Weekly Recap for Week Ended November 7, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Significant News / Developments from Week Ended Nov. 7, 2025

Pieces I’ve put out in the past week:

Past week was a busy one folks. Sorry for flooding everyone’s inboxes (particularly Thursday) but I’m trying to keep myself accountable in a timely manner. I do appreciate everyone who reads these updates and I hope you are finding the information valuable.

Should be a little quieter this upcoming week but we will be getting ETOR 3Q25 EPS, SCHW & HOOD official October Metrics and a couple conference appearances.

Cboe Global Markets, Inc. (CBOE) 3Q25 Earnings Review

October Exchange Volumes (CBOE, CME, ICE, MIAX, NDAQ) – Volumes and Volatility Increase in October; MIAX Surpasses ICE in Multi-List Options Market Share

Miami International Holdings Inc. (MIAX) 3Q25 Earnings Review

Fixed Income Trading Platforms (MKTX, TW) - October Metrics

The Charles Schwab Corporation (SCHW) Announces Acquisition of Forge Global (FRGE)

Robinhood Markets, Inc. (HOOD) 3Q25 Earnings Review

Online Brokers (HOOD, IBKR, SCHW) - September Metrics Review

MarketAxess Holdings Inc. (MKTX) 3Q25 Earnings Review

Other notable news:

Prediction Markets

Winklevoss-Founded Gemini (GEMI Moves to Enter Prediction Markets

GEMI is looking to move into prediction markets soon

In May it applied for regulatory approval with the CFTC to create its own derivatives exchange though the application is still pending and the approval process is likely to be extended given the government shutdown

MyPrize Becomes the First Social Gaming Business to Offer Prediction Markets in Strategic Partnership with Crypto.com

MyPrize is the fastest growing social gaming business in the US

It has announced a partnership with Crypto.com to bring prediction markets for sports, crypto politics and more to its 1M+ users globally

DraftKings (DKNG) CEO says prediction markets aren’t luring customers away from sports betting

CEO Jason Robins suggests that prediction markets are an entirely different product than what DraftKings traditionally offers

However, DKNG did recently acquire RailBird to launch its own prediction markets platform

Google Finance Integrates Polymarket, Kalshi Prediction Market Data

Roll-out expected in coming weeks

Once users have access they will be able to ask questions in the search bar and be presented with relevant data from prediction markets

Crypto

Crypto’s Retail Era Rattled With ETFs Facing $89,600 Pain Point

The average Bitcoin cost basis for all lifetime inflows into US Spot Bitcoin ETFs is around $89,613

Some are concerned that if Bitcoin reaches that level positioning could flip

Coinbase Faces Flak from Traditional Bankers on Its Push for Trust Bank Charter

U.S. bank lobbying groups The Independent Community Bankers of America and the Bank Policy Institute have written letters to the OCC opposing COIN’s effort to obtain a bank charter

The arguments from the lobbying groups suggest that COIN’s trust bank would struggle to operate at a profit in a bear market and that the OCC would face difficulties in safely dissolving the trust if it failed

Foreign-Exchange Veterans Seek to Rebuild Crypto in Wall Street’s Image

A group of former FX professionals is seeking to build venues for crypto trading that focus only on matching buyers and sellers while leaving custody and credit to other providers unlike most crypto venues today which provide all of the above

They believe this distinction will help make crypto a more “grown-up” asset class

Stablecoin-enabled payments infrastructure platform Zynk raises $5 million from Coinbase Ventures and others

Zynk has said it will use the funding to expand its payment corridors, enhance liquidity and compliance infrastructure and develop partnerships with payment providers

Fintech Ripple gets $40 billion valuation after $500 million funding

Ripple has raised $500M in funding from Fortress Investment Group, Citadel Securities, Pantera Capital, Galaxy Digital, Brevan Howard and Marshall Wace

Switzerland is crossing the crypto Rubicon

The Swiss government has launched a consultation on allowing stablecoins to be issued in the country

The proposal sketches out new licenses for payment instrument institutions and crypto institutions that would bring stablecoin issuers under Swiss financial law

Crypto trading app Fomo raises $17M Series A from Benchmark

The trading platform has onboarded over 120k users, is doing $20-$40M a day in volume and about $150k in daily revenue

Tokenization

UBS, Chainlink Execute First Onchain Tokenized Fund Redemption in $100T Market

UBS completed the first onchain redemption of a tokenized fund using Chainlink’s digital transfer agent

The transaction involved the tokenized UBS USD Money Market Investment Fund Token

BTCC Reports $29.2B in Tokenized RWA Futures Trading Amid Broader On-Chain Growth

Trading activity in BTCC’s real world asset futures reached $29.2B USDT across 2Q25 and 3Q25

The exchange posted $16.4B in volume during 2Q and $12.8B in 3Q

Chainlink Introduces CRE to Fast-Track Institutional Tokenization

Chainlink Runtime Environment (CRE) is a platform for institutions to deploy smart contracts across multiple blockchains with built-in compliance and data integration

It is already being used by J.P. Morgan and UBS and further features are to be added in 2026

Franklin Templeton (BEN) brings tokenized USD money market fund to Hong Kong

The fund will be initially only available to institutional and professional investors

Eventually it plans to offer a retail-approved tokenized fund

Retail Investors

Retail Traders Post Worst Day Since April as Tech Rally Stumbles

Goldman Sachs’ Retail Favorites Index was down 3.6% on Tuesday, the worst decline since April 10, following a disappointing earnings report from Palantir and Michael Burry disclosing short positions against Palantir and Nvidia

Groww Parent Company Billionbrains Garage Ventures Set to Go Public

Groww is Bengaluru-based Indian retail trading platform that offers trading in stock, ETFs, mutual funds, IPO shares, futures, options and more

The company has over 18M transacting users on the platform and 2.6T INR in client assets (~29.5B USD)

Private equity investor body sounds alarm over rush of retail money

A report from Institutional Limited Partners Association has warned that the number of deals needed to deploy the rush of retail dollars into the private equity sector could pull fund managers’ attention away from investing capital of pension plans and endowments

Apollo’s (APO) Rowan Targets Retail-Focused Firms to Back Private Asset Growth

Apollo plans to use partnerships with asset manager firms that already serve retail investors to reach this new client base

Apollo has already struck partnerships with State Street (STT) and Lord Abbett on funds focused on individuals

Traditional Markets

TXSE Raises Second Round of Financing

Second round of financing comes from J.P. Morgan (JPM) and brings total capital raised to more than $250M

Investors in TXSE now include JPM, SCHW, BLK, and Citadel, among others

TXSE plans to launch trading in U.S. equities in early 2026 with ETP and corporate listings to follow

Regulators call for action on ‘front-running’ by market makers

Iosco has called for a limit on “pre-hedging” activity by market makers and dealers

In pre-hedging a market maker will buy or sell a security before they win an order to manage inventory and protect themselves from anticipated price changes

The practice typically occurs in competitive request for quote systems

Ornn Raises $5.7M in Seed Round to Launch World’s First Compute Futures Exchange

Ornn is building a compute exchange hoping to introduce U.S. regulated cash-settled traditional and perpetual futures on compute hours

Ornn believes this will allow AI data companies to lock in training and inference costs through long hedges, allow data center operators and cloud providers to presell capacity and stabilize revenue through short hedges, and allow lenders and investors to manage collateral risk tied to GPU depreciation

Ornn’s compute price indices track the cost of GPU compute across cloud and on-prem providers

Wall Street Upstarts Shake Up ETF World as Big Three Lose Ground

Barriers to entry in the ETF space have come down dramatically in recent years thus there has been a flood of new entrants entering the space, with 60 new ETF issuers entering the market over the past two years

Given the wave of new entrants the largest players in the space BlackRock (BLK), Vanguard and State Street (STT) have only drawn in 57% of ETF inflows YTD, their lowest share on record

Adena Friedman Sees Three Key Ways Blockchain Can Help Reshape Finance

NDAQ CEO Adena Friedman has said blockchain can reshape traditional financial infrastructure by overhauling post trade systems, unlocking trapped capital in clearinghouses, and enabling faster payments

Why the bond market still relies on voice

Despite the increase in algorithmic trading in the bond market in recent years, 50% of corporate credit still trades via voice

While algo trading has grown, it has freed up humans to focus on larger block trades, which have only grown in size in recent years

The bond market remains too idiosyncratic for all trading to migrate to electronic platforms and when things get choppy traders want to hear a voice on the other end of a trade

Brussels opens probe into Deutsche Börse and Nasdaq (NDAQ) over derivatives

The European Commission has opened an investigation into Deutsche Borse and Nasdaq into possible collusion between the two to not compete in listing, trading and clearing of certain derivatives

Global Bond Sales Binge Hits Record $5.95 Trillion This Year

Issuance has been dominated by financial institutions and governments

Despite the issuance binge, demand is outpacing net supply

Citadel Securities Hires Sales Co-Heads for Block Equity Trades

Hired Joseph Anastasio from Citigroup and Samuel French from BofA to lead sales for large equity block trades

These hires follow Elan Luger who was hired as head of high-touch equities trading as Citadel is working to grow its institutional business

Company Specific Updates for Week Ended Nov. 7, 2025

Exchanges

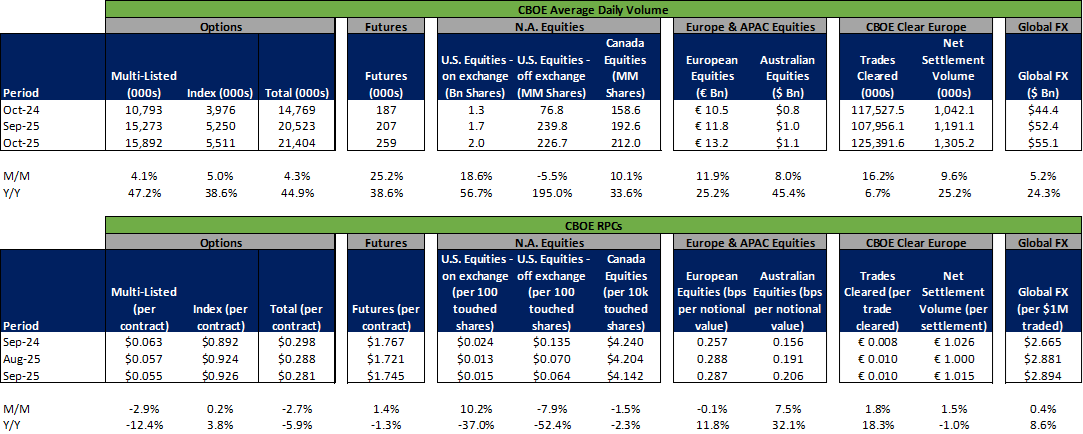

Cboe Global Markets, Inc. (CBOE 0.00%↑)

Reports October Volumes

Previewed much of this in my report from Monday here

If volume holds through quarter-end should see decent uplift in transaction volume Q/Q

CBOE Volume and RPC Metrics

Source: company documents

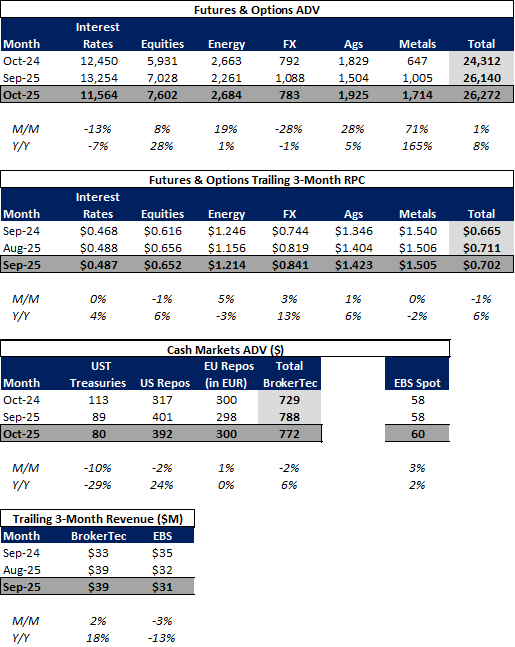

CME Group Inc. (CME)

Livestock sector optimism fuels a modest rise in farmer sentiment

Farmer sentiment rose 3 points in October to 129

Current conditions index rose 8 points to 130

Future expectations index was unchanged at 129

Declares 4Q25 Dividend of $1.25

Unchanged from prior quarter

Reports Official October Volumes

Previewed much of this in my report from Monday here

If volume holds through quarter-end should see decent uplift in transaction volume Q/Q

CME Volume and RPC Metrics

Source: company documents

Intercontinental Exchange, Inc. (ICE 0.00%↑)

CFO to Present at J.P. Morgan Ultimate Services Conference

Tuesday, November 18 at 11:40am ET

Files prospectus for debt issuance

Use of proceeds to refinance debt due in 2025

Reports October Volumes

Volumes started 4Q solid with all products up Y/Y

RPCs were also solid with futures RPC +1% M/M, options RPC +20% M/M and equities RPC unchanged M/M

For a deeper look at volume trends and EPS upside see my report from Monday here

ICE Volume Metrics

Source: company documents

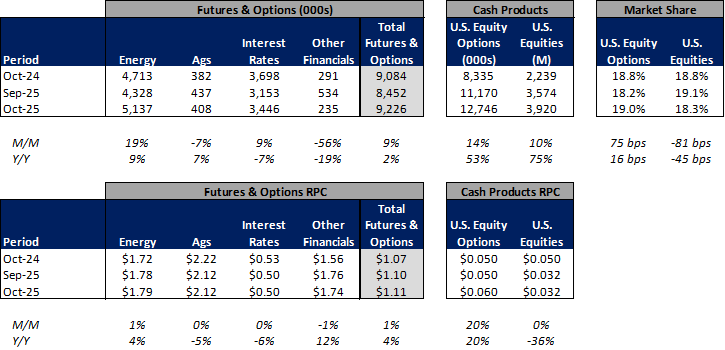

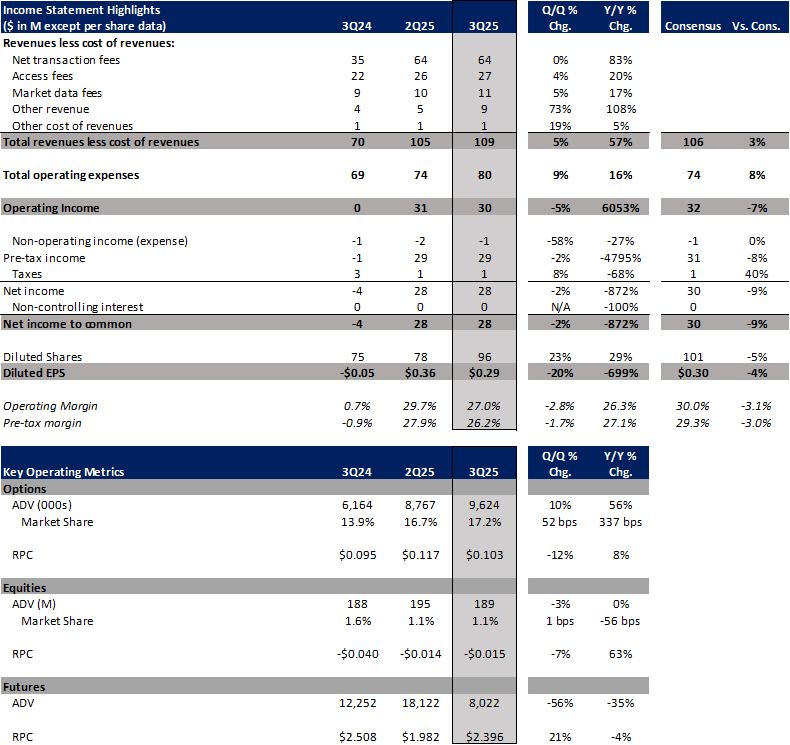

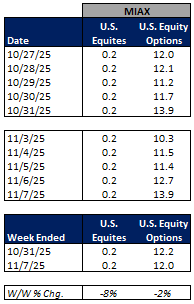

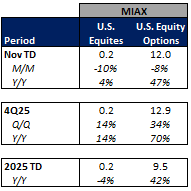

Miami International Holdings Inc. (MIAX)

Reports October Volumes

Previewed much of this in my report from Monday here

Reports record options market share in October and surpasses ICE for first time ever

If volume holds through quarter-end should see decent uplift in transaction volume Q/Q

Reports 3Q25 EPS

Solid first quarter as public co.

Market share gains continue to impress

Exchange operating leverage on display

More detail available in my full 3Q25 EPS recap piece here

MIAX Volume and Market Share Statistics

Source: company documents

MIAX Earnings Summary

Source: company documents

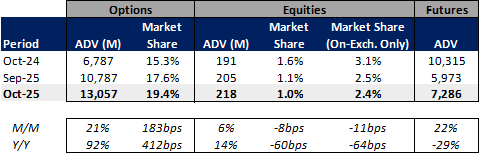

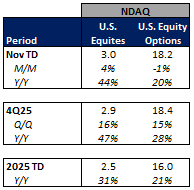

Nasdaq, Inc. (NDAQ)

Reports October Volumes

Volume across the board was up a good amount Y/Y in October

For a deeper look at volume trends and EPS upside see my report from Monday here

NDAQ Volume Metrics

Source: company documents

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Unveils Fixed Income’s First Opening & Closing Auctions

MarketAxess has developed an opening and closing auction protocol for U.S. High Grade and U.S. High Yield credit trading

The new protocol is expected to go live in the coming weeks, and development was completed in consultation with an advisory group consisting of AllianceBernstein, BlackRock, DWS and State Street

The new protocol is expected to unveil greater price formation and liquidity at the beginning and end of the trading day

Files 3Q25 10-Q

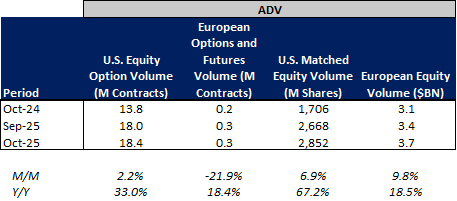

Reports October Volume Metrics

Volumes declined both M/M and Y/Y

Picks up market share in USHG and USHY M/M

Fee Per Million in October unchanged M/M across both credit and rates

More detail available in my fixed income trading platforms recap here

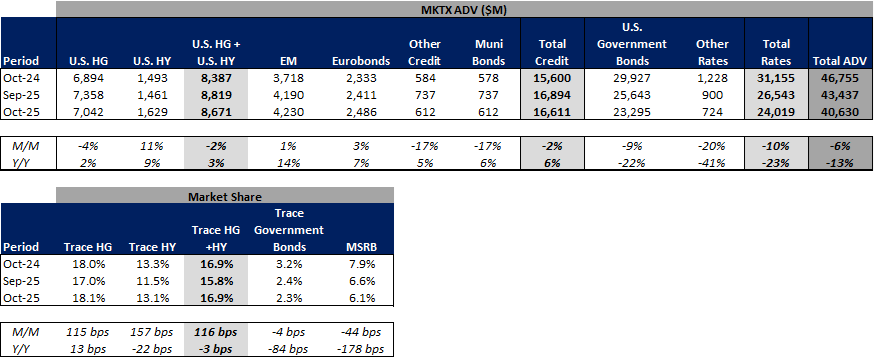

Reports 3Q25 EPS

EPS beats street forecast by 8% on lower expenses, slightly higher revenue

More detail can be found in my full recap here

MKTX Reported Monthly ADV ($M) and Market Share Statistics

Source: company documents

MKTX Earnings Summary and Key Metrics

Source: company documents

Tradeweb Markets Inc. (TW 0.00%↑)

Appoints Sandra Buchanan as Chief People Officer

Previously she served as Chief Human Resources Officer at GCM Grosvenor

She will join the Executive Committee and report to CEO Billy Hult

Brings U.S. Treasury Benchmark Data On-Chain Via Chainlink

TW has collaborated with Chainlink, an operator for on-chain finance, to publish the Tradeweb FTSE U.S Treasury Benchmark Closing Prices on-chain via DataLink, an institutional grade publishing service powered by Chainlink

The collaboration allows institutions to leverage TW’s treasury data in an always-available environment

Through this collaboration, TW and Chainlink aim to unlock new opportunities for innovation and 24/7 access to markets

Reports October Volume Metrics

Volumes decline M/M but increased Y/Y

Cedes some share to MKTX in USHG and USHY credit M/M

More detail available in my fixed income trading platforms recap here

TW Reported Monthly ADV ($B) and Market Share Statistics

Source: company documents

Online Brokers

eToro Group Ltd. (ETOR 0.00%↑)

Launches Club Subscription, Unlocking Platinum Tier Benefits

Benefits include eToro Visa debit card, unlimited access to eToro’s AI analyst, a dedicated account manager, higher crypto staking revenue, discounts on conversion fees and discounted tax returns

Subscribers also get access to exclusive Smart Portfolios and premium research content

Previously these perks were only available to users with balances of $25k or more

Subscription will initially be available to users in the UK and EU with additional regions to follow

Subscription price $4.99 per month or $49.99 per year

Rewards crypto deposits with 1% back in stocks in the UK and Europe

1% back on crypto transfers into eToro Crypto Wallet will be in local stock of their choice

eToro to present at KBW Fintech & Payments Conference

Wednesday, November 12 at 3:25pm ET

Robinhood Markets, Inc. (HOOD 0.00%↑)

Team’s Up with Sage Home Loans to Democratize Access to Homeownership

Through an agreement with Sage Home Loans, all Robinhood Gold subscribers can access mortgage rates at least 0.75% below the national average along with a $500 credit towards closing costs on new home purchases or refinances

To Present at Wolfe Research Wealth Symposium

Wednesday, November 12 at 10:15am ET

Files 3Q25 10-Q

Announced Anticipated Date for Reporting October Monthly Metrics

Thursday, November 13 post- close

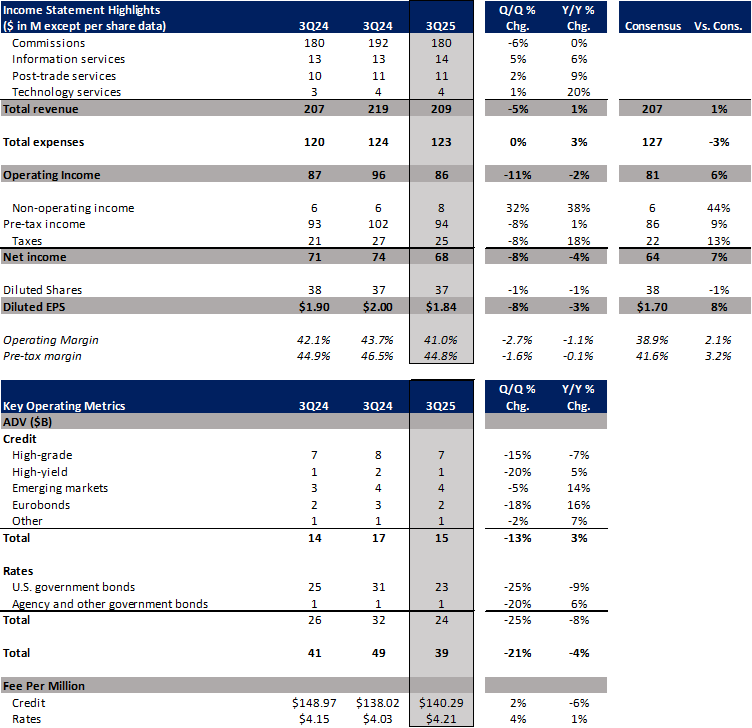

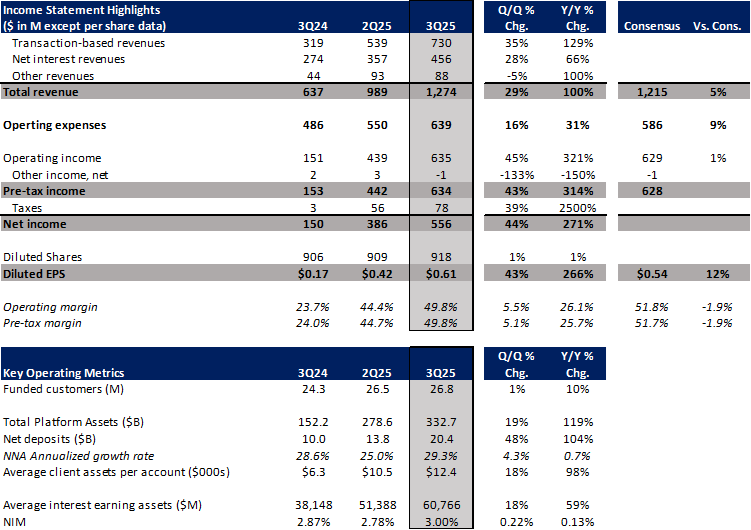

Reports 3Q25 EPS

Revenue and EPS beat street

More detail can be found in my full recap here

HOOD Earnings Summary and Key Metrics

Source: company documents

Interactive Brokers Group, Inc. (IBKR 0.00%↑)

Financial Advisors Are Increasingly Optimistic Heading into Year-End

More than half of financial advisors are bullish on US Markets

47% hold a positive outlook on global markets

59% have changed their views on the market since June

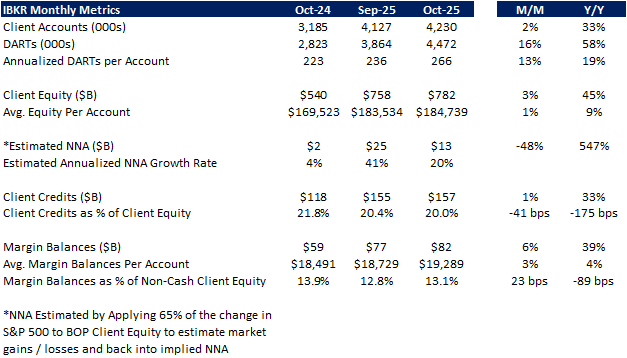

Reports October Monthly Metrics

Client accts. +33% Y/Y

DARTs +16% M/M (+58% Y/Y)

est. NNA 20% annualized growth rate

Margin balances +6% M/M

IBKR October Monthly Metrics

Source: company documents

The Charles Schwab Corporation (SCHW 0.00%↑)

Advisor Services Expands Schwab Advisor ProDirect Program

SCHW is now making its Advisor ProDirect program available to current independent RIA client firms as well as to advisors moving to independence (which the program was initially rolled out for in July)

The roll out to existing RIAs will begin in January

Most ETF Investors Can Envision Moving to ETF-Only Portfolios

Announces Acquisition of Forge Global FRGE For $660M

More detail can be found in my piece here

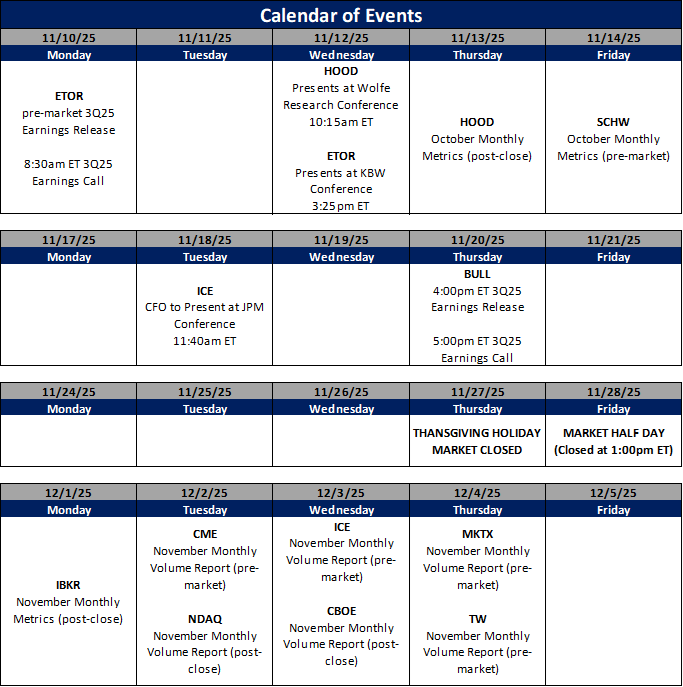

Company Specific Updates Anticipated for the Upcoming Week (Ended Nov. 14, 2025)

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

eToro Group Ltd. (ETOR)

3Q25 Earnings Release

Monday, November 10 pre-market

Conference call 8:30am ET

Presents at KBW Conference

Wednesday, November 12 at 3:25pm ET

Robinhood Markets, Inc. (HOOD)

Presents at Wolfe Wealth Symposium

Wednesday, November 12 at 10:15am ET

October Monthly Metrics Release

Thursday, November 13 post-close

The Charles Schwab Corporation (SCHW)

October Monthly Metrics Release

Friday, November 14 pre-market

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Nov. 7, 2025

S&P U.S. Manufacturing PMI (Oct.) – 52.5 vs. prior 52.2

ISM Manufacturing (Oct.) – 48.7% vs. consensus 49.3% and prior 49.1%

Auto Sales (Oct.) – 15.3M vs. prior 16.4M

ADP Employment (Oct.) – 42k vs. consensus 22k and prior (29k)

S&P U.S. Services PMI (Oct.) – 54.8 vs. consensus 55.2 and prior 55.2

ISM Services (Oct.) – 52.4% vs. consensus 50.5% and prior 50.0%

Preliminary Consumer Sentiment (Nov.) – 50.3 vs. consensus 53.0 and prior 53.6

Consumer Credit (Sep.) – $13.1B vs. consensus $10.0B and prior $363.2M

Major Macro Updates Scheduled for the Upcoming Week (Ended Nov. 14, 2025)

Monday, Nov. 10

None to Note

Tuesday, Nov. 11

NFIB Optimism Index (Oct.) – prior 98.8

Wednesday, Nov. 12

None to Note

Thursday, Nov. 13

None to Note (Unless the Government Reopens)

Friday, Nov. 14

None to Note (Unless the Government Reopens)

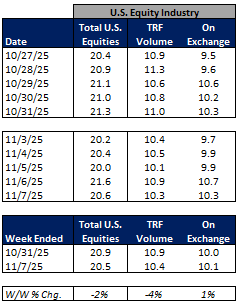

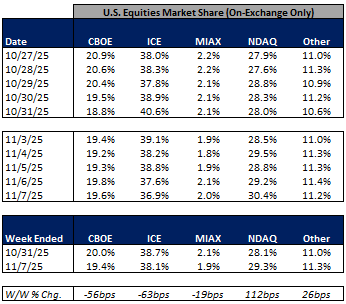

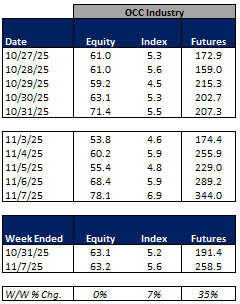

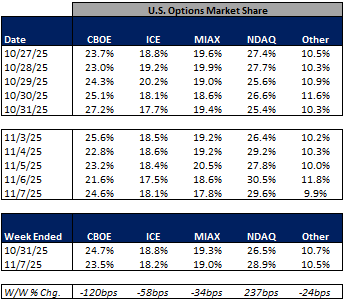

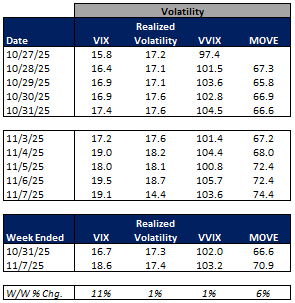

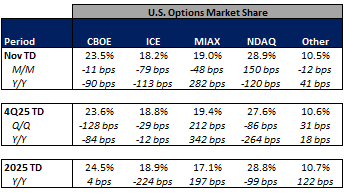

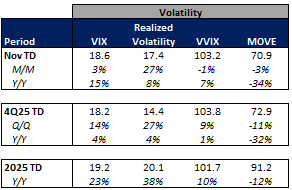

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

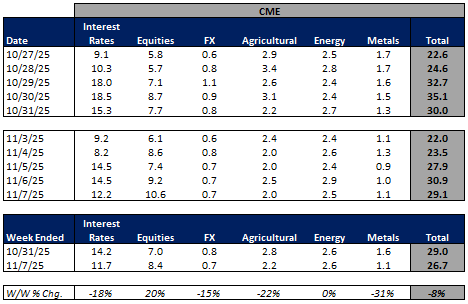

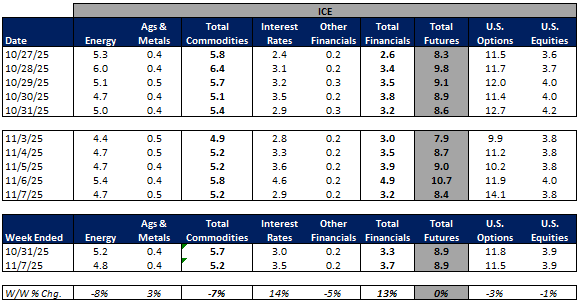

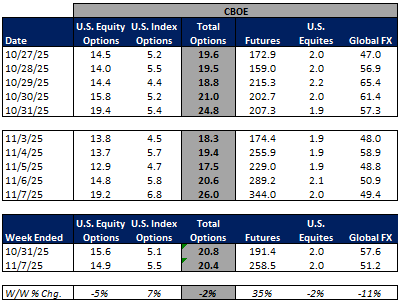

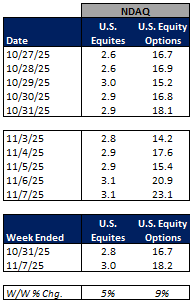

For the week ended November 7, 2025, volumes were mixed but mainly lower W/W while volatility increased W/W.

The average VIX for the week was up 11% from the prior week, average realized volatility was up 1% W/W, average volatility of volatility (as measured by the VVIX) was up 1% W/W and the average MOVE index (U.S. Treasuries volatility) was up 6% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were up 35% W/W, CME futures volumes were down 8% W/W, and ICE futures volumes were unchanged W/W.

Total U.S. Equities ADV was down 2% W/W, as TRF volumes fell 4% W/W and on-exchange volumes were up 1% W/W. Industry equity options volumes were unchanged W/W while index options volumes rose 7% W/W.

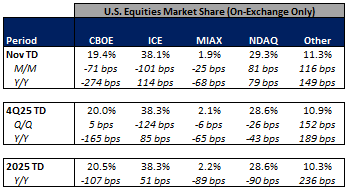

In terms of market share trends for the past week, NDAQ and other exchanges picked up share in U.S. equities on-exchange trading while CBOE, ICE, and MIAX gave up some share on the week. Within U.S. equity options, NDAQ picked up share while CBOE, ICE, MIAX and other exchanges ceded share in the week.

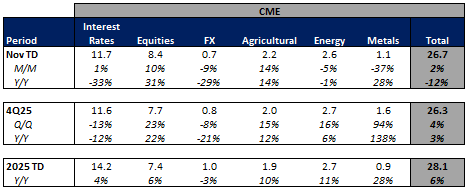

CME Futures Volumes (M)

Source: Company Daily Volume Releases

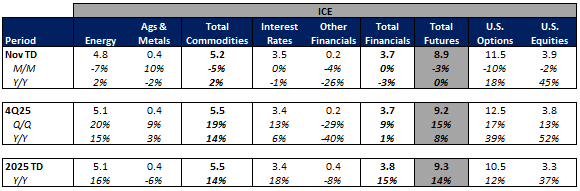

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

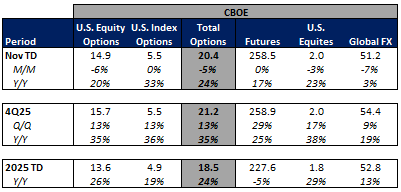

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

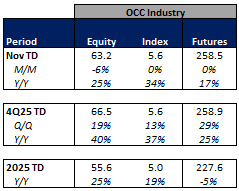

For the month to date, exchange volumes are trending mainly lower M/M but mainly higher Y/Y. This comes as volatility is mixed M/M but mostly higher on a Y/Y basis.

The average VIX in November is up 15% Y/Y while realized volatility is up 8% Y/Y and volatility of volatility is up 7% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in November is down 34% Y/Y.

Futures volumes are mixed Y/Y as ICE futures ADV is unchanged vs. November 2024 ADV. Meanwhile, CME ADV is down 12% Y/Y while CBOE futures ADV is up 17% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 41% MTD while option volumes are up 25% for equity options and up 34% for index options.

In terms of market share trends for the month-to-date, NDAQ and Other exchanges have picked up share in U.S. equities on-exchange trading relative to last month’s levels while CBOE, MIAX, and ICE have given up some share. Within U.S. equity options, NDAQ has picked up share vs. last month while CBOE, ICE, MIAX and other exchanges have ceded share.

For further details on MTD, QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

MIAX U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Equities Market Share Trends (On-Exchange Traded Volume Only)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

U.S. Options Market Share Trends

Source: OCC

Volatility Metrics

Source: Yahoo Finance

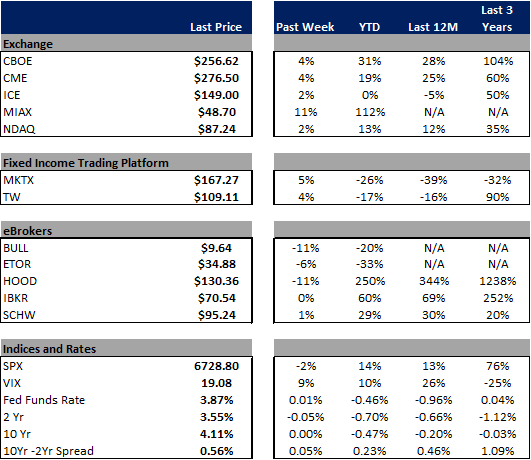

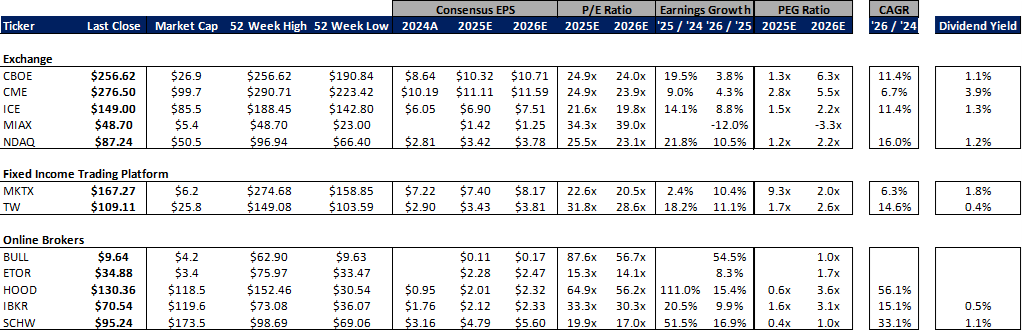

Major Indices, Interest Rates and Company Share Price Trends

The market closed out the week down 2% W/W as concerns over the AI trade took hold. Yields were flat to down on the week as the curve steepened and the EOP VIX was up 9% on the week.

In terms of the companies I follow, HOOD showed the weakest performance, falling 11% on the week after reporting earnings on Wednesday evening. In the rest of the eBroker space, BULL fell 11% on no meaningful news, ETOR declined 6% while IBKR was flat and SCHW rose 1% after announcing its acquisition of FRGE. in exchange land, MIAX rose 11% after reporting its first earnings release as a public company Wednesday evening, CBOE and CME were both up 4% on renewed volatility over the past week while ICE and NDAQ were each up 2%. In the fixed income space, MKTX rose 5% after reporting earnings results Friday morning while TW was up 4%.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: Yahoo Finance

Guidance Tracker

Exchanges

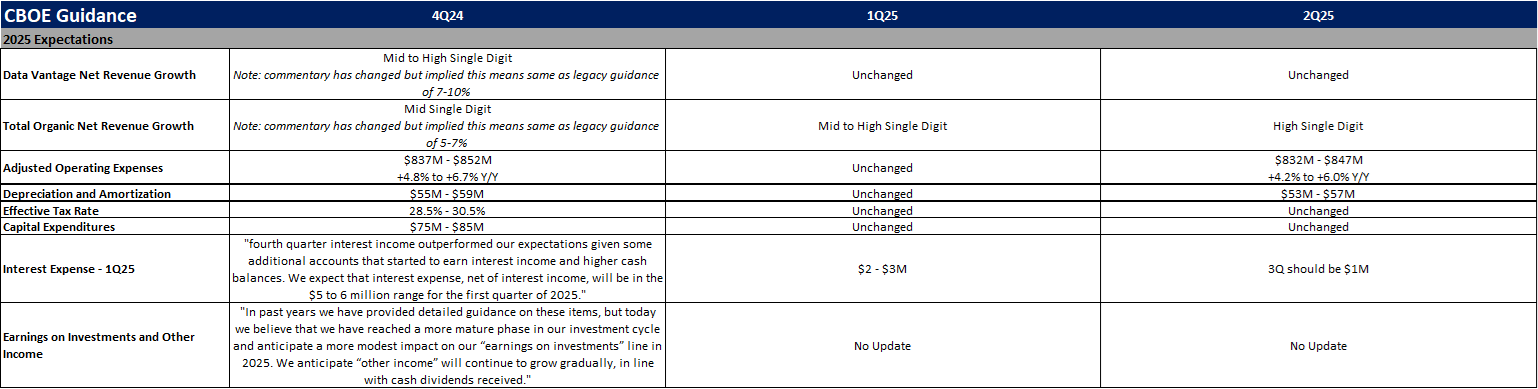

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

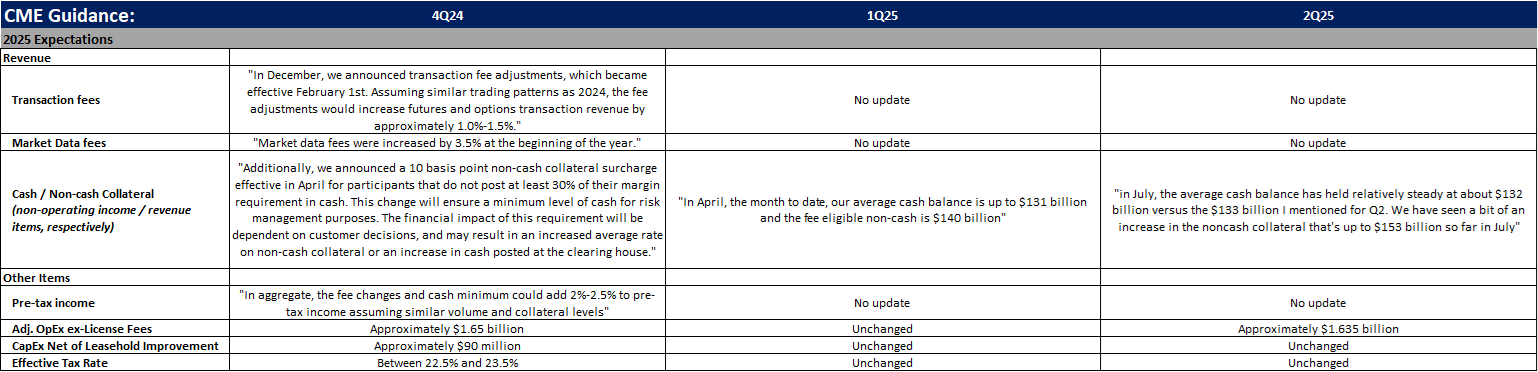

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

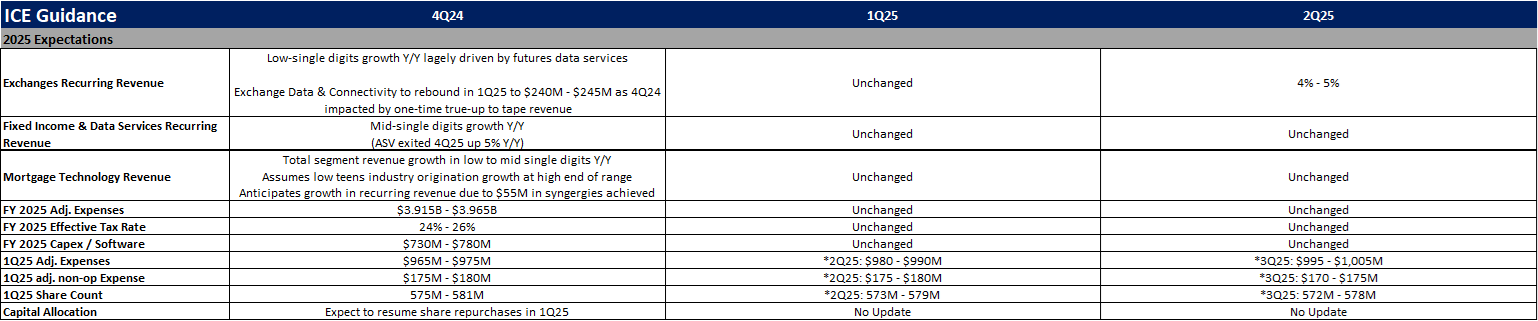

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

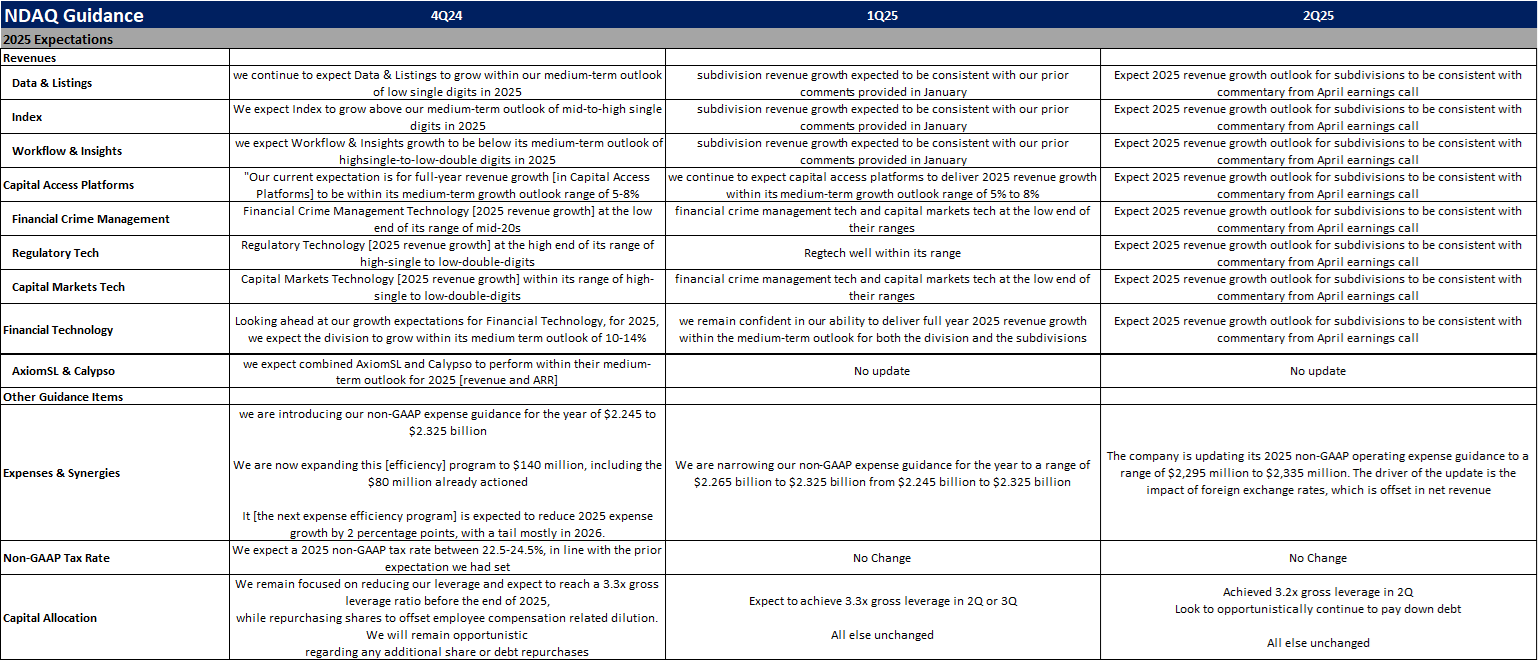

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

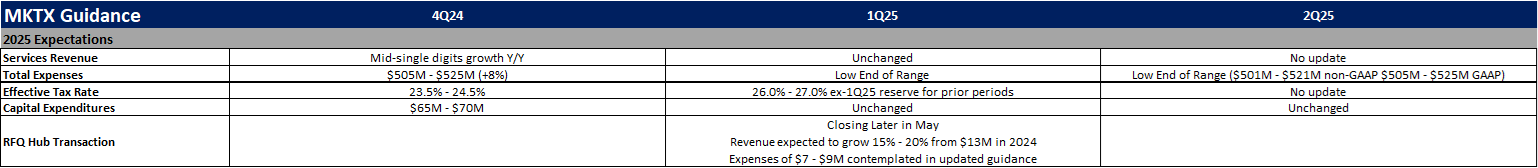

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

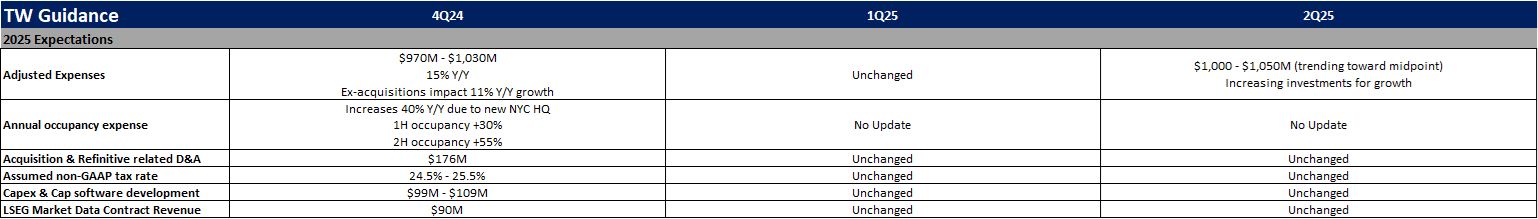

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

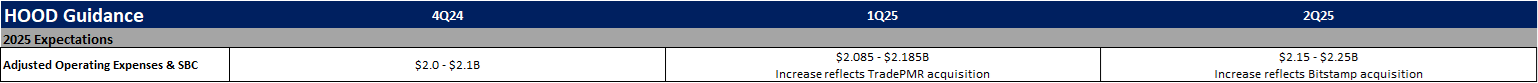

Online Brokers

Robinhood Markets, Inc. (HOOD)

Source: Company documents

Note: HOOD provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

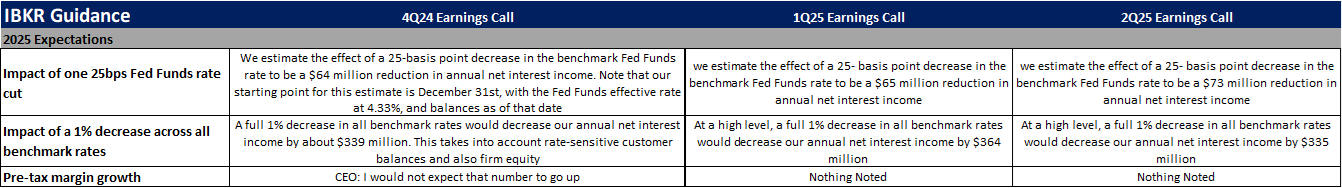

Interactive Brokers Group, Inc. (IBKR)

Source: Company documents

Note: IBKR provided additional guidance points / commentary on its 2Q25 earnings call, but key annual highlights are included above for the sake of simplicity

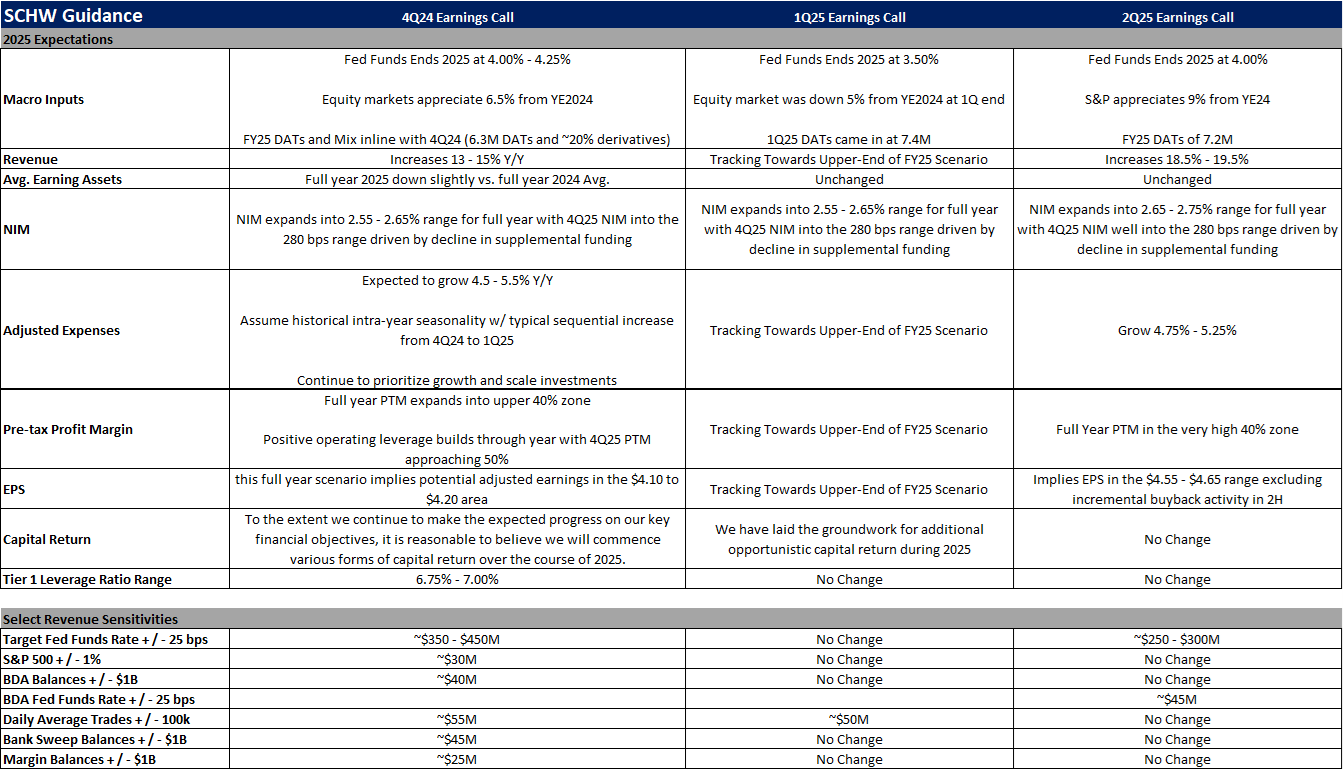

The Charles Schwab Corporation (SCHW)

Great roundup of the brokrage space. The online broker competiton between IBKR, SCHW, and HOOD is heating up, especially with prediction markets entering the mix. IBKR's strengh in international markets gives them an edge, but these new verticals could shake things up.