Weekly Recap for Week Ended November 14, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Nov. 14, 2025

Hey all, I apologize this piece is coming out a bit later than typical. Last week was a busy one on the work front for me so I’ve been playing a bit of catch up with my non-work related hobbies.

Pieces I’ve put out in the past week:

eToro Group Ltd. (ETOR) 3Q25 Earnings Review

Online Brokers (HOOD, IBKR, SCHW) - October Metrics Review

Other notable news:

Prediction Markets

PrizePicks partners with Polymarket

PrizePicks is a leading fantasy sports operator in the U.S.

PrizePicks will integrate Polymarket’s event contracts into the PrizePicks app

Polymarket Becomes Yahoo Finance’s Exclusive Crypto Prediction Market Provider

The partnership will provide real time insights based on Polymarket bets to Yahoo Finance users

Cboe to Launch Prediction Markets Within Months But Avoid Sports

CBOE is planning to launch its offering through its own organic efforts which it hopes to come to fruition in the next several months

TKO, Polymarket strike multiyear deal to integrate prediction markets into UFC events

The deal makes UFC and Zuffa Boxing the first sports organizations to incorporate prediction market technology into live events

Polymarket will provide real-time data visualizations of fan sentiment and momentum during fights

Crypto

Japan Cracks Down on Crypto Treasury Stocks

Japan Exchange Group is considering stricter regulations on merger regulations and enforcing mandatory audits for digital asset treasury (DAT) firms

The possible regulatory overhaul comes as a number of DAT companies’ shares have plunged in value from the highs reached over the summer

Fireblocks in Talks to Raise Funds for Buyback of Staff Shares

Crypto infrastructure firm Fireblocks is in talks to raise funding, the proceeds of which will be used to run a tender for the repurchase of shares

Fireblocks counts Bank of New York Mellon, Revolut and WorldPay amongst its client base

Crypto Asset Manager Grayscale Shows Revenue Drop in IPO Filing

Grayscale filed publicly for an IPO this past week

Filing shows revenue for the nine months ended September 30 came in at $318.7M, down from $397.9M the prior year period

Grayscale has about $35B in AUM and 40+ products providing exposure to over 45 different tokens

Lighter Raises $68M at $1.5B Valuation to Take on Decentralized Derivatives Rivals

Funding will support new derivatives across multiple chains, deeper liquidity and monetization tools for institutions

Lighter has recorded 30-day perpetual trading volume of $279.5B with open interest around $1.7B

Hedge Funds Ramp Up Crypto Use After Trump’s Regulatory Push

The percentage of traditional hedge funds holding crypto this year rose to 55% from 47% in 2024

47% of institutional investors said they were encouraged to increase crypto allocations due to the current regulatory climate

Ledger Eyes New York IPO or Fund Raise

Crypto hardware wallet company Ledger is planning to go public in NY

Planned listing follows record revenues in the triple digit millions this year

Ledger manages clients’ bitcoin worth approximately $100B

At its last funding round in 2023, Ledger was valued at $1.5B

Ripple rejects IPO plans despite SEC case victory

Ripple President, Monica Long, has said the company is very well capitalized and can fund organic growth, inorganic growth, and strategic partnerships and has no plans or timeline for an IPO

Acting CFTC chair confirms push to launch leveraged spot crypto trading on regulated exchanges

According to acting CFTC chair, Caroline Pham, the products could launch on DCMs as soon as next month

Coinbase Abandons $2 Billion Acquisition of Stablecoin Firm BVNK

SoFi Rolls Out Crypto Trading With Bitcoin, Ethereum, Solana and More

SoFi users will be able to buy crypto assets using funds from their checking or savings accounts

The launch marks the firm’s reentry into the crypto space after it previously ended crypto services in 2023

Tokenization

Global securities watchdog says ‘tokenization’ creates new risks

IOSCO has publish report a report suggesting tokenization could leave investors uncertain about whether they own the underlying asset or just the crypto token the issuer creates

Additionally, the report suggests tokenization could potentially suffer from spill-over effects from inter-linkages with the crypto asset markets

XStocks hits $10B in volume 4 months after launch as tokenized stocks gain traction

Traditional Markets

Nasdaq Is ‘Staffing Up’ Ahead of ETF Share-Class Listing Deluge

After the SEC indicated it would allow Dimensional Fund Advisors to create ETF share classes of a mutual fund roughly 80 competitors are waiting for similar fund structure approval

NDAQ is looking to add staff in its exchange traded product group, legal and compliance to ensure enough support for the issuers’ launches

Macquarie CEO Counts on Volatility to Return After Profit Hit

The CEO of Macquarie has suggested volatility in commodities markets should return based on history noting that volatility does not tend to stay subdued across all commodities for multiple years in a row

Companies still need IPOs

Despite the push to open private markets up to retirement plans and retail investors, IPOs remain an important destination for companies seeking long-term capital, brand visibility and investor diversification

Shutdown Endgame Revives US IPO Prospects as Year End Looms

At least half a dozen companies have publicly filed for IPOs and could see listings completed ahead of the November 27 Thanksgiving holiday in the U.S. now that the U.S. government has reopened

Retail Trading

‘Squid Game market’: how Asian retail traders are driving US meme stocks

South Korean traders have piled into U.S. markets this year with holdings doubling to a record $170B at the end of October

Many have been drawn into the market through the resurgence in meme stocks this year

Other

Pitchbook Makes Startup Data Available via ChatGPT

Through the integration, Pitchbook subscribers will be able to ask questions to Pitchbook’s AI assistant and get facts and figures on deals and market trends in the private company spacer

The insights are generated using Pitchbook’s data and a combination of AI and human expertise

DealMaker Raises $20M to Advance Retail Capital-Raising Platform

Funding round comes from existing investor CIBC Innovation Banking and new investor Information Venture Partners

Dealmaker has helped companies raise over $2.3B in capital directly from individual investors

Morgan Stanley joins rivals in rolling out private company research

Morgan Stanley launched a dedicated private company research page on its website last week

This follows rivals J.P. Morgan and Citigroup who have similarly begun publishing research on prominent private companies

Millennials are piling into alternative assets

Data from Goldman Sachs Asset Management show that alternative products make up 20% of Millennials’ portfolios

US Treasurer strikes final pennies at Philadelphia Mint

On Wednesday, November 12, the U.S. Treasurer minted the final penny marking an end to 232 years of penny production in the U.S.

Rising production costs, changing consumer habits and technology have made the production untenable according to the Treasury

Suspending penny production is expected to save the U.S. mint $56M a year

Despite the halt to penny production, pennies will remain legal tender and there are an estimated 300B pennies in circulation today

Company Specific Updates for Week Ended Nov. 14, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE 0.00%↑)

BNY Becomes First Agent Lender to Use Cboe Clear Europe’s Securities Financing Transactions Service

CME Group Inc. (CME)

FanDuel and CME Group Unveil New Prediction Markets Platform to Launch in December

New service will launch through the new FanDuel Predicts app

Sports events contracts will be available in states where online sports betting is not yet legal

As sports betting becomes legal in additional states FanDuel will stop offering sports events contracts in those states

In addition to sports contracts, event contracts will be offered on benchmark financial contracts such as the S&P 500, Nasdaq-100, oil and gas, gold, crypto currencies and economic indicators

Intercontinental Exchange, Inc. (ICE 0.00%↑)

Mortgage Monitor: Number of Highly Qualified Refinance Candidates Reaches 3.5-Year High Amid Easing Mortgage Rates

Lower mortgage rates are expanding refinance eligibility particularly amongst recent vintage borrowers

ICE’s Global Natural Gas Markets at Record Liquidity

Nat gas futures hit record open interest of 25.3M on October 28

North America nat gas futures hit record OI of 21.2M on November 3

Bright MLS to Integrate ICE’s Paragon Connect into Its Technology Ecosystem

Bright MLS is the nation’s largest multiple listing service (MLS)

Paragon Connect is a mobile-first MLS platform that allows real estate professionals to research, collaborate and manage listings from anywhere

Miami International Holdings Inc. (MIAX)

Announces Expanded Roles for Shelly Brown and Joseph W. Ferraro

Mr. Brown was appointed CEO of MIAX Futures and Chief Strategy Officer of Miami International Holdings

Mr. Ferraro was appointed President of MIAX Products, LLC

Nasdaq, Inc. (NDAQ)

CFO to Present at a Number of Upcoming Conferences

J.P. Morgan Ultimate Services Investor Conference on Tuesday, November 18 at 2:00pm ET

RBC Capital Markets Global Technology, Internet, Media & Telecom Conference on Wednesday, November 19 at 10:40am ET

UBS Global Technology and AI Conference on Tuesday, December 2 at 12:55pm ET

Fixed Income Trading Platforms

None to Note

Online Brokers

Webull Corporation (BULL)

Announces Strategic Partnership with Meritz Financial Group to Broaden Access to Global Markets and Enter South Korea

Together the companies will allow South Korean investors to access the U.S. equity markets

The agreement marks BULL’s entry into the South Korean market

eToro Group Ltd. (ETOR 0.00%↑)

Files for ASR transaction

Will be accelerating the repurchase of $50M shares of stock under the company’s announced $150M repurchase authorization

Reports October Monthly Metrics

Metrics appear to start 4Q strong with trading volumes continuing to increase dramatically Y/Y

Reports Third Quarter 2025 Results

Reports EPS beat vs. street on stronger revenue

Full recap is available in my 3Q25 Earnings Review

Robinhood Markets, Inc. (HOOD 0.00%↑)

The Charles Schwab Corporation (SCHW 0.00%↑)

STAX Score Is Up for Fifth Consecutive Month in October

STAX increased to 48.12

The October reading ranks “moderate low” compared to historical averages

Celebrates More Than Ten Years of Employee Skills-Based Volunteerism

Reports October Monthly Metrics

Full recap available in my eBroker October Metrics Review

Company Specific Updates Anticipated for the Upcoming Week (Ended Nov. 21, 2025)

Exchanges

Intercontinental Exchange, Inc. (ICE)

CFO to Present at JPM Conference

Tuesday, November 18 at 11:40am ET

Nasdaq, Inc. (NDAQ)

CFO to Present at JPM Conference

Tuesday, November 18 at 2:00pm ET

CFO to Present at RBC Conference

Wednesday, November 19 at 10:40am ET

Fixed Income Trading Platforms

None to Note

Online Brokers

Webull Corporation (BULL)

3Q25 Earnings Release

Thursday, November 20 post-close

Conference Call 5:00pm ET

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Nov. 14, 2025

NFIB Optimism Index (Oct.) – 98.2 vs. consensus 98.2 and prior 98.8

Major Macro Updates Scheduled for the Upcoming Week (Ended Nov. 21, 2025)

Monday, Nov. 17

Empire State Manufacturing Survey (Nov.) – consensus 5.5 and prior 10.7

Tuesday, Nov. 18

Homebuilder Confidence Index (Nov.) – consensus 37 and prior 37

Business Inventories (Aug.) – consensus 0.1% and prior 0.2%

Wednesday, Nov. 19

Philadelphia Fed Manufacturing Survey (Nov.) – consensus 3.0 and prior (12.8)

U.S. Trade Deficit (Aug.) – consensus ($61.0B) and prior ($78.3B)

Thursday, Nov. 20

U.S. Employment Report (Sep.) – prior 22k

U.S. Unemployment Rate (Sep.) – prior 4.3%

U.S. Hourly Wages (Sep.) – prior 0.3%

Hourly Wages Y/Y (Sep.) – prior 3.7%

Initial Jobless Claims (week ended Nov. 15) – consensus 225k

Existing Home Sales (Oct.) – consensus 4.08M and prior 4.06M

Friday, Nov. 21

S&P Flash U.S. Services PMI (Nov.) – prior 54.8

S&P Flash U.S. Manufacturing PMI (Nov.) – prior 52.5

Final Consumer Sentiment (Nov.) – consensus 51.0 and prior 50.3

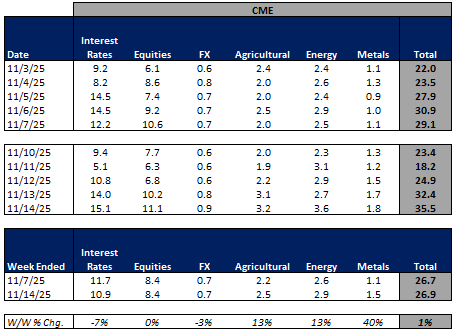

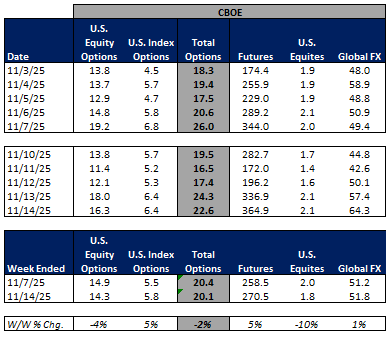

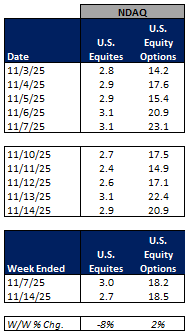

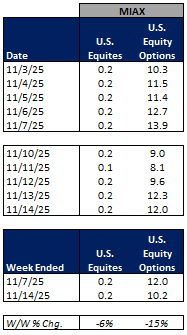

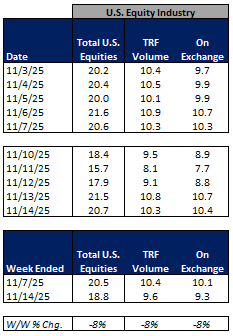

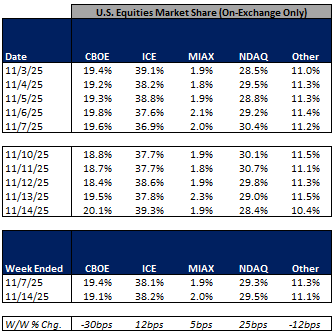

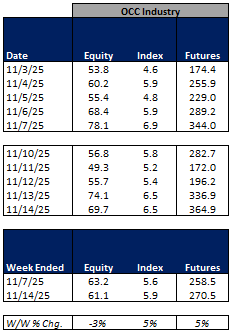

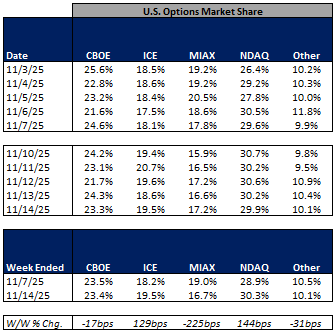

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

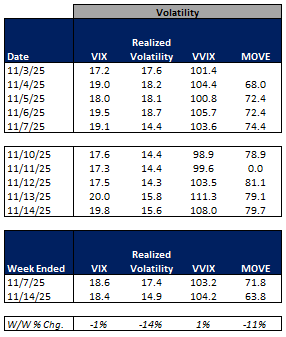

For the week ended November 14, 2025, volumes were mixed W/W while volatility was mainly lower W/W.

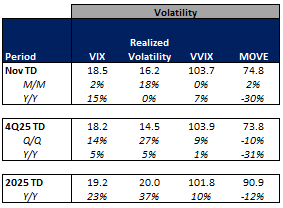

The average VIX for the week was down 1% from the prior week, average realized volatility was down 14% W/W, average volatility of volatility (as measured by the VVIX) was up 1% W/W and the average MOVE index (U.S. Treasuries volatility) was down 11% W/W.

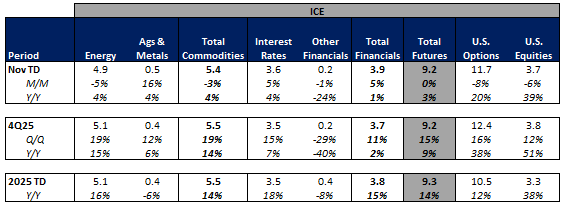

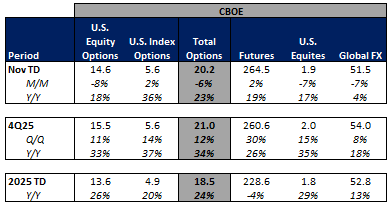

Futures average daily volumes (ADV) were higher as CBOE futures volumes were up 5% W/W, CME futures volumes were up 1% W/W, and ICE futures volumes were up 7% W/W.

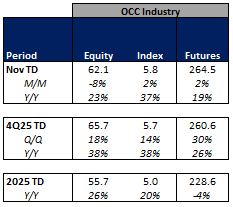

Total U.S. Equities ADV was down 8% W/W, as TRF volumes fell 8% W/W and on-exchange volumes were down 8% W/W. Industry equity options volumes were down 3% W/W while index options volumes rose 5% W/W.

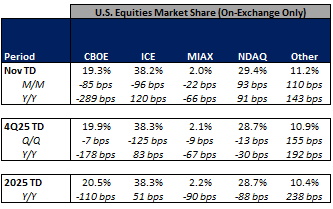

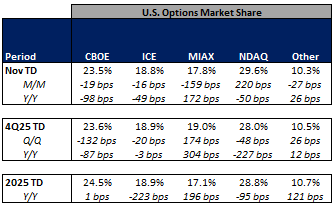

In terms of market share trends for the past week, NDAQ, MIAX and ICE picked up share in U.S. equities on-exchange trading while CBOE and other exchanges gave up some share on the week. Within U.S. equity options, NDAQ and ICE picked up share while CBOE, MIAX and other exchanges ceded share in the week.

For further details on weekly volume trends by exchange and by product line please see the charts below.

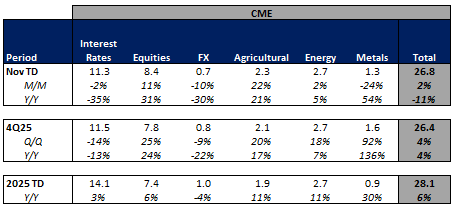

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

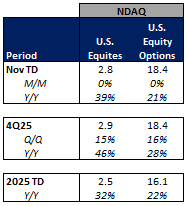

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

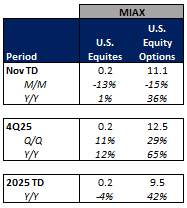

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

For the month to date, exchange volumes are trending mixed M/M but mainly higher Y/Y. This comes as volatility is mostly higher M/M and Y/Y.

The average VIX in November is up 15% Y/Y while realized volatility is unchanged Y/Y and volatility of volatility is up 7% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in November is down 30% Y/Y.

Futures volumes are mixed Y/Y as ICE futures ADV up 3% vs. November 2024 ADV. Meanwhile, CME ADV is down 11% Y/Y while CBOE futures ADV is up 19% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 35% MTD while option volumes are up 23% for equity options and up 37% for index options.

In terms of market share trends for the month-to-date, NDAQ and Other exchanges have picked up share in U.S. equities on-exchange trading relative to last month’s levels while CBOE, MIAX, and ICE have given up some share. Within U.S. equity options, NDAQ has picked up share vs. last month while CBOE, ICE, MIAX and other exchanges have ceded share.

For further details on MTD, QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week unchanged W/W. Yields were up on the week while the curve flattened slightly and the EOP VIX was up 4% on the week.

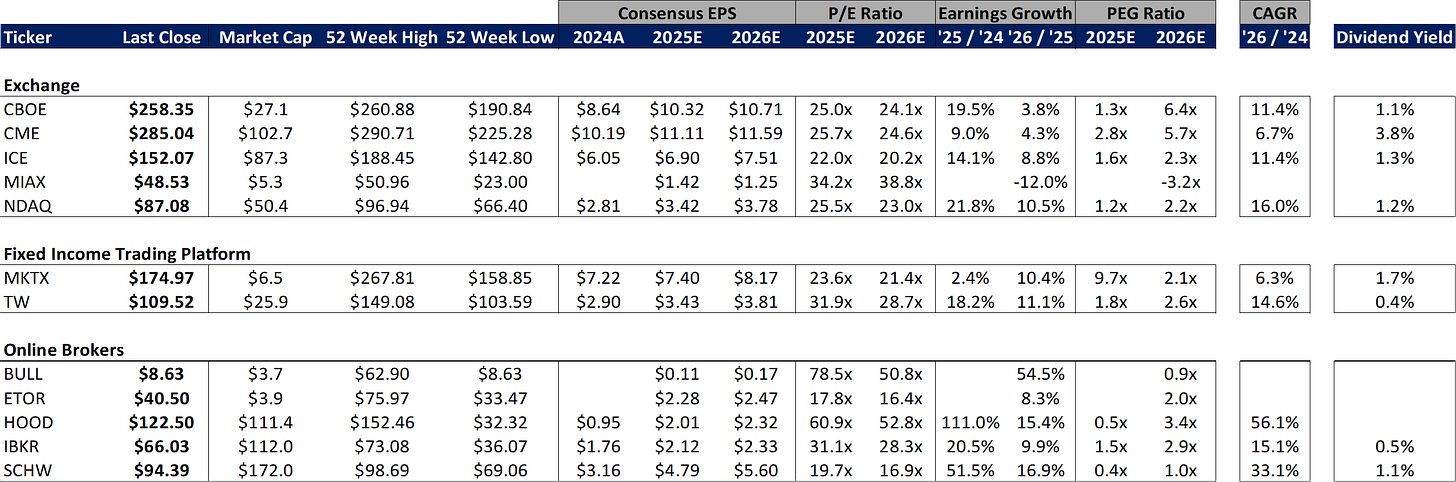

In terms of the companies I follow, ETOR showed the strongest performance, rising 16% on the week after reporting earnings on Monday. In the rest of the eBroker space, BULL fell 10% on no meaningful news, HOOD declined 6%, IBKR declined 6% and SCHW fell 1%. In exchange land, CME rose 3%, ICE increased 2%, CBOE was up 1% while MIAX and NDAQ were both flat on the week. In the fixed income space, MKTX rose 5% while TW was unchanged.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: Yahoo Finance

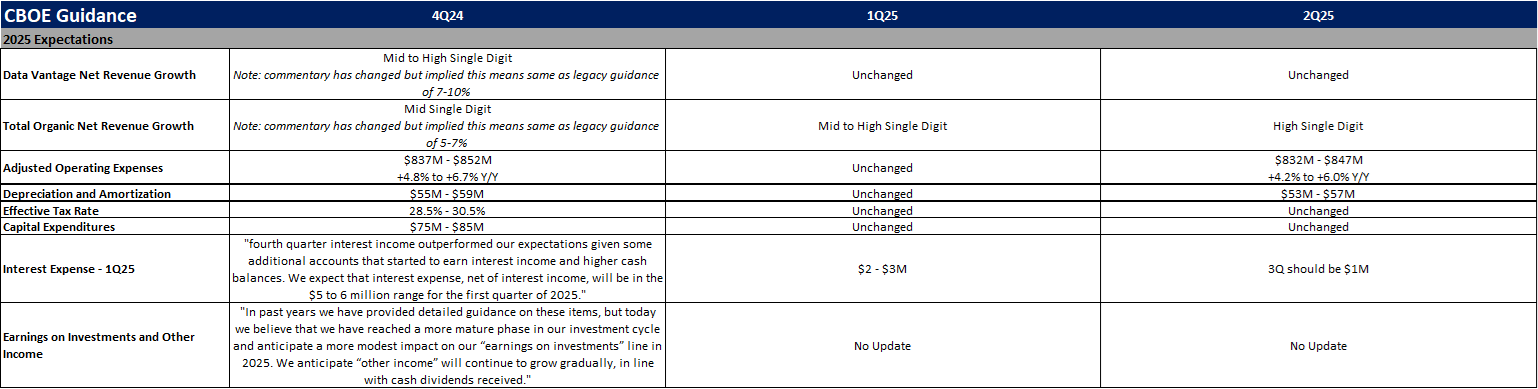

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

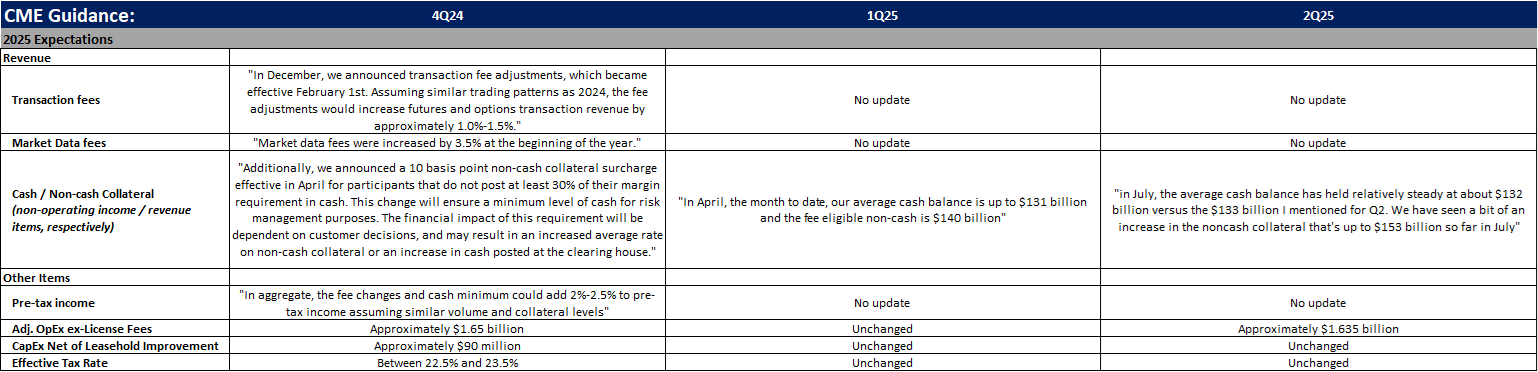

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

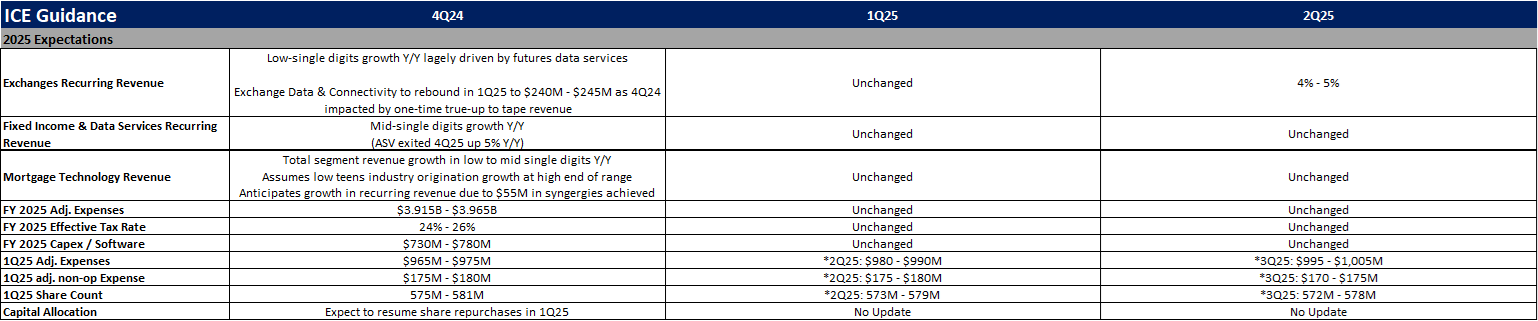

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

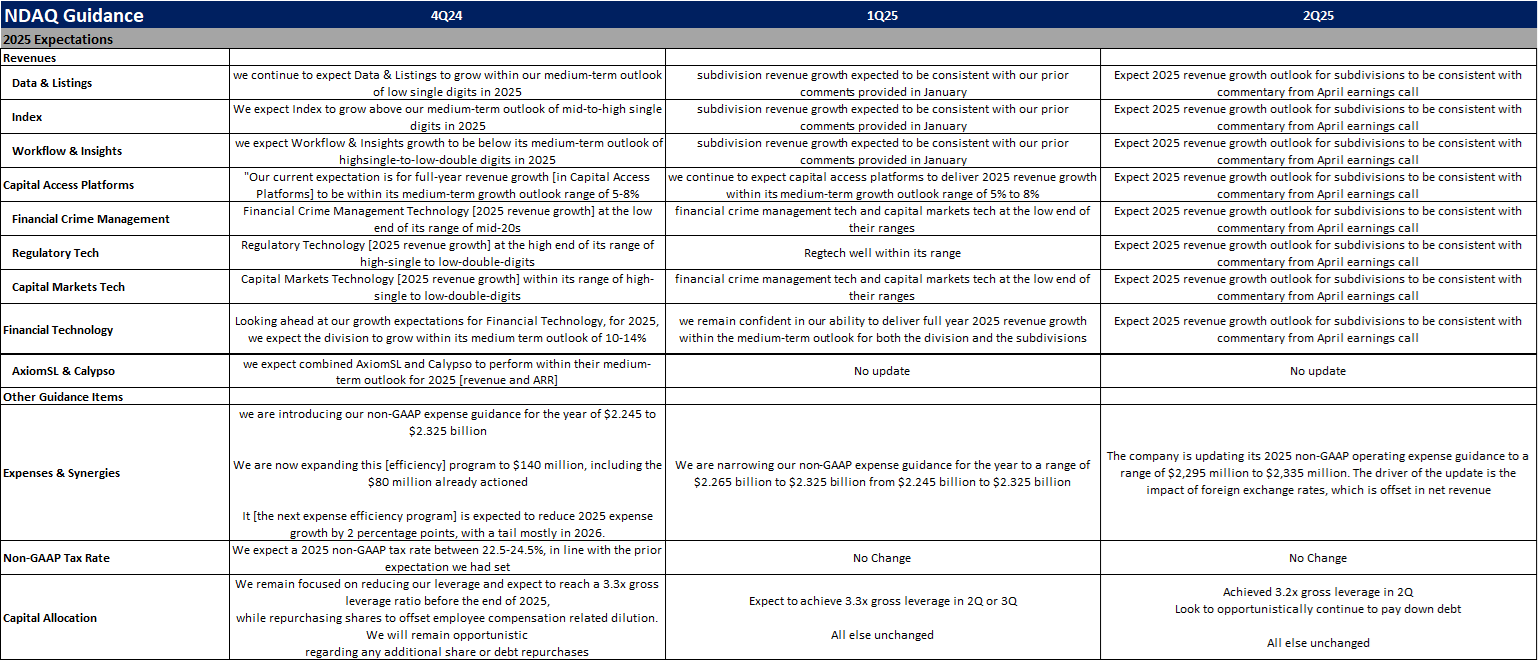

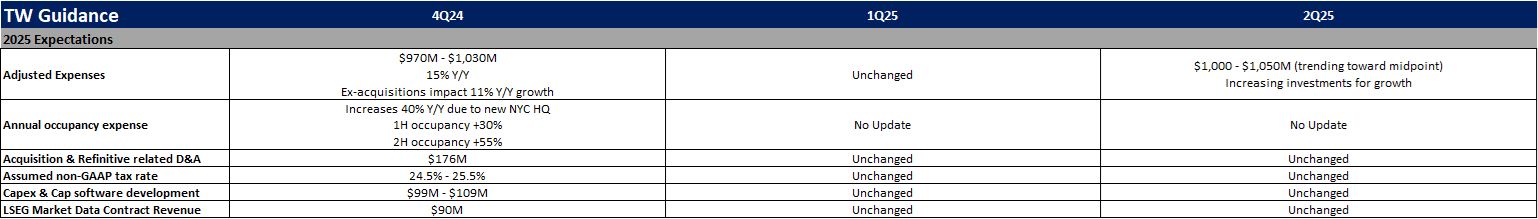

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

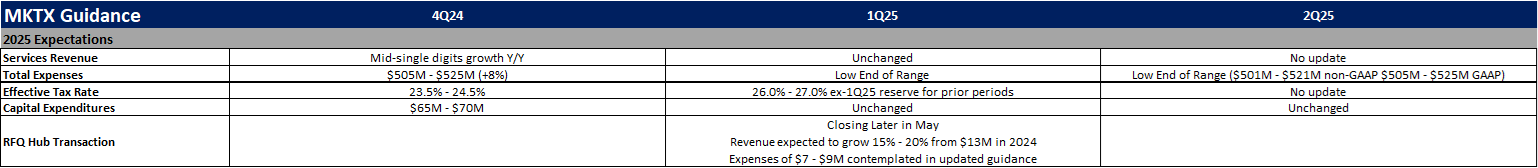

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

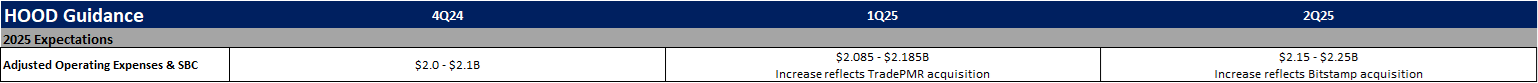

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

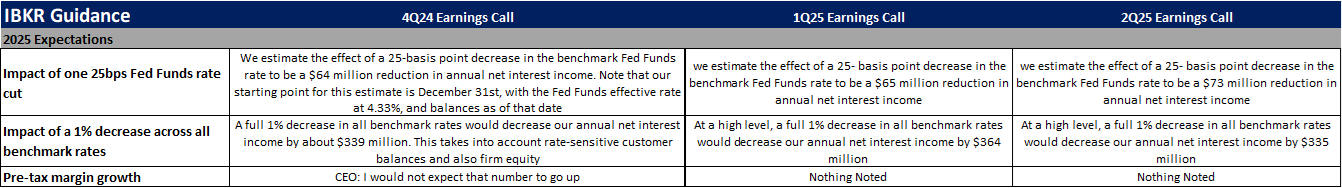

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

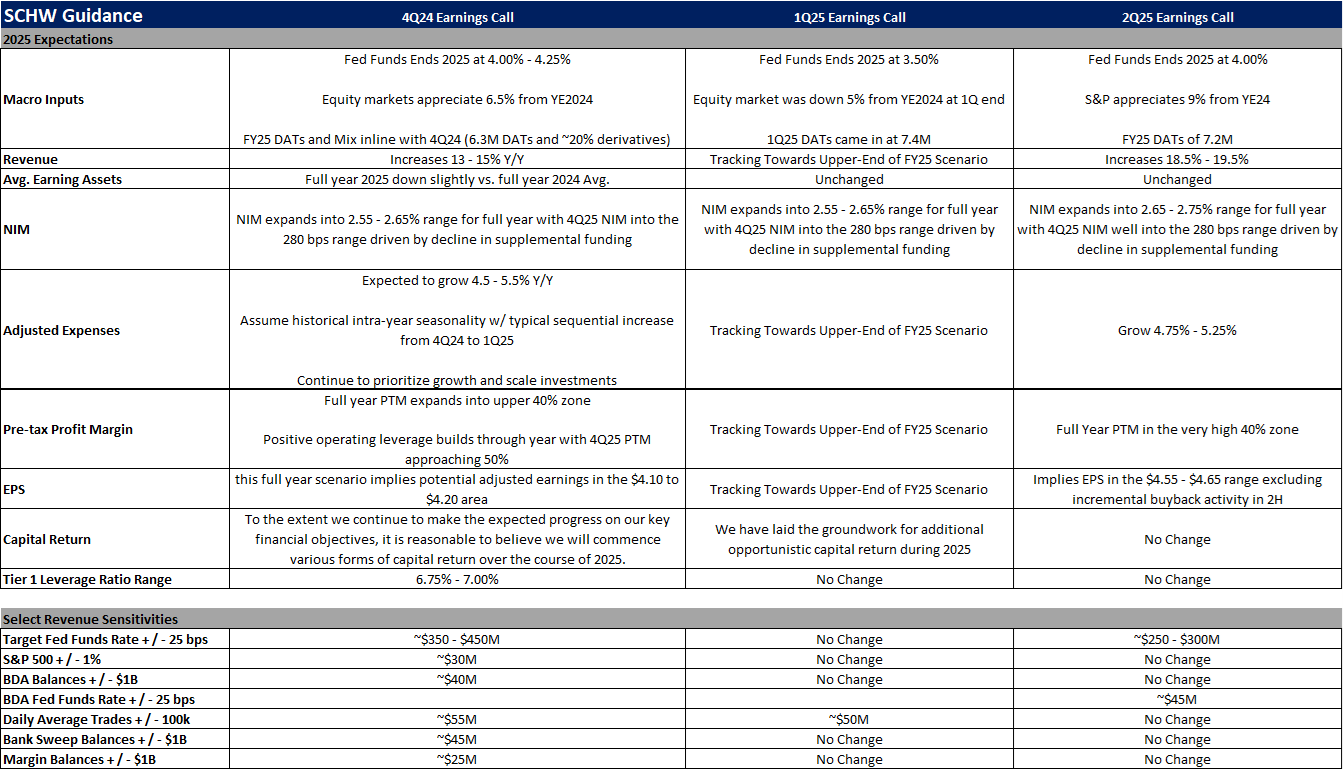

The Charles Schwab Corporation (SCHW)