Weekly Recap for Week Ended October 3, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Oct. 3, 2025

Pieces I’ve put out in the past week:

September Exchange Volume Recap

Other notable news:

Wealthfront Files S-1

Hedge funds and HFT Converging

Power Struggle Upends US Crypto Watchdog

Bullish (BLSH) announces launch of spot trading in the U.S.

Private Market Blowups Highlight Perils for Retail Investors

Global currency markets hit $10T a day in trading volume

US IPOs Face SEC Approval Deadline Ahead of Government Shutdown

London Drops Out of Top 20 IPO Markets After Falling Behind Mexico

TXSE Receives From 1 Approval from SEC

HOOD Explores Launching Prediction Markets Outside US

Nonbanks Struggle to Gain FX Trading Market Share

Deutsche Borse and Circle to Integrate Stablecoins into European Market Infrastructure

Integral Launches Stablecoin-Based Crypto Prime Broker

SEC Weighs Plan to Allow Blockchain-Based Stock Trading

SEC, CFTC Pledge Closer Cooperation and Harmonization on Crypto Market Oversight

SEC Willing to Engage with Tokenized Asset Issuers

IG Wins FCA Approval for Crypto License and Expands UK Offering

Bullish to launch crypto options trading

Robinhood CEO believes tokenization framework will be in most major markets by 2030

Prediction markets volume more than doubles to $4.3B in September

Canton Network surpassed 500k daily transactions

Polymarket to relaunch in US within days

Circle expands $635M tokenized Treasury fund to Solana

Stablecoins could cut reliance on bank lending

BBVA and SGX Crypto Offering

Mantle launches tokenization platform

Company Specific Updates for Week Ended Oct. 3, 2025

Exchanges

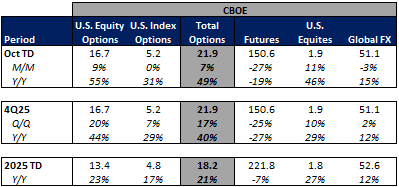

Cboe Global Markets, Inc. (CBOE)

Announces Derivatives and Data Vantage Leadership Appointments

Rob Hocking is succeeding Cathy Clay who is leaving for a new opportunity

Hocking rejoins CBOE as ECP, Global Head of Derivatives

Hocking previously held roles at CBOE, DRW, Goldman Sachs and Hull Trading

Brian McElligott is joining as SVP, Global Head of Cboe Data Vantage

McElligott previously held roles at CME, Tradeweb and Morningstar

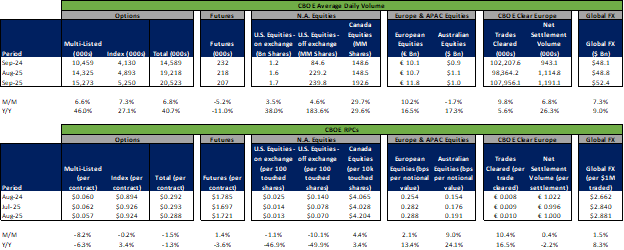

Reports September Volume & August RPCs

Volumes largely known ahead of release (as noted here)

RPCs were mixed M/M, options, U.S. equities lower and all other higher

Based on these results & RPC guide for 3Q expecting net transaction fees of $445M (+4% Q/Q, +14% Y/Y)

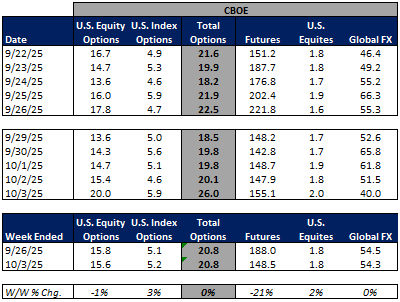

CBOE Monthly Volume & RPCs

Source: company documents

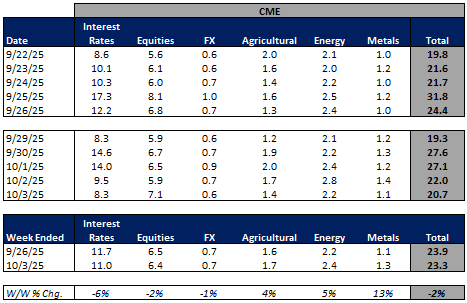

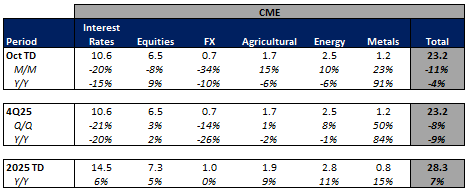

CME Group Inc. (CME)

Files to Expand FICC Cross-Margining to End User Clients

Together with DTCC, CME filed to expand cross margining to end user clients by December 2025

Plans to Offer 24 Hour Trading in Crypto Futures and Options

Crypto futures and options trading planned to be available 24 hours a day seven days a week beginning in early 2026

Holiday and weekend trading will have a trade date of the following business day with clearing, settlement and regulatory reporting occurring the following business day

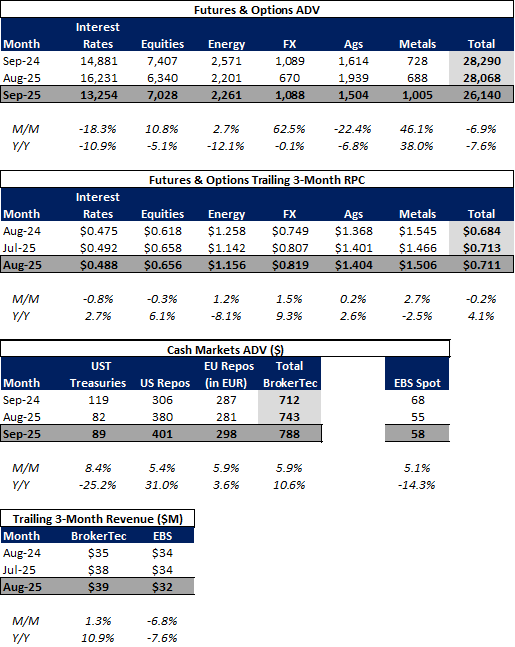

Reports September volume and August RPC

Volume details largely known and recapped in my monthly piece here

RPCs largely flat M/M in Aug

Based on these results anticipating 3Q transaction based revenue of $1.2B (-12% Q/Q, -6% Y/Y)

CME September Metrics Detail

Source: company documents

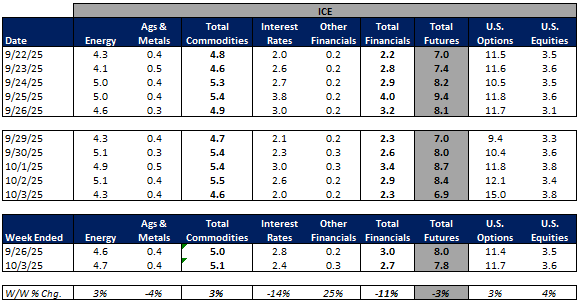

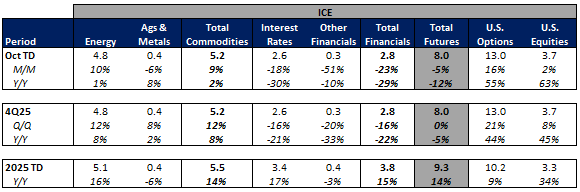

Intercontinental Exchange, Inc. (ICE)

Total Futures Markets at Record Open Interest

OI Reached a record 56.8M on September 25 with record commodities OI of 43M and energy OI of 41M

Transitions AMERIBOR to ICE Data Indices

Follows ICEs acquisition of AFX earlier this year which was the prior administrator of AMERIBOR

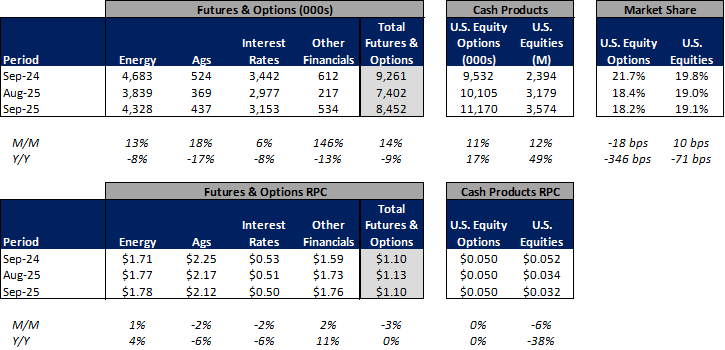

Reports September volumes and RPCs

Volumes were known ahead of the release (my exchange volume recap for the month is available here)

Futures RPC -3% M/M, flat Y/Y

Options RPC flat M/M & Y/Y

Equities RPC -6% M/M, -38% Y/Y

Based on these results I expect Exchange Segment Transaction-Based revenues for 3Q25 of $890M (-14% Q/Q, unchanged Y/Y)

ICE September Volume and RPC

Source: company documents

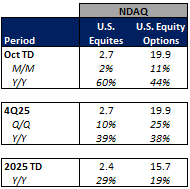

Nasdaq, Inc. (NDAQ)

Announces 3Q25 Earnings Call

Tuesday, October 21 pre-market

Conference call 8:30am ET

Fixed Income Trading Platforms

None to Note

Online Brokers

eToro Group Ltd. (ETOR)

Retail Investors Flock to AI Tools

Percent of retail investors using AI tools rose by 46% in one year

19% of retail investors now use AI tools to pick or alter portfolios

Robinhood Markets, Inc. (HOOD)

Announces 3Q25 Earnings Release Date

Wednesday, November 5 post-close

Conference call 5:00pm ET

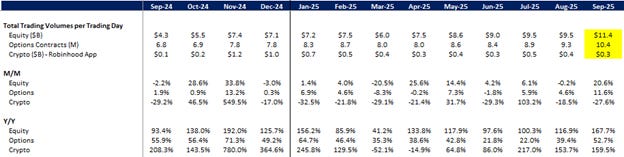

Announces September MTD Trading Metrics

Trading volumes per trading day appear to continue to be strong with equities up 21% M/M, Options up 12% M/M and only crypto down 28% M/M (though up 160% Y/Y)

HOOD Trading Volume Per Trading Day

Source: company documents

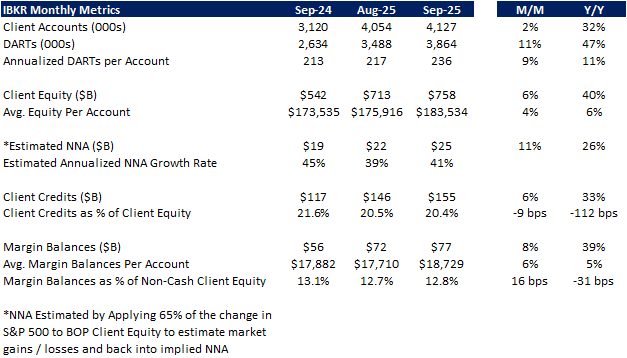

Interactive Brokers Group, Inc. (IBKR)

Reports September Metrics

Client accts. +34% Y/Y ex. introducing broker withdrawal

DARTs +11% M/M

Est. NNA 41% annualized growth rate

Margin balances +8% M/M

IBKR Monthly Metrics

Source: company documents

Company Specific Updates Anticipated for the Upcoming Week (Ended Oct. 10, 2025)

Exchanges

Nasdaq, Inc. (NDAQ)

September Metrics Release

Tuesday, October 7 post-close

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

September Metrics Release

Monday, October 6 pre-market

Tradeweb Markets Inc. (TW)

September Metrics Release

Monday, October 6 pre-market

Online Brokers

None to Note

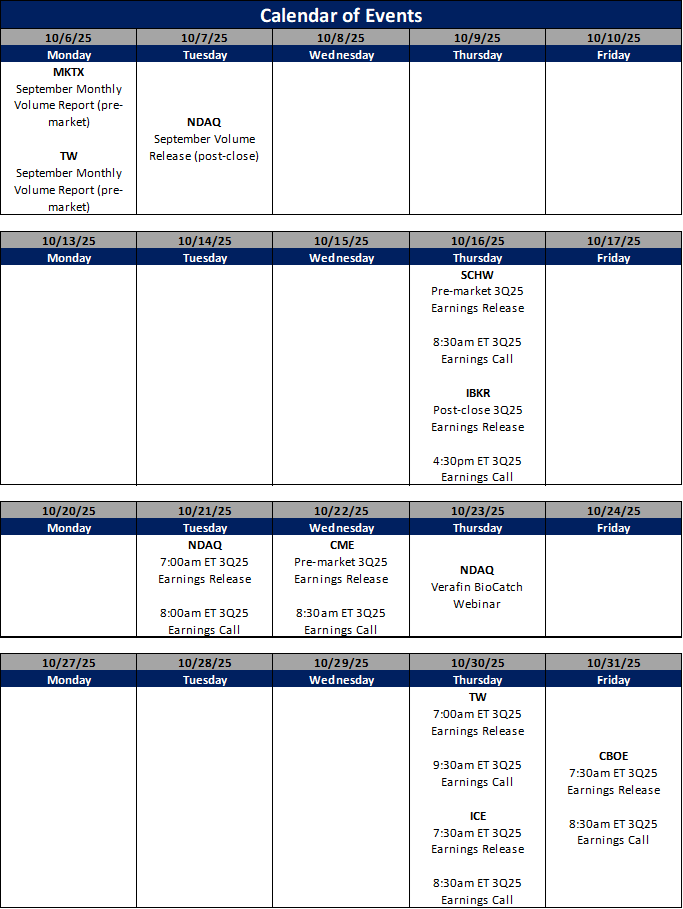

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Oct. 3, 2025

Pending Home Sales (Aug.) – 4.0% vs. consensus 0.0% and prior (0.3%)

S&P Case Shiller Home Price Index (Jul.) – 1.8% vs. consensus 1.9% and prior 2.2%

Chicago Business Barometer (Sep.) – 40.6 vs. consensus 43.8 and prior 41.5

Job Openings (Aug.) – 7.2M vs. consensus 7.1M and prior 7.2M

Consumer Confidence (Sep.) – 94.2 vs. consensus 96.0 and prior 97.4

ADP Employment (Sep.) – (32k) vs. consensus 45k and prior (3k)

Construction Spending (Aug.) – DELAYED consensus (0.2%) and prior (0.1%)

S&P Final U.S. Manufacturing PMI (Sep.) – 52.0 vs. consensus 52.0 and prior 52.0

ISM Manufacturing (Sep.) – 49.1% vs. consensus 49.0% and prior 48.7%

Auto Sales (Sep.) – 16.4M vs. prior 16.1M

Initial Jobless Claims (week ended Sep. 27) – DELAYED consensus 222k and prior 218k

Factory Orders (Aug.) – DELAYED consensus 1.4% and prior (1.3%)

U.S. Employment Report (Sep.) – DELAYED consensus 45k and prior 22K

U.S. Unemployment Rate (Sep.) – DELAYED consensus 4.3% and prior 4.3%

U.S. Hourly Wages (Sep.) – DELAYED consensus 0.3% and prior 0.3%

Hourly Wages Y/Y (Sep.) – DELAYED consensus 3.6% and prior 3.7%

S&P Final U.S. Services PMI (Sep.) – 54.2 vs. consensus 54.0 and prior 54.5

ISM Services (Sep.) – 50.0% vs. consensus 52.0% and prior 52.0%

Major Macro Updates Scheduled for the Upcoming Week (Ended Oct. 10, 2025)

Monday, Oct. 6

None to Note

Tuesday, Oct. 7

U.S. Trade Deficit (Aug.) – consensus ($60.7B) and prior ($78.3B)

Consumer Credit (Aug.) – consensus $14.0B and prior $16.0B

Wednesday, Oct. 8

FOMC September Meeting Minutes Released

Thursday, Oct. 9

Initial Jobless Claims (week ended Oct. 4) – consensus N/A and prior DELAYED

Wholesale Inventories (Aug.) – prior 0.1%

Friday, Oct. 10

Preliminary Consumer Sentiment (Oct.) – consensus 53.5 prior 60.4

Monthly U.S. Federal Budget (Sep.) – prior ($170.7B)

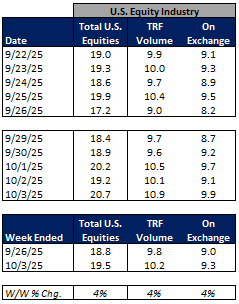

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

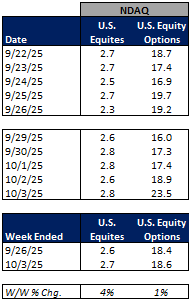

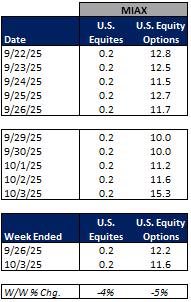

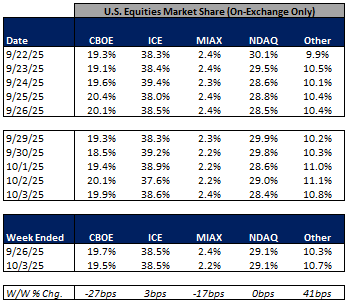

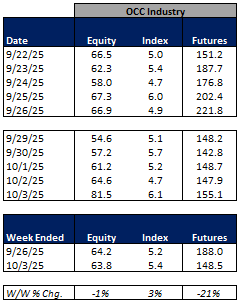

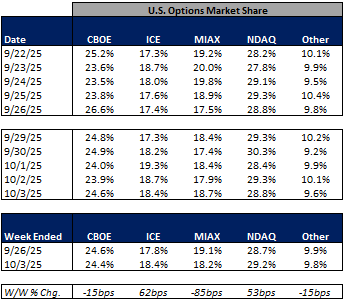

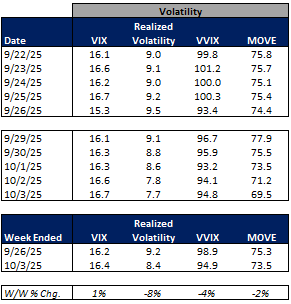

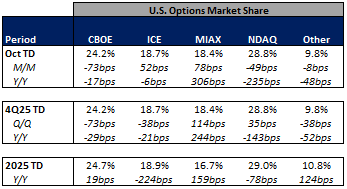

For the week ended October 3, 2025, volumes were mixed as volatility was mostly lower W/W.

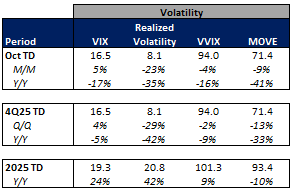

The average VIX for the week was up 1% from the prior week, average realized volatility was down 8% W/W, average volatility of volatility (as measured by the VVIX) was down 4% W/W and the average MOVE index (U.S. Treasuries volatility) was down 2% W/W.

Futures average daily volumes (ADV) were lower as CBOE futures volumes were down 21% W/W, CME futures volumes were down 2% W/W, and ICE futures volumes were down 3% W/W.

Total U.S. Equities ADV was up 4% W/W, as TRF volumes rose 4% W/W and on-exchange volumes were up 4% W/W. Industry equity options volumes were down 1% W/W while index options volumes rose 3% W/W.

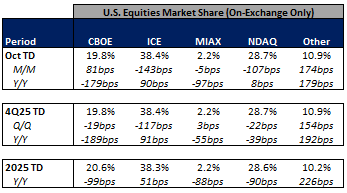

In terms of market share trends for the past week, ICE and other exchanges picked up share in U.S. equities on-exchange trading while MIAX and CBOE gave up some share and NDAQ was unchanged on the week. Within U.S. equity options, ICE and NDAQ picked up share while MIAX, CBOE, and other exchanges ceded share in the week.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

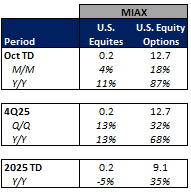

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

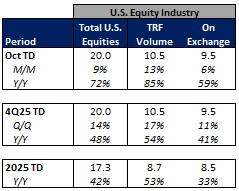

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

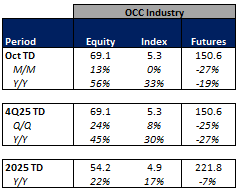

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

For the month to date, exchange volumes are trending mixed M/M and Y/Y. This comes as volatility is mainly lower M/M and on a Y/Y basis.

The average VIX in October is down 17% Y/Y while realized volatility is down 35% Y/Y and volatility of volatility is down 16% Y/Y. Treasuries volatility is also lower Y/Y as the average MOVE index in October is down 41% Y/Y.

Futures volumes are lower Y/Y as ICE futures ADV is down 12% vs. October 2024 ADV. Meanwhile, CME ADV is down 4% Y/Y while CBOE futures ADV is down 19% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 72% MTD while option volumes are up 56% for equity options and up 33% for index options.

In terms of market share trends for the month-to-date, CBOE and Other exchanges have picked up share in U.S. equities on-exchange trading relative to last month’s levels while NDAQ, MIAX, and ICE have given up some share. Within U.S. equity options, MIAX and ICE have picked up share vs. last month while CBOE, NDAQ and Other exchanges have ceded share.

For further details on MTD, QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

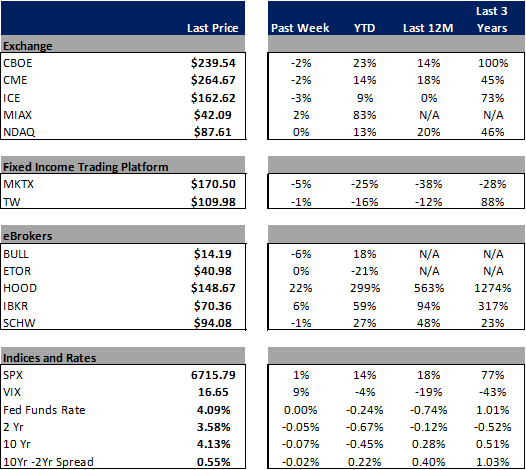

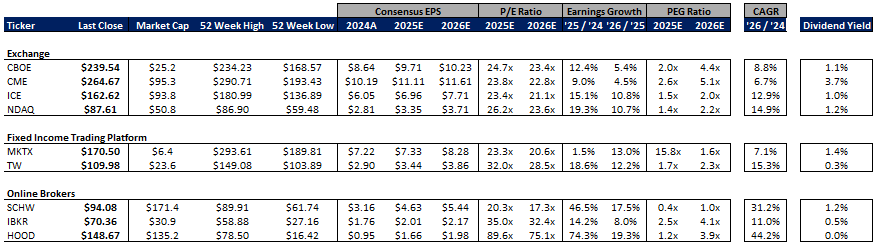

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week up 1% W/W. Yields were lower on the week while the curve flattened slightly and the VIX was up 9% on the week.

In terms of the companies I follow, HOOD showed the strongest performance in the group, rising 22% on no meaningful news. The remainder of the eBrokers were mixed with BULL falling 6% and SCHW declining 1% while IBKR was up 6% and ETOR was unchanged on the week. In fixed income land, MKTX fell5% while TW fell 1%. Within the exchanges, MIAX rose 2% on no meaningful news. Meanwhile, NDAQ was unchanged, CME fell 2%, CBOE fell 2% and ICE was down 3% on the week.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: Yahoo Finance

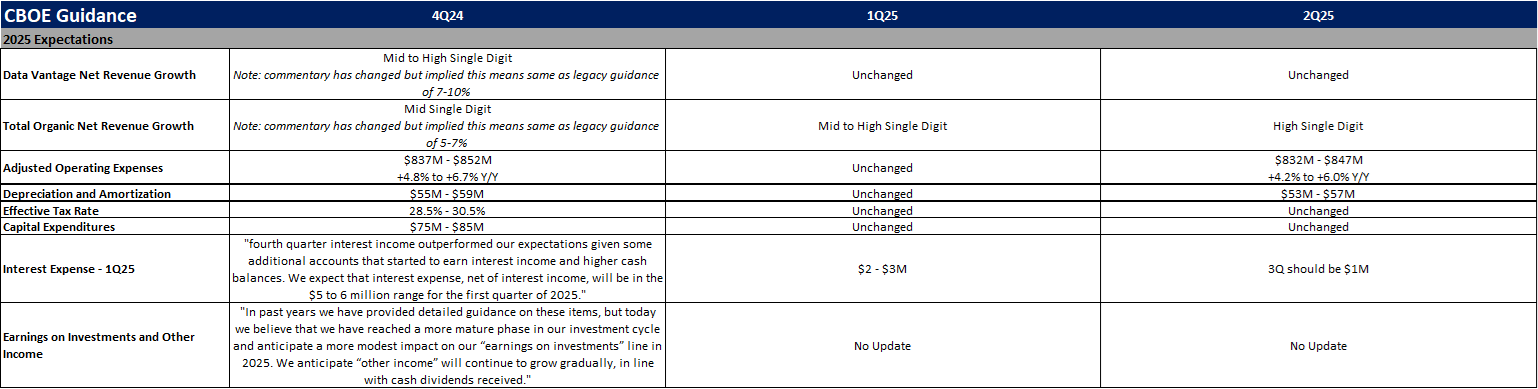

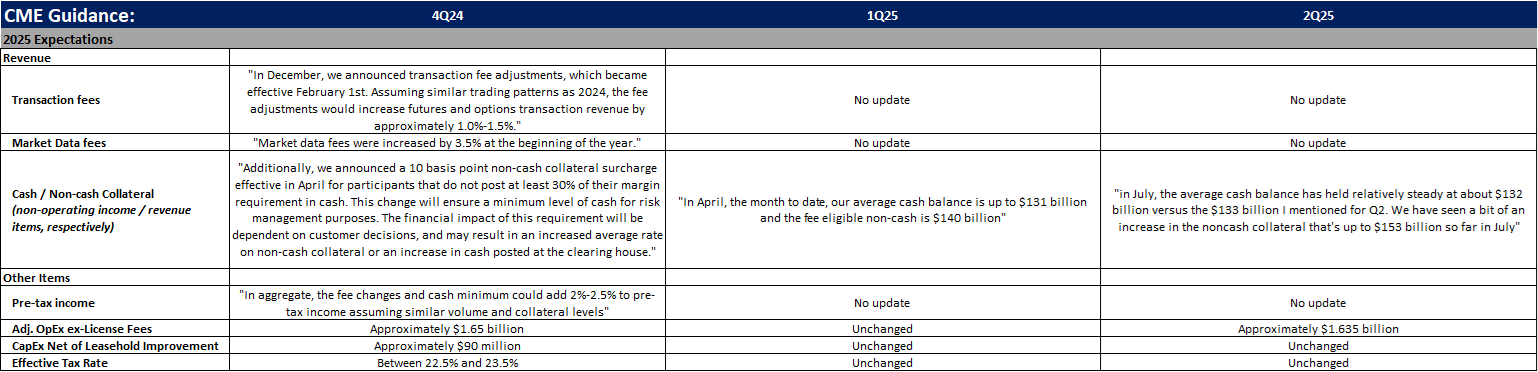

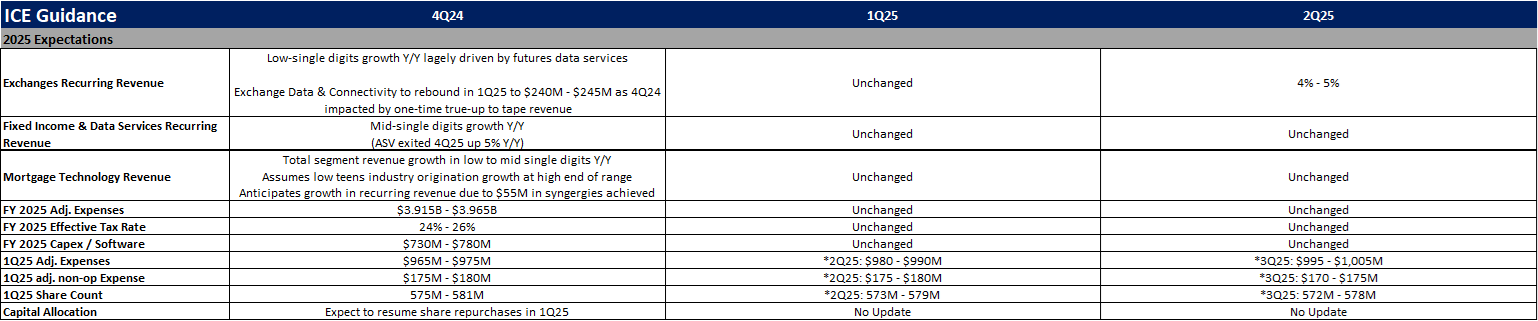

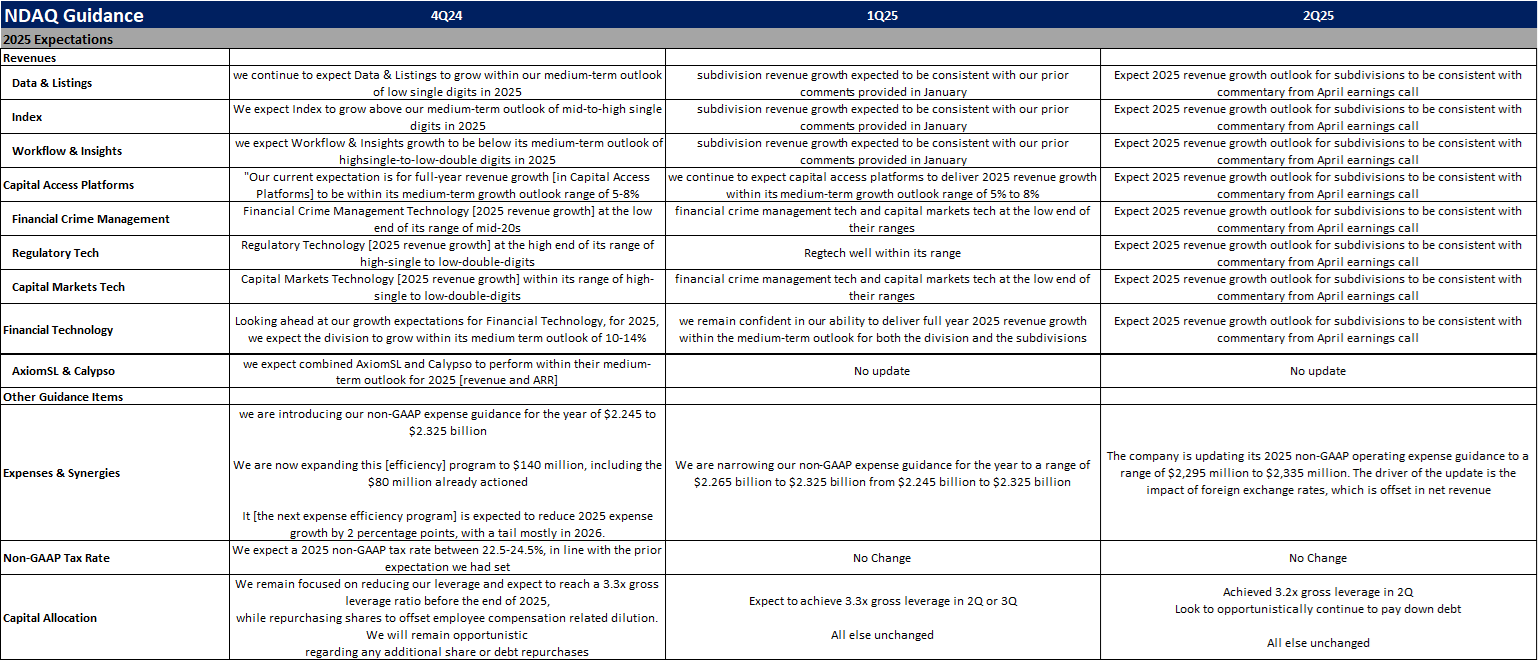

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

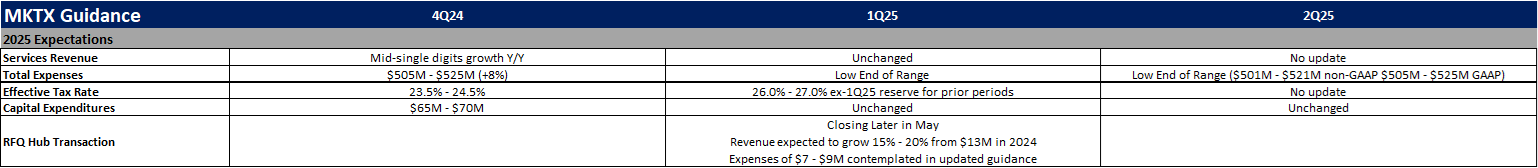

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

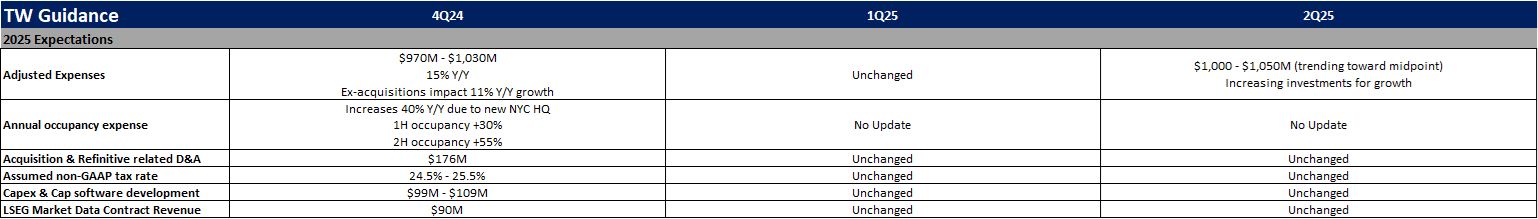

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

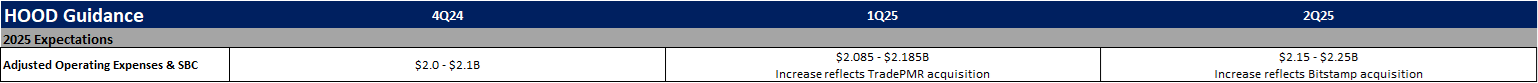

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

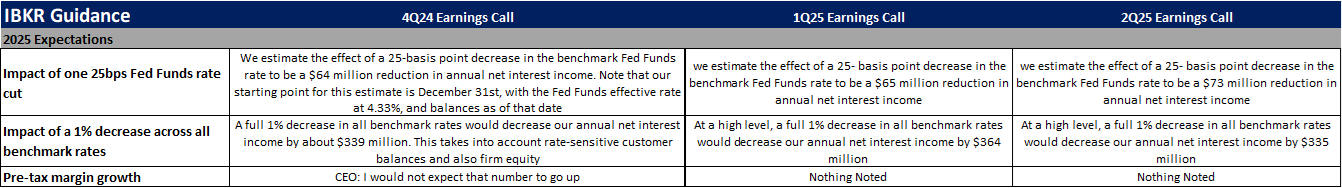

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

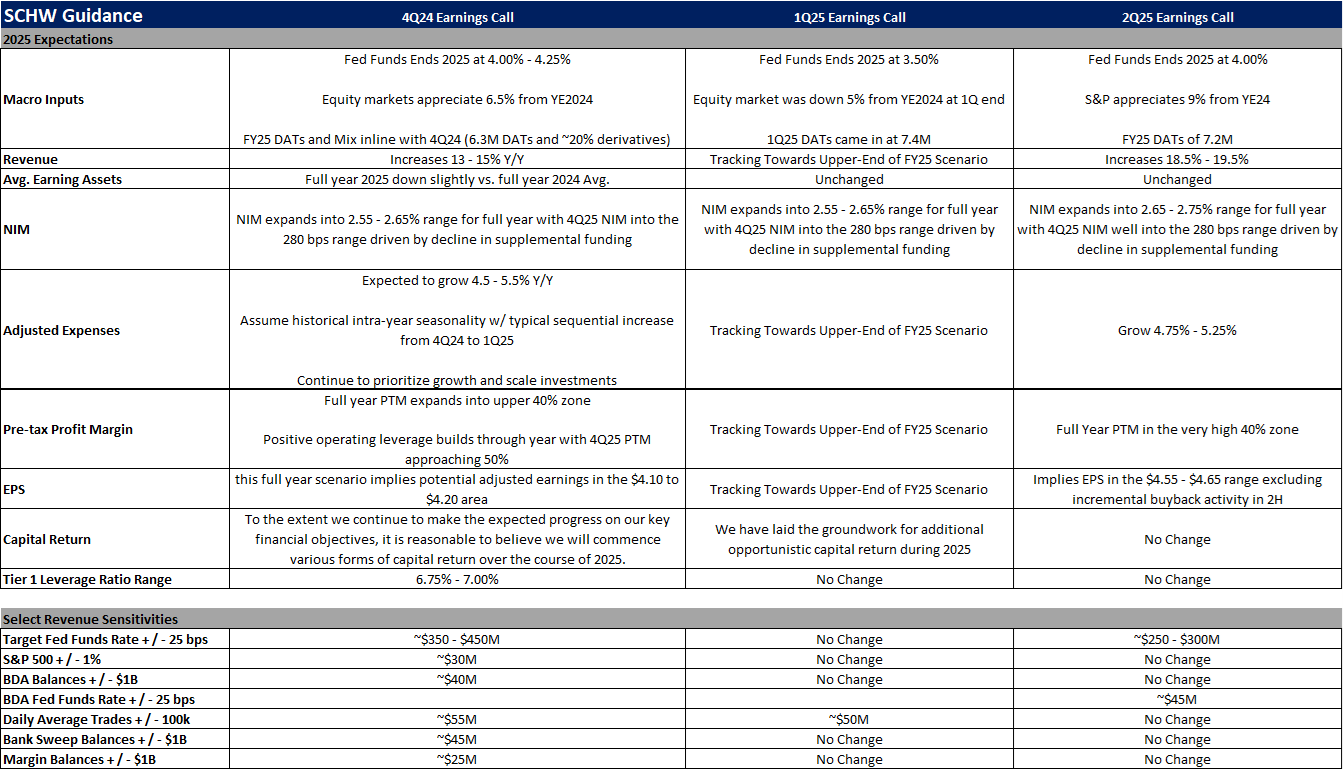

The Charles Schwab Corporation (SCHW)

Excellent comprehensive recap as always! The NDAQ market share data you've compiled is particularly useful for tracking competitive dynamics. Interesting to see NDAQ holding steady in U.S. equities on-exchange trading W/W while picking up share in equity options - that options market share gain is meaningful given the high revenue capture in that segement. Looking ahead, I'm curious how their September metrics (releasing Oct 7) will reflect the volatility decline you mentioned (VIX down 17% Y/Y). Their index and data businesses tend to be less volume-sensitive than pure transaction revenue, which has been a strategic strength. The 3Q earnings call on Oct 21 should provide good color on whether they're maintaining that 7-8% organic growth target in the current environment.