Weekly Recap for Week Ended February 28, 2025

Weekly Recap of Major Micro / Macro Data Points and Things to Look Forward to in the Week Ahead

Company Specific Updates for Week Ended Feb. 28, 2025

Exchanges

CME Group Inc. (CME)

Expands access to capital efficiencies available when trading U.S. Treasuries and CME Interest Rate Futures that have offsetting risk exposure

Increases risk management, improves liquidity, reduces costs and enables greater efficiency

Under the agreement, FICC will designate cross-margin accounts, allowing eligible positions to offset with eligible CME interest rate futures

Sets New Daily Volume Record of 67.1 Million Contracts

Total interest rates hit record 50.9 million contracts

Executives to present at Raymond James Institutional Investors Conference

Intercontinental Exchange, Inc. (ICE)

Open Interest Reaches Record 100M contracts

Included record OI in global commodities markets of 68.7M contracts

Record 65.3M energy related contracts

Natural gas OI reached record 43.8M contracts

Nat gas contracts achieved record 37.9M contracts

Henry Hub futures contracts reached record 8.7M contracts

February 19 saw record nat gas trading of 3.2M, surpassing prior record hit in 2012

View the OI records as a strong positive as open interest tends to be a leading indicator of future volumes on the exchange as well as strength and depth of the market

Nasdaq, Inc. (NDAQ)

CFO to present at Morgan Stanley Technology, Media & Telecom Conference

Announces Early Results of Cash Tender Offers for Up to $218 Million Outstanding Debt Securities

Upsized tender offer by $18M

Again, view the tender offer as a positive as NDAQ continues to prioritize debt paydown

Estimate this will save NDAQ ~$10M in annual interest expense vs. year end 2024 debt levels

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Tradeweb Markets Inc. (TW)

Online Brokers

The Charles Schwab Corporation (SCHW)

SCHW quarterly trader sentiment survey indicates two thirds of traders view the market as overvalued, citing mega cap tech and AI stocks as most crowded trades

Survey included 1,040 active traders and took place between January 8-17

While traders view market as overvalued, 51% remain bullish and 34% are bearish

Younger traders (under 40 years old) have seen an increase in bullishness to 60% from less than 50% in 4Q

Traders view the new U.S. administration as largest factor impacting stocks in 2025

Traders are most bullish on energy, IT, financials and utilities

Also most bullish on domestic stocks, value, growth AI and equities in general

Company Specific Updates Anticipated for the Upcoming Week (Ended Mar. 7, 2025)

Exchanges

Cboe Global Markets, Inc. (CBOE)

February volume release expected Wednesday, March 5 (post-close)

CME

February volume release expected Tuesday, March 4 (pre-market)

Executives to present at Raymond James Institutional Investors Conference Tuesday, March 4 at 11:35am ET

ICE

February volume release expected Wednesday, March 5 (pre-market)

NDAQ

To Present at Morgan Stanley Technology, Media & Telecom Conference Monday, March 3 at 4:05pm ET

February volume release expected Tuesday, March 4 (post-close)

Fixed Income Trading Platforms

MKTX

February volume release expected Wednesday, March 5 (pre-market)

CEO to present at Raymond James Institutional Investors Conference Monday, March 3 at 4:35pm ET

TW

February volume release expected Thursday, March 6 (pre-market)

CEO to present at Raymond James Institutional Investors Conference Tuesday, March 4 at 8:40am ET

Online Brokers

Interactive Brokers Group, Inc. (IBKR)

February metrics release expected Monday, March 3 (post-close)

Next Four Weeks Calendar

Source: Company press releases and my estimates around timing

Major Macro Updates for Week Ended Feb. 28, 2025

S&P Case-Shiller Home Price Index (Dec.) – 4.5% vs. prior 4.3%

Consumer Confidence (Feb.) – 98.3 vs. consensus 102.4 and prior 104.1

New Home Sales (Jan.) – 657k vs. consensus 674k and prior 698k

Initial jobless claims (week ended Feb. 22) – 242k vs. consensus 225k and prior 219k

Durable Goods Orders (Jan.) – 3.1% vs. consensus 1.9% and prior (2.2%)

GDP Second Revision (4Q24) – 2.3% vs. consensus 2.3% and prior 2.3%

Pending Home Sales (Jan.) – (4.9%) vs. consensus (2.0%) and prior (5.5%)

Personal Income (Jan.) – 0.9% vs. consensus 0.4% and prior 0.4%

Personal Spending (Jan.) – (0.2%) vs. consensus 0.1% and prior 0.7%

PCE Index Y/Y (Jan.) – 2.5% vs. consensus 2.5% and prior 2.6%

Core PCE Index Y/Y (Jan.) – 2.6% vs. consensus 2.6% and prior 2.9%

Advanced U.S. Trade Balance in Goods (Jan.) – ($153.3B) vs. prior ($122.5B)

Chicago Business Barometer (Feb.) – 45.5 vs. consensus 41.0 and prior 39.5

Major Macro Updates Scheduled for the Upcoming Week (Ended Mar. 7, 2025)

Monday, Mar. 3

S&P Final Manufacturing PMI (Feb.) – prior 51.6

Construction Spending (Jan.) – consensus 0.1% and prior 0.5%

ISM Manufacturing (Feb.) – consensus 50.6% and prior 50.9%

Auto Sales (Feb.) – prior 15.6M

Tuesday, Mar. 4

None to Note

Wednesday, Mar. 5

ADP Employment (Feb.) – consensus 143k and prior 183k

S&P Final Services PMI (Feb.) – prior 49.7

Factory Orders (Jan.) – consensus 1.6% and prior (0.9%)

ISM Services (Feb.) – consensus 52.9% and prior 52.8%

Fed Beige Book Published

Thursday, Mar. 6

Initial jobless claims (week ended Mar. 1) – consensus 243k and prior 242k

U.S. Productivity Final (4Q) – consensus 1.2% and prior 1.2%

U.S. Trade Deficit (Jan.) – consensus ($100B) and prior ($98.4B)

Wholesale Inventories (Jan.) – consensus 0.3% and prior (0.5%)

Friday, Mar. 7

U.S. Jobs Report (Feb.) – consensus 160k and prior 143k

U.S. Unemployment Rate (Feb.) – consensus 4.1% and prior 4.0%

U.S. Hourly Wages (Feb.) – consensus 0.3% and prior 0.5%

Hourly Wages Y/Y (Feb.) – consensus 4.1% and prior 4.1%

Consumer Credit (Jan.) – consensus $12.0B and prior $40.8B

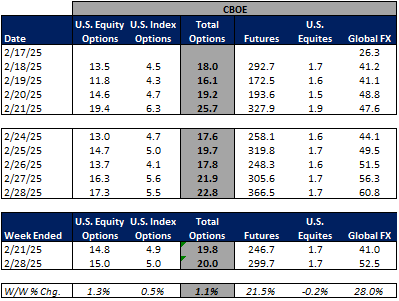

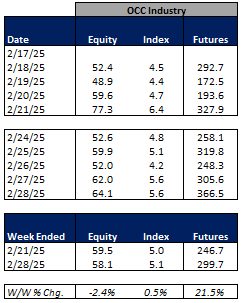

Exchange Volume Update

Exchange Volumes Over Past Week and W/W Trends

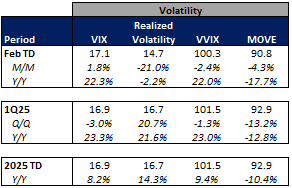

For the week ended February 28, 2025, volumes were mixed week over week, while volatility metrics increased across the board due to macro concerns.

The average VIX for the week was up 22% from the prior week, average realized volatility was up 6% W/W, average volatility of volatility (as measured by the VVIX) was up 11% W/W and the average MOVE index (U.S. Treasuries volatility) was up 12% W/W.

Futures average daily volumes (ADV) were mixed as CBOE futures volumes were up 22% W/W, CME futures volumes were up 46% W/W, and ICE futures volumes were down 1% W/W.

Total U.S. Equities ADV was up 3% W/W, mainly driven by on-exchange trading as TRF volumes were up 1% W/W. Industry equity options volumes were down 2% W/W while index options volumes increased 1% W/W.

For further detail on weekly volume trends by exchange and by product line please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

Exchange Volumes MTD / QTD / YTD Trends

Exchange volumes are tracking mainly higher in February-to-date. This comes as volatility is mixed MTD on a Y/Y basis.

The average VIX in February-to-date is up 22% Y/Y while realized volatility is down 2% Y/Y and volatility of volatility is up 22% Y/Y. Treasuries volatility is lower Y/Y as the average MOVE index in February-to-date is down 18% Y/Y.

Futures volumes are higher Y/Y as ICE futures MTD ADV is up 17% vs. February 2024 ADV. Meanwhile, CME ADV is up 12 Y/Y while CBOE futures ADV is up 13% Y/Y.

In terms of equities and options volumes, total U.S. equities ADV is up 33% MTD while option volumes are up 23% for equity options and up 10% for index options.

For further details on MTD / QTD and YTD ADV please see the charts below.

CME Futures Volumes (M)

Source: Company Daily Volume Releases

ICE Futures (M), U.S. Equities (B) and U.S. Equity Options (M) Volumes

Source: Company Daily Volume Releases, Cboe Global Markets and OCC

CBOE Options (M), Futures (K), U.S. Equity (B), and FX Volumes ($B)

Source: Company Daily Volume Releases and OCC

NDAQ U.S. Equity (B) and Option (M) Volumes

Source: Cboe Global Markets and OCC

U.S. Total Industry Equity Volumes (B)

Source: Cboe Global Markets

U.S. Total Industry Equity Option and Index Option Volumes (M)

Source: OCC

Volatility Metrics

Source: Yahoo Finance

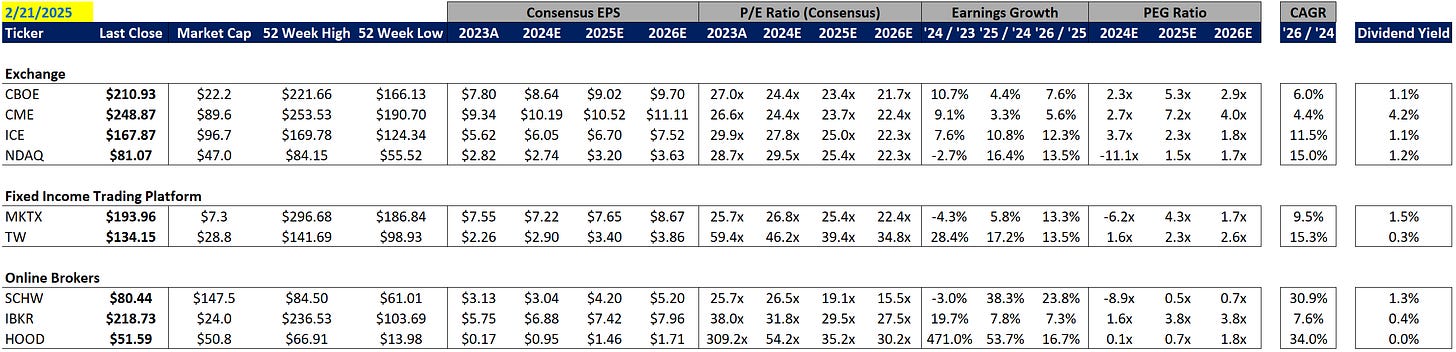

Major Indices, Interest Rates and Company Share Price Trends

Markets ended the week lower with the S&P down 100bps W/W. Thursday saw a broad based sell-off as economic concerns weighed on sentiment driven by softer housing data and continued concerns over the impact of tariffs on the economic outlook.

In terms of the companies I follow, IBKR showed the softest performance (-7%) on limited news. Within the exchanges, ICE showed strongest performance, closing out the week up 3. On the Fixed Income Trading Platform side, TW performed well on limited micro news in the week.

Source: Yahoo Finance, FRED, U.S. Department of the Treasury

Comp Sheet

Source: PitchBook

Guidance Tracker

Exchanges

Cboe Global Markets, Inc. (CBOE)

Source: Company documents

Note: CBOE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

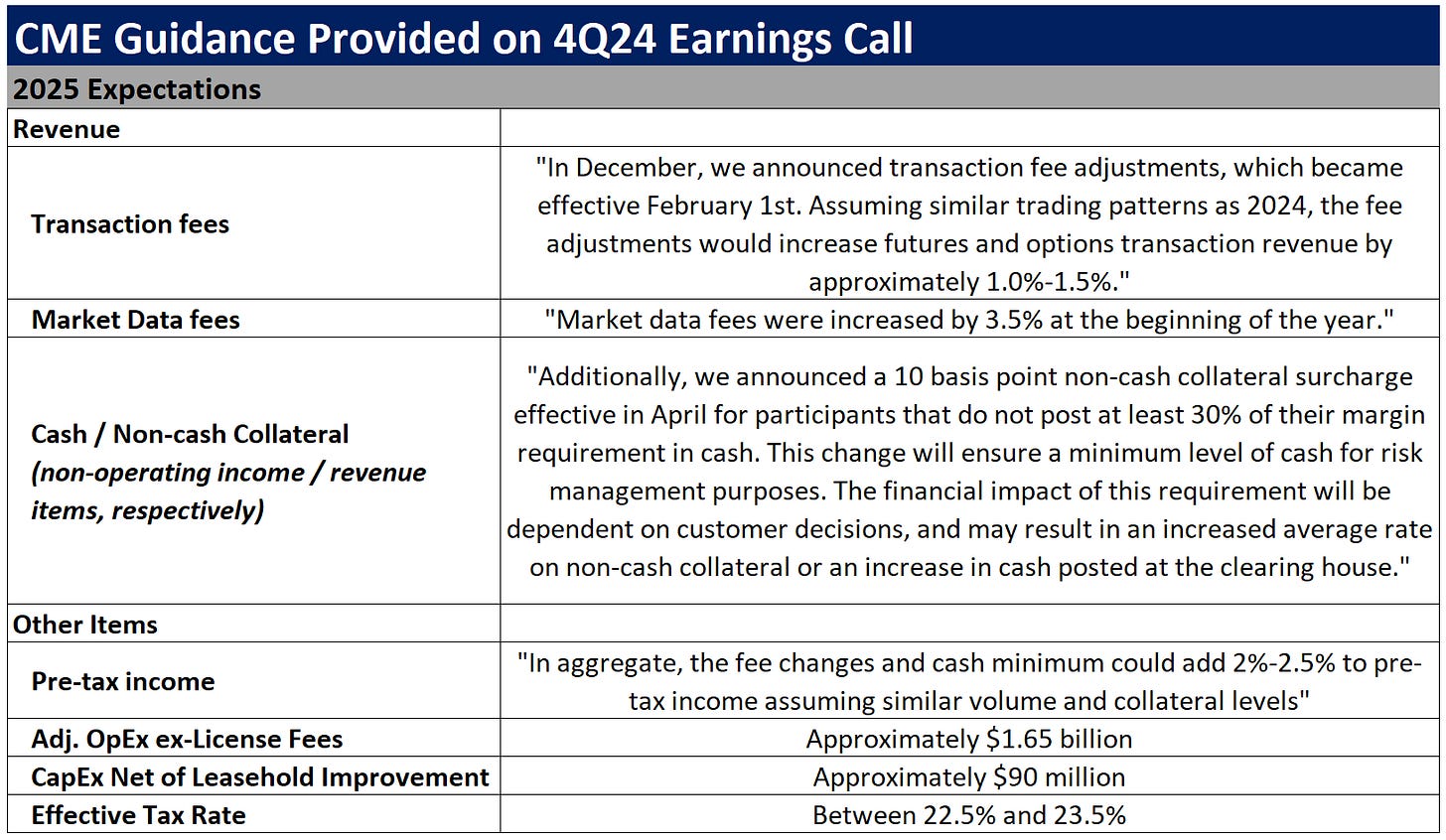

CME Group Inc. (CME)

Source: Company documents

Note: CME provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Intercontinental Exchange, Inc. (ICE)

Source: Company documents

Note: ICE provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

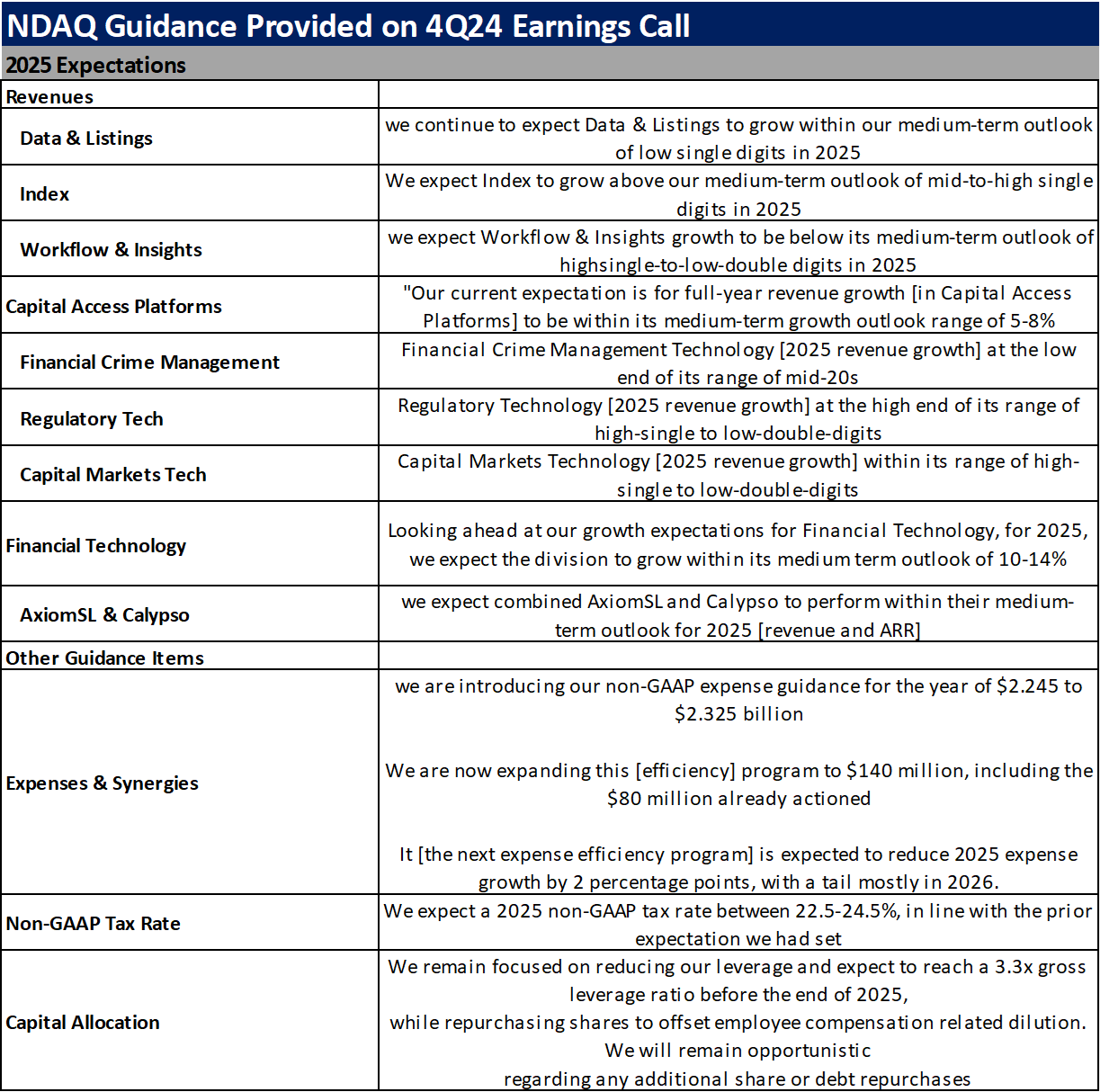

Nasdaq, Inc. (NDAQ)

Source: Company documents

Note: NDAQ provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Fixed Income Trading Platforms

MarketAxess Holdings Inc. (MKTX)

Source: Company documents

Note: MKTX provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

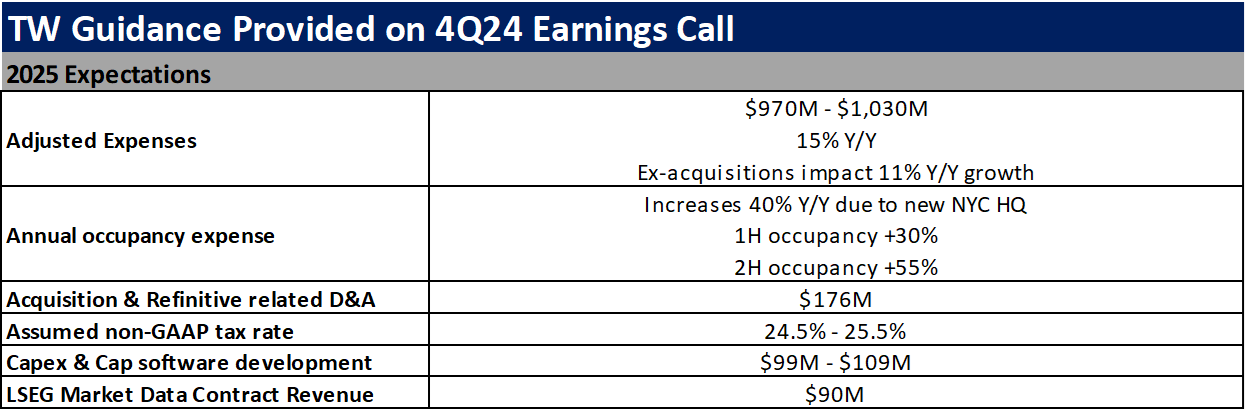

Tradeweb Markets Inc. (TW)

Source: Company documents

Note: TW provided additional guidance points / commentary on its 4Q24 earnings call, but key annual highlights are included above for the sake of simplicity

Online Brokers

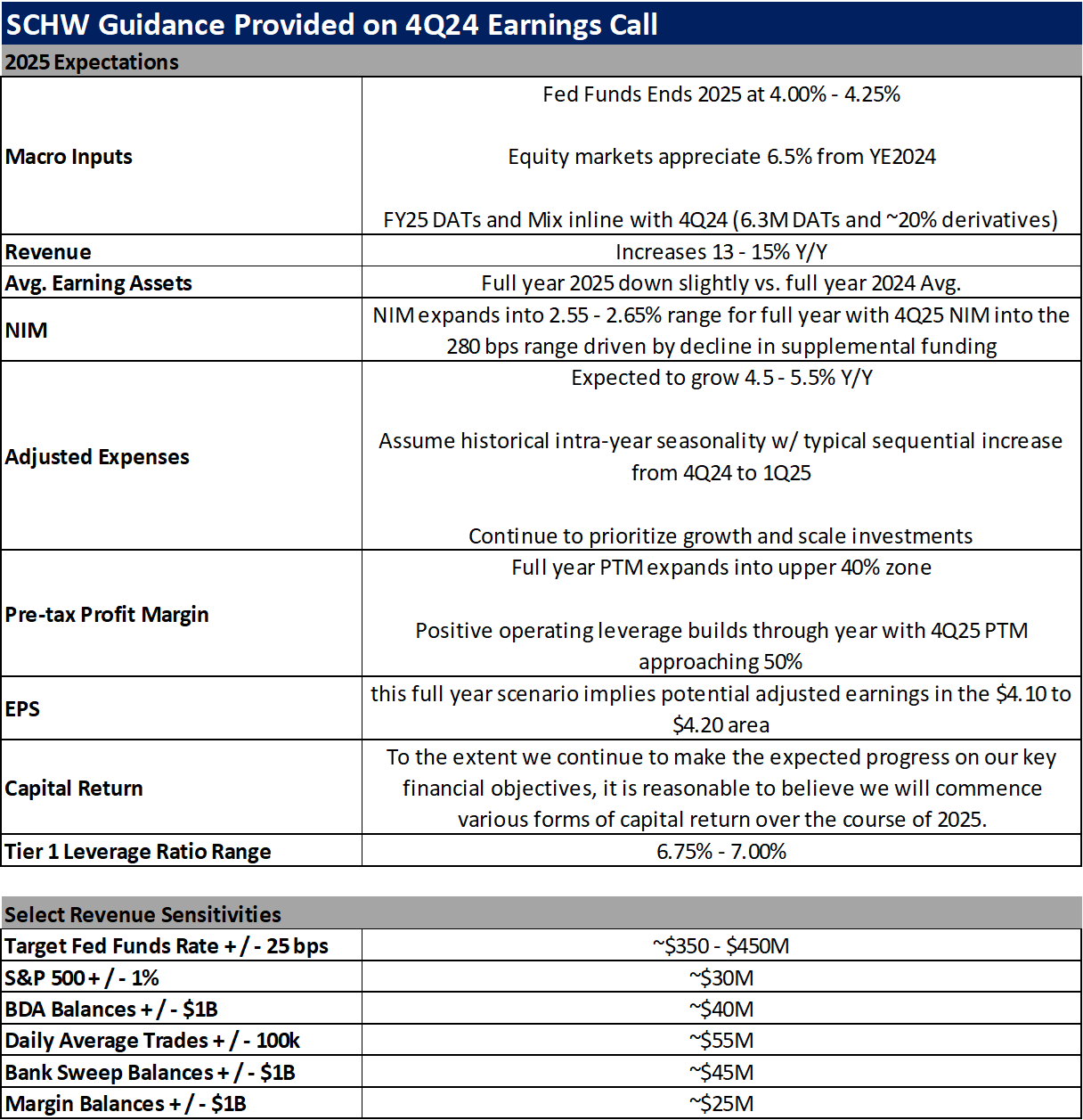

The Charles Schwab Corporation (SCHW)