Nasdaq, Inc. (NDAQ) 1Q25 Earnings Review

Earnings Beat Street Forecast; Organic Growth Remained Strong in 1Q Though Sales Cycles Have Become Elongated Due to Macro Backdrop

EPS Beats Consensus Forecast On Lower Expenses

NDAQ reported 1Q25 earnings prior to market open today. Total net revenue came in at $1,237M, up 1% Q/Q and up 11% Y/Y. The sequential increase in revenue was driven by an increase in market services revenues, which rose 5% Q/Q and were up 19% Y/Y to $281M. Meanwhile, capital access platforms revenue increased by 1% Q/Q (+8% Y/Y) to $515M, financial technology revenue declined 1% Q/Q (+10% Y/Y) to $432M and other revenue declined 10% Q/Q (unchanged Y/Y) to $9M. On the expense side, total adjusted operating expenses came in at $555M, which was essentially unchanged sequentially (+6% Y/Y) and drove operating margins to 55.1% (up 40bps Q/Q and up 200bps Y/Y). Non-operating expense came in at $86M (-7% Q/Q, -15% Y/Y) and adjusted diluted EPS came in at $0.79, up 4% Q/Q (+24% Y/Y).

Relative to consensus estimates, revenue came in essentially inline with the consensus forecast of $1,234M. Meanwhile, pre-tax income was about 3% higher than the street and adjusted EPS came in 2% above consensus.

In terms of key operating metrics, volume detail for the quarter was known coming into today’s print, however, new revenue metrics from today’s print include revenue detail for the market services businesses and total ARR detail across NDAQ’s more subscription focused businesses. Within market services, U.S. equity derivative revenue was up 2% Q/Q (+19% Y/Y), U.S. equities revenue was up 6% Q/Q (+26% Y/Y), E.U. equities revenue was up 12% Q/Q (+8% Y/Y) and E.U. derivatives revenue was up 8% Q/Q (+15% Y/Y). ARR for capital access platforms increased 1% Q/Q (+5% Y/Y) to $1,281M and ARR for financial technology increased 3% Q/Q (+11% Y/Y) to $1,550M.

NDAQ Earnings Summary and Key Operating Metrics

Source: company data and Tikr.com

Highlights from NDAQ Earnings Call, Presentation and Press Release

In terms of the outlook going forward, NDAQ 0.00%↑ management touched on several details during this morning’s earnings call that are worth highlighting:

Revenue Synergies – Remain on track to surpass $100M in synergies from cross-sells by the end of 2027. Achieved 19 cross sells since Adenza acquisition including 2 in 1Q25

Expense Synergies – On pace to achieve expanded expense synergy target of $140M as over $100M have been actioned by the end of 1Q25

Deleveraging – Gross leverage ended 1Q25 at 3.4x. Should achieve 3.3x in 2Q25 or 3Q25 (depending on FX rates). Plan to pay down $400M in debt coming due in June, primarily with cash on hand

Sales Cycles – Uncertainty in global macro and regulatory environment is causing some delays in large decisions and client readiness which will likely have an effect on revenue and ARR growth in 2Q (speaking to the Financial Technology segment in particular)

Expenses – Adjusted the expense guide up by $10M at mid-point of range (new range $2,265M - $2,325M)

Capital Access Platforms Revenue Outlook – Continue to expect 2025 revenue growth within medium-term outlook range with subdivision growth consistent with comments provided on 4Q24 call (see here for a table of prior commentary in the guidance tracker section)

Financial Technology Revenue Outlook – Continue to expect 2025 revenue growth within medium-term outlook range. Financial Crime Management Tech revenue and Capital Markets Tech revenue are likely at the low end of their ranges. Regulatory Technology well within its range.

Other notable highlights from the earnings call/press release:

Capital and Capital Return – Priorities for capital have not changed: complete post-Adenza deleveraging, organic growth, and expanding dividend and repurchasing shares

M&A – Management remains focused on growing organically and haven’t really been evaluating M&A

IPO Environment – Pipeline continues to be strong however companies are remaining patient given market volatility. Not seeing changes in conversations with global companies looking to the U.S. markets for a listing

Broad Thoughts / Outlook

I thought this was an OK quarter from NDAQ. Organic growth continued to remain strong with total Solutions Revenue organic growth of 9% (within NDAQ’s medium-term outlook range of 8-11%). Capital Access Platforms revenue continues to be impressive at 8% (medium-term outlook 5-8%), driven by another quarter of really strong growth in Index (organic growth 15%) and it was great to see Data and Listings organic growth tick up to 4% in the quarter. Within Financial Technology, Financial Crime Management and Capital Markets continued to be on the softer side relative to NDAQ’s medium-term outlook, though this shouldn’t have come as a major surprise given the macro backdrop. I continue to be impressed with NDAQ’s pace of deleveraging post-Adenza acquisition and think the current capital allocation strategy is well balanced.

NDAQ Organic Growth Rates

Source: 1Q25 Earnings Presentation

Note: given we have fully lapped the closing of the Adenza acquisition, organic growth rates in 1Q25 primarily exclude the impact of FX

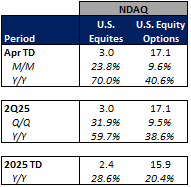

Volumes are off to a strong start in 2Q-TD. Total April ADV for NDAQ’s U.S. equities business is up 70% Y/Y in April-to-date and U.S. options volumes are up 41% Y/Y in April-to-date. If the current strong volume environment were to persist through quarter end, I see 9% upside to 2Q EPS relative to 1Q EPS based just on volume outperformance alone.

NDAQ U.S. Equities and U.S. Options Volume April-TD, 2Q-TD and YTD

Source: OCC and Cboe Global Markets

As I have stated previously, I do not anticipate the current elevated volume levels to persist indefinitely. However, if I were to assume 10% upside to volumes for NDAQ that translates into 3% EPS upside to consensus estimates. Applying 3% upside to the current consensus estimate for 2025 of $3.17 implies 2025 EPS of $3.27. Based on where shares are currently trading ($74/share) this implies a multiple on adjusted consensus EPS of 22.8x, which is a 5% premium to NDAQ’s 3 year average multiple of 21.8x. Given I see potential continued risk to NDAQ’s more subscription-based revenues due to the softer economic backdrop and cautious IPO environment I continue to want to avoid NDAQ in favor of the more transaction focused businesses of CBOE and CME which are seeing a huge benefit from the current volatile economic outlook.