Weekly Recap for Week Ended October 10, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Oct. 10, 2025

Pieces I’ve put out in the past week:

Fixed Income Trading Platforms September Metrics (here)

Other notable news:

IPOs in Limbo as Shutdown Threatens Billions of Dollars of Deals

Handful of potential IPOs set for later this year could be impacted or delayed by prolonged government shutdown

If shutdown lasts beyond the end of this week, timeline becomes tighter to get IPO completed before Thanksgiving after accounting for a 15 day holding period ahead of marketing the IPO

Nasdaq (NDAQ 0.00%↑) Has Become Market of Choice for Dubious Penny-Stock IPOs

Since the start of 2024 there have been 164 penny-stock IPOs (defined as an IPO price below $5) and 147 of them have been on Nasdaq (the remainder on NYSE American)

Of the 2024 penny-stock IPOs that have one-year returns available as of Sept. 30, average returns have been a 37% decline from IPO price

Influx of penny-stock listings comes despite Nasdaq filing with the SEC to tighten listings standards, particularly for small Chinese based companies

Galaxy (GLXY 0.00%↑) launches GalaxyOne

New retail trading platform designed to compete with the likes of HOOD 0.00%↑ and ETOR 0.00%↑ but geared more toward affluent accredited investors

Offers trading in U.S. stocks and ETFs as well as crypto

Offers 4% APY on cash deposits and 8% yield investment note for accredited investors with a minimum deposit of $25k

Cboe Global Markets (CBOE 0.00%↑) Gets Nod to List Firms in Australia

The Australian Securities & Investments Commission (ASIC) approved CBOE’s application to list Australian stocks on Tuesday

Will provide more choice for companies seeking to list in Australia and provides competition for Australia’s main exchange ASX Ltd.

While this could be a slight positive for CBOE and slight negative for ASX it’s likely many issuers will continue to choose to list at ASX in order to be included in ASX’s indices

Rachel Reeves Steps up Efforts to Secure More Company Listings for the UK

UK Chancellor Rachel Reeves is increasing effort to attract more listings to the UK including granting tax relief on proceeds from listings as well as providing tax relief on costs of an IPO

The hope is that more UK companies will choose to list in the local market as London fell out of the world’s top 20 listings markets for the first 9 months of this year

Crypto Exchange Spot Trading Falls to $1.67T in September

Spot trading down 10% from August to lowest level since June

However, spot bitcoin ETFs experienced a shift from net outflows to net inflows for the month

Bullish Releases September Trading Metrics

Total trading volume declined 19% M/M to $39.6B

Spot trading volume was down 16% M/M to 37.3B

Perpetuals were down 52% M/M to $2.2B

Bullish and Deutsche Bank Partner to Deliver Fiat Integration for Crypto Trading

Deutsche Bank will provide corporate banking services to Bullish including facilitation of fiat deposits and withdrawals for Bullish’s Hong Kong and German businesses

Setup will include real-time reporting and instant payments as well as a virtual accounting solution

Ares Capitalizing on Retail in Alternative Assets

Ares has 185 employees in 10 offices working on product development for retail and already has over $50B in AUM with market share of retail approaching 10%

Some have suggested retail has been funneled weaker deals as retail has grown in the segment with institutions seeing better deal flow but according to Ares, allocations have been based on capital available with many investments flowing to both retail and institutions

Ares CEO, Michael Arougheti believes the interest in alt assets from retail has come from increased concentration in liquid, public securities

Arougheti does not believe 401(k) accounts will bolster AUM much until regulations change as the primary definition of fiduciary duty is cost, not return from the assets, so while alternatives could provide higher returns many plan sponsors may be uncomfortable allocating assets to alternatives due to the higher fee structure

Jamie Dimon Would Welcome Change in Quarterly Earnings

Dimon said he would be supportive of removing the quarterly earnings requirement but noted JPM would likely continue reporting earnings quarterly but on a much more scaled back level

He did suggest that the bigger problem for companies’ longtermism approach was when companies provide guidance and back themselves into a corner to hit an earnings target

He also suggested the endless rules companies have to follow to maintain public company status is the big issue with declining public companies in the U.S. and that the quarterly earnings process is just a small piece of that problem

Retail Rush to Private Assets is Raising Risks

The flood of retail money into private assets is pressure fund managers to deploy capital quickly, raising risks of managers buying lower quality assets

S&P Global Plans to Launch Crypto Ecosystem Index

Index will include 35 companies involved in digital asset operations, infrastructure providers, blockchain applications and financial services and 15 cryptocurrencies

S&P is also partnering with Dinari, a provider of tokenized U.S. public securities, to create a token tracking the new benchmark

Gold Backed Crypto Tokens Top $3B

Tokenized gold trading topped $640M on Monday and the total market cap of tokenized gold surpassed $3B as underlying gold crossed $4k per ounce for the first time ever

Crypto Race to Tokenize Stocks Raises Investor Protection Flags

Financial regulators and traditional financial firms are warning that tokenized equities pose risks to investors and threaten financial stability

Though the new offerings are marketed like traditional stocks they offer far fewer investor rights, protections, and disclosures as traditional equities and typically more closely resemble a derivative contract

The tokenization trend has exploded in popularity recently with HOOD 0.00%↑, COIN 0.00%↑, Kraken, GEMI 0.00%↑ and others launching or exploring these products and NDAQ 0.00%↑ has petitioned the SEC to allow tokenized securities to trade on its exchange

Citadel, SIFMA and the World Federation of Exchanges (WFE) have all raised concerns to regulators about tokenized securities, though the WFE has noted that it is supportive of NDAQ’s proposal because NDAQ’s proposal would treat the tokens on its exchange just as traditional securities

Clearly tokenization is going to become more prevalent in the markets and could provide significant benefits to how securities trade and clear, but it must be implemented correctly

Carlyle Release Proprietary U.S. Economic Indicators

Using data from its portfolio of 277 companies, 694 real estate investments and 730k employees worldwide, Carlyle released proprietary U.S. economic data

The data shows the U.S. economy adding 17k jobs in September, U.S. GDP running at growth 2.7%, Energy inflation running down 3.3%, Services inflation less shelter up 3.3% and Durables inflation up 2.3%

AI Debt Hits $1.2T, Becoming Largest Investment-Grade Market Segment

AI companies now make up 14% of the U.S. high grade market, up from 11% in 2020 and surpassing U.S. Banks, the largest sector in the J.P. Morgan US Liquid Index (JULI) at 11.7%

Additionally, AI company debt trades at 74 bps, 10 bps tighter than the JULI

Crypto Exchange Gemini (GEMI 0.00%↑) Launches Australian Arm

Gemini already has institutional customers from Australia that have been serviced through the company’s global arm

Crypto adoption rate in Australia rose to 31% earlier this year from 28% last year

Influx of Retirement Funds Could Push Private Markets to Daily Pricing

Demand for disclosure is likely to intensify as 401(k) allocations move more into alternative assets according to KKR’s head of client services, Eric Mogelof

Jane Street Looks to Expand Into Physical Markets in Trading Push

The company is actively hiring in its physical gas business to expand its capabilities in the natural gas markets

SEC Eases IPO Path During Government Shutdown

Typically companies can not go public during a government shutdown because staff is unable to review registration statements

However companies can allow their registration statements to become automatically effective which involves setting the IPO price 20 days before the listing instead of pricing it the night before

In an announcement on the SEC website, the SEC said it would not punish companies that omit pricing details from prospectuses filed during the shutdown and go public during or after the shutdown ends

Block Street Raises $11.5M

Funding comes from Hack VC, DWF Labs, and executives from Jane Street and Point72

Block Street plans to use the funding to build infrastructure for on chain trading of tokenized stocks

Kalshi Announces $300M in Series D Funding at $5B Valuation

Fundraising led by A16Z and Sequoia with participation from Paradigm, Coinbase Ventures, General Catalyst, Spark and CapitalG

Also announced it is now available in over140 countries

Kraken Expands CME 0.00%↑ Derivative Access to Oil, Gold and FX

The company has been preparing this expansion after acquiring NinjaTrader earlier this year

Move comes as Kraken is exploring an IPO with a potential valuation of $20B

Company Specific Updates for Week Ended Oct. 10, 2025

Exchanges

CME Group Inc. (CME)

Farmers Say Current Conditions on U.S. Farms Weakening

Sentiment essentially unchanged, rising 1 point to 126

Index of current conditions fell 7 points to 122

CME Group Metals Complex Reaches All-Time Daily Volume Record

On October 9, CME metals traded 2.1M contracts, 24% higher than the prior daily record set in April 2024

Intercontinental Exchange, Inc. (ICE)

Falling Rates Lead to Best Homebuying Affordability in 2.5 Years

With 30-year mortgage rates falling to 6.26% in September average monthly principal and interest fell to $2,148 or 30% of median household income

Announces strategic $2B investment in Polymarket

Values Polymarket at $8B pre-investment

ICE will become a global distributor of Polymarket’s event-driven data

ICE and Polymarket have also agreed to partner on future tokenization efforts

Investment consideration in cash and not expected to have material impact on ICE’s 2025 financial results or capital return plans

Loomis Sayles Selects ICE Climate to Advance Climate Risk Integration Across Portfolios

ICE’s data will support Loomis Sayles approach to identifying financially material climate risk across municipal bonds, global corporates, securitized and sovereign debt

ICE Climate’s data includes metrics for flood, wildfire, hurricane, extreme heat and cold exposure and Scope 1, 2, and 3 emissions transition risk indicators

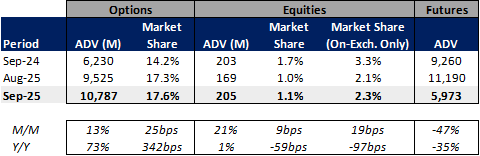

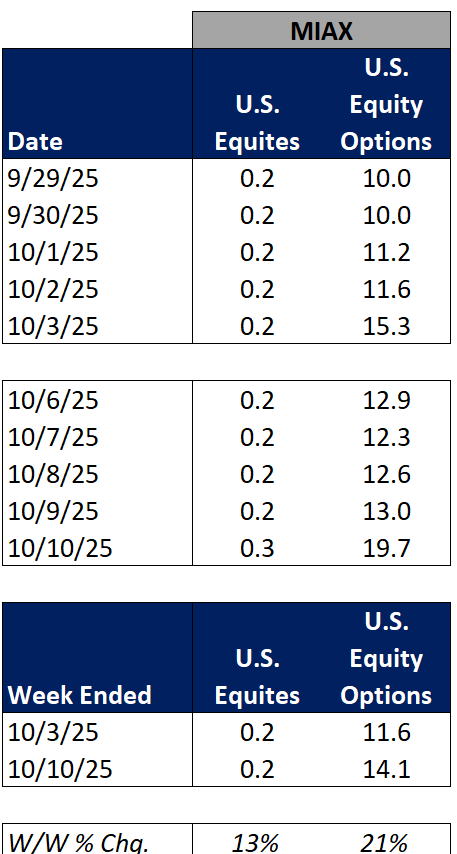

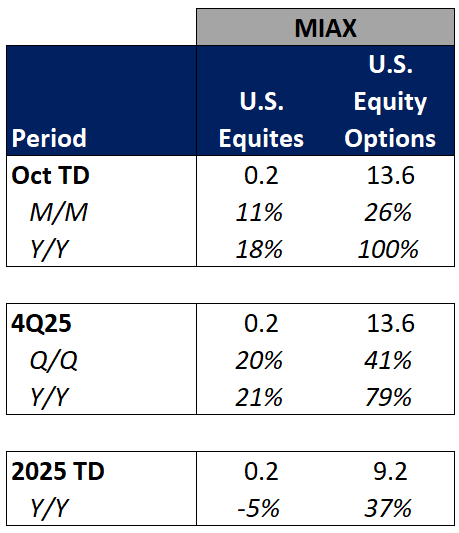

Miami International Holdings, Inc. (MIAX)

Reports Official September Trading Volume

Volume stats largely known ahead of

Market share up M/M in Options (new record) & Equities

Futures ADV -47% M/M, -35% Y/Y

More detail in my exchange September volume recap note from Oct. 1 available here

MIAX September Volumes & Market Share

Source: company documents

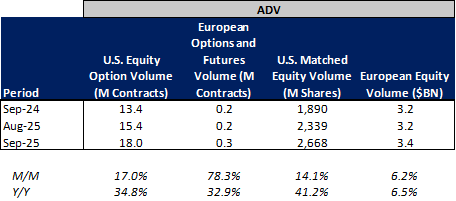

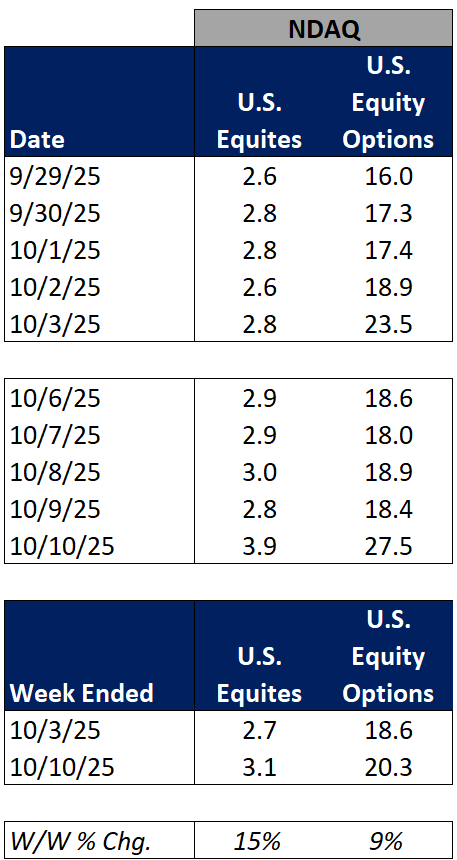

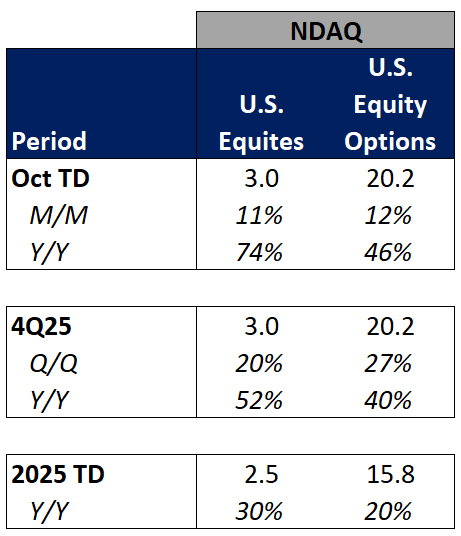

Nasdaq, Inc. (NDAQ)

Reports official trading volume for September

Volumes across the board were up meaningfully both M/M and Y/Y

More detail in my exchange September volume recap note from Oct. 1 available here

NDAQ September Volumes

Source: company documents

Fixed Income Trading Platforms

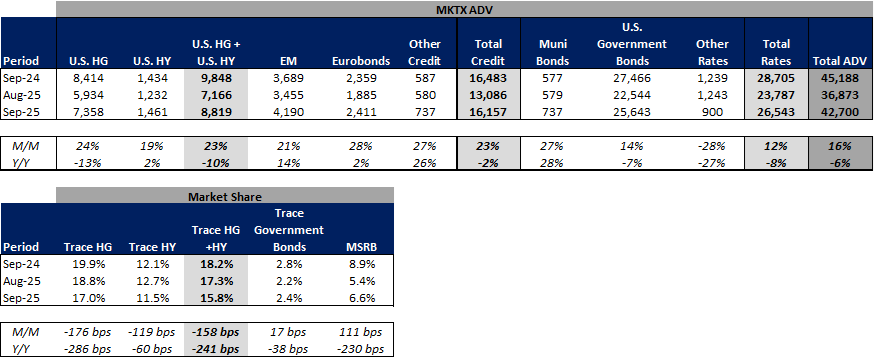

MarketAxess Holdings Inc. (MKTX)

Reports September Volume Metrics and 3Q Fee Per Million Data

Total volume up 16% M/M to $42.7B (-6% Y/Y)

Credit Fee Per Million +1% Q/Q

Rates Fee Per Million +3% Q/Q

More detail in my fixed income platforms recap note here

MKTX Monthly Metrics

Source: company documents

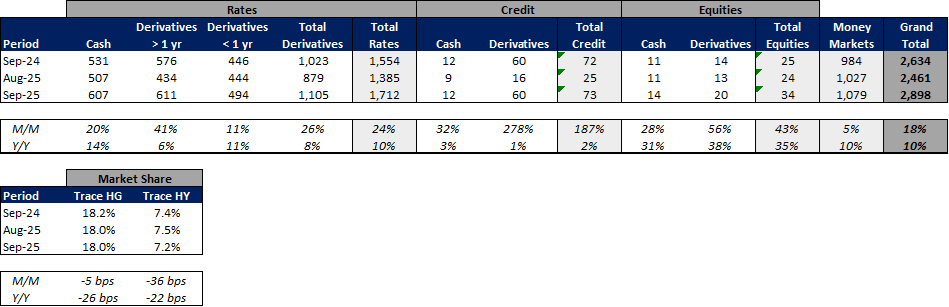

Tradeweb Markets Inc. (TW)

Announces 3Q25 Earnings Release Date

Thursday, October 30

Press Release scheduled for 7:00am ET

Conference call at 9:30am ET

Expands Algorithmic Execution Capabilities for U.S. Treasuries

The capabilities enable traders to manage and execute orders over a set time horizon while maintaining dealer relationships and benefit from the risk protections of executing with a bank counterparty

Tradeweb offers access to both dealer and proprietary algos

Reports September Volume Metrics and 3Q Fee Per Million Data

Total volume up 18% M/M to $2.9T (+10% Y/Y)

Fee Per Million down 6% Q/Q

Fixed fees for rates, credit, equities and money markets +2% Q/Q

More detail in my fixed income platforms recap note here

TW Monthly Metrics

Source: company documents

Online Brokers

eToro Group Ltd. (ETOR)

Announces 3Q25 Earnings Release Date

Monday, November 10

Press release pre-market

Conference call 8:30am ET

Interactive Brokers Group, Inc. (IBKR)

Expands Tax Planning Suite with New Professional Tools

New Tax Planner tool uses inputs such as income from other sources, deductions and withholdings to create a personal tax profile for users

Helps identify tax loss opportunities across the portfolio and offers tax smart trading

The Charles Schwab Corporation (SCHW)

STAX Score Keeps Rising in September

STAX rises to 46.12 from 43.69 in August

Reading ranks “moderate low” compared to historical average

Retail traders branched out from Mag-7 stocks into higher-volatility, AI-adjacent names

Schwab clients were net buyers of equities in September

Schwab Stock Plan Services Launches Schwab Private Issuer Equity Services

New offering brings SCHW’s public company stock plan experience to private company administrators

Offering to be powered by Qapita an equity management platform for private companies

Qapita primarily serves companies across Southeast Asia with 70% of the 2,700 companies using it based in India. This partnership will greatly expand its U.S. presence

As part of the partnership with Qapita, SCHW took part in Qapita’s $26.5M series B funding round

Provides equity management tools, offers guidance to employees, and ensures a seamless transition for administrators and employees when a company goes public without administrators having to transition to a new provider

Company Specific Updates Anticipated for the Upcoming Week (Ended Oct. 17, 2025)

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

3Q25 earnings release

Thursday, October 16 post-close

Conference call 4:30pm ET

The Charles Schwab Corporation (SCHW)

3Q25 earnings release

Thursday, October 16 pre-market

Conference call 8:30am ET

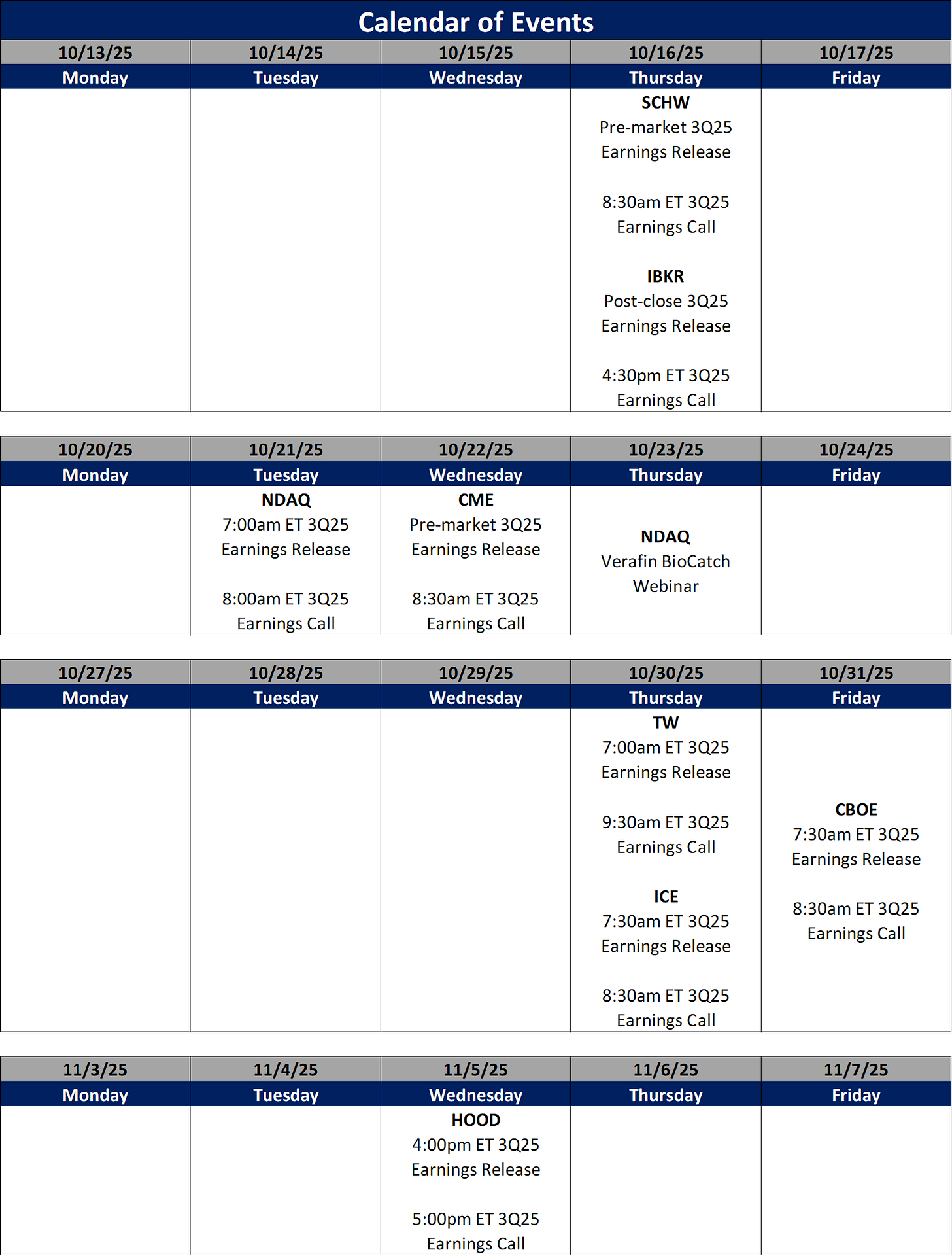

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Oct. 10, 2025

U.S. Trade Deficit (Aug.) – DELAYED consensus ($60.7B) and prior ($78.3B)

Consumer Credit (Aug.) – $363M vs. consensus $14.0B and prior $18.1B

Initial Jobless Claims (week ended Oct. 4) – DELAYED consensus N/A and prior DELAYED

Wholesale Inventories (Aug.) – DELAYED prior 0.1%

Preliminary Consumer Sentiment (Oct.) – 55.0 vs. consensus 53.5 prior 55.1

Monthly U.S. Federal Budget (Sep.) – DELAYED prior ($170.7B)

Major Macro Updates Scheduled for the Upcoming Week (Ended Oct. 17, 2025)

Monday, Oct. 13

None to Note

Tuesday, Oct. 14

NFIB Optimism Index (Sep.) – prior 100.8

Wednesday, Oct. 15

Empire State Manufacturing Survey (Oct.) – consensus (0.5) and prior (8.7)

Thursday, Oct. 16

Initial Jobless Claims (week ended Oct. 11) –consensus N/A and prior DELAYED

U.S. Retail Sales (Sep.) – consensus 0.4% and prior 0.6%

Retail Sales Minus Autos (Sep.) – consensus 0.4% and prior 0.7%

Producer Price Index (Sep.) – consensus 0.3% and prior (0.1%)

Core PPI (Sep.) – prior 0.3%

PPI Y/Y (Sep.) – prior 2.6%

Core PPI Y/Y (Sep.) – prior 2.8%

Philadelphia Fed Manufacturing Survey (Oct.) – consensus 10 and prior 23.2

Business Inventories (Aug.) – consensus 0.2% and prior 0.2%

Homebuilder Confidence Index (Oct.) – prior 32

Friday, Oct. 17

Housing Starts (Sep.) – consensus 1.31M and prior 1.31M

Building Permits (Sep.) – consensus 1.35M and prior 1.31M

Import Price Index (Sep.) – consensus 0.1% and prior 0.3%

Import Price Index Minus Fuel (Sep.) – prior 0.4%

Industrial Production (Sep.) – consensus 0.1% and prior 0.1%

Capacity Utilization (Sep.) – consensus 77.3% and prior 77.4%

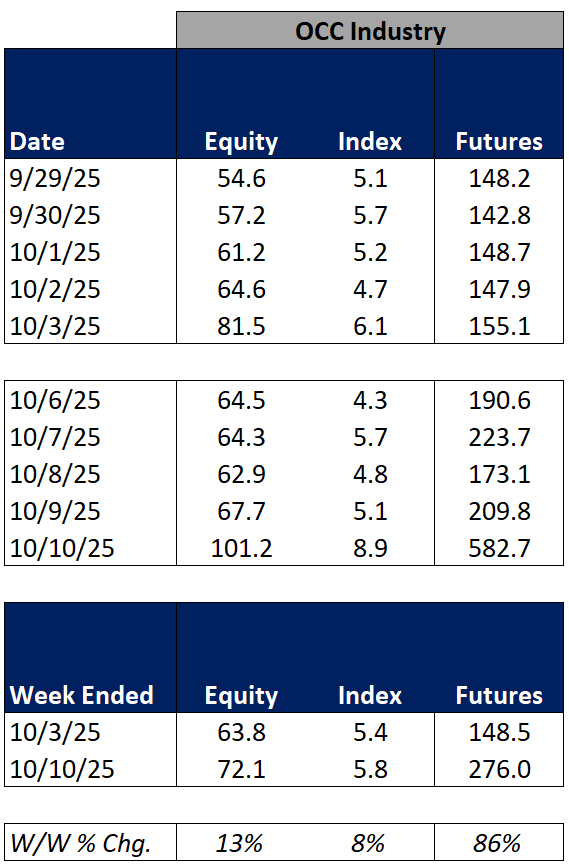

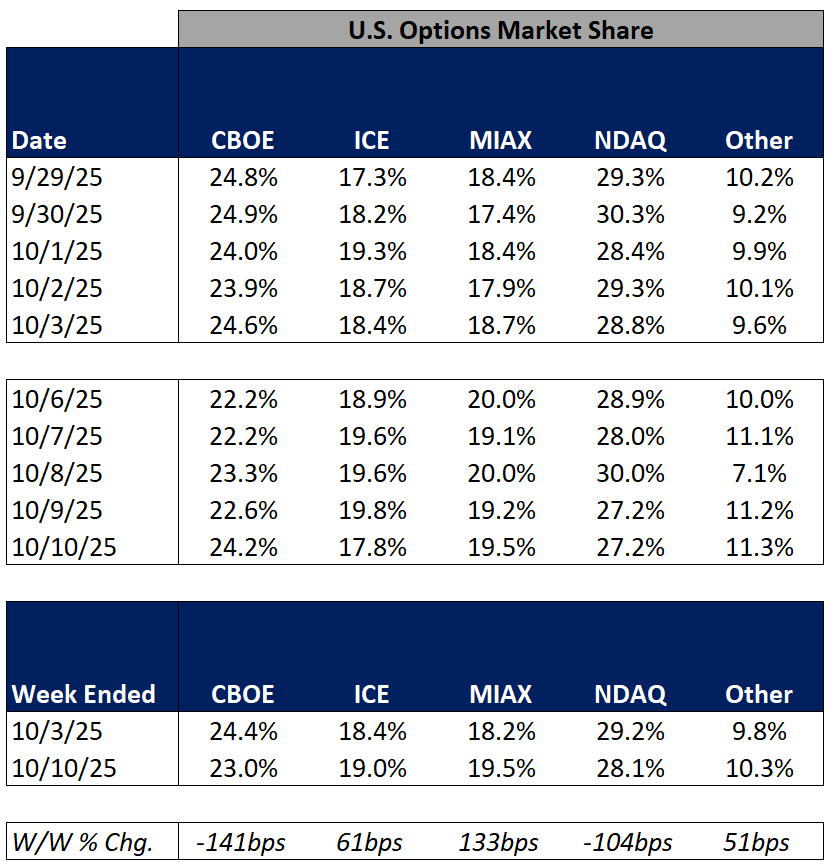

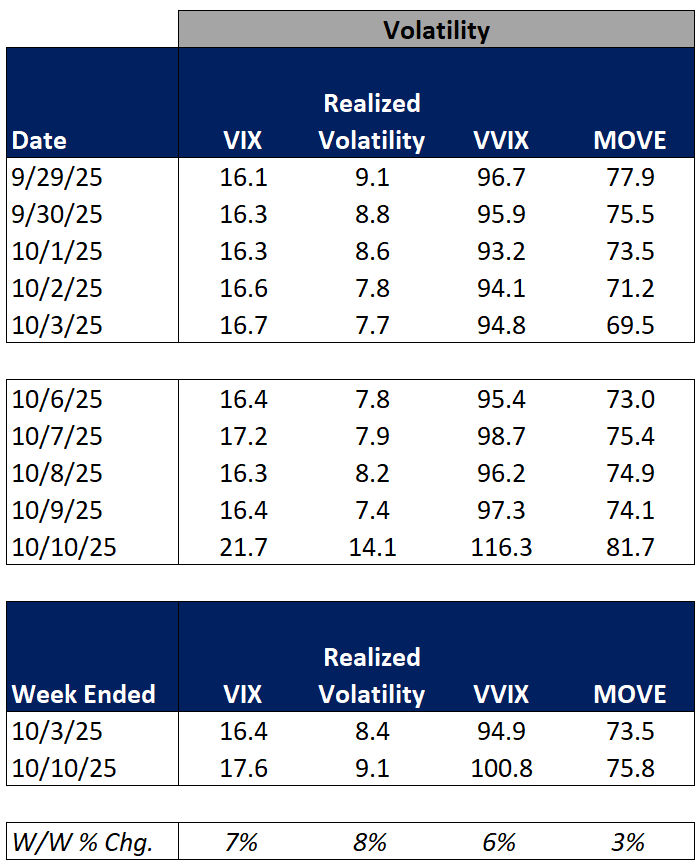

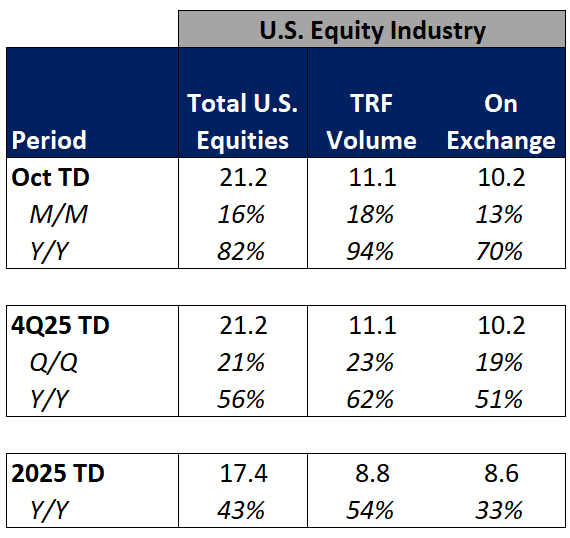

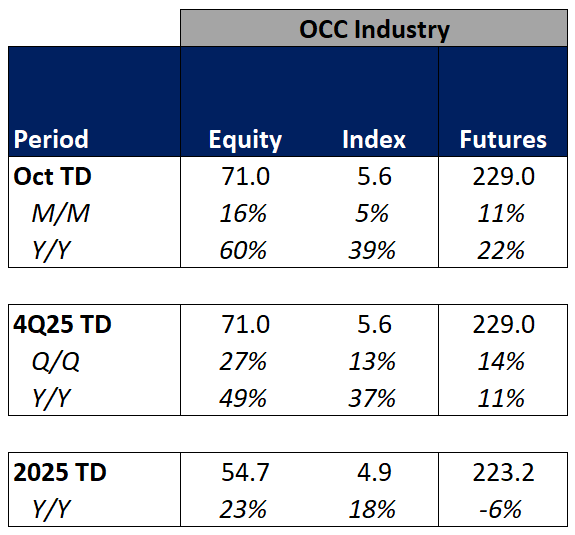

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

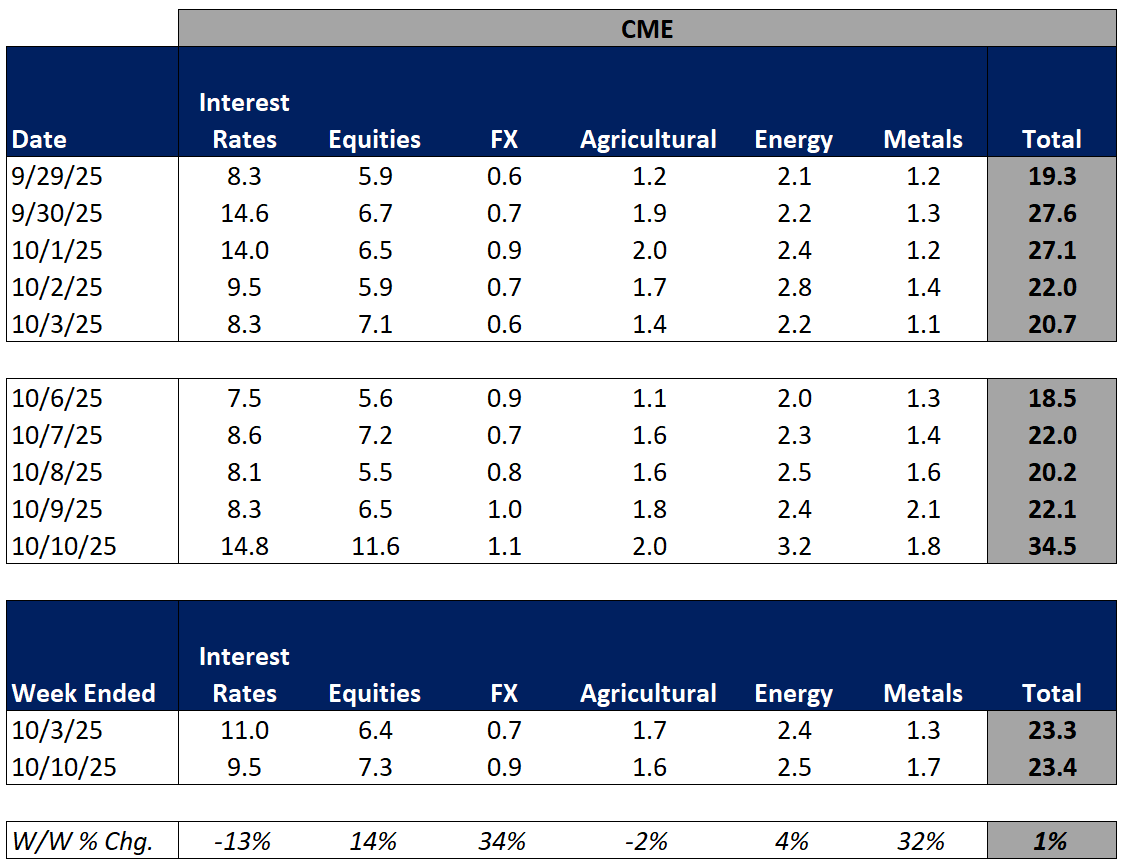

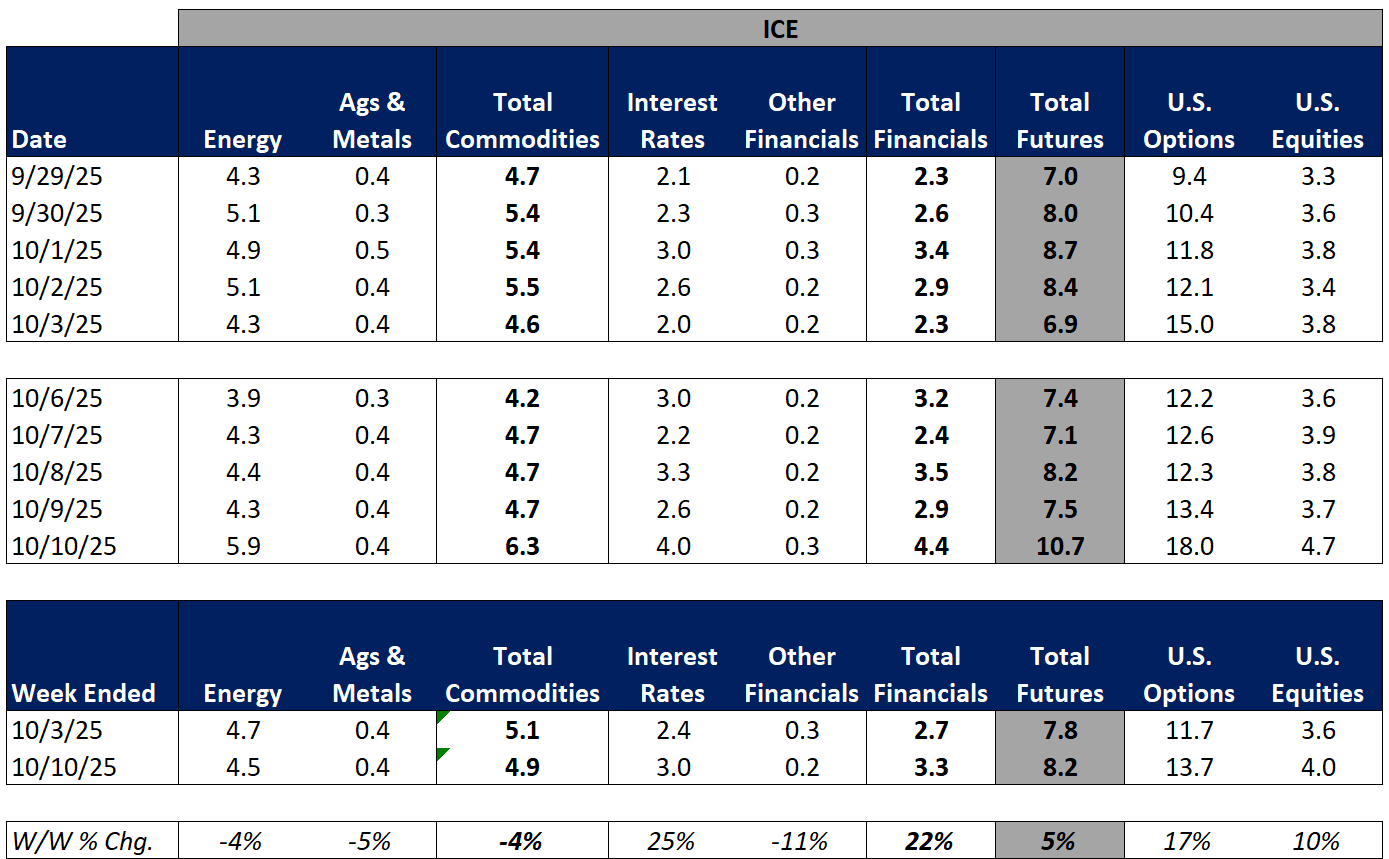

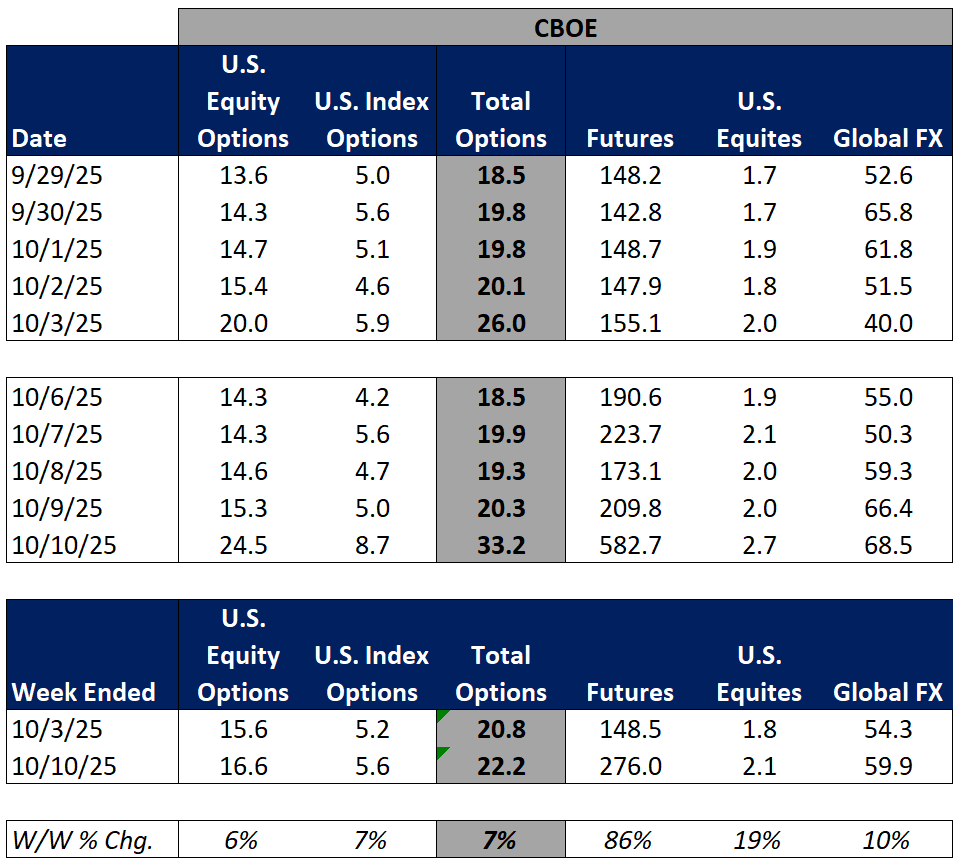

For the week ended October 10, 2025, volumes were higher and volatility was higher W/W primarily driven by an uptick on Friday after President Trump commented that he was considering increasing tariffs on China to 100%.

The average VIX for the week was up 7% from the prior week, average realized volatility was up 8% W/W, average volatility of volatility (as measured by the VVIX) was up 6% W/W and the average MOVE index (U.S. Treasuries volatility) was up 3% W/W.

Futures average daily volumes (ADV) were higher as CBOE futures volumes were up 86% W/W, CME futures volumes were up 1% W/W, and ICE futures volumes were up 5% W/W.

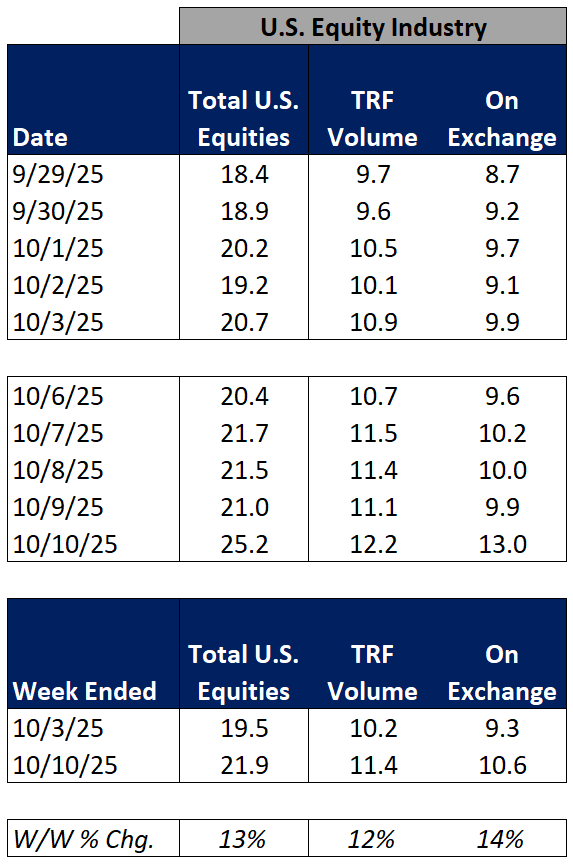

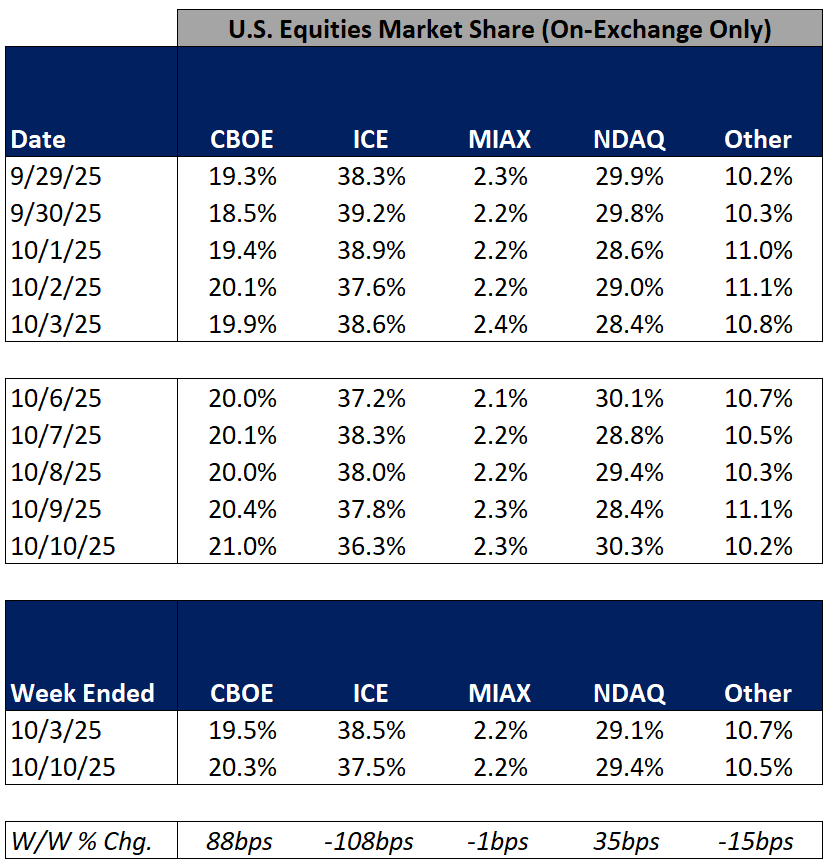

Total U.S. Equities ADV was up 13% W/W, as TRF volumes rose 12% W/W and on-exchange volumes were up 14% W/W. Industry equity options volumes were up 13% W/W while index options volumes rose 8% W/W.

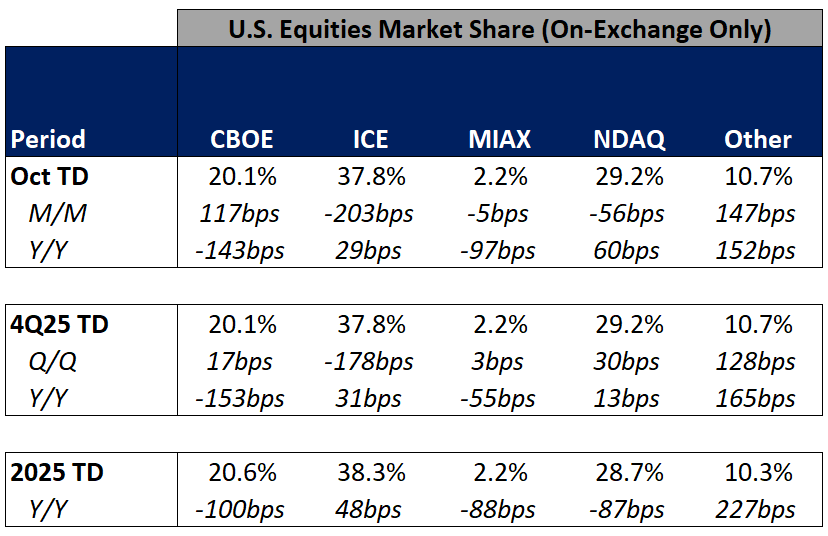

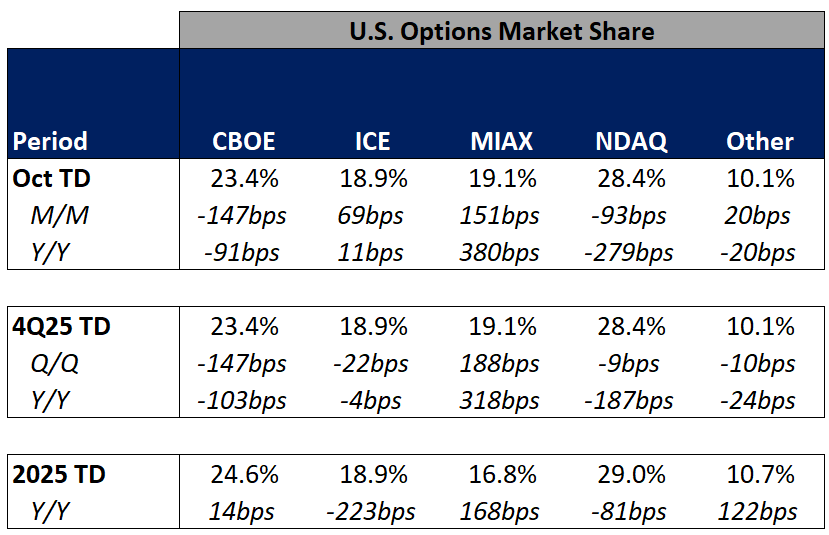

In terms of market share trends for the past week, CBOE and NDAQ picked up share in U.S. equities on-exchange trading while MIAX, ICE and other exchanges gave up some share on the week. Within U.S. equity options, ICE and MIAX picked up share while NDAQ, CBOE, and other exchanges ceded share in the week.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

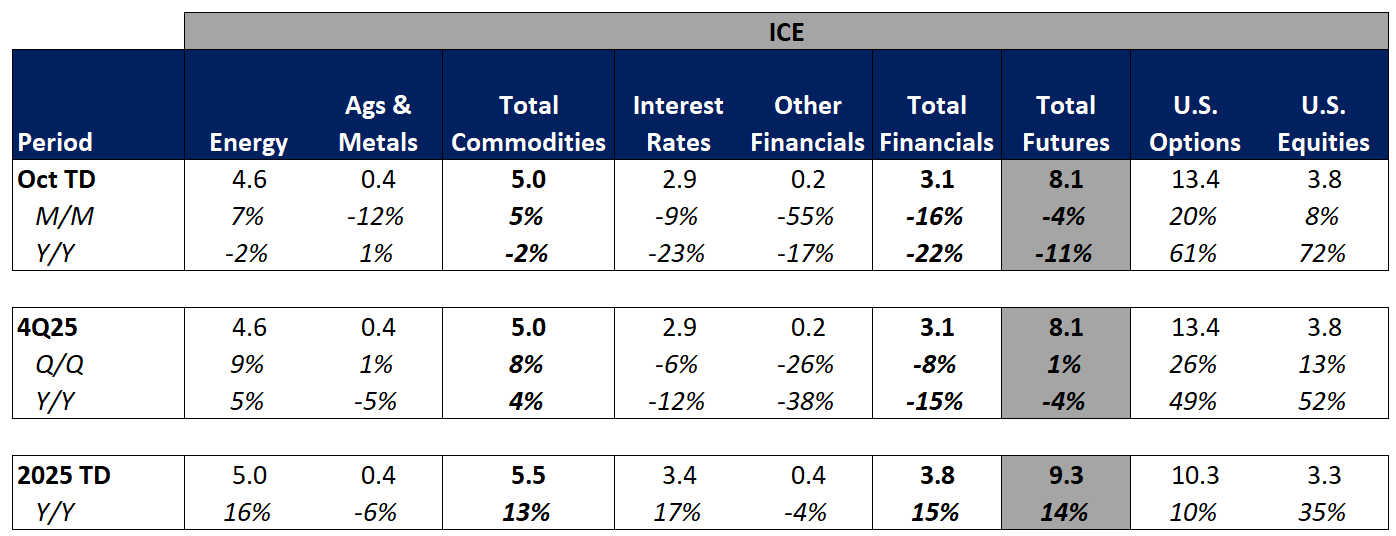

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

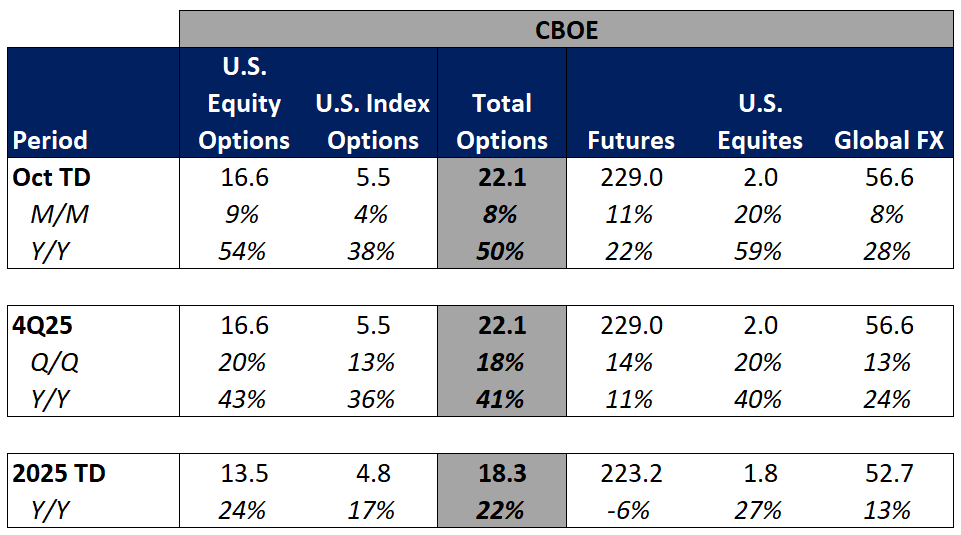

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

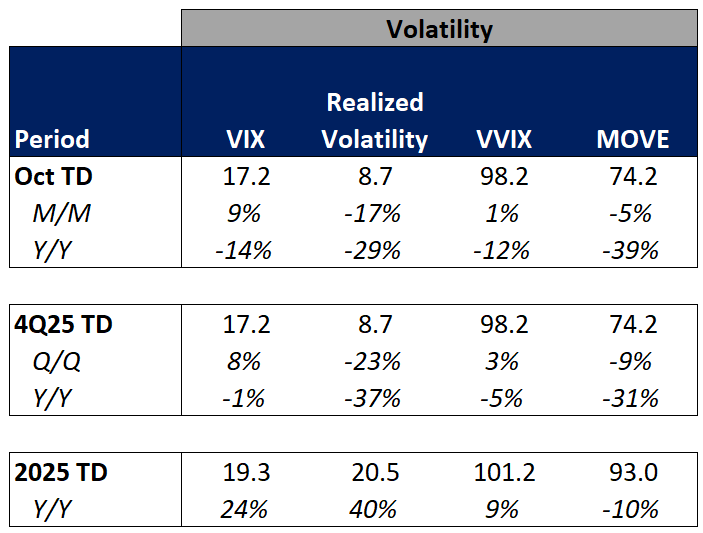

Volatility Metrics

Source: Yahoo Finance

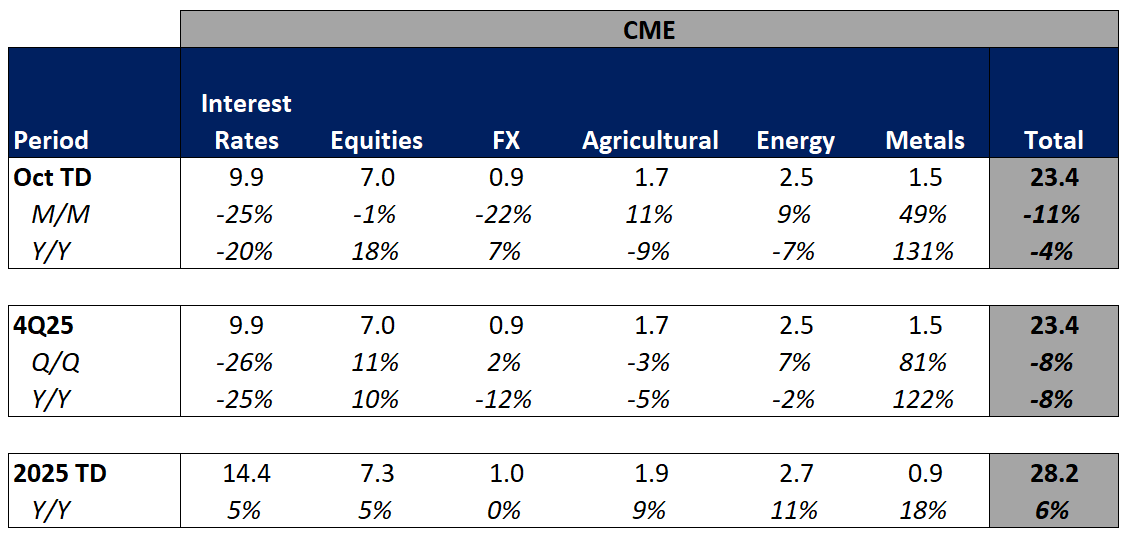

Exchange Volumes MTD / QTD / YTD Trends

For the month to date, exchange volumes are trending mixed M/M and Y/Y. This comes as volatility is mixed M/M and lower on a Y/Y basis.

The average VIX in October is down 14% Y/Y while realized volatility is down 29% Y/Y and volatility of volatility is down 12% Y/Y. Treasuries volatility is also lower Y/Y as the average MOVE index in October is down 39% Y/Y.

Futures volumes are mixed Y/Y as ICE futures ADV is down 11% vs. October 2024 ADV. Meanwhile, CME ADV is down 4% Y/Y while CBOE futures ADV is up 86% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 82% MTD while option volumes are up 60% for equity options and up 39% for index options.

In terms of market share trends for the month-to-date, CBOE and Other exchanges have picked up share in U.S. equities on-exchange trading relative to last month’s levels while NDAQ, MIAX, and ICE have given up some share. Within U.S. equity options, MIAX and ICE have picked up share vs. last month while CBOE, NDAQ and Other exchanges have ceded share.

For further details on MTD, QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

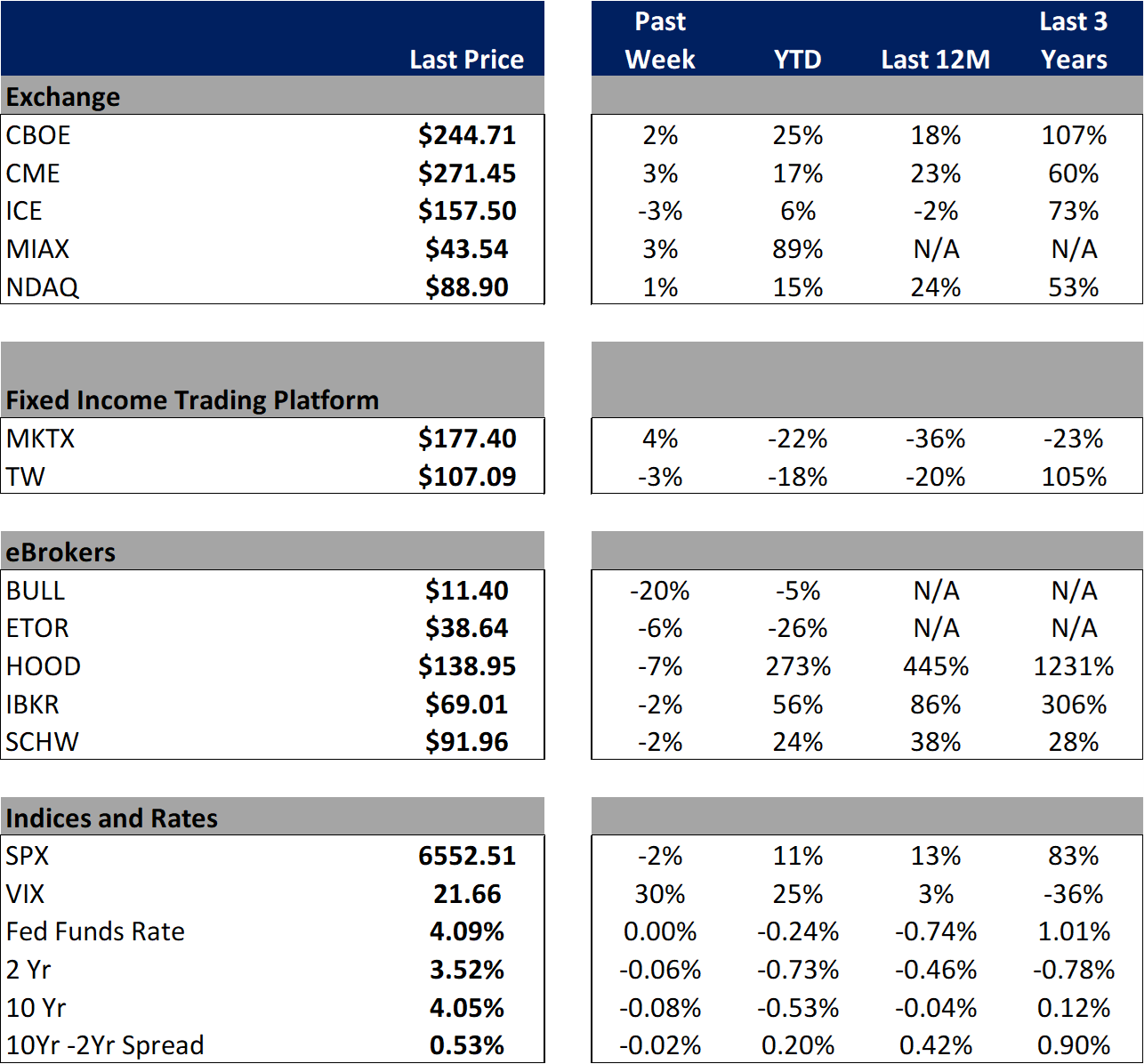

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week down 2% W/W driven by a steep selloff on Friday after President Trump threatened additional tariffs on China Friday morning. Yields were lower on the week and the curve flattened slightly and the VIX was up 30% on the week.

In terms of the companies I follow, BULL showed the weakest performance in the group, falling 20% on no meaningful news. The remainder of the eBrokers were all lower as well with HOOD falling 7%,ETOR declining 6% while IBKR was down2% and SCHW was down 2% on the week. In fixed income land, MKTX rose4% while TW fell 3%. Within the exchanges, MIAX rose 3% after reporting monthly metrics for September. Meanwhile, NDAQ was up 1%, CME rose3%, CBOE rose 2% and ICE was down 3% on the week.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

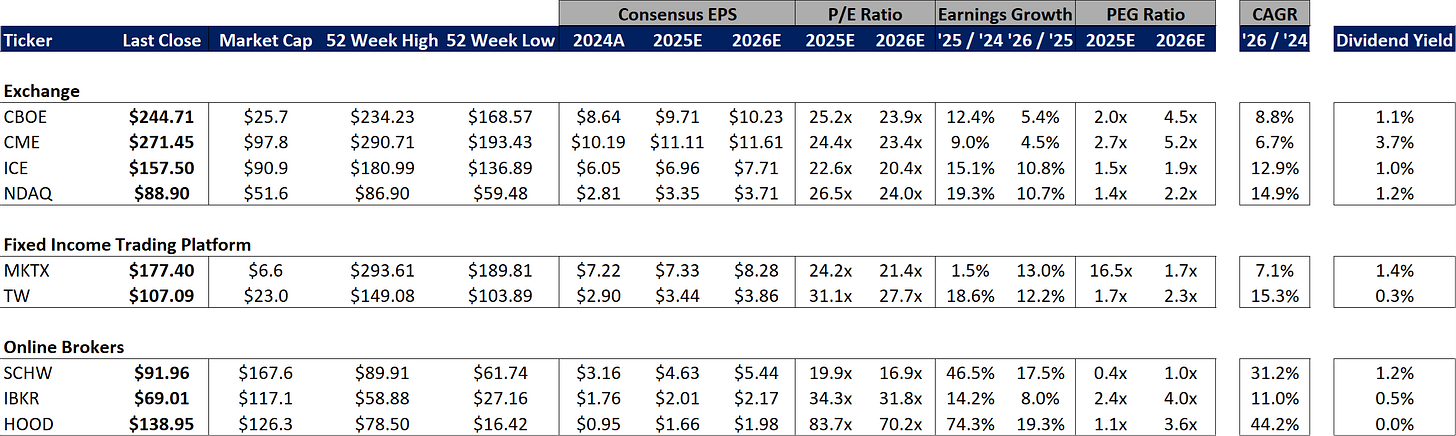

Comp Sheet

Source: Yahoo Finance

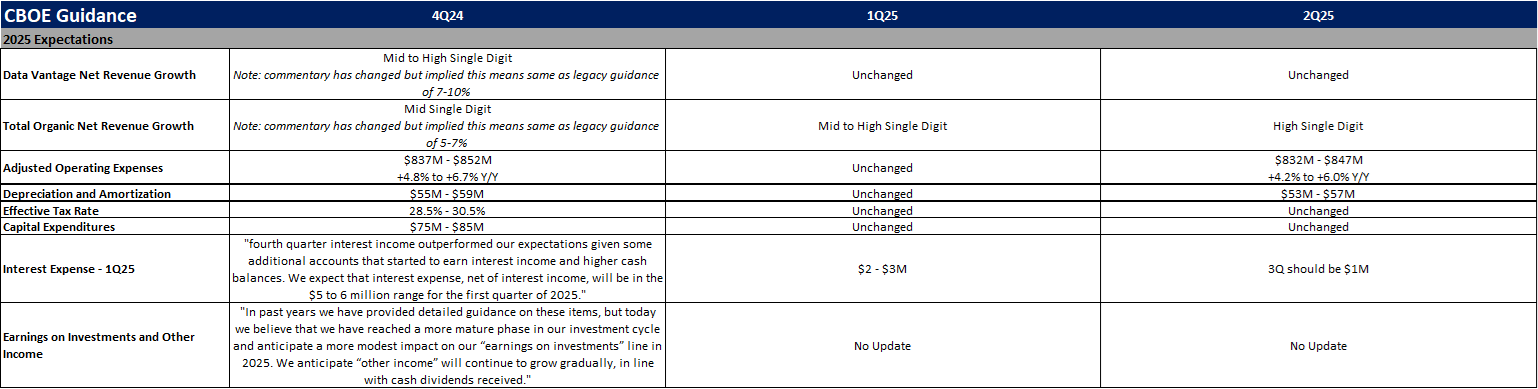

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

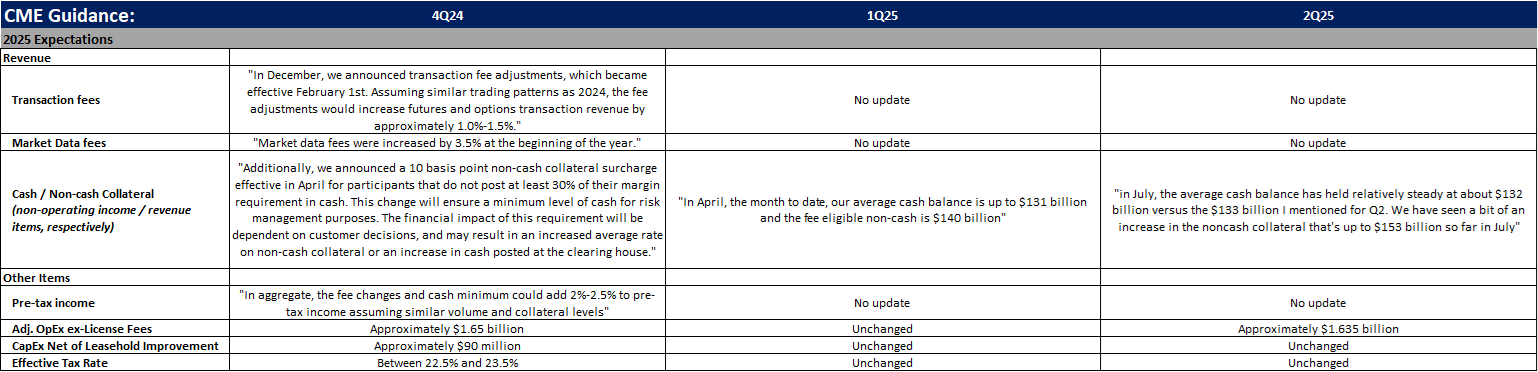

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

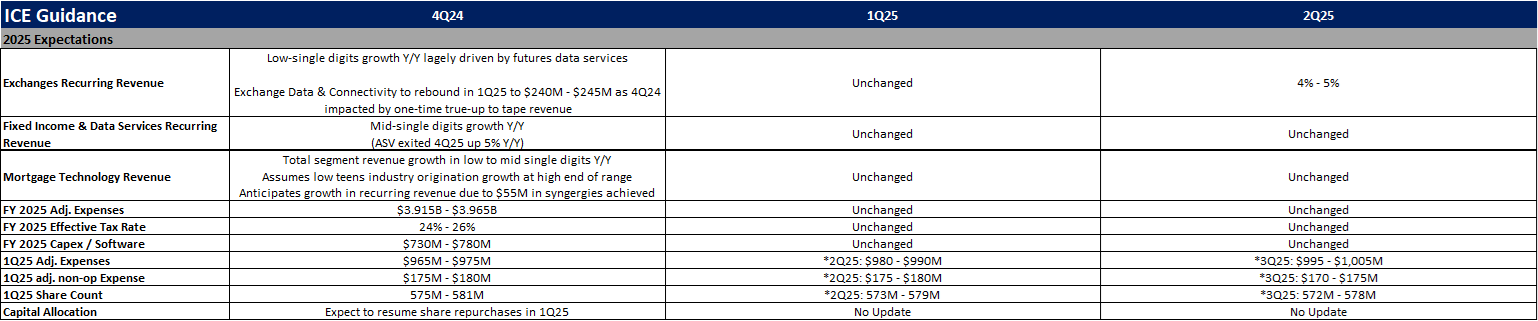

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

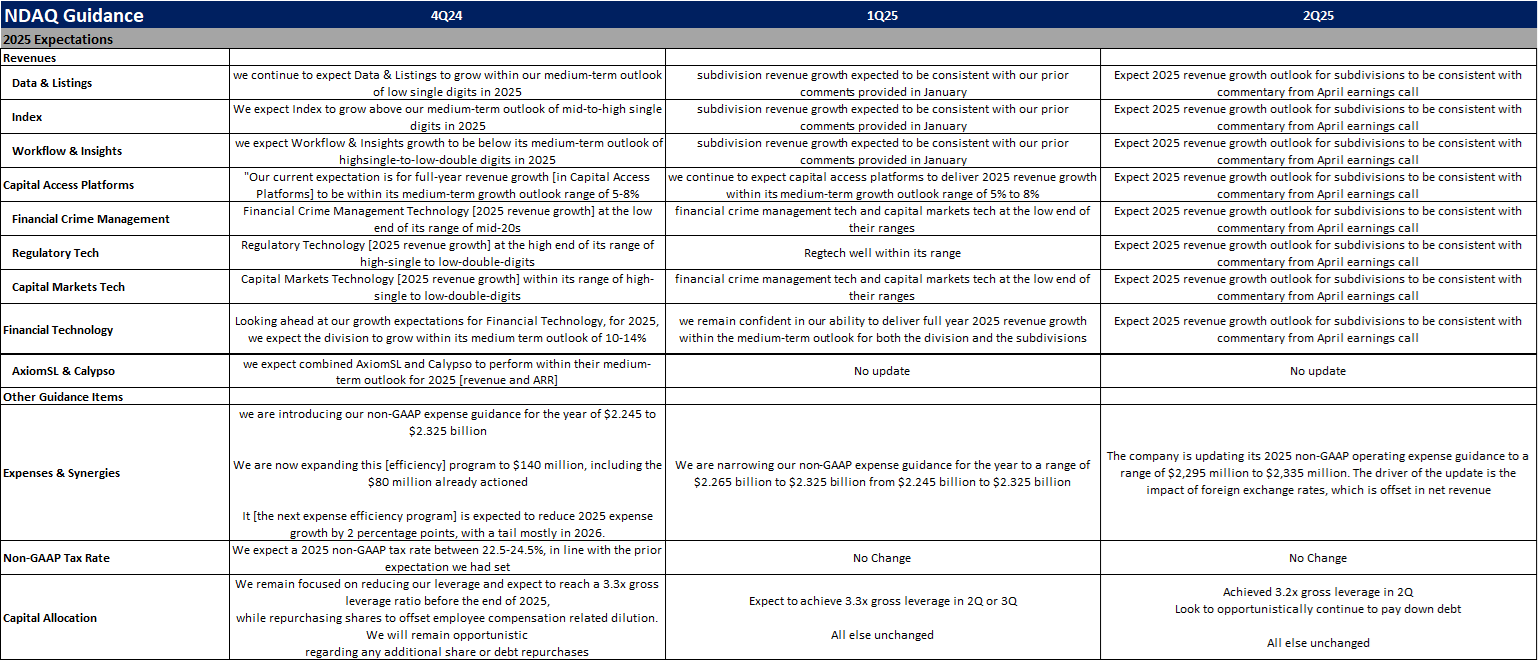

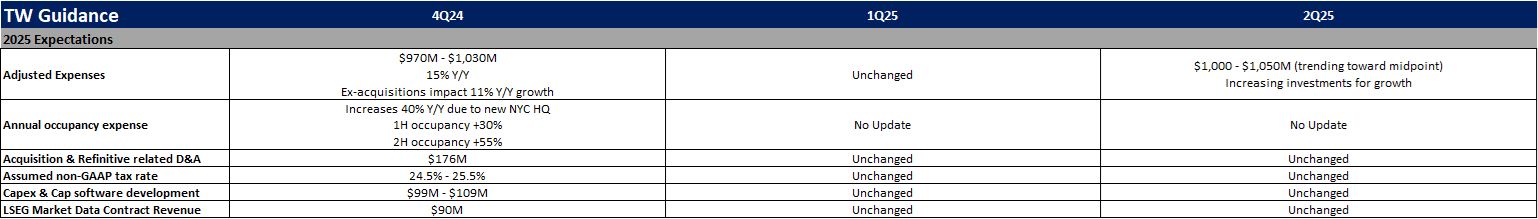

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

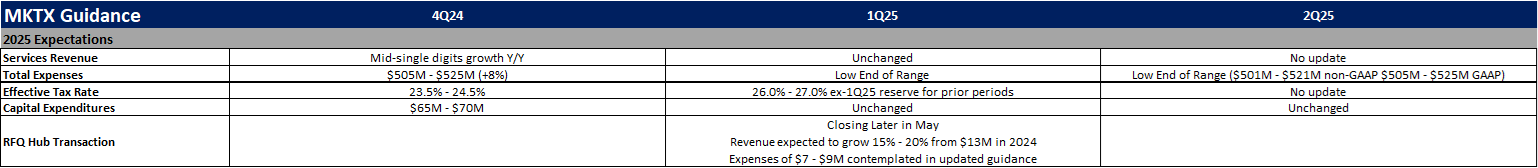

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

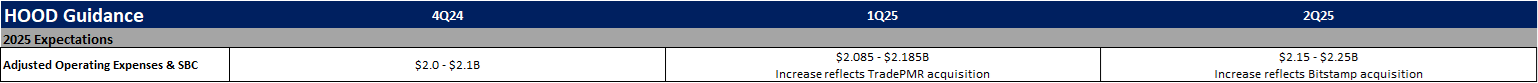

Online Brokers

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

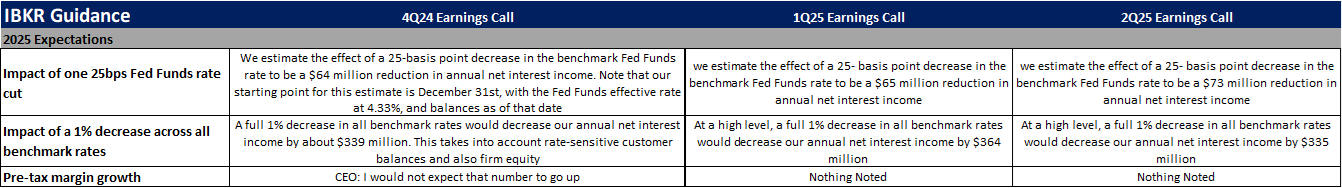

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

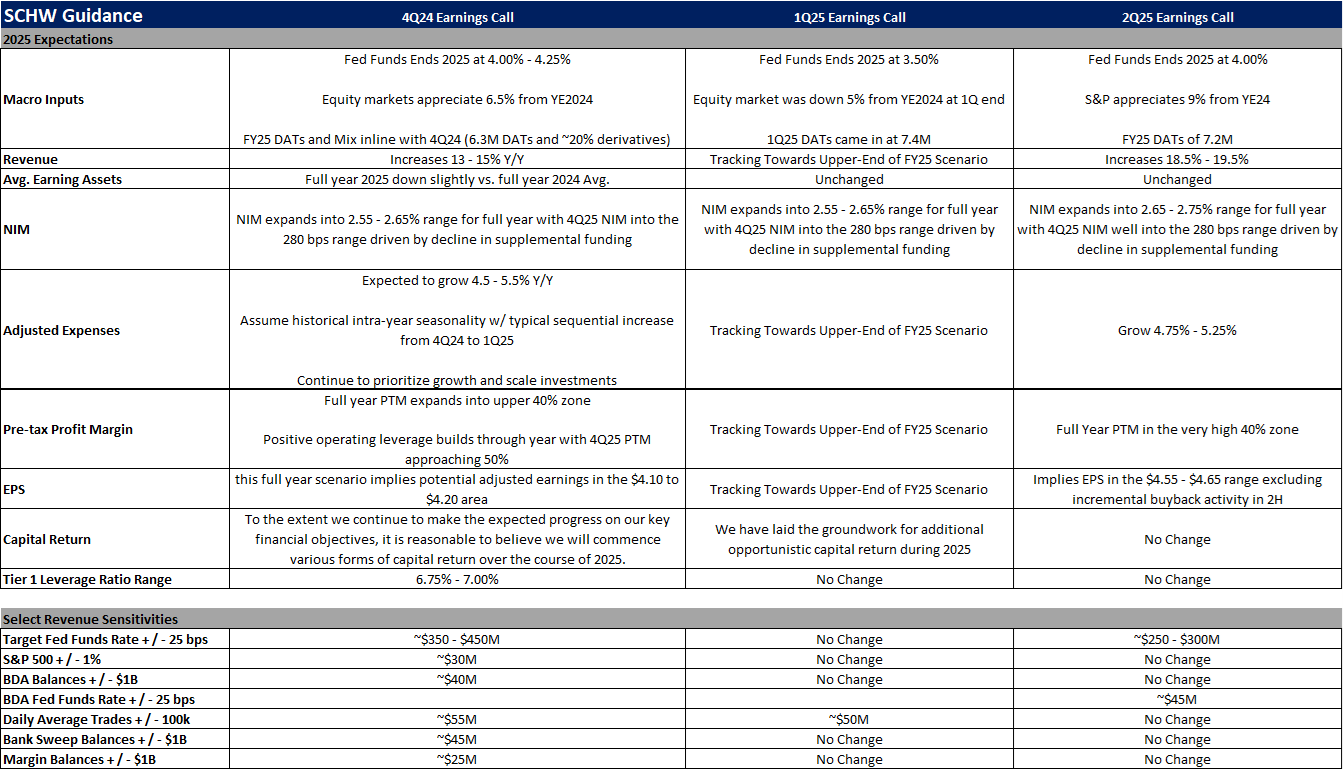

The Charles Schwab Corporation (SCHW)

The Ares retail strategy commentary is particularly interesting. 185 employees focused on retail product development shows serious commitment to the channel. The point about 401(k) regulations being cost-focused rather than return-focused is spot on - that regulatory shift would be transformtive for alt AUM growth. Their early mover advantage in retail alts distribution could be meaningful as more wealth managers get comfortable with the asset class.