Weekly Recap for Week Ended March 14, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Company Specific Updates for Week Ended Mar. 14, 2025

Exchanges

Cboe Global Markets, Inc. (CBOE)

Plans to Launch S&P 500® Equal Weight Index Options on April 14, 2025

Options will be cash-settled and based on 1/10th the value of the S&P 500 EWI

Offers clients different exposure to the same constituents of the S&P 500

CME Group Inc. (CME)

Completed public offering of $750M senior notes

As previously announced offering replaces $750M in senior notes due in 2025

Bearing interest rate of 4.400%

To Launch Bloomberg Commodity (BCOM) Subindex Futures on March 31

Announced first quarter earnings release date of April 23, pre-market

Fixed Income Trading Platforms

None to Note

Online Brokers

The Charles Schwab Corporation (SCHW)

Trading activity index moves higher amid higher volatility

Index increased to 51.94 from 49.45 in January

Reports monthly metrics for February

Net new assets came in at $48B (5.6% annualized growth rate)

Average interest earning assets decreased 2% M/M to $425B

Transactional sweep cash increased $4.7B to $321B

Robinhood Markets, Inc. (HOOD)

Reports February operating data

Funded customers increased 8% Y/Y to 25.6M

Assets Under Custody increased 58% Y/Y (down 8% M/M) to $187B

Net Deposits were $4.8B, an annualized growth rate of 28% vs. January AUC

Margin balances increased 129% Y/Y to $8.7B

Cash Sweep Balances increased 45% Y/Y to $26.2B

Sec lending revenue was $22M (+69% Y/Y, -12% M/M

Company Specific Updates Anticipated for the Upcoming Week (Ended Mar. 21, 2025)

Exchanges

None to Note

Fixed Income Trading Platforms

None to Note

Online Brokers

None to Note

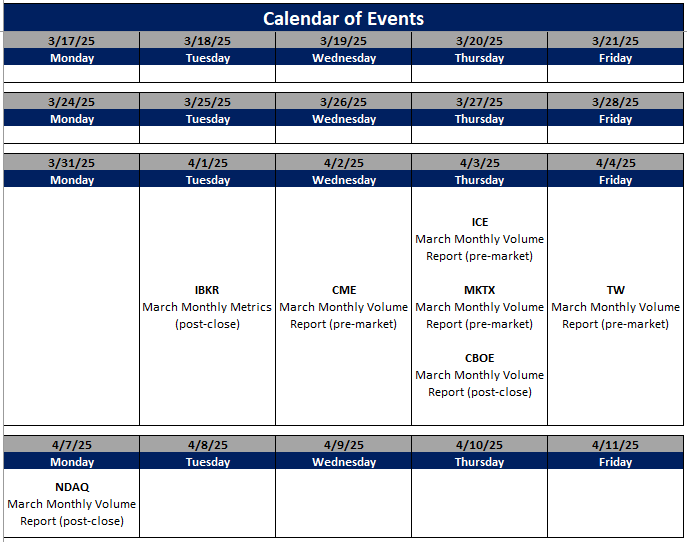

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Mar. 14, 2025

NFIB Optimism Index (Feb) –100.7 vs. consensus 101.0 and prior 102.8

Job Openings (Jan.) – 7.7M vs. consensus 7.6M and prior 7.6M

Consumer Price Index (Feb.) – 0.2% vs. consensus 0.3% and prior 0.5%

CPI Year over Year (Feb.) – 2.8% vs. consensus 2.9% and prior 3.0%

Core CPI (Feb.) – 0.2% vs. consensus 0.3% and prior 0.5%

Core CPI Y/Y (Feb.) – 3.1% vs. consensus 3.0% and prior 3.0%

Monthly U.S. Federal Budget (Feb.) – ($307B) vs. consensus ($296B) and prior ($296B)

Initial jobless claims (week ended Mar. 8) – 220k vs. consensus 225k and prior 221k

Producer Price Index (Feb.) – 0.0% vs. consensus 0.3% and prior 0.4%

PPI Year over Year (Feb.) – 3.2% vs. prior 3.7%

Core PPI (Feb.) – 0.2% vs. consensus 0.3% and prior 0.3%

Core PPI Year over Year (Feb.) – 3.3% vs. prior 3.4%

Prelim. Consumer Sentiment (Mar.) – 57.9 vs. consensus 63.2 and prior 65.7

Major Macro Updates Scheduled for the Upcoming Week (Ended Mar. 21, 2025)

Monday, Mar. 17

U.S. Retail Sales (Feb.) – consensus 0.6% and prior (0.9%)

Retail Sales Minus Autos (Feb.) – consensus 0.3% and prior (0.4%)

Empire State Manufacturing Survey (Mar.) – consensus (1.8) and prior 5.7

Business Inventories (Jan.) – consensus 0.3% and prior (0.2%)

Homebuilder Confidence Index (Mar.) – consensus 42 and prior 42

Tuesday, Mar. 18

Housing Starts (Feb.) – consensus 1.38M and prior 1.37M

Building Permits (Feb.) – consensus 1.45M and prior 1.48M

Import Price Index (Feb.) – consensus (0.2%) and prior 0.3%

Import Price Index Minus Fuel (Feb.) – prior 0.1%

Industrial Production (Feb.) – consensus 0.3% and prior 0.5%

Capacity Utilization (Feb.) – consensus 77.9% and prior 77.8%

Wednesday, Mar. 19

FOMC Rate Decision and Chair Press Conference

Thursday, Mar. 20

Initial jobless claims (week ended Mar. 15) – consensus 222k and prior 220k

Philadelphia Fed Manufacturing Survey (Mar.) – consensus 12.0 and prior 18.1

Existing Home Sales (Feb.) – consensus 3.97M and prior 4.08M

U.S. Leading Economic Indicators (Feb.) – consensus (0.2%) and prior 0.3%

Friday, Mar. 21

None to Note

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

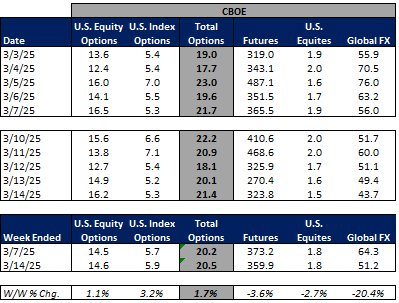

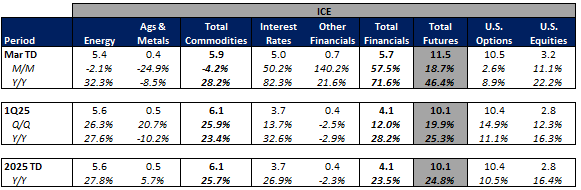

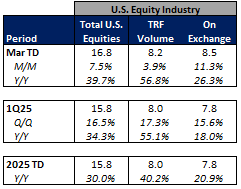

For the week ended March 14, 2025, volumes mainly declined week over week, while volatility metrics generally increased due to macro concerns.

The average VIX for the week was up 8% from the prior week, average realized volatility was up 26% W/W, average volatility of volatility (as measured by the VVIX) was essentially flat W/W and the average MOVE index (U.S. Treasuries volatility) was up 1% W/W.

Futures average daily volumes (ADV) declined as CBOE futures volumes were down 4% W/W, CME futures volumes were down 17% W/W, and ICE futures volumes were down 27% W/W.

Total U.S. Equities ADV was essentially flatW/W, mainly driven by off-exchange trading as TRF volumes were up 2% W/W. Industry equity options volumes were down 4% W/W while index options volumes increased 3% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

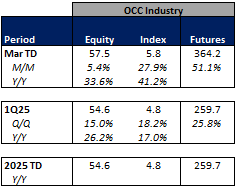

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking mainly higher in March-to-date. This comes as volatility is higher MTD on a Y/Y basis.

The average VIX in March-to-date is up 73% Y/Y while realized volatility is up 54% Y/Y and volatility of volatility is up 40% Y/Y. Treasuries volatility is higher as well Y/Y as the average MOVE index in March-to-date is up 8% Y/Y.

Futures volumes are higher Y/Y as ICE futures MTD ADV is up 46% vs. March 2024 ADV. Meanwhile, CME ADV is up 48% Y/Y while CBOE futures ADV is up 68% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 40% MTD while option volumes are up 34% for equity options and up 41% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Major Indices, Interest Rates and Company Share Price Trends

Markets ended the week lower with the S&P down 230bps W/W. The week was volatile as concerns over the impact of tariffs on the economic outlook continued to drive sentiment.

In terms of the companies I follow, the online brokers showed the softest performance (+3% to -13%) mainly driven by the macro-outlook. Within the exchanges, CME showed the strongest performance, closing out the week up 2%. On the Fixed Income Trading Platform side, TW performed the best, increasing 2% on limited news.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

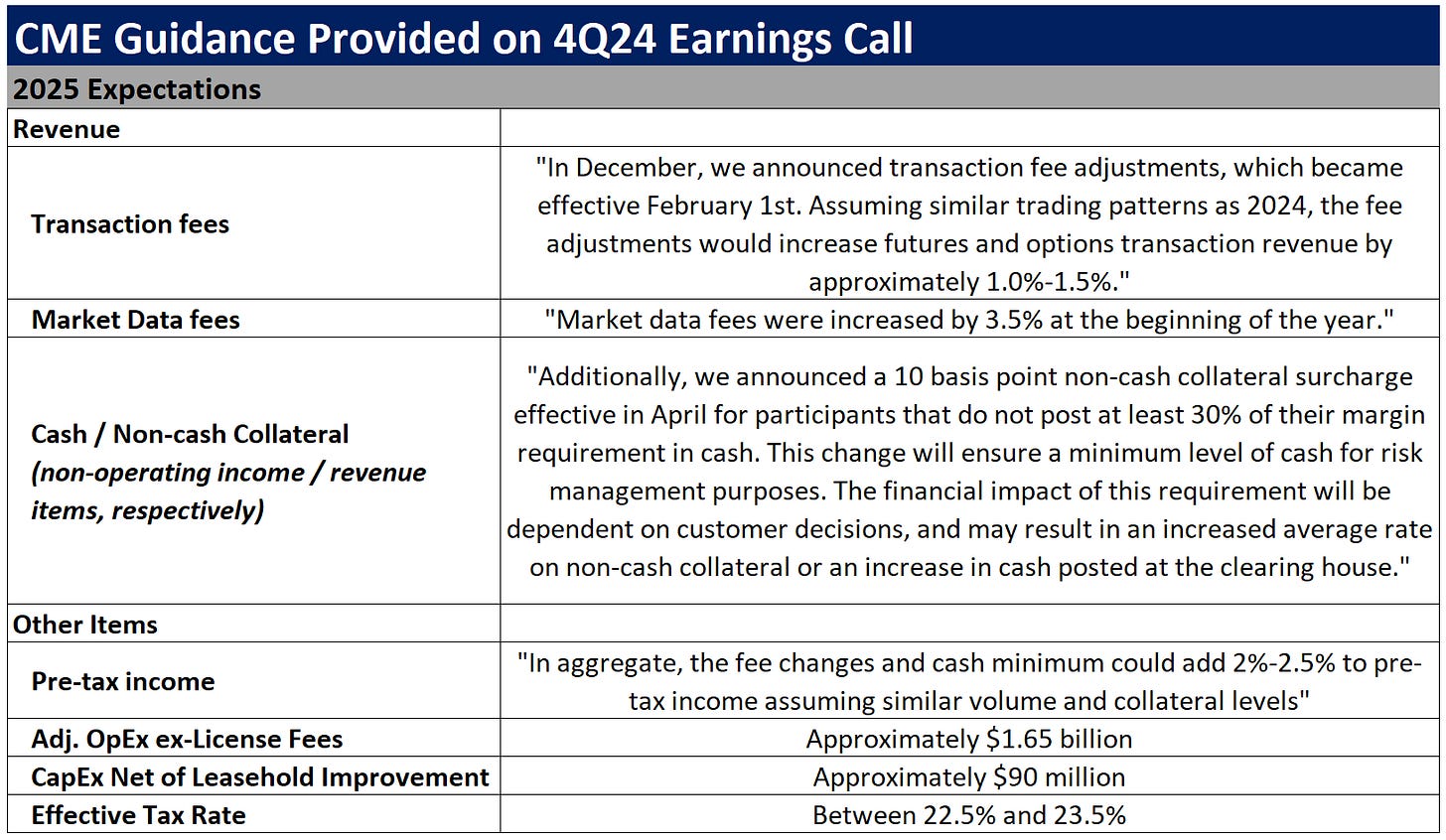

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

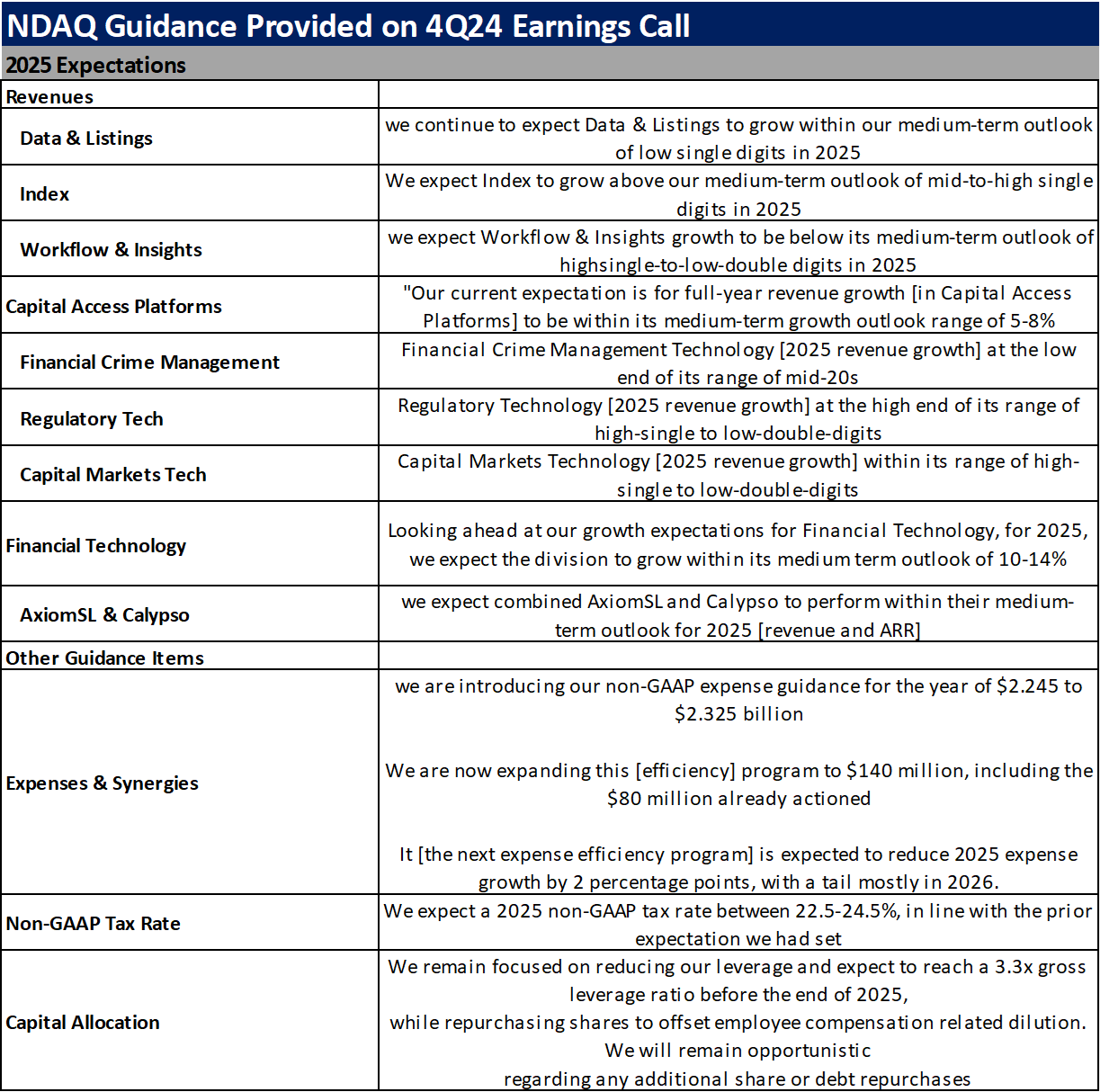

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

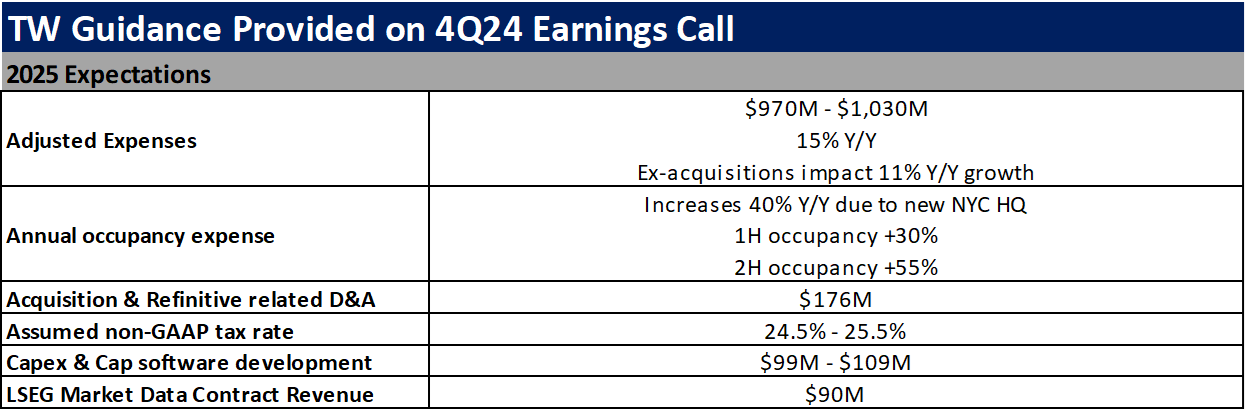

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

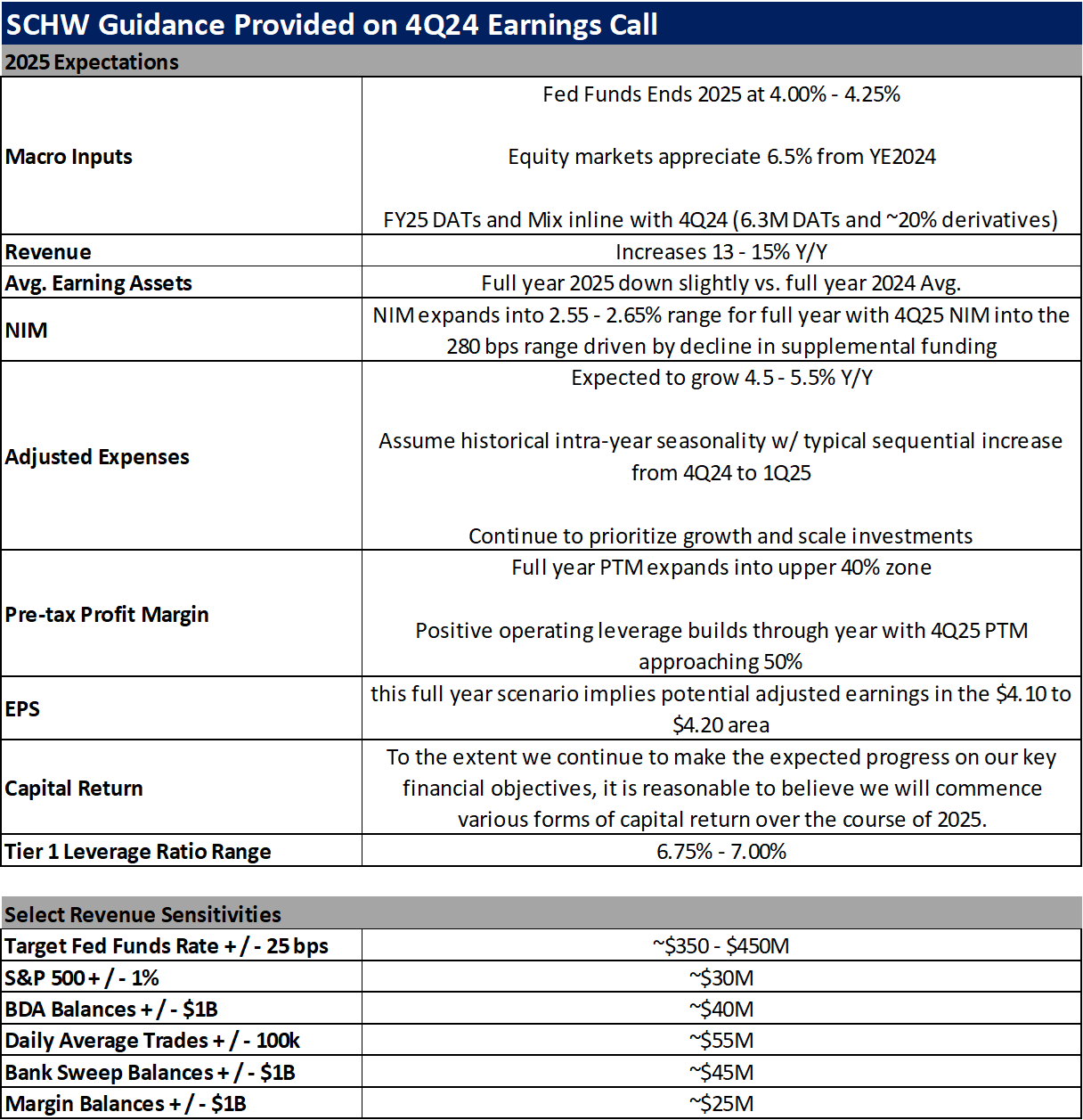

The Charles Schwab Corporation (SCHW)