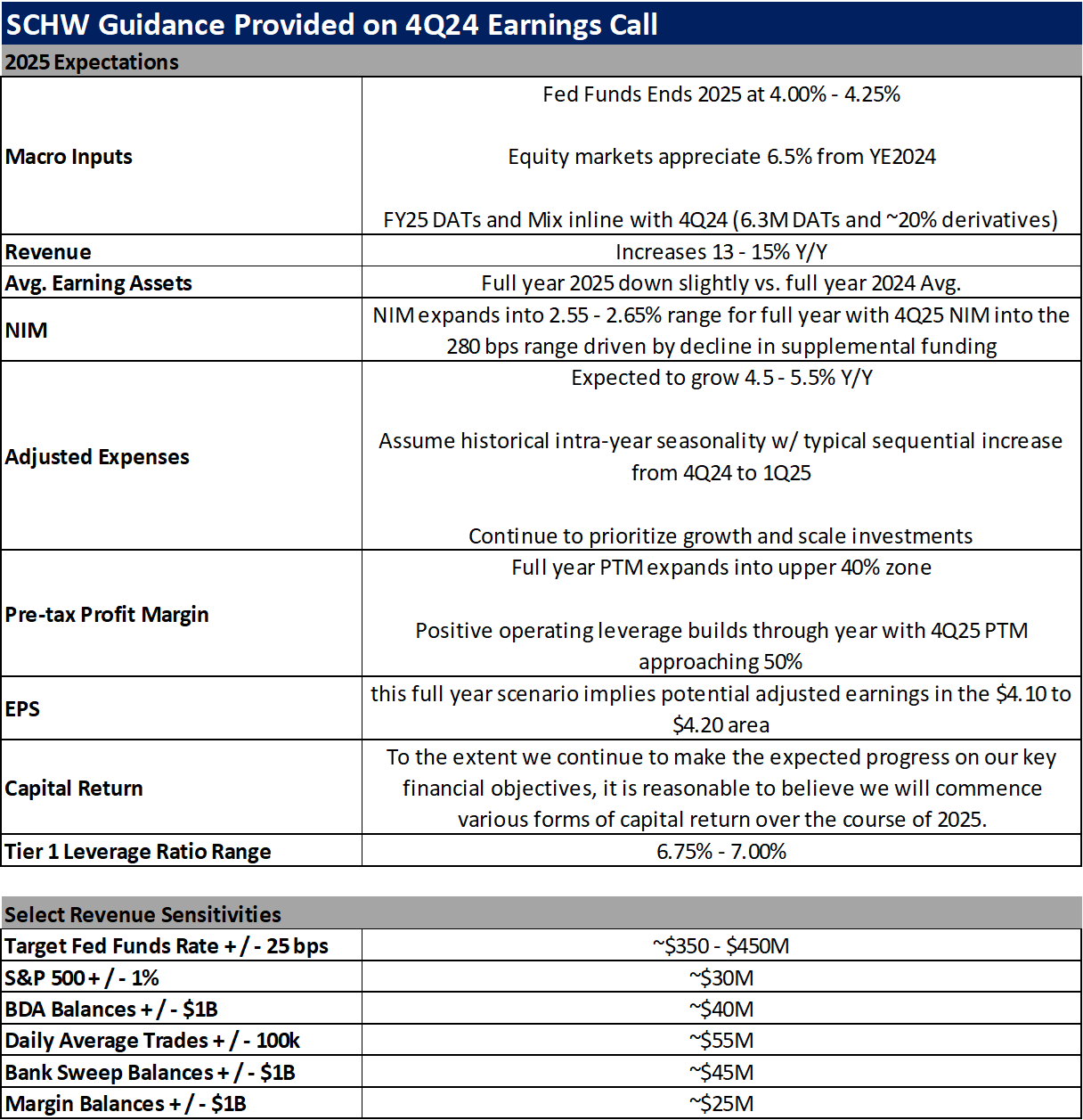

The Charles Schwab Corporation (SCHW)