Weekly Recap for Week Ended October 24, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Oct. 24, 2025

I apologize for this recap coming out a bit later than typical. I was traveling for a family event the tail end of last week through Monday this week.

Pieces I’ve put out in the past week:

Nasdaq (NDAQ 0.00%↑) 3Q25 Earnings Review

CME Group (CME 0.00%↑) 3Q25 Earnings Review

Other notable news:

I would like to begin with a quick note. I feel as though this blog has rapidly evolved into a crypto / DeFi markets update platform. While I do not want my posts to exclusively focus on the goings ons in the crypto markets (I love following the traditional exchanges and brokers), news at the intersection of TradFi and DeFi is coming fast and heavy. Therefore, it is my duty to stay up to date on the newer markets in the space (it felt like about half of CME 0.00%↑’s earnings call was focused on prediction markets) and I will keep you all up to date on things I am seeing.

Red Hot Prediction Markets

DraftKings (DKNG 0.00%↑) Acquires Railbird Technologies To Launch Prediction Market

Railbird is federally licensed with the CFTC to offer prediction market contracts

The company plans to offer contracts on the outcomes of events in finance, culture and entertainment with other products slated for the future and the company will be able to connect to multiple exchanges

Polymarket Seeking Funding at $12-$15B Valuation

This would be up from the $8B pre-money valuation ICE 0.00%↑ invested at just 16 days ago

Additionally, Kalshi is seeking to raise at around a $10B valuation, which would be an increase from the $5B valuation placed on Kalshi when it raised $300M in funding on October 10

Need I remind us that Kalshi was valued at $2B and Polymarket was valued at $1B at the end of June this year

NHL has Partnered with Kalshi and Polymarket on Licensing

This is the first major U.S. sports league to partner with prediction markets platforms

Under terms of the deal, Kalshi and Polymarket can use terms such as “NHL” and “Stanley Cup” and refer to teams by their names. The companies can also use the NHL logo

Prediction Markets Boom as Volumes Surpass 2024 Election

Kalshi and Polymarket saw volume surpass $2B for the week ended October 19, which surpasses volumes experienced across both platforms during the 2024 U.S. presidential election

Given rapid growth and high transaction volumes some users have reported delays on high volume days such as Saturday, though spokespeople for Kalshi have said the backend exchange has been operating fine and any issues experienced have been resolved

Limitless Prediction Market Closes $10M Seed Round Ahead of LMTS Token Launch

Funding was led by 1confirmation with participation from Collider, F-Prime, DCG, Coinbase Ventures, Node Capital, and Arrington Capital

Limitless has also surpassed $500M in total trading volume on the platform

Volume has grown rapidly with September volume 25x higher than August and in October the exchange surpassed September’s volume by mid-month

Crypto

Coinbase (COIN 0.00%↑) acquires Echo for $375M

Echo is an onchain capital raising platform that allows projects to raise capital directly from their community either through a private sale or by self-hosting a public token sale

Coinbase plans to start with crypto token sales and eventually expand into tokenized securities and real world assets

Echo has already helped 300 projects raise a total of over $200M

Gemini (GEMI 0.00%↑) bullish on UK market as crypto adoption climbs to 24%, but says many still waiting on regulatory ‘stamp of approval’

Coinbase Sees TradFi Institutions Driving Crypto Derivatives Boom

According to the head of Coinbase’s derivative sales, the company expects a wave of TradFi institutions to start using digital asset derivatives for investments or hedging

He said asset managers from the U.S. and EU have woken up globally to regulated crypto derivatives recently

OCC Chief Plays Down Stablecoin ‘Bank Run’ Fears

The head of the OCC, Jonathan Gould told attendees at the American Bankers Association annual convention in Charlotte that any material flight from the banking system into stablecoins would not happen overnight or in an unnoticed fashion and if a material flight occurred, he would take action

He also urged community banks to view stablecoins as tools to compete against larger banks rather than as existential threats

UK watchdog sues crypto exchange linked to billionaire Trump backer

The UK FCA has filed a lawsuit against HTX for unlawfully promoting crypto asset services to UK consumers in breach of the UK’s financial promotions regime

According to the FCA the action is part of its commitment to protect consumers and uphold the integrity of the UK financial markets

Citadel CEO Ken Griffin acquires major stake in Solana treasury firm

Ken Griffin has taken a 4.5% stake in DeFi Development Corp, a company building a large Solana reserve

Crypto Exchange Kraken Is Taking Staff on Caribbean Island Retreat in January: Sources

The news comes after Kraken reported record revenue and improved EBITDA in 3Q25

The trip is expected to energize the firm ahead of an anticipated U.S. listing next year according to people familiar with the plan

Kraken has also handed out one-time bonuses to employees earlier this year

‘Total land rush’: Bitcoin, Solana lead the way with over 150 crypto ETF filings awaiting review

Currently there are 155 crypto-based ETP filings tracking 35 different digital assets

While the U.S. government shutdown has slowed the review process experts are optimistic that approval is imminent

Global Retail Crypto TXs Surge 125% as Regulatory Clarity Improves

New regulatory actions, improved access, and reduced barriers for retail participation have enabled rapid expansion in retail crypto TXs

FalconX Acquires Leading ETP Provider 21shares

21shares provides the world’s largest suite of cryptocurrency ETPs

Thea acquisition marks an acceleration of the convergence of listed markets and digital assets

Together the two companies plan to accelerate the creation of tailored investment products that meet institutional and retail demand for regulated digital asset exposure

SEC, CFTC target end-of-year milestones for crypto oversight amid government shutdown

On Tuesday, acting chair of the CFTC, Caroline Phan, posted to X (twitter) that the agency is prioritizing crypto trading and tokenized collateral by the end of 2025

Additionally, on Wednesday also noted a push to get initiatives done by the end of the year in an interview on CNBC

Tokenization

‘UK can do better’: Kraken urges regulators to move faster on stablecoin and tokenization rules

The head of Kraken’s UK business said regulators need to move faster on regulatory clarity around tokenized assets and stablecoins as now ~20% of UK households own cryptocurrency

Kraken says tokenized equities trading surpasses $5 billion as revenues double

Trading of Kraken’s xStocks tokenized U.S. equities has reached over $5B since launch and reached more than 37k users

Additionally, Kraken announced record 3Q25 revenue of $648M which was up more than 100% Y/Y and adjusted EBITDA for the quarter of $179M, up from a loss of $7M a year ago

Real Estate Tokenization Firm Propy Eyes $100M U.S. Expansion to Modernize Title Industry

Propy is planning to acquire $100M in property title firms across the U.S. and use blockchain technology, tokenization and AI to streamline title operations

Propy has also developed an AI escrow agent which has reduced about 40% of the workload in real estate transactions

Traditional Markets (What a Concept)

Cboe (CBOE 0.00%↑) Looks to Extend Options Hours in Overnight Trading Push

CBOE has filed a proposal with the SEC to allow single stock equity options to trade from 7:30am to 9:25am and from 4:00pm to 4:15pm

The proposal is a step toward a broader widening of single name equity options trading to more closely match that of underlying equities and eventually move towards 24/5 trading

CBOE is only proposing to extend hours for certain equity securities based on trading volume, market cap and share activity

Trump Tariffs Hand Surprising Win to London Metals Exchange Over New York Rival

Trading volumes in LME’s base metals business are up 4% Y/Y through September

This compares to a 34% Y/Y decline in copper contract trading volume on Comex (owned by CME 0.00%↑) in New York

Much of this has been due to the LME’s ability to offer trading in a bonded warehouse where the price of copper is prior to when any tariffs come due, whereas the Comex price is after the tariff rate has already been applied

Twelve-Hour Stock Trading Drives Explosive Activity in Korea’s $2.4 Trillion Market

South Korea’s new stock exchange Nextrade has accounted for nearly 30% of equity transactions last month, just months after launching

This has partly been due to lower fees on the alternative exchange and longer hours

The pace of the exchange’s success has prompted regulators to review rules that cap trading activity on the ATS

Beyond Meat’s Meme-Stock Resurrection Sparks a Retail-Trading Record

According to data from Citi, Beyond Meat’s recent rally sparked a huge surge in retail volumes, with retail trading making up 16% of total share volumes on Tuesday, October 2, the highest level on record

IPO Market

Shutdown Stalemate Brings US IPO Holdouts Off the Sidelines

Despite the government shutdown, some companies are continuing to press forward with listings with Navan and Beta Technologies using a 20-day waiting period before listing

Investment bankers are potentially looking at a busy stretch in early November as firms look to go public before the end of the year

Why London’s Once-Vibrant Stock Market Is in a Rut

Total capital raised on London’s stock market through the first 3 quarters of this year was at the lowest level in over 35 years

The slump comes as more companies chose to list in New York or have been taken private in recent years

Additionally, as companies have switched listing venues from the UK to New York companies have typically seen a valuation boost as the FTSE trades at 13x forward EPS vs. 22x for the S&P 500

Other

Coinbase, Robinhood Go Down for Hours Amid Widespread AWS Outage

Top crypto trading platforms went down for hours on Monday, October 20 due to the AWS outage

According to some users the apps were totally unusable during the outage

Coinbase has said it is working to reorganize services to prevent future outages

Private Credit Begins Sacrificing Secrecy to Draw in Retail Cash

Many funds are now allowing retail investors to buy into funds on a monthly or even daily basis

Given the adjustment about 20% of Houlihan Lokey’s direct lending clients in its portfolio valuation business are requiring monthly valuations

Despite more frequent NAV updates, most funds are not providing frequent investor valuation updates on specific loans in a portfolio

Company Specific Updates for Week Ended Oct. 24, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE 0.00%↑)

Declares 4Q25 Quarterly Dividend of $0.72

Unchanged from prior dividend

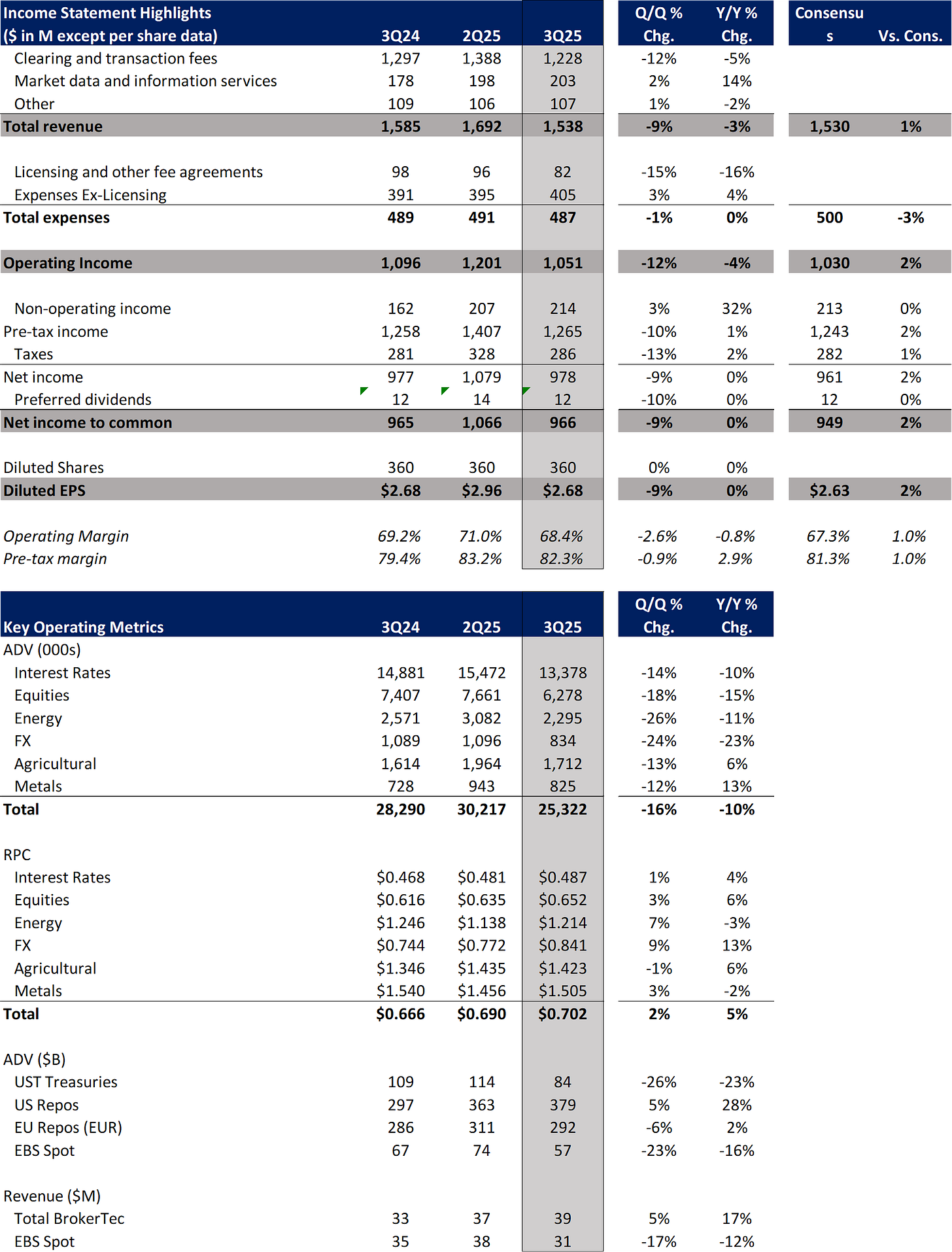

CME Group Inc. (CME 0.00%↑)

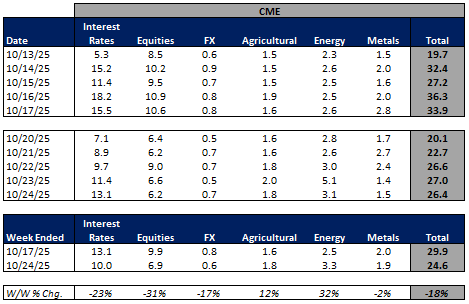

Metals Complex Reaches All-Time Daily Volume Record

On Friday, October 17 CME’s metals contracts reached 2.8M contracts, surpassing the prior record (set on October 9, 2025) by 32%

Files 3Q 10-Q

Reports 3Q25 Earnings

Beats street EPS forecast

More details available in my recap post here

CME Earnings Summary and Key Operating Metrics

Source: company data and Tikr.com

Intercontinental Exchange, Inc. (ICE 0.00%↑)

Open Interest Reaches a Record 107M

Record achieved on October 20 and puts total OI up 16% Y/Y

First Look at Mortgage Performance

Delinquencies remain well below pre-pandemic norms with DQ rate down 2bps M/M to 3.42%

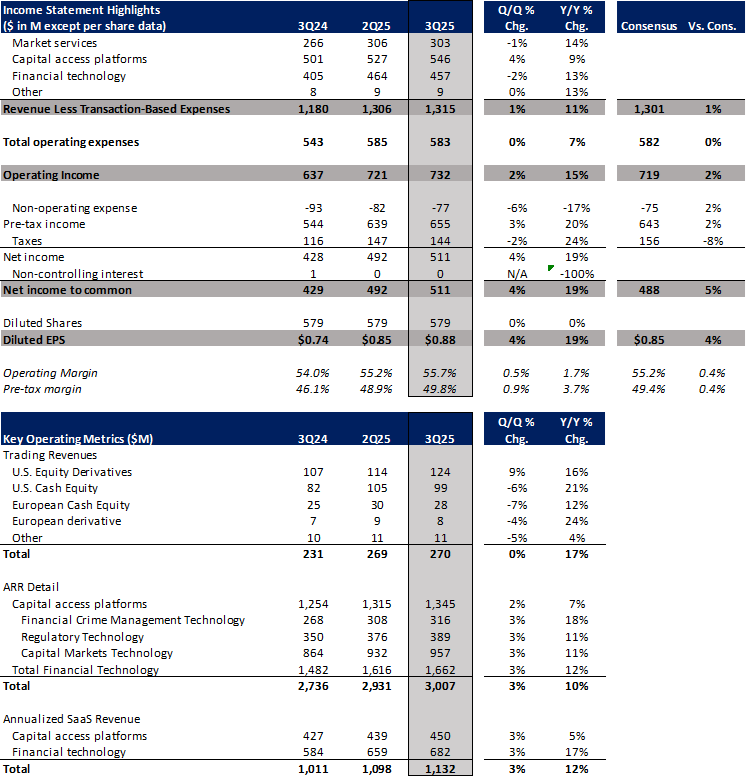

Nasdaq, Inc. (NDAQ 0.00%↑)

Announces 4Q25 Dividend of $0.27

Unchanged Q/Q

Files 3Q25 10Q

Reports 3Q25 Earnings

Beats street EPS forecast

More details available in my recap post here

NDAQ Earnings Summary and Key Operating Metrics

Source: company data and Tikr.com

Fixed Income Trading Platforms

Tradeweb Markets Inc. (TW 0.00%↑)

Launches First Electronic Marketplace for Saudi Riyal Bonds

Launched ATS for trading Sukuk and Saudi Riyal-denominated debt instruments

Builds on TW’s global multi-asset Emerging Markets platform

Las month, Saudi Arabia was added to the J.P. Morgan EM Bond Index watchlist in a move that is projected to bring $5B in initial foreign inflows

Online Brokers

Webull (BULL 0.00%↑)

Reduces Minimum ASX Trading Fee to $1

The company now offers the lowest-cost CHESS-sponsored brokerage fee minimums for trading ASX shares

eToro Group Ltd. (ETOR 0.00%↑)

Doubles Down in Australia, Enhances Local Trading Experience with AUD Accounts and More

Australian users can now use AUD to deposit, hold and invest on eToro

Local users will soon be able to earn interest on AUD cash holdings, deposit crypto into their accounts and enable recurring investments

eToro is also planning to add over 200 more ASX-listed stocks and make Spaceship Super available in app

Financial services’ obsession with ‘confidence gap’ is putting women off investing, warns eToro

57% of industry reports talk about women and their investing confidence in negative, often patronizing terms

1 in 5 women say being told the lack confidence puts them off investing

The Charles Schwab Corporation (SCHW 0.00%↑)

2025 Modern Wealth Survey Shows American Investors Are Expanding Beyond Traditional Portfolios

Two thirds of Americans believe investing requires supplementing traditional investments

20% say the 60/40 portfolio is outdated

More than 60% of Americans say investing today requires a long term view

70% say they have more patience investing now than when they started

20% of respondents say crypto currency is a good investment

65% of crypto owners expect to increase their holdings

Nearly 50% of respondents are interested in owning alternative assets such as private equity, hedge funds and venture capital

Declares 4Q25 Quarterly Dividend of $0.27

Unchanged from prior dividend

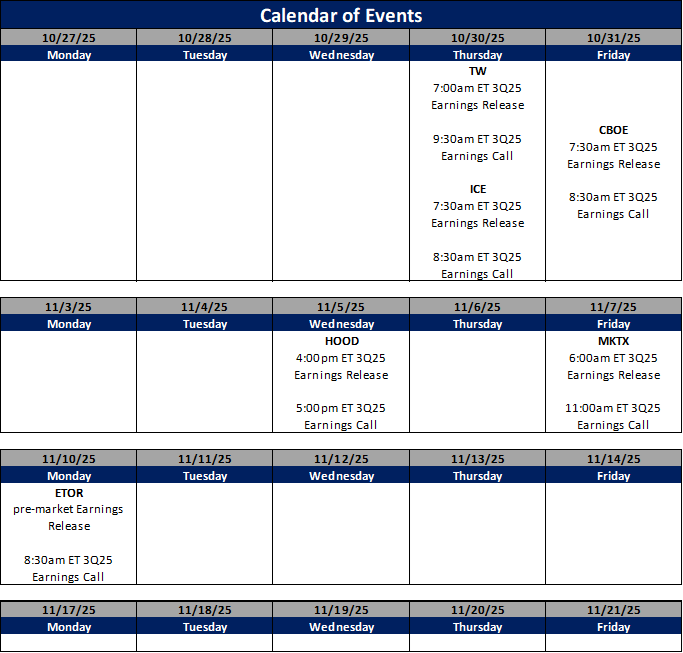

Company Specific Updates Anticipated for the Upcoming Week (Ended Oct. 31, 2025)

Exchanges

Cboe Global Markets, Inc. (CBOE 0.00%↑)

3Q25 Earnings Release

Friday, October 31, Pre-market

Conference call 8:30am ET

Intercontinental Exchange, Inc. (ICE 0.00%↑)

3Q25 Earnings Release

Thursday, October 30, Pre-market

Conference call 8:30am ET

Fixed Income Trading Platforms

Tradeweb Markets Inc. (TW)

3Q25 Earnings Release

Thursday, October 30, Pre-market

Conference call 9:30am ET

Online Brokers

None to Note

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Oct. 24, 2025

Existing Home Sales (Sep.) – 4.06M vs. consensus 4.06M and prior 4.0M

Consumer Price Index (Sep.) – 0.3% vs. consensus 0.4% and prior 0.4%

CPI Y/Y (Sep.) – 3.0% vs. consensus 3.1% and prior 2.9%

Core CPI (Sep.) – 0.2% vs. consensus 0.3% and prior 0.3%

Core CPI Y/Y (Sep.) – 3.0% vs. consensus 3.1% and prior 3.1%

S&P Flash U.S. Services PMI (Oct.) – 55.2 vs. consensus 54.0 and prior 54.2

S&P Flash U.S. Manufacturing PMI (Oct.) –52.2 vs. consensus 51.8 and prior 52.0

Final Consumer Sentiment (Oct.) – 53.6 vs. consensus 54.9 and prior 55.1

Major Macro Updates Scheduled for the Upcoming Week (Ended Oct. 31, 2025)

Monday, Oct. 27

Durable Goods Orders (Sep.) – prior 2.9%

Durable Goods Minus Transportation (Sep.) – prior 0.4%

Tuesday, Oct. 28

S&P Case Shiller Home Price Index (Aug.) – prior 1.8%

Consumer Confidence (Oct.) – prior 94.2

Wednesday, Oct. 29

Advanced U.S. Trade Balance in Goods (Sep.) – ($85.5B)

Advanced Retail Inventories (Sep.) – 0.0%

Advanced Wholesale Inventories (Sep.) – prior (0.2%)

Pending Home Sales (Sep.) – 4.0%

FOMC Decision

Thursday, Oct. 30

Initial Jobless Claims (week ended Oct. 25) – consensus N/A and prior DELAYED

U.S. GDP (3Q) – prior 3.8%

Friday, Oct. 31

Employment Cost Index (3Q) – prior 0.9%

Personal Income (Sep.) – prior 0.4%

Personal Spending (Sep.) – prior 0.6%

PCE Index (Sep.) – prior 0.3%

PCE Y/Y (Sep.) – prior 2.7%

Core PCE Index (Sep.) – prior 0.2%

Core PCE Y/Y (Sep.) – prior 2.9%

Chicago Business Barometer (Oct.) – prior 40.6

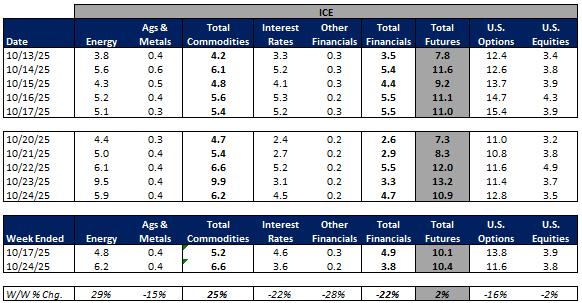

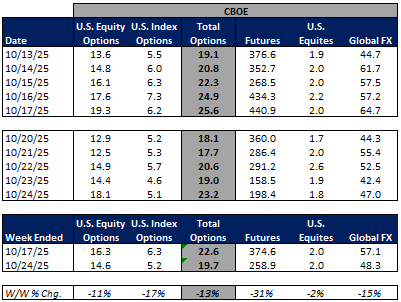

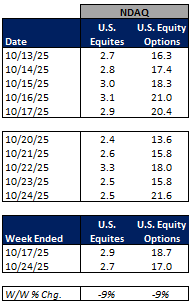

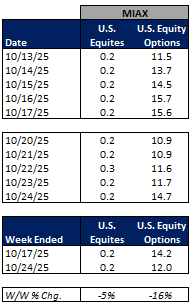

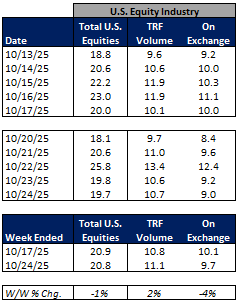

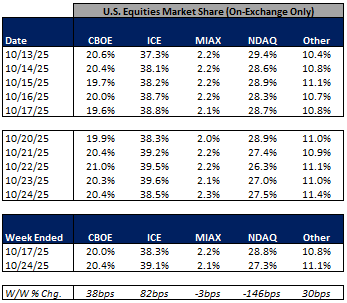

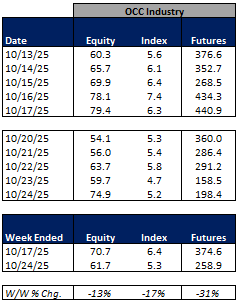

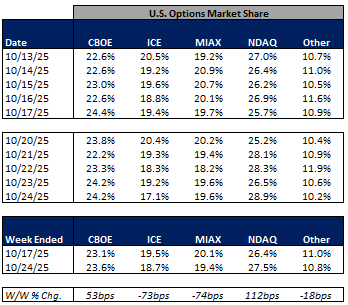

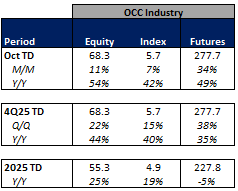

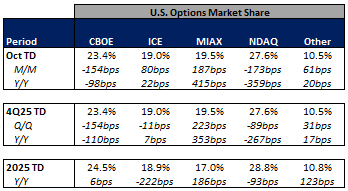

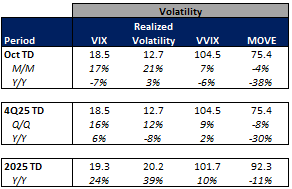

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

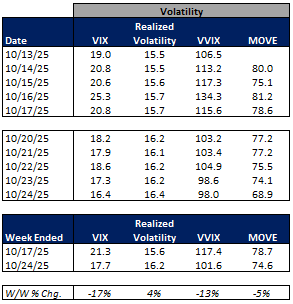

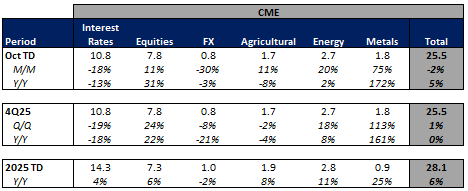

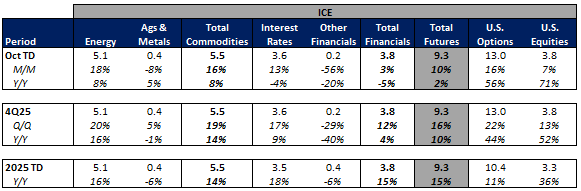

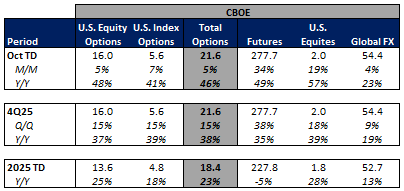

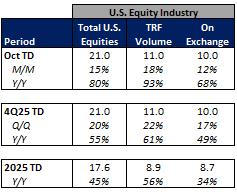

For the week ended October 24, 2025, volumes and volatility were both mostly lower W/W.

The average VIX for the week was down 17% from the prior week, average realized volatility was up 4% W/W, average volatility of volatility (as measured by the VVIX) was down 13% W/W and the average MOVE index (U.S. Treasuries volatility) was down 5% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were down 31% W/W, CME futures volumes were down 18% W/W, and ICE futures volumes were up 2% W/W.

Total U.S. Equities ADV was down 1% W/W, as TRF volumes rose 2% W/W and on-exchange volumes were down 4% W/W. Industry equity options volumes were down 13% W/W while index options volumes fell 17% W/W.

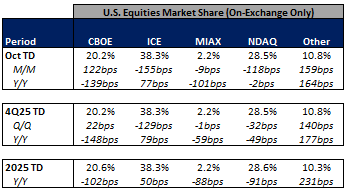

In terms of market share trends for the past week, ICE, CBOE and Other Exchanges picked up share in U.S. equities on-exchange trading while MIAX and NDAQ gave up some share on the week. Within U.S. equity options, CBOE and NDAQ picked up share while ICE, MIAX and other exchanges ceded share in the week.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

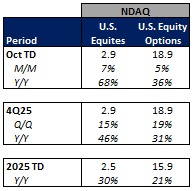

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

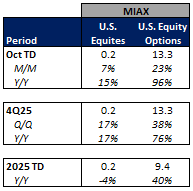

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

For the month to date, exchange volumes are trending mainly higher M/M and Y/Y. This comes as volatility is mostly higher M/M but lower on a Y/Y basis.

The average VIX in October is down 7% Y/Y while realized volatility is up 3% Y/Y and volatility of volatility is down 6% Y/Y. Treasuries volatility is also lower Y/Y as the average MOVE index in October is down 38% Y/Y.

Futures volumes are higher Y/Y as ICE futures ADV is up 2% vs. October 2024 ADV. Meanwhile, CME ADV is up 5% Y/Y while CBOE futures ADV is up 49% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 80% MTD while option volumes are up 54% for equity options and up 42% for index options.

In terms of market share trends for the month-to-date, CBOE and Other exchanges have picked up share in U.S. equities on-exchange trading relative to last month’s levels while NDAQ, MIAX, and ICE have given up some share. Within U.S. equity options, MIAX, ICE and other exchanges have picked up share vs. last month while CBOE and NDAQ have ceded share.

For further details on MTD, QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

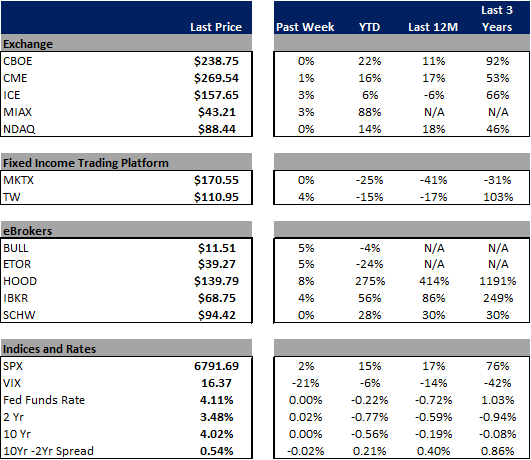

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week up 2% W/W. Yields were flat to up on the week while the curve flattened slightly and the EOP VIX was down 21% on the week.

In terms of the companies I follow, HOOD showed the strongest performance in the group, rising8%. In the remainder of eBroker land BULL and ETOR were both up 5% on the week while IBKR was up 4% and SCHW was unchanged. In fixed income land, MKTX was unchanged while TW was up 4%. Within the exchanges, MIAX rose3%, ICE rose3%, CME was up 1% while NDAQ and CBOE were both unchanged on the week.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

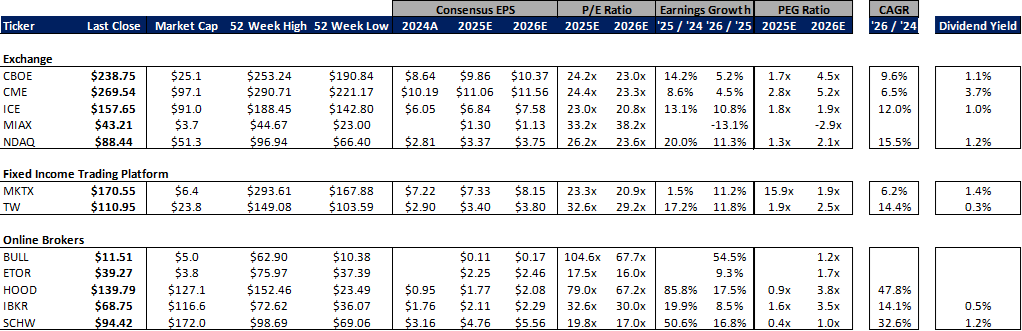

Comp Sheet

Source: Yahoo Finance

Guidance Tracker

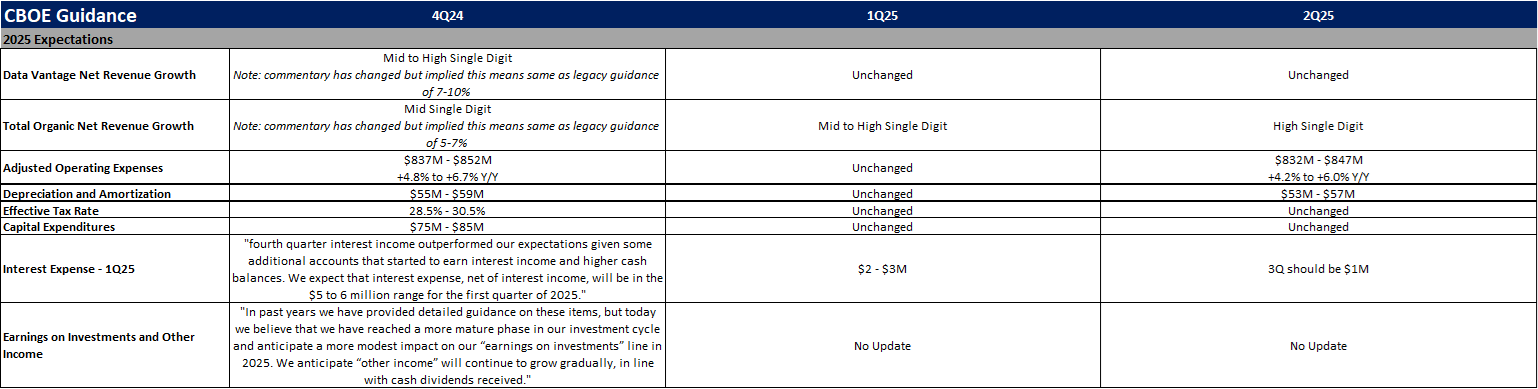

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

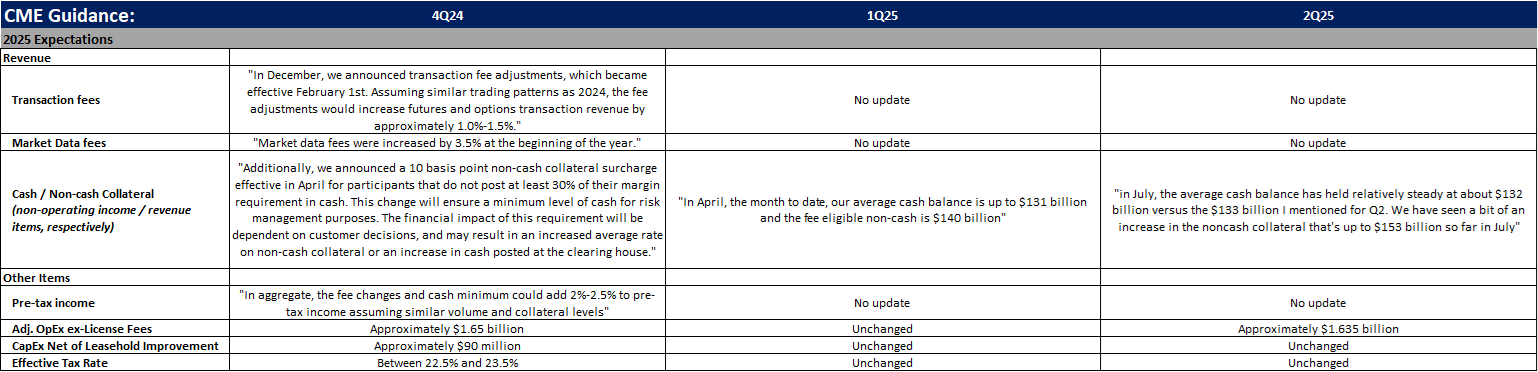

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

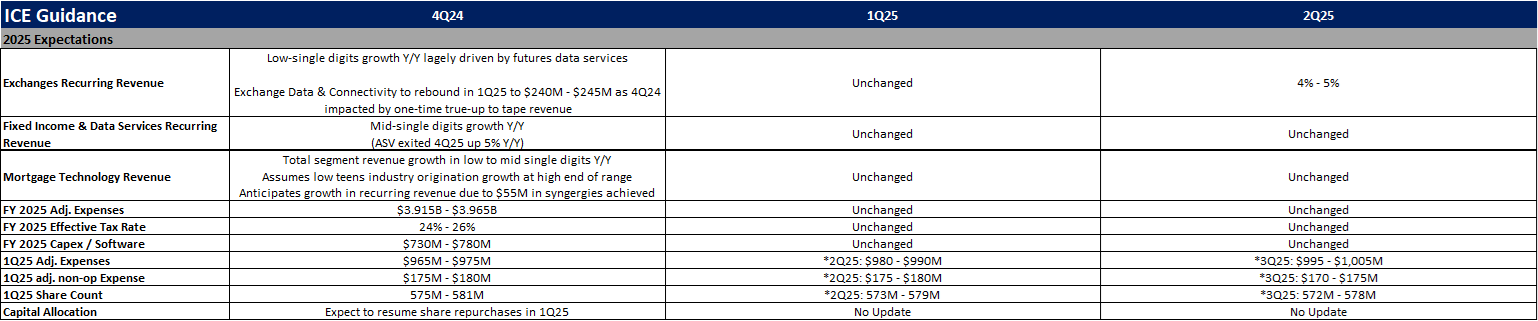

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

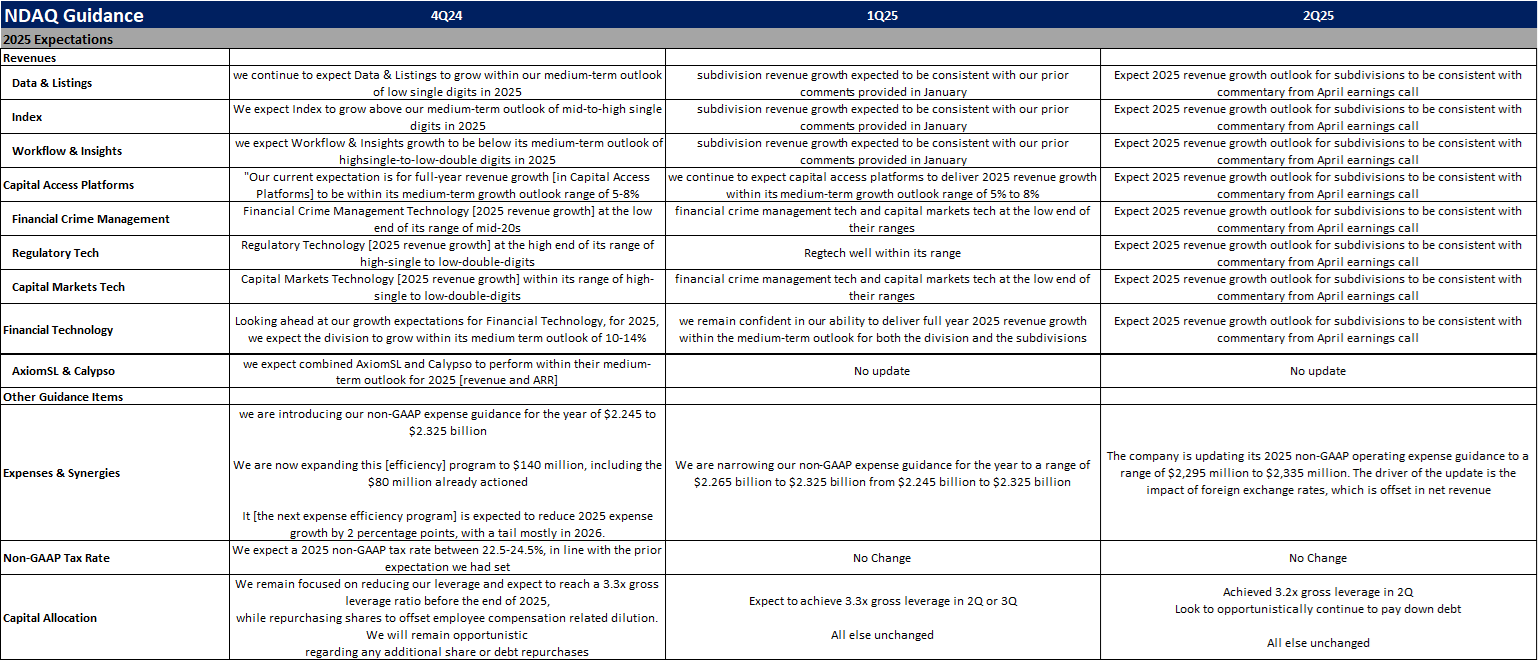

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

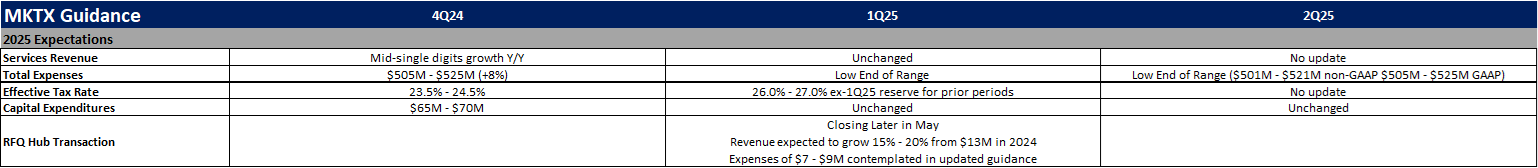

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

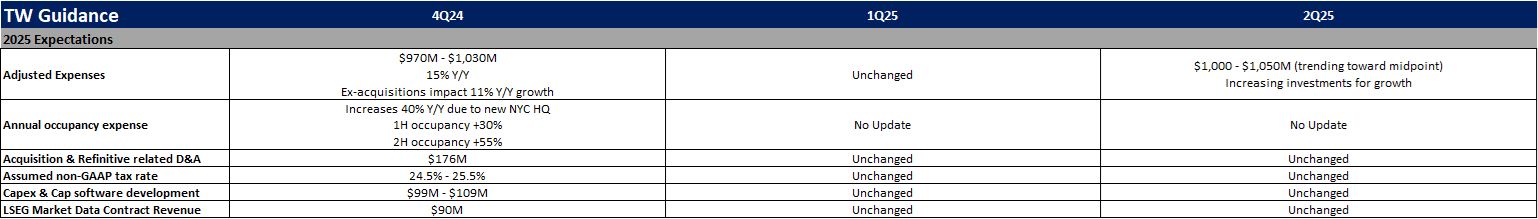

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

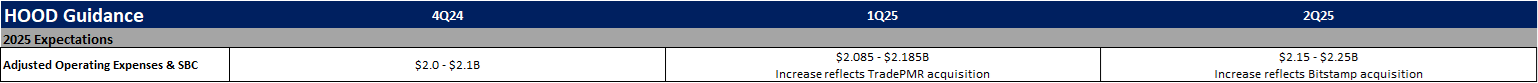

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

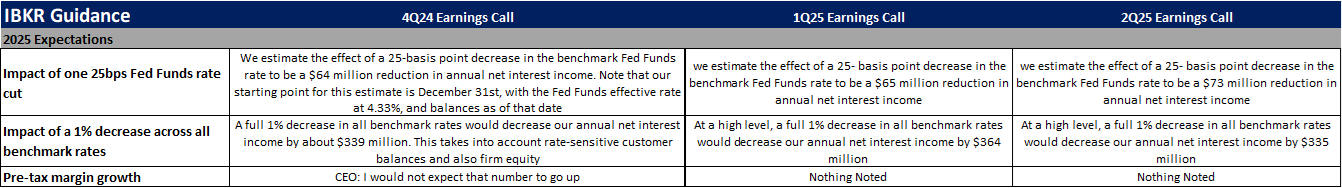

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

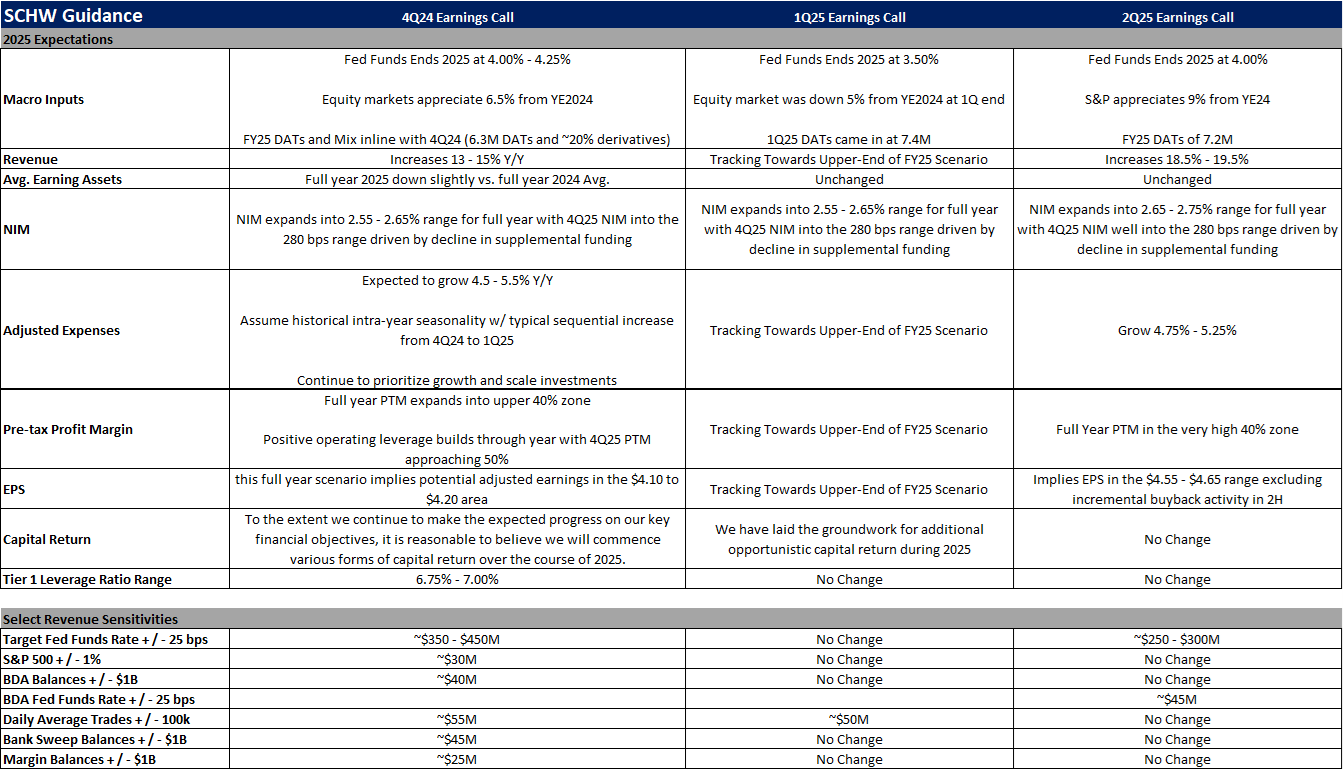

The Charles Schwab Corporation (SCHW)

Great comprehensive recap! The Echo acquisition at $375M is a smart move for Coinbase - positioning themselves in the capital raising space gives them more touchpoints across the crypto ecosystem lifecycle. Combined with the institutional interest in crypto derivatives you mentoned, it seems like they're building a really robust infrastructure play beyond just being an exchange. The AWS outage was definitely a reminder of the single-point-of-failure risks, but hopefully their reorganization efforts will address that. Looking forward to seeing how earnings look given all these strategic moves.