Intercontinental Exchange, Inc. (ICE) 1Q25 Earnings Review

Record Earnings Beat Consensus Estimates on Record Revenue; Mortgage Tech Business Performed Better Than Feared

EPS Beat Consensus Forecast as Revenue Comes in <1% Ahead of Expectations

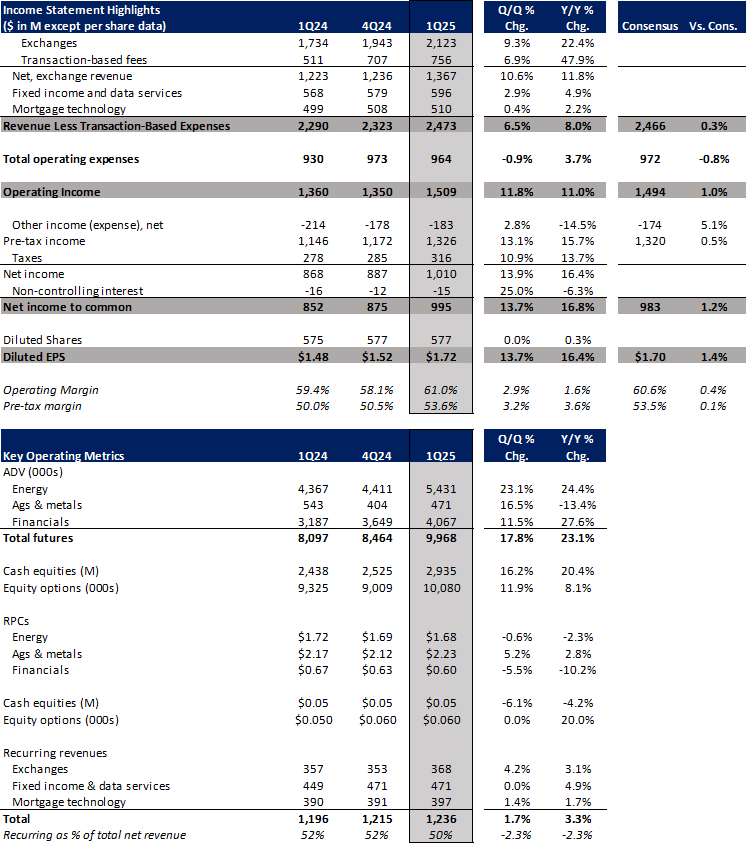

ICE reported 1Q25 earnings prior to market open today. Total net revenue came in at a record $2,473M, up 7% Q/Q and up 8% Y/Y. The sequential increase in revenue was driven by an increase in exchanges revenue, which rose 11% Q/Q and were up 12% Y/Y to $1,367M. Meanwhile, fixed income and data services revenue increased by 3% Q/Q (+5% Y/Y) to $596M and mortgage technology revenue increased <1% Q/Q (+2% Y/Y) to $510M. On the expense side, total adjusted operating expenses came in at $964M, which was down 1% sequentially (+4% Y/Y) and drove operating margins to 61.0% (up 290bps Q/Q and up 160bps Y/Y). Non-operating expense came in at $183M (+3% Q/Q, -15% Y/Y) and adjusted diluted EPS came in at a record $1.72, up 14% Q/Q (+16% Y/Y).

Relative to consensus estimates, revenue came in <1% above the consensus forecast of $2,466M. Meanwhile, pre-tax income was about 1% above the street and adjusted EPS came in 1% above consensus.

In terms of key operating metrics, volume detail and RPCs for the quarter were known coming into today’s print, however, to recap the quarter, total futures and options ADV was 9.97M for 1Q25 (+18% Q/Q, +23% Y/Y) while U.S. cash equities ADV came in at 2.9B (+16% Q/Q, +20% Y/Y) and U.S. equity options came in at 10.1M (+12% Q/Q, +8% Y/Y). On the RPC side, energy futures RPC declined 1% Q/Q (-2% Y/Y) to $1.68, ags & metals RPC increased 5% Q/Q (+3% Y/Y) to $2.23, financial futures RPC decreased 6% Q/Q (-10% Y/Y) to $0.60, cash equities RPC fell 6% Q/Q (-4% Y/Y) to $0.05 and equity options RPC was unchanged Q/Q (+30% Y/Y) at $0.060.

ICE Earnings Summary and Key Operating Metrics

Source: company data and Tikr.com

Highlights from ICE Earnings Call, Presentation and Press Release

In terms of the outlook going forward, ICE 0.00%↑ management touched on several details during this morning’s earnings call that are worth highlighting:

FY ’25 Guidance Update – No change to revenue, expenses, tax rate or capex expectations for the full year

2Q25 Guidance Update – Adj. operating expenses $980 - $990M, adj. non-operating expenses $175 – 180M, share count 573 – 579M. Increased expense vs. 1Q25 of $964M reflects weaker dollar, full quarter of merit increases, and accrual awards for strong YTD performance. Lower non-operating expenses vs. 1Q25 of $183M reflects lower interest expense from deleveraging. 1Q25 expenses also benefitted from better savings and synergies

Mortgage Tech Revenue Insights – 1Q25 servicing revenue included $2 – $3M of one-time revenue. During 1Q as minimums have come down on transaction side customers have been subject to higher transaction fees which is likely why they outperformed origination activity. Transaction revenue also benefitted from higher default management revenues as foreclosure starts have begun to tick higher from historic lows. In terms of rest of year, have a number of large clients that signed over the past 12-18 months which are beginning to come online and should provide a natural tailwind. Not changing original guidance range for Mortgage Tech broadly as original guide assumed flat to mid-teens growth in originations, which encompasses a fairly wide range of outcomes

Capital Allocation Strategy – Continue to focus on deleveraging, targeting about 3x (ended 1Q at 3.2x). Always looking at M&A opportunities, however given performance of the business “leaning into” buybacks at this point as they weigh inorganic growth ROI vs. investing in their own shares

Other notable highlights from the earnings call/press release:

Customer Detail

Mortgage Tech

Signed 20 new Encompass clients in 1Q

Recently signed a significant MSP client with United Wholesale Mortgage

Signed on a large global asset manager to McDash data offering

Flagstar/Rocket Mortgage/Mr. Cooper impacts – combined, make up around 4% of IMT revenue. Have multi-year contracts in place. Flagstar impact will begin to be felt later this year. If Rocket/Mr. Cooper decide to move off MSP it will take a couple of years

Fixed Income and Data Services

Signed two additional licensing deals with large global asset managers – one moving existing AUM ($10B) to ICE’s index family and one launching new ETF against ICE’s index solutions

Exchanges

Backlog for IPOs remains strong with a variety of companies seeking to raise capital when volatility abates

Texas exchange launch – have had very strong dialogue with issuers in the state and expect to be able to announce additional listings on the Texas exchange in the near future

Broad Thoughts / Outlook

I thought this was a strong quarter out of ICE. The company put up record revenue, record operating income and record EPS in the quarter. Revenue growth was strong in the quarter, and it was great to see the second quarter in a row of growing Mortgage Tech revenues (albeit much of the growth coming from the non-recurring side). Though early in the year, I was a bit nervous coming into the print that mgmt. would take down expectations for the Mortgage Tech business given a bit of softness in the mortgage market of late, so the fact that they didn’t was a welcome surprise.

Volumes are off to a strong start in 2Q-TD. Total April ADV for ICE’s futures and options businesses was up 44% Y/Y in the wake of the tariff induced volatility in the markets. Cash equities volumes increased 63% Y/Y to 3.8B and U.S. equity options ADV increased 10% Y/Y to 10.3M.

ICE Futures and Options Volume April, 2Q-TD and YTD

Source: company documents, Cboe Global Markets and OCC

As I have stated previously, I do not anticipate the current elevated volume levels to persist indefinitely. However, if I were to assume 10% upside to volumes for ICE that translates into 6% EPS upside to consensus estimates. Applying 6% upside to the current consensus estimate for the next twelve months of $6.99 implies NTM EPS of $7.41. Based on where shares are currently trading ($172/share) this implies a multiple on adjusted consensus EPS of 23.1x, which is a 9% premium to ICE’s 3-year average multiple of 21.2x.

For the past few weeks I have continued to lean towards shares of CBOE and CME given the uncertain economic outlook and potential for sustained volatility for the foreseeable future. While I continue to tilt that way, I’m beginning to warm up to shares of ICE. Admittedly, the stock has performed very well lately, rising 13% off its post-liberation day lows vs. +9% for CME and +7% for CBOE and it does trade at a premium to its 3-year average based on the math above. However, if the recovery in the mortgage business is to believed/sustained, its possible consensus estimates trend higher over the coming months. For now, I am keeping my eye on it (sorry for a non-committal on what to do with the shares – but remember this is not financial advice 😊).