eToro Group Ltd. (ETOR) 1Q25 Earnings Review

1Q25 Results Seemed OK; Investment in Marketing Due to Favorable Market Conditions Weights on PTM

Reports Revenue & EPS Beat in First Quarter as Public Company; Pre-Tax Margins Contract on Marketing Investment

ETOR 0.00%↑ reported 1Q25 earnings pre-market this morning. Total net contribution came in at $217M, down 14% Q/Q but up 8% Y/Y. The Y/Y increase was driven by net trading contribution from equities, commodities, and currencies, which rose 33% Y/Y (+21% Q/Q) to $97M. Additionally, net interest increased 11% Y/Y (unchanged Q/Q) to $50M and eToro money rose 10% Y/Y (-12% Q/Q) to $22M while subscriptions were flat Y/Y (and Q/Q) at $2M and net trading contribution from cryptoassets declined 25% Y/Y (-52% Q/Q) to $46M. On the expense side, operating expenses came in at $147M, up 15% Y/Y which drove a 420bps Y/Y decline in pre-tax margins to 32.5% (note I am calculating pre-tax margins off of net contribution, not total revenue and income). ETOR noted in its press release that the increase in expenses was related to investment in marketing and growth (selling and marketing expense was up 64% Y/Y) given solid market conditions, so this investment contributed to the Y/Y decline in pre-tax margin. Diluted net income per share came in at $0.69, down from $0.76 in the year ago period.

Relative to consensus estimates, revenue came in 2% above the consensus forecast of $214M (and at the high-end of ETOR’s guidance range from its latest F-1). Operating expenses were inline with street estimates while EPS came in 14% above consensus.

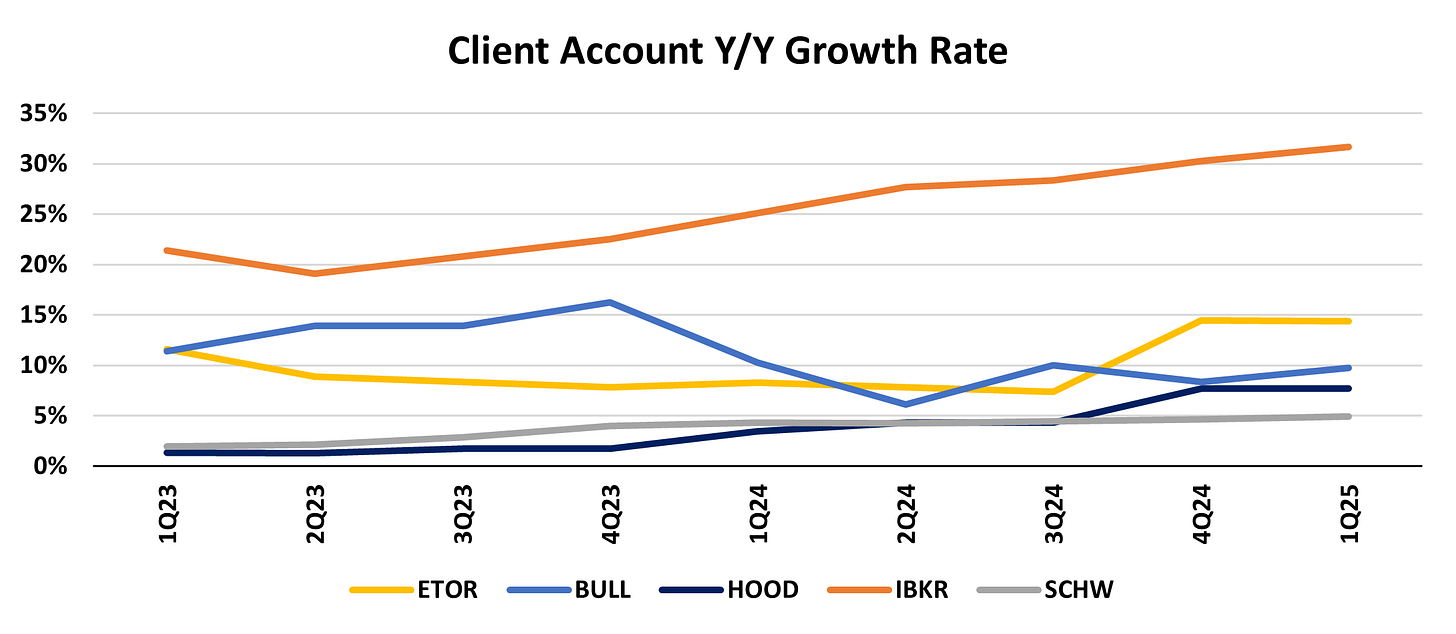

In terms of key operating metrics, total funded accounts ended the quarter at 3.6M (+3% Q/Q, +14% Y/Y), customer assets ended the quarter at $14.8B (-11% Q/Q, +21% Y/Y), number of trades for equities, commodities and currencies declined 5% Y/Y (+7% Q/Q) and number of trades for crypto assets was unchanged Y/Y (-13% Q/Q). Average assets per customer account came in at $4,134 (-13% Q/Q, +6% Y/Y). The sequential decline in customer assets Q/Q was primarily driven by a pullback in cryptoassets in 1Q.

ETOR Earnings Summary and Key Operating Metrics

Source: Tikr.com and company data

Highlights from ETOR Presentation and Press Release

While ETOR did not host an earnings call this quarter, the management presentation and press release included a number of key points that are worth highlighting:

2Q25-TD Performance Update – As of May 31, ETOR had 3.61M funded accounts (+1% from 1Q25 end) and $16.9B in assets under administration (+14% from 1Q25 end)

Highlighted Four Strategic Pillars Driving Growth

Trading – via enhancing trading experience by expanding assets available and rolling out more sophisticated tools (launched futures in Europe and options in the UK, expanded trading hours to 24x5 across a number of stocks and ETFs, added 40 more crypto tokens)

Investing – via personalization and more expanded asset universe (added stocks from Abu Dhabi and Hong Kong stock exchanges, continued growth of Smart Portfolios with launch of commodities portfolio in partnership with WisdomTree, launched securities lending in Europe and expanded crypto staking)

Wealth Management – via local savings and investing products to support long-term financial needs (introduced self-directed offering as part of UK ISA, introduced recurring investments, initiated integration of Spaceship – Australian investing app acquired in 2024)

Neo-Banking – via improvements to the eToro money offering (partnerships with local financial institutions to offer virtual bank accounts in multiple currencies)

Continues to Expand Financial Education and AI – Now offering 3,000 articles, videos podcasts and webinars in 11 languages with the help of AI to accelerate production

Regulatory Developments – Obtained European Crypto Authorization MiCA from CySEC enabling passporting of cryptoassets across EU. Completed SOC2 Type II compliance certification

Broad Thoughts

Given consensus estimates were just published yesterday, I’m not entirely sure what buy-side expectations were heading into this release (though ETOR did preview Net Contribution, Net Income, funded accounts and assets under administration in its latest F-1 filing). However, I thought the quarter seemed fine. When comparing net trading contribution for cryptoassets to HOOD 0.00%↑’s reported transaction-based revenues from crypto, ETOR did underperform on both a Q/Q and Y/Y basis, though the geographic mix of clients is dramatically different between the two companies, which could be playing a factor here. However, looking at net trading contribution for equities, commodities and currencies vs. all other transaction-based revenue for HOOD, ETOR outperformed on a quarter over quarter basis but underperformed Y/Y (again, client mix could be playing a factor here). I think the stock could be trading off a bit this morning on the 2Q-TD update as client account growth quarter-to-date seems a bit lighter than we’ve seen the past couple of quarters. Additionally, the stock has had quite a run during the past few sessions, so could be giving back some of those gains.

eBroker Quarterly Key Metrics Comparison